|

Across the country, thousands of small businesses — many on the verge of collapse — have not been able to obtain a forgivable loan from the Paycheck Protection Program. The initial $349 billion for the program ran out in a few days. Congress approved an additional $310 billion last week, but most of that money will go to businesses already in the pipeline. Many small enterprises will still be left out.

One person who isn't having trouble getting cash from the Paycheck Protection Program: Trump donor Monty Bennett, who is a multi-millionaire.

Bennett, like Trump, is in the hotel business. Bennett is the CEO of Ashford Inc., which makes money "advising" two related companies, Ashford Hospitality Trust and Braemar Hotels & Resorts, which own hotels. (Bennett serves as chairman of the board of the two subsidiaries.) The companies had "combined revenue last year of $2.2 billion."

According to filings with the SEC, Bennett's three companies have secured $96.1 million in Paycheck Protection Program loans. And more may be on the way. According to a fact sheet produced by the three companies, they've applied for a total of $126 million in Paycheck Protection Act loans.

Will these funds be used to pay hotel employees? It does not appear that way. The loans will be forgiven by the government if 75% of the money is used for payroll expenses, up to a $100,000 annual salary for each employee. According to the companies' fact sheet, "it appears that we will only minimally qualify, and we will have to pay the balance back when it is due in 2 years." That suggests the bulk of the money will not be spent on qualified payroll expenses.

This seems to be a change from a few days ago when Bennett told the Wall Street Journal that "75% or more of the proceeds will be used to bring our employees back to work with the balance to be used to pay utilities, rent, and debt service to lenders.” The companies have "laid off or furloughed 95% of staff."

Bennett, however, continues to do quite well. His total compensation in 2019 was $5,668,730, including a bonus $2,340,930. In March, as the pandemic devastated the economy, Bennett paid himself 75% of his bonus, or $1,755,697. The remaining $585,233 will be paid out, "promptly following" Bennett's "determination that the effects of the novel coronavirus (COVID-19) have subsided, but no later than December 31, 2020." Bennett has also taken an unspecified "significant pay reduction" on his $950,000 base salary this year.

In March, the companies also awarded $10 million in "preferred stock dividends" to certain shareholders. As a result, "Bennett and his father, a shareholder in one of the Ashford companies, received more than $2 million." According to the company, the figure is "only" half of what they were entitled to as owners of "preferred" shares.

On Thursday, the Treasury Department released new guidelines asserting that it is “unlikely” that any public company “with substantial market value and access to capital markets” qualifies for the loans. Treasury Secretary Steve Mnuchin said there would be “severe consequences” for companies that did not return the money by May 7. But Bennett says his companies will keep the Paycheck Protection Program money.

Why is Bennett not concerned about potential consequences? It doesn't hurt that he is a major Trump donor, contributing "$200,000 to the Trump campaign, the Republican National Committee, and a joint fundraising committee supporting both of them since last year." His donations to Trump's 2016 reelection were even larger.

In March, Bennett also hired a lobbying firm run by "Jeff Miller, who was a finance vice-chair of President Trump’s 2017 inaugural committee." This cycle, Miller "has raised more than $2.8 million for the RNC and a Trump joint fundraising committee… including $2.5 million in the first quarter of 2020 alone."

Bennett, who inherited his business from his father, has been defiant about his thirst for government money despite his enormous personal wealth. "I won’t apologize for being a capitalist in America, or for being reasonably successful at it. But even a capitalist system with companies only and no government backstop does not work," Bennett wrote in a Medium post.

Not all public companies, however, share Bennett's perspective on the Paycheck Protection Program.

12 public companies that are giving the money back

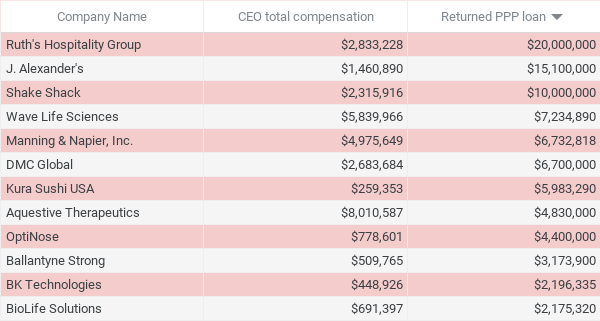

On March 22, Popular Information identified 32 public companies that pay their CEOs $1 million or more and have received Paycheck Protection Program loans. Since then, 11 public companies have returned over $78 million in loans. Shake Shack announced it would return its $10 million loan on March 20.

|

56 public companies paying their CEOs millions while collecting taxpayer money intended for struggling small businesses

While some public companies are returning their Paycheck Protection Program loans, a larger number are joining the program. At least 204 publicly traded companies have received Paycheck Protection Program loans and not returned them, according to data compiled by FactSquared.

A review of hundreds of recent SEC filings by Popular Information reveals that 56 of these companies pay their CEOs more than $1 million per year. The salary information is based on the latest data available, which is from either 2018 or 2019.

|

It's possible that some of these companies will return the money before the Treasury Department's May 7 deadline. But others explicitly said they plan to keep the money. "We have the need for assistance the PPP was intended for and we applied for the loan to meet that need," PolarityTE, a Utah-based biotech company that received a $3.6 million forgivable loan on April 12, said in a statement.

On April 16, four days after the loan was granted, PolarityTE awarded its current COO, Richard Hague, a $165,000 cash bonus. On the same day, Chief Counsel Cameron Hoyler received a $125,000 bonus.

In 2018, PolarityTE paid former CEO Denver Lough $13,714,337 in total compensation, including a bonus of $1,010,000. Former CFO Paul Mann’s total compensation was $13,862,967. The company also paid former COO Eric Swanson $4,525,587.

There are no advertisers or wealthy donors behind Popular Information. This publication exists because of readers like you. Support independent accountability journalism with a paid subscription.

Thanks for reading!