Aziz Sunderji - The Week in Review

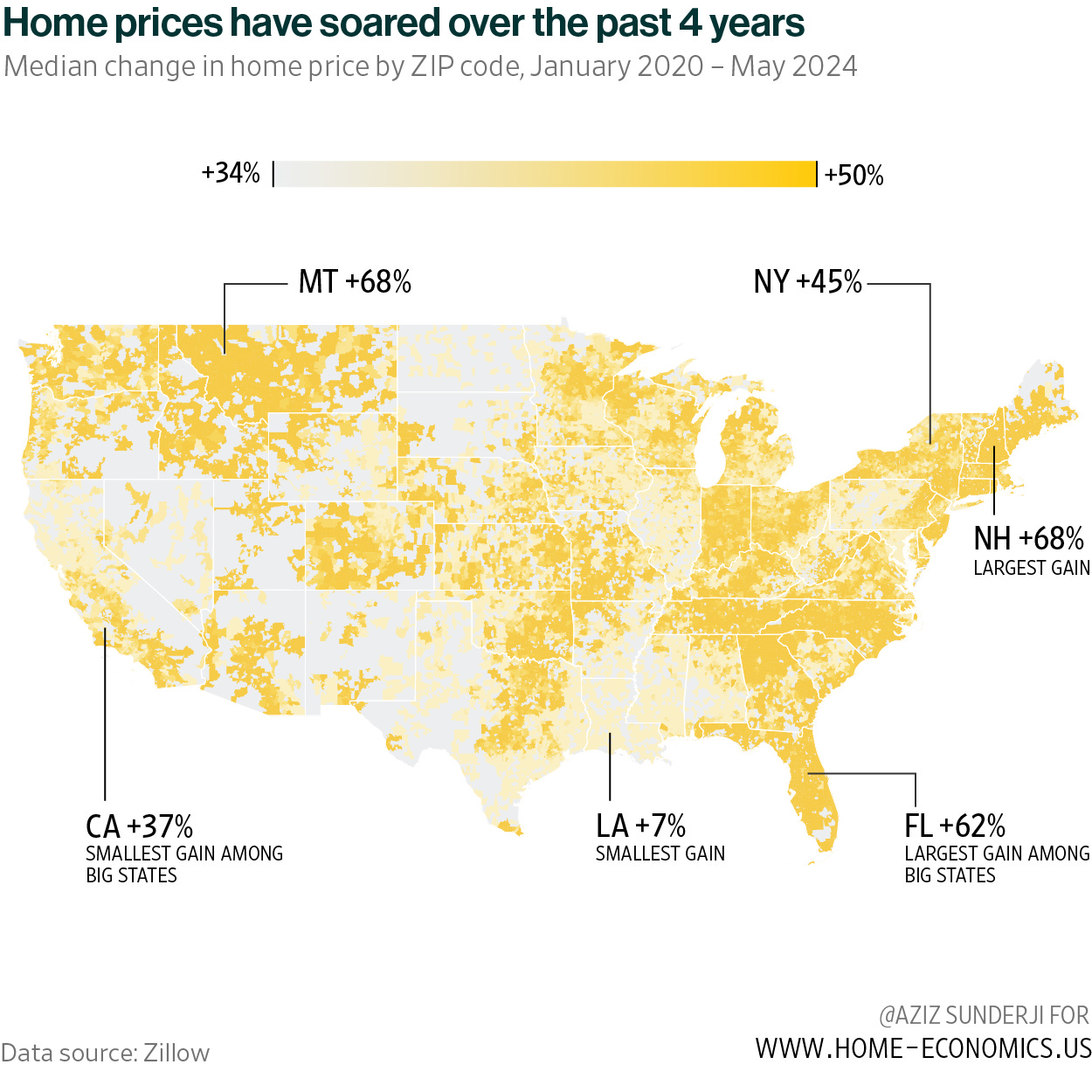

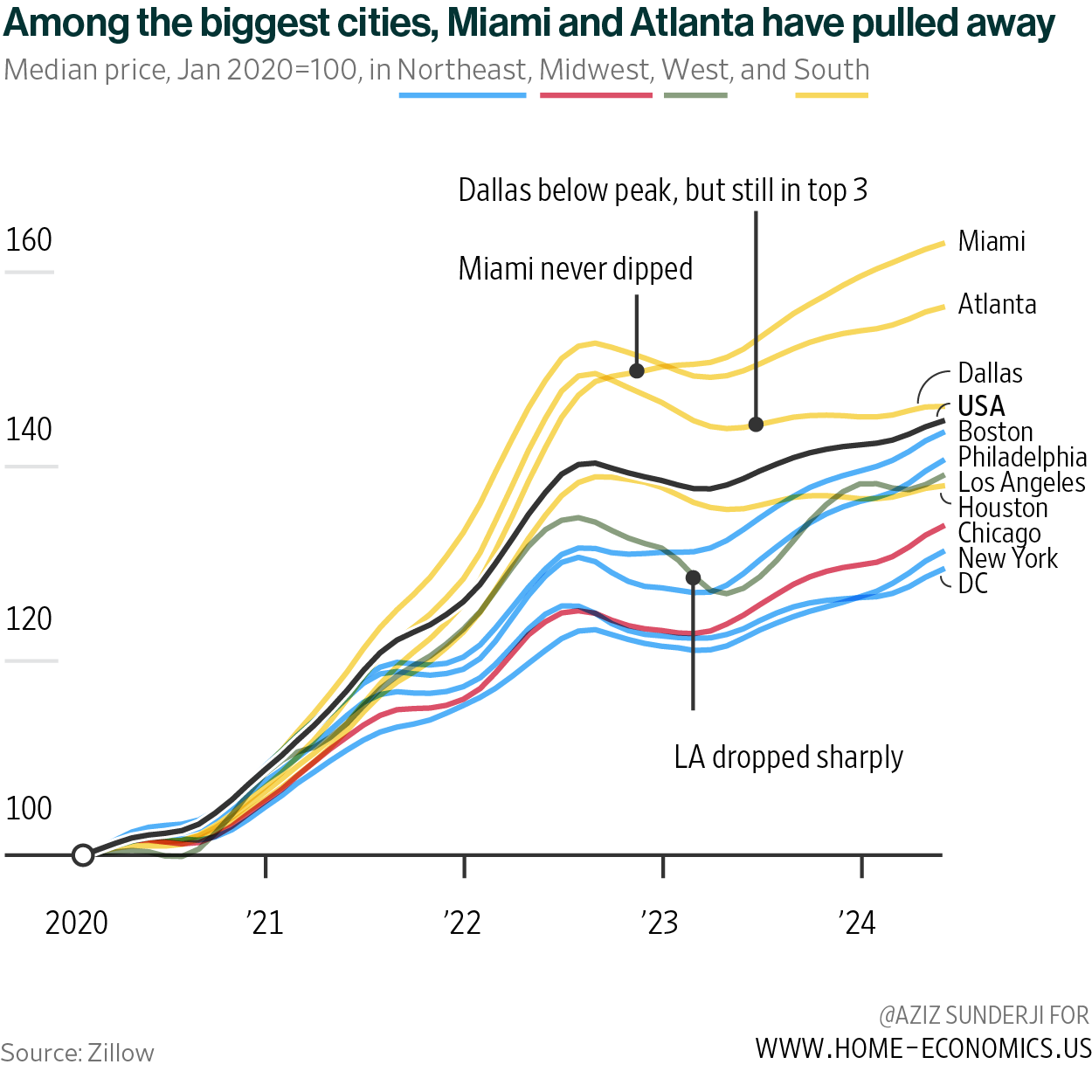

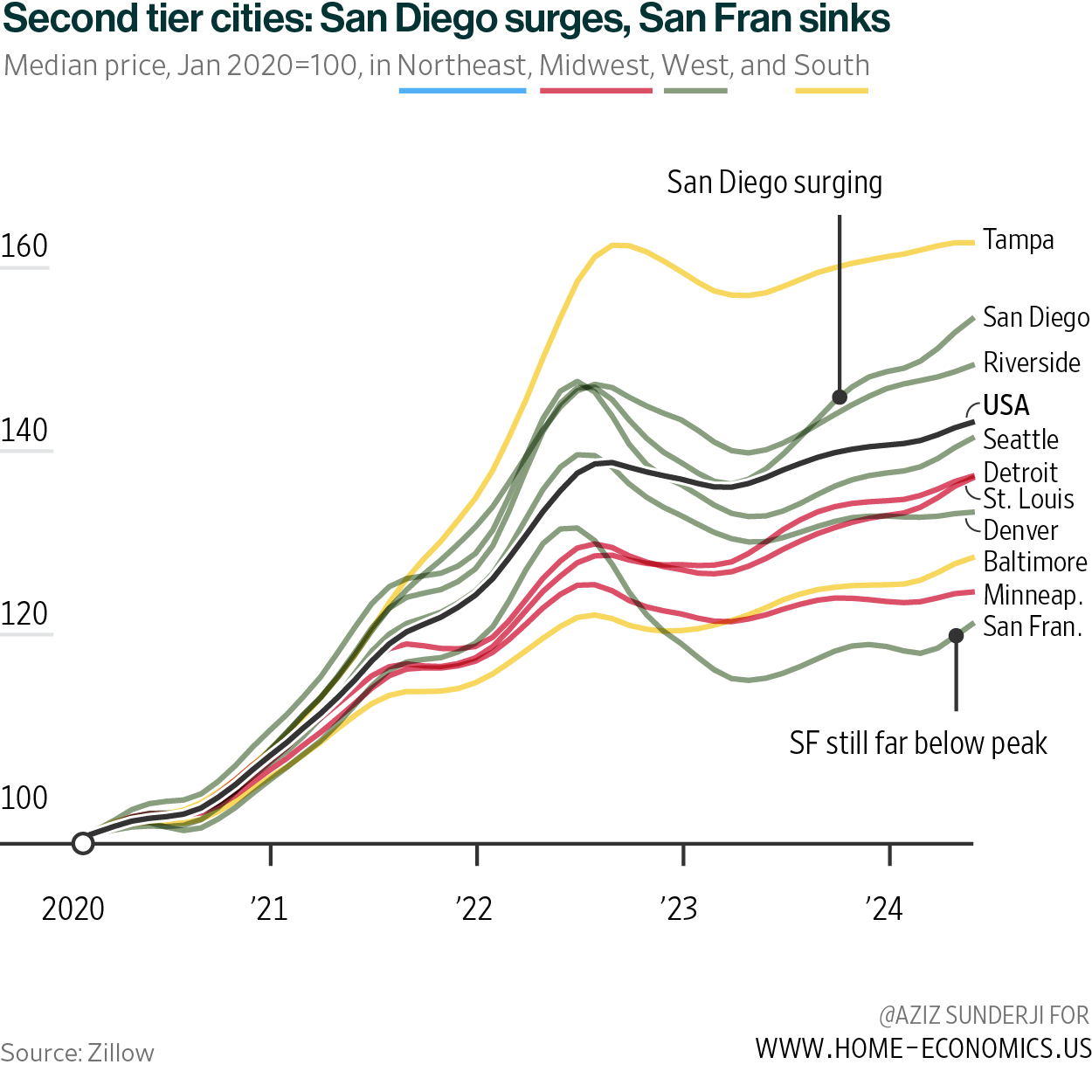

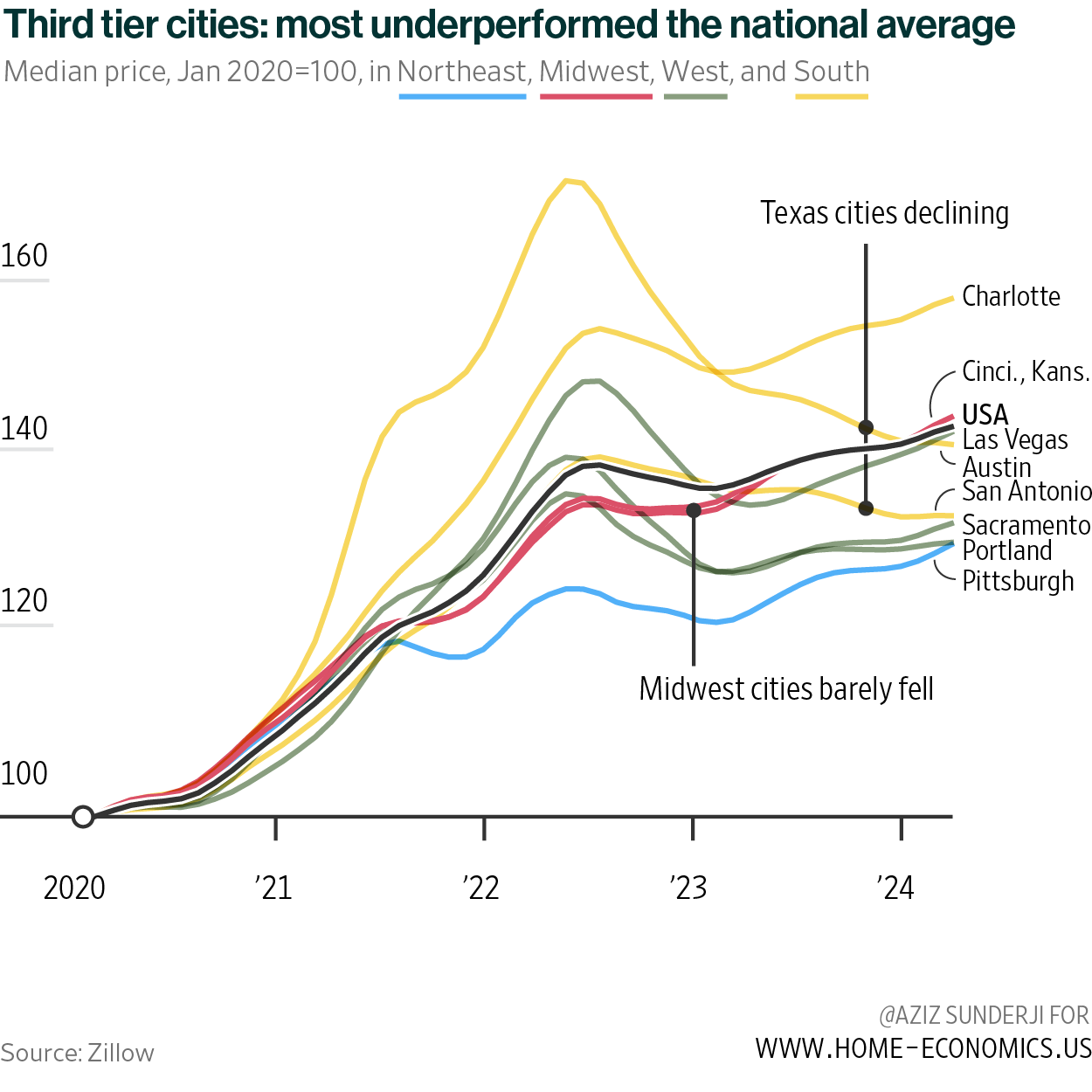

Welcome back to The Week in Review. I hope you had a good one. Is it just me, or does life become infinitely busier in June? The weather is beautiful, so there are lots of outdoor sports to be played. For me, that’s mainly running and tennis. Everyone is traveling, and since New York is a hub if not a destination for many people, I (happily) have lots of friends passing through the city. It’s also moving season, and this year my household is participating in the great migration: we are selling our Park Slope, Brooklyn apartment to move into a rental on the Upper West Side of Manhattan. All of this is taking place against a backdrop of work-life that, if anything, seems more intense at this time of year than in, say, February. Most of the things filling up my life these days are fun and interesting, and I feel very lucky. At the same time, I feel like I need a three day nap. Turning to the week ahead, it’s a fairly busy one for housing-related economic data. We get the results of the NAHB homebuilder survey on Wednesday (sentiment has been rangebound for the past year). The Census Bureau releases new home starts on Thursday. The last release showed the single family market gently falling back to pre-pandemic norms, and the multifamily market completing units at a record pace but barely starting new ones (summary here, ◉). The NAR releases existing home sales on Friday—the last few readings have been disappointing. Subscribers can download the housing economic data calendar here ◉. Articles with a ◎ are free. Those with a ◉ have free previews but are only accessible in full for paying subscribers. Upgrade your subscription here: News: Zillow released home prices for May I’m doing something slightly different this week: a deep dive into a single news item: the Zillow home price release, which came out on Wednesday (I explain why Zillow’s index is the best measure of home prices here, ◉). To recap the landscape: markets soared from 2020-22. Then, they dipped with higher interest rates. This softening continued through 2023. Over the past year, prices have climbed again. But a recent surge of inventory is now leading to renewed price declines some markets. I feel a bit disoriented at this point—maybe you feel similarly. So, it feels like a good time to step back, zoom out, and analyze the change in home prices across the country since 2020. Here’s what things look like on a national basis since then: everything is up, but with a huge dispersion in price moves: Florida OrangeThe best performing large state has been Florida, where cities like Miami have climbed more than 60% since the start of 2020. The worst performing large state has been California, dragged down in particular by San Francisco and areas north of it. Trends are mixed in the northeast, where New York has seen average gains, but in nearby New Hampshire prices have risen by more than any other state. Overall, Louisiana has seen the most modest price appreciation—only 7%. This could be a function of the weak economy there, and soaring home insurance costs (though, insurance costs are also soaring in Florida). Of course, states are diverse, and I think we can get a more tangible handle on price moves by looking at changes across metro regions. For simplicity and comparability, I split these into three tiers: the largest 10 cities, the next nearest 10, and then a final third tier. I also colored each series by its region: Northeast, Midwest, West, and South. Here's what price action in the top-tier looks like: One very clear trend is that southern cities—Miami, Atlanta, and Dallas—have outperformed the rest of the country. Miami is particularly notable for having entirely avoided the trend, seen in almost every other city, of declining prices between mid-2022 and early 2023. While prices were falling across the country, in Miami they merely climbed more slowly. Prices in Dallas have flatlined for a year, but because they rose so dramatically between 2020 and mid-2022, Dallas still remains one of the places where prices have risen the most when measured over the last 4 years. Business-focused cities, like Washington DC, New York, and Chicago have all meaningfully underperformed the national market. As a current seller of a home in New York City, I feel this acutely. There are many factors influencing home prices, of course, but I don't think it's a stretch to argue that work from home and work from anywhere have caused prices in expensive cities with many white collar workers to rise less than they have elsewhere. Indeed, I recently wrote about the massive decline in New York City's population in recent years (here, ◉). Unsurprisingly, this seems to be resulting in tepid home price appreciation. A San-wich of Prices in the WestThe tier of second cities, shown below, includes more metro areas from the West and Midwest, providing us a good picture of what's happening in those areas. One of the most notable features of this chart is just how little prices in San Francisco have risen. Why have prices risen so little in San Francisco? The tech-focused city has faced the brunt of the ‘tech-cession’—a stagnation in tech hiring—since interest rates rose in 2022. Tech jobs are also easily done remotely, and tech companies have embraced the remote work trend enthusiastically. Joseph Politano has illustrated the migration of tech jobs away from San Francisco, here ◉. At the other end of the California spectrum, San Diego has surged over the past year and a half, making it one of the best performing metro areas over that time. This is especially remarkable because, as recently as early 2023, San Diego had appreciated in line with the national average. In the Midwest, prices have climbed less than average. Home price appreciation in Minneapolis is not far different from San Fransisco. Keeping it Weird in AustinThe most notable trend among the third-tier cities, shown below, is the spectacular boom and bust in Austin. I use the word ‘bust’ timidly here, since many argue it is Austin’s success building more housing that has brought prices down and alleviated housing affordability. Prices have also fallen meaningfully in San Antonio over the past year. In this group, Charlotte has been the fastest climber: prices there now stand 50% higher than in early 2020. In sum, across the country, prices have risen substantially over the past four years. Higher interest rate have dampened gains, but prices in most places are higher today than ever before. Sequel. What’s the most “late-stage capitalism” problem out there? Surely, too many things to watch on a screen ranks highly. I feel like I get about 18 different excellent movies and TV shows recommendations throughout the week, only to sit down to watch something on a Saturday night and draw a complete blank. Sequel is an app that allows you to quickly enter the name of any movie, TV series, videogame, book, or audiobook—it automatically recognizes which category your entry falls into—and stores it in a list. Surprisingly simple? Yes. Also surprisingly useful? Yes. Sequel, for Apple devices, here ◎. Perplexity. I thought everyone knows about this AI-powered internet search tool, but apparently not. My tech-savvy older brother in Toronto hadn’t heard of it. Perplexity does what you want Google to do. Because—unless you’re looking for a long list of add-blighted spammy AI glurge—Google has become essentially useless. Perplexity scans the internet to answer your questions. And unlike other AI tools, it provides links to the sources it used. A massive time saver and game changer for the future of the internet. Perplexity AI, here ◎/◉ (the paid tier is worth it). Fly-by-Jing Chili Crisp. Why aren’t you putting chili crisp on your fish, hamburgers, chicken, and pizza? Is it because you’re a no-fun curmudgeon? Don’t be a no-fun curmudgeon! People, or at least people in Brooklyn, seem to have caught on to the magic of chili crisp, and we’ve witnessed a proliferation of chili crisp choices. But, for the discerning eater, there is really only one choice: Fly-by-Jing Chili Crisp, here ◉. Home Economics is a reader-supported publication. Please consider upgrading to a paid subscription to support our work. Paying clients receive access to the full archive, forecasts, data sets, and exclusive in-depth analysis. This edition is free—you can forward it to colleagues who appreciate concise, data-driven housing analysis. |

Older messages

The Week in Review

Saturday, June 15, 2024

Week of June 10 — taking stock of home price changes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Week in Review

Saturday, June 8, 2024

Week of June 3 — Payrolls pop, Sentiment sags ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Week in Review

Monday, June 3, 2024

Week of May 20th — Sales Stumble, Tennis Tribulations ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Week in Review

Monday, June 3, 2024

Week of May 27th — Rents Retreat as Prices Peak ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

TLDR: The Future of Homeownership

Tuesday, May 21, 2024

Talking you through my analysis ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Reacher. Is. Back. And Alan Ritchson's Star is STILL Rising

Sunday, March 9, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE THIS WEEK'S MUST-READ Reacher. Is. Back. and Alan Ritchson's Star is STILL Rising. Reacher. Is. Back. and Alan Ritchson's Star

12 Charming Movies to Watch This Spring

Sunday, March 9, 2025

The sun is shining, the tank is clean – it's time to watch some movies ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10 Ways to Quiet Annoying Household Noises

Sunday, March 9, 2025

Digg Is Coming Back (Sort Of). Sometimes the that's noise bothering you is coming from inside the house. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY 10 Ways to

The Weekly Wrap # 203

Sunday, March 9, 2025

03.09.2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekend: Introducing the Butt Mullet Dress 👀

Sunday, March 9, 2025

— Check out what we Skimm'd for you today March 9, 2025 Subscribe Read in browser Header Image But first: Join the waitlist for a new premium Skimm experience Update location or View forecast

Starting Thursday: Rediscover Inspiration Through Wordsworth

Sunday, March 9, 2025

Last chance to register for our next literary seminar starting March 13. March Literary Seminar: Timothy Donnelly on William Wordsworth Rediscover one of the most influential poets of all time with

5 little treats for these strange and uncertain times

Sunday, March 9, 2025

Little treat culture? In this economy?

RI#266 - Down the rabbit hole/ What is "feels-like" temp/ Realtime voice tutor

Sunday, March 9, 2025

Hello again! My name is Alex and every week I share with you the 5 most useful links for self-improvement and productivity that I have found on the web. ---------------------------------------- You are

Chaos Theory: How Trump is Destroying the Economy

Sunday, March 9, 2025

Trump's erratic, chaotic governing style is dragging down the economy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Chicken Shed Chronicles.

Sunday, March 9, 2025

Inspiration For You. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏