The Pomp Letter - The Banks Don't Want The Crypto Wealth

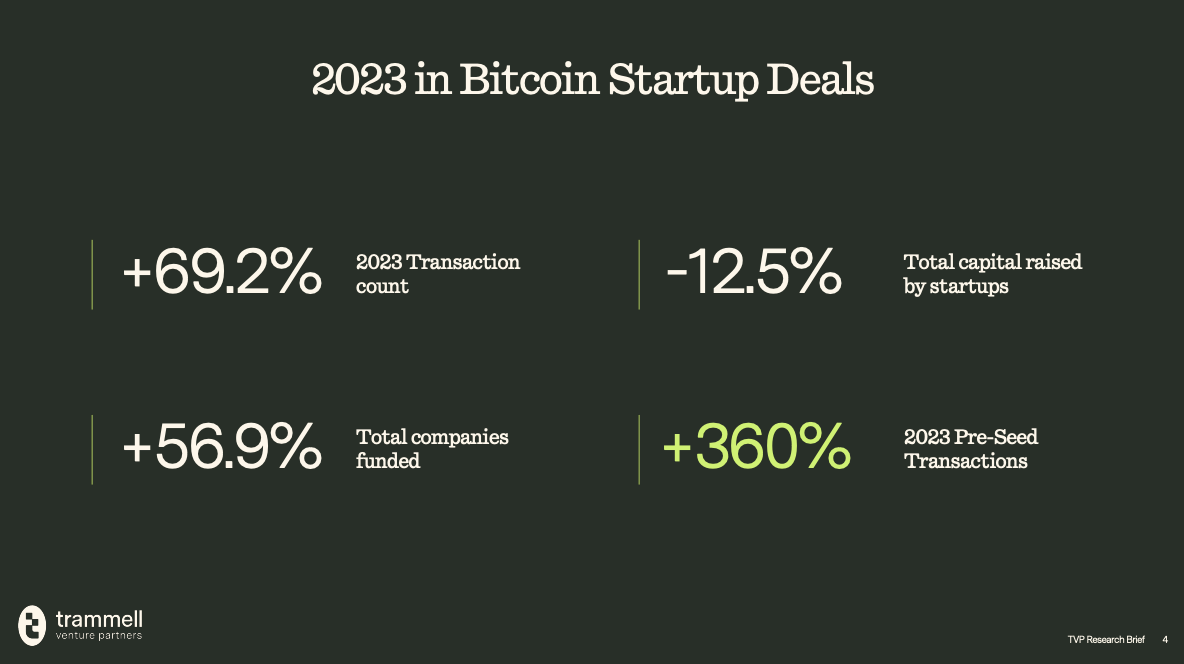

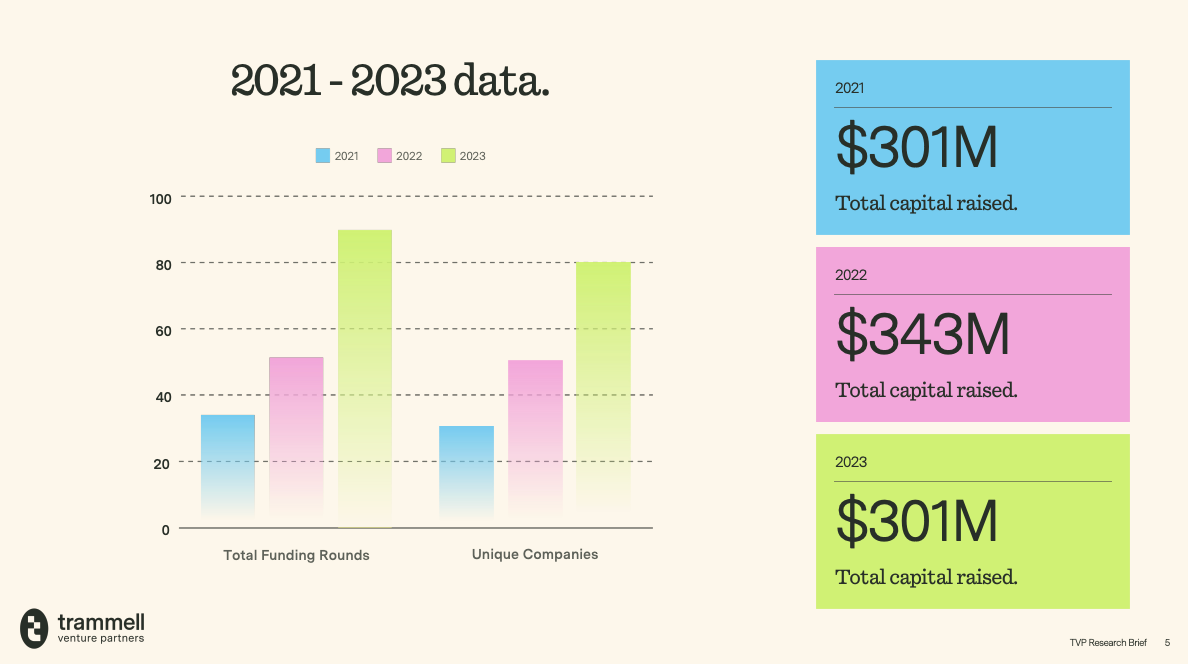

To investors, New industries bring new problems. The market has been focused on the various ramifications of bitcoin and crypto adoption, but these conversations have historically revolved around geopolitics, nation state acceptance, and portfolio construction. People find it easy to discuss the large, easy-to-identify ramifications. The devil is always in the details though. One of the small problems that has become obvious over the last few years is a disconnect between legacy banks and the wealth generated in this new industry. Here is how the problem works — someone bought bitcoin early and has held the asset till today. On paper, they have “made” approximately $10 million in gains on that bitcoin position. This same person currently has $150,000 in cash sitting in their bank account. They have no other investable assets other than their bitcoin. In this scenario, if the person wants to go to the bank and get a mortgage or a loan, the bank will measure the individual’s net worth at $150,000. Yes, you read that right. The banks do not count bitcoin or cryptocurrency holdings towards an individual’s net worth calculation for the purposes of underwriting traditional financial products or services. This makes it difficult for people who have majority of their net worth in this new asset class to access these legacy products/services. At the same time this is happening, an entire generation of investors are creating material wealth in the new asset class. So either the banks will have to capitulate and change their underwriting methodology, or new companies will be created to service the crypto wealth holders with various financial services. One example of a newcomer is Meanwhile, a startup that has created the world’s first bitcoin life insurance company. They denominate everything, from their internal P&L to the policies they service, in bitcoin. Clients can contribute bitcoin and clients can get paid out from the policies in bitcoin. Not only is this a pretty good idea, but investors such as Sam Altman, Lachy Groom, Google’s Gradient Ventures, and Stillmark are all betting that the company will be very successful. Here is a conversation that I did with Meanwhile CEO Zac Townsend recently:  I have no clue if this company will work. Startups are hard. Meanwhile appears to have momentum and I found the team to be impressive. The bigger story to me is that bitcoin-focused (and crypto-focused) financial service providers are coming to fill the gap left by the legacy banks. If the incumbents are going to ignore the trillions of dollars in wealth that has been generated, the economic incentive is too strong for startups to stay on the sidelines. Someone is going to service these people. The question is whether the startups can quickly get big enough to compete with the large incumbents once they change their mind. The folks at Trammel Venture Partners put out a report on bitcoin-focused venture capital trends recently. These two slides caught my attention to help quantify this development: You can read the full report from TVP by clicking here. New industries bring new problems. New problems bring new opportunities for new companies. This is going to be worth paying attention to as the startups and incumbents battle it out for billions of dollars in future value. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Zac Townsend is the Co-Founder & CEO of Meanwhile, the world’s first bitcoin denominated life insurance company. In this conversation, we talk about traditional life insurance, protection, tax advantages, opportunities, and what Zac is building at Meanwhile using bitcoin to eliminate risk. Listen on iTunes: Click here Listen on Spotify: Click here Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

Geopolitical Chess Meets Economics

Monday, April 22, 2024

To investors, There was a flurry of new legislative bills related to foreign conflicts that made progress in recent days. Although it seems absurd to send nearly $100 billion abroad while the United

Podcast app setup

Sunday, April 21, 2024

Open this on your phone and click the button below: Add to podcast app

Overview of Today's Bitcoin Halving

Friday, April 19, 2024

Listen now (4 mins) | To investors The bitcoin halving is scheduled to happen later today. I asked Meta's new AI model to explain what the halving was and here is the output: “The Bitcoin Halving

New Bitcoin ETP Just Launched That Generates Yield

Thursday, April 18, 2024

Listen now (4 mins) | To investors, The finance industry is built on capital appreciation and yield. Investors scour the world to find assets that will go up in price or assets that will give them

Special Message from Anthony Pompliano 🙏🏼

Tuesday, April 16, 2024

Hey - thanks for being a free subscriber to The Pomp Letter. I have a surprise for you. As you know, I spend hours per day studying financial markets, so I can put together timely letters to help you

You Might Also Like

A Cricket Legend’s Abrupt Exit

Thursday, December 26, 2024

"Humiliation was going on," Mr Ravichandran said of his son's abrupt retirement from all forms of international cricket. "How long can he tolerate all this?"

One final game before the year ends

Thursday, December 26, 2024

This game will win you an insane prize and you don't even risk death like in Squid Game

Podcast app setup

Thursday, December 26, 2024

Open this on your phone and click the button below: Add to podcast app

24% of all Seed VC Rounds Were For SaaS in 2024

Thursday, December 26, 2024

And it's clear now, SaaS is back. To view this email as a web page, click here saastr daily newsletter Carta: 24% of all Seed VC Rounds Were For SaaS in 2024 By Jason Lemkin Monday, December 23,

🎙️ New Episode of The Dime Uniform Genetics, F1 Hybrids, Better Yields: New Age Cannabis Cultivation ft. Ralph Risch

Thursday, December 26, 2024

Listen here 🎙️ Uniform Genetics, F1 Hybrids, Better Yields: New Age Cannabis Cultivation ft. Ralph Risch F1 hybrid seeds are the cornerstone of modern agriculture, offering the least expensive and

Would you like to WIN a MacBook Pro?

Thursday, December 26, 2024

You're invited to join in on all the fun! View in browser ClickBank Steven Clayton and Aidan Booth officially kicked off their monster '12 Day Giveaway' celebration yesterday, and you'

The Daily Coach's 10 Most-Read Pieces of 2024

Thursday, December 26, 2024

Thank you for being part of our journey and allowing us to be part of yours.

New top offers (and CB Summit is coming!)

Thursday, December 26, 2024

Just in time for 2025, we have a plethora of top offers goodness for you – plus a new ClickBank Summit live event you won't want to miss... CB Logo High Res 200x23 ClickBank Newsletter Check out

What the rise of the niche and nano-creator means for influencer marketing

Thursday, December 26, 2024

As the creator economy swells, niche creators stand out capturing user attention and advertiser dollars. December 26, 2024 What the rise of the niche and nano-creator means for influencer marketing As

Numbers mean nothing without benchmarking

Thursday, December 26, 2024

The funds-of-funds conundrum; a comeback year for PE mega-funds; see where European VC went in 2024; ultrafast delivery drives foodtech VC Read online | Don't want to receive these emails? Manage