Are Retail Investors Beating Institutions To The Bitcoin Spot ETFs?

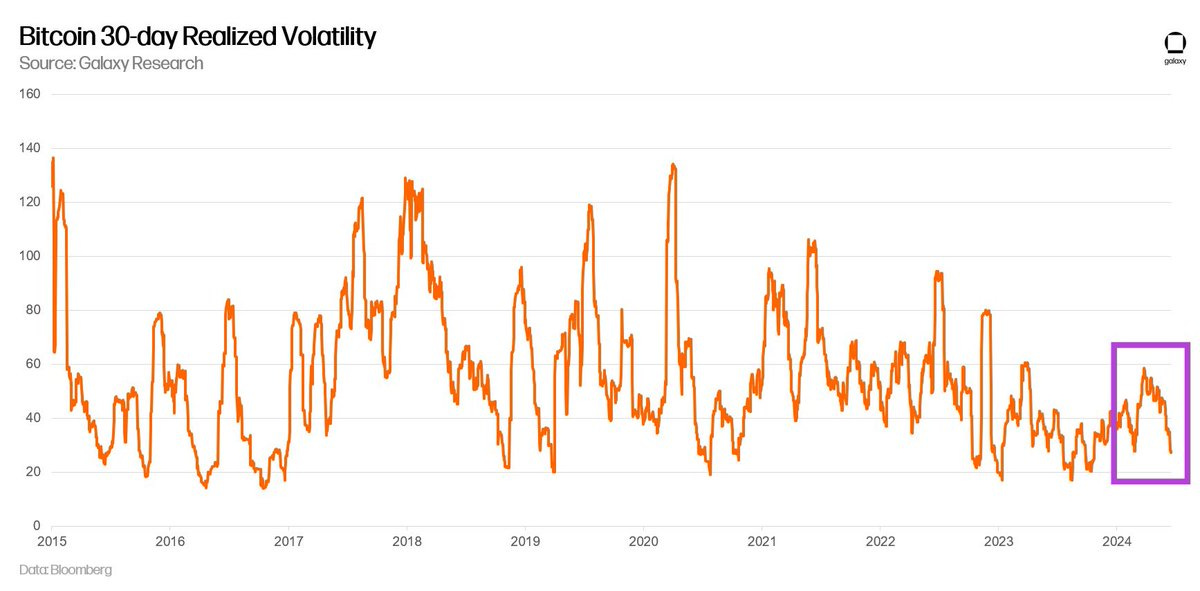

To investors, A few people have been asking me why bitcoin spot ETF inflows have been occurring, but the price of bitcoin is not drastically increasing. This is a good question, so I figured I would do my best to answer. We must first understand that financial markets are highly complex. There is almost never a single answer for why the price of an asset is moving up, down, or sideways. Bitcoin is the perfect example. The second thing we must understand is that bitcoin’s volatility has been dropping significantly. Galaxy’s Head of Research Alex Thorn shared this chart, which shows a historically low reading on the 30-day realized volatility metric. The next important data point is that ETF inflows have largely been from individual retail investors, not institutional allocators. CNBC’s Tanaya Macheel wrote over the weekend the following about comments made by Blackrock’s chief investment officer of ETF and index investments:

This is a narrative violation because people have been bragging about institutional adoption of the ETFs. I have also personally thought that much of the inflows must be coming from institutions given the billions of dollars that are now sitting in those funds. It looks like I was wrong. Bianco Research’s Jim Bianco points out a recent data point from JP Morgan suggesting that the spot ETFs are not only getting retail capital, but they are actually not receiving net new capital:

Jim’s point here is interesting — not only is he arguing that retail has been moving capital from outside the system to inside the system, but he claims the ETFs are doing the opposite of what bitcoin originally set out to do. This brings me to the Ether ETFs which will supposedly be approved before the end of the summer. If these funds follow a similar path, there will be little to no institutional participation. Retail investors will move some of their capital from the spot asset to the spot ETF. And price will likely appreciate to a degree, but I doubt it will be the ~ 50% gain we saw in bitcoin’s price. Lastly, it is important to be aware of the basis trade. Many of the sophisticated investors who are participating in the ETF market have been going long spot bitcoin and short futures. This allows them to clip basis points while remaining market neutral. You can easily see the ETF inflows, but what most people have been missing in the analysis is the increase in short futures interest. As I started this letter, financial markets are highly complex. There is never a single culprit for why an asset price goes up, down, or sideways. Bitcoin has been lulling everyone to sleep. Don’t view that as a bad thing. Spend your time trying to understand why it is happening. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Phil Rosen, the Co-Founder of Opening Bell Daily, interviews Anthony Pompliano. Topics include bitcoin, President Trump's recent support of the industry, interest rates, financial media, and more. Listen on iTunes: Click here Listen on Spotify: Click here Anthony Pompliano on Bitcoin, Bull Markets, Interest Rates, and the Presidential Race Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Stablecoins & Artificial Intelligence Want To Save The US From Crisis

Monday, June 17, 2024

Listen now (4 mins) | To investors, The Wall Street Journal published an op-ed over the weekend from former House speaker Paul Ryan titled Crypto Could Stave Off A US Debt Crisis. In the article, Ryan

Podcast app setup

Monday, June 17, 2024

Open this on your phone and click the button below: Add to podcast app

Bitcoin Is Infiltrating Public Company Balance Sheets

Friday, June 14, 2024

Listen now (3 mins) | To investors, The public markets are starting to embrace bitcoin globally. MicroStrategy started the game with their announcement of a bitcoin treasury strategy. MicroStrategy

Podcast app setup

Thursday, June 13, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Thursday, June 13, 2024

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

Hack retention like unicorns do

Monday, December 23, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

The Profile: The CEOs attending psychedelic retreats & the crypto founders getting ‘debanked’

Sunday, December 22, 2024

This edition of The Profile features crypto entrepreneurs, 'psychedelic' CEOs, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤔A lingering suspicion...

Sunday, December 22, 2024

Plus, what stands in most marketers' way... hey-Jul-17-2024-03-58-50-7396-PM Here at Masters in Marketing, Caroline, Laura, and I have interviewed some very bright minds from some very bold brands.

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄