Hi y’all —

Last weekend, I was at a bar with my roommate when she flipped her phone around to show me an Instagram ad for a funny T-shirt. Within seconds, I was typing in my credit card number; a minute later, I had spent $40.

The shirt is hilarious — the design is a picture of Star Wars sadboi Anakin Skywalker above the Taylor Swift lyrics “I can fix him (no, really, I can)” — but it's scary how easily I was influenced. I didn’t even hesitate before pressing purchase. (Maybe this had to do with the margarita I was drinking at the time, though who could say.)

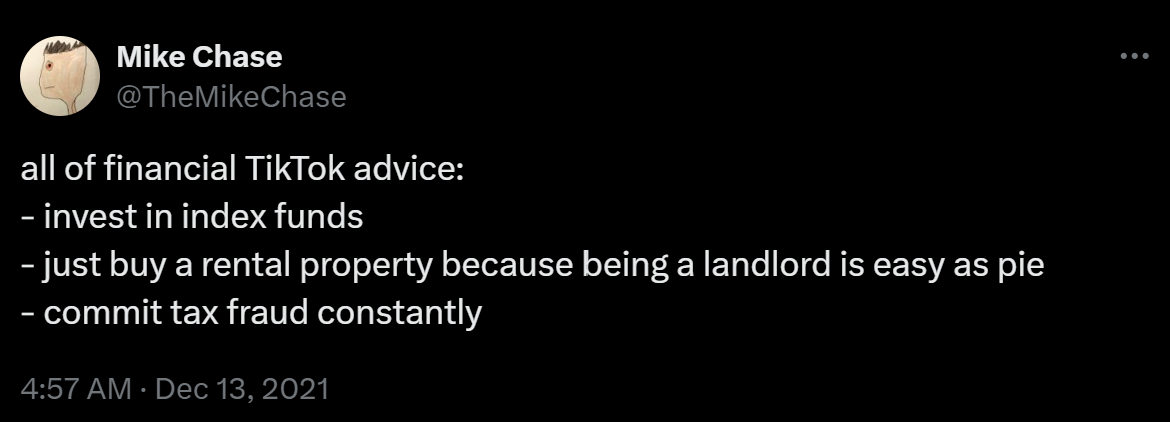

Using social media these days means being influenced on pretty much everything all the time. And that includes money. There’s an entire community of “finfluencers” — financial influencers — who make content about investing, saving, spending and the like.

But anyone can say whatever they want online. Can I really trust a faceless Reddit user to give me solid money advice? How should I vet financial tips I find on social media?

This is a real issue, especially for young people. In a WallStreetZen survey last year, 76% of Gen Zers said they learned about personal finance from YouTube and TikTok. Another 83% said they’ve encountered misleading money information online.

Jordan Sowhangar, vice president and wealth advisor at Girard, a Univest Wealth Division, tells me that while it’s great that these videos get younger consumers interested in money, it can be dangerous if they follow the directions blindly.

A 2023 paper from the Swiss Finance Institute analyzed the performance of over 29,000 finfluencers on Twitter and found that a whopping 56% of them had negative skills that led to worse investing returns. (“The advice by antiskilled finfluencers creates overly optimistic beliefs most times and persistent swings in followers’ beliefs,” the researchers wrote.)

So when I see financial content online, Sowhangar says, it’s important to look first for the creator’s credentials. On their page, do they list acronyms like CFP (certified financial planner), CPA (certified public accountant) or CFA (chartered financial analyst)? Do they have a Series 7 license (that allows them to sell securities) or a Series 66 license (for investment advisors)?

Each of these programs has its own requirements, but we’ll use the CFP certification process as an example. To become a CFP, a person has to complete an average of 12 to 18 months of financial planning coursework, have a bachelor’s degree, pass a 170-question exam, complete 6,000 hours of professional experience or 4,000 hours of apprenticeship work, sign an ethics declaration and pass a background check.

Whew.

Of course, it’s possible for someone who’s not credentialed to give good advice, but that’s not the point. The point is that by putting their training and experience on display, a creator is showing users “why they’re able and suitable to give this advice,” Sowhangar says. It also means that they report to a governing body and have to meet ongoing standards, so they can be held accountable if they don’t give good advice.