|

Ordinary Americans take tax evasion seriously because of its steep consequences — but for the super rich, getting away with tax evasion is just a game of cat and mouse. Rock the boat.

Why The IRS Went Soft On Crime

By Spencer Woodman

AP Photo/Risto Bozovic [View in browser] Michael Welu worked at the IRS for decades as a specialist in helping agents identify and investigate possible tax crimes. In an agency known for offices working in their own silos, Welu had the rare ability to move between divisions, dissecting and learning each office’s particular customs and procedures. But that experience had its own consequence for Welu: Seeing disparities in how the separate divisions treated different tiers of taxpayers left him exasperated and helped drive him into early retirement. For more than 30 years, Welu watched the agency struggle with budget cuts and dwindling staff. What troubled Welu, he says, went deeper than just resource constraints. During his time at the IRS, he says, upper management in the division tasked with auditing large corporations and ultrawealthy people — the Large Business and International Division — was quick to dismiss any suggestion that a powerful taxpayer may have committed a crime, and commonly discouraged front-line agents from pursuing big cases. This stood in deep contrast to the office that policed small businesses and self-employed people, which was empowered to — as Welu saw it — take an appropriately firm stance toward taxpayers breaking the law, even if they were dealing with far smaller dollar amounts. “I was putting butchers, bakers, and candlestick makers in jail, but the big stuff we really wanted to go after was being ignored,” Welu told the International Consortium of Investigative Journalists. “It could be the most egregious, ridiculous scheme and they were just not interested.”  Former IRS agent Michael Welu at his home in Iowa. Image: Stephen Mally / The International Consortium of Investigative Journalists. In 2022, Congress approved a Biden administration proposal to give the IRS $80 billion to improve customer service and strengthen its efforts to enforce tax law on wealthy individuals and large corporations. President Joe Biden has repeatedly pledged that under his administration the IRS will use its new money to target illegal tax schemes by these high-end taxpayers, who are believed to do an outsize portion of tax cheating. ICIJ found that the agency will need more than new funding to fulfill the president’s promise. The IRS’s Large Business and International Division, or LB&I, takes a comparatively light approach toward the country’s most powerful taxpayers, according to a review of records and interviews with current and former agents. In the agency’s own comments to ICIJ, the IRS suggested that large corporations break the law less often than other types of businesses. ICIJ found that the agency treats these powerful taxpayers accordingly. New data obtained by ICIJ shows that over the past five years, LB&I flagged no more than 22 instances of possible tax crimes for the agency’s criminal investigators to review further — out of trillions of dollars in annual income from large corporations and ultrawealthy people that the office oversees. During the same five years, the IRS office that covers small businesses and self-employed people flagged roughly 40 times more possible crimes, sending criminal investigators 848 referrals. This office is larger than LB&I and deals with easier cases, but many of the individuals and businesses it audits deal in dollar amounts too small to be considered for a criminal referral. The IRS’s civil divisions, which make up the vast majority of the agency’s workforce, are supposed to flag egregious tax cheating cases for potential prosecution from the volumes of returns they process and audit. The comparatively small number of referrals from LB&I has frustrated officials within the Criminal Investigation Division, who say they’re often unsupported in identifying cases involving the biggest taxpayers. In response to questions from ICIJ, the IRS said that comparing criminal referrals between divisions is misleading, adding that LB&I conducts “the most complex audit situations the IRS faces, and there are unique circumstances around each examination.” The agency said that large corporations generally have a limited ability to commit crimes, since they are audited by independent accounting firms and often have disclosure requirements. It said that LB&I ensures its agents have the training and resources to identify tax crimes and make referrals when necessary. The agency emphasized that it “is in a period of transition” and that it takes time to hire staff and strengthen its capabilities in the most complex areas of tax enforcement.

|

Free Shipping!

|

Check out The Lever’s merch. Every purchase supports holding the powerful accountable through the tireless independent journalism that corporate media will not do. Free shipping on all orders. |

|

|

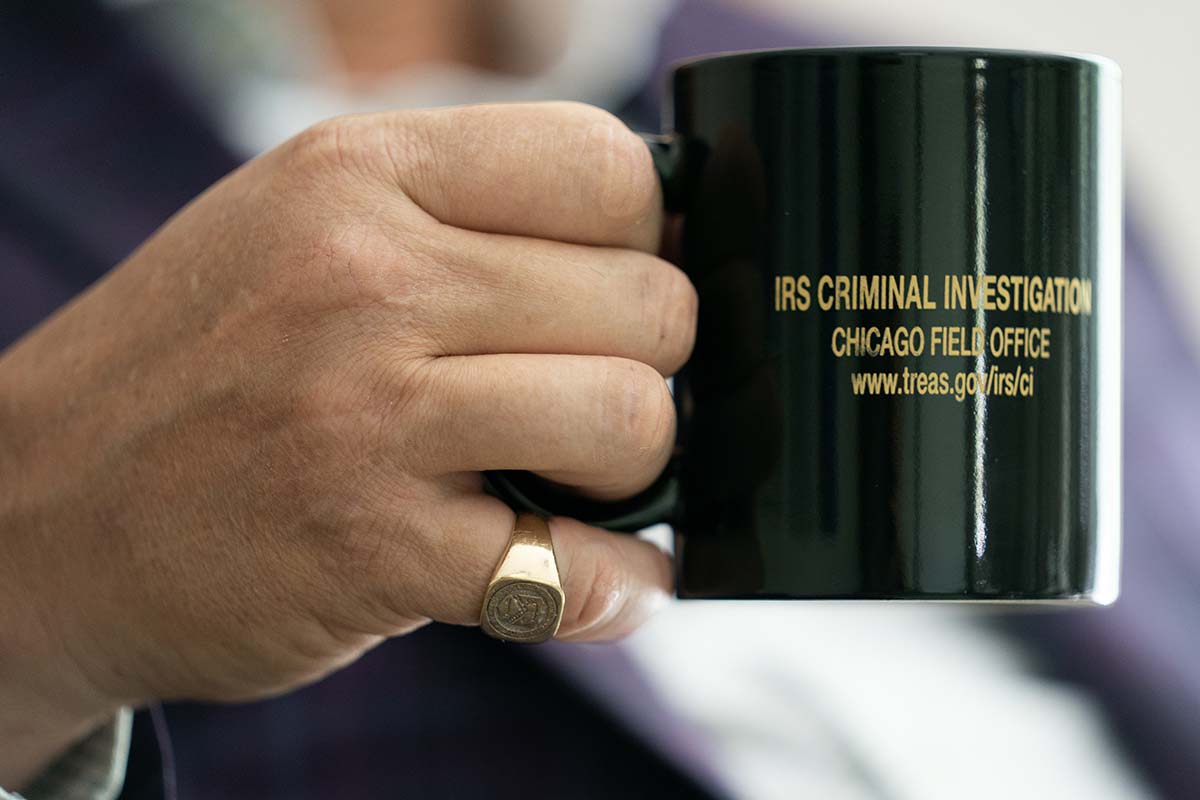

Welu and other agents said LB&I is not a monolith; some offices and managers within the division are more willing to stand up to high-income earners than others. Current and former agents pointed to various reasons for the office’s unique approach, including a separate set of audit rules and a sort of learned helplessness from years of fierce pushback by wealthy taxpayers amid government budget cuts. The movement of IRS officials in and out of the major accounting firms that represent big taxpayers has also raised questions of fair treatment. Whatever the ultimate explanation, Welu and several current IRS agents told ICIJ that LB&I’s enforcement style encourages continuous egregious behavior by the most well-heeled taxpayers, who know the office will almost certainly not elevate reports of tax dodging to criminal investigators. A Treasury Department inspector general has opened an inquiry into whether LB&I gives large corporations preferential treatment, according to people with knowledge of the matter. Tax evasion by the ultrarich is a key element in Oxfam International’s recent forecast that the world will soon see its first trillionaire. Experts say the U.S.’s failures to address high-end tax evasion have contributed to worsening global inequality. “Normal taxpayers are scared of the IRS — they fear real consequences,” one current LB&I agent, who spoke on the condition of anonymity, told ICIJ. “These highly wealthy people, it’s more like a game to them.” Different Rules For The WealthiestLB&I is the most important office in the IRS’s — and President Biden’s — commitment to ensure billionaires and multinational corporations pay their fair share. The IRS says the amount of U.S. taxes left uncollected could exceed $600 billion per year. And the Treasury Department, the IRS’s parent agency, has estimated that wealthy people commit an outsize share of tax evasion. As of 2019, the top 1 percent of Americans were estimated to be responsible for 28 percent of the “tax gap” — defined as the difference between taxes that are owed and collected. This number added up to an estimated $163 billion annually. LB&I is seen as an elite office within the IRS and a destination for more experienced and sophisticated agents. The office has 5,700 employees. LB&I is leading a new push to improve oversight of investment partnerships, like hedge funds and private equity firms, that alone account for trillions of dollars in income each year and are known to operate in gray areas of tax law to provide substantial benefits to their investors. LB&I agents who want to audit such elite taxpayers effectively have a difficult job. They not only must be excellent accountants but also must have knowledge of arcane corners of tax law, investigative skills and experience in financial forensics. Caseloads are often heavy, and incentives can tilt toward closing audits quickly. When agents find evidence of serious cheating, the easier win is to nudge a taxpayer to pay the government its owed tax rather than attempt to add on civil or criminal penalties. A 2019 report by the IRS’s inspector general examined dozens of cases where LB&I officials declined to impose civil penalty fees on taxpayers who had underpaid the agency by more than $10,000. Even when auditors find an egregious case, they may decide against crafting a criminal referral — known internally as a fraud referral — which can add significant time to an audit for an uncertain future payoff. Welu and other current and former agents argue that this has been happening more than it should. The office, agents say, has established a soft playbook around reporting possible crimes that gives high-end taxpayers confidence that, if they’re audited, the highest cost of getting caught cheating will amount to little more than paying the taxes they owed in the first place. Although federal agents frequently deal with a degree of confrontation, it’s often discouraged at LB&I by timid managers and gun-shy attorneys, according to current and former agents.  Michael Welu holds an IRS-branded mug and wears a custom IRS ring he had made after his retirement. Image: Image: Stephen Mally / The International Consortium of Investigative Journalists. Obtaining information about income, deductions and money movements is crucial for building a tax case. Although IRS agents have the power to send legally binding demands for information — known as summonses — LB&I agents issue comparatively few of them, instead relying more on information requests that do not carry the force of law, according to current and former agents. Unlike with these softer requests, a taxpayer who ignores a summons can be criminally prosecuted. A half-dozen current and former IRS agents told ICIJ that LB&I agents can go their whole careers without sending a summons. An agent within LB&I, who spoke on the condition of anonymity, described an office culture averse to summonses. He said that as a new agent wanting to take a more forceful posture toward suspected tax cheats, he found little help. “When I asked around about how to craft a summons, no one was familiar with it,” he said. “I was asking experienced agents who had been there for a while and it was something they hadn’t done.” The agent said managers within LB&I appear to fear that issuing a summons would upset the esteemed lawyers and accountants representing the country’s wealthiest taxpayers. In one publicly reported instance, an auditor in LB&I’s Global High Wealth unit who merely mentioned the possibility of a summons while auditing a billionaire was forced to apologize after the billionaire’s representatives complained to the IRS, according to ProPublica. Welu says the reluctance to issue summonses generally came from the higher levels of management. Welu would attempt to overcome this resistance by preparing a united front of lower-level attorneys to support taking steps like sending a summons for bank records or compelling a taxpayer to be interviewed by agents, he says. “It’s standard practice in Small Business [and Self-Employed Division], and they don’t think twice about it,” Welu told ICIJ. “But in LB&I, oh my god, I’d have to round up a coalition of support. I’d have to pave the road.” ICIJ found that LB&I’s written rules impose layers of restrictions on issuing summonses, compared with the Small Business and Self-Employed Division. These extra steps for LB&I agents include sending two warnings to taxpayers who have not complied with a voluntary information request before sending a summons, according to agents and an ICIJ examination of the IRS handbook. LB&I auditors are also required to, at the outset of an audit, share an audit plan with taxpayers, allow them to suggest changes to the impending audit, and request they sign the plan. Nina Olson, who served for 18 years as the IRS’s national taxpayer advocate, tasked with ensuring the fair treatment of taxpayers, says that LB&I’s audit steps provide powerful actors with more information earlier that they can use to defend themselves. “LB&I has a bespoke audit process,” Olson, who left the IRS in 2019, told ICIJ. “With LB&I, you get a custom-made suit. With the Small Business and Self-Employed Division, you get it off the rack whether it fits you or not.” While at the IRS Olson tried unsuccessfully to get the small business division to adopt the extra steps taken in LB&I audits, which she says provides taxpayers a greater level of transparency and due process. “Other people don’t get those protections,” Olson said. “It’s only large corporations and the wealthiest individuals.” “An Ingrained Culture”One of the most recent examples of the U.S. government at least attempting to pursue a multinational corporation for alleged tax crimes was a major investigation into manufacturing giant Caterpillar, which used aggressive offshore maneuvers to avoid hundreds of millions of dollars in taxes. In 2017, federal agents, including IRS criminal investigators, raided three Caterpillar facilities in Illinois. But the following year, the criminal investigation was abruptly halted amid circumstances now under investigation by two Democratic U.S. senators. The senators are seeking information on possible political interference in the investigation by lawyers hired by Caterpillar, which included William Barr, who served as President George H.W. Bush’s attorney general and would later hold the same post under President Donald Trump. LB&I did refer Caterpillar to IRS criminal investigators, but it did so only after the Criminal Investigation Division notified LB&I that it had opened its own inquiry into the corporation’s possible tax dodges, according to two longtime IRS agents familiar with the case. “It’s Caterpillar — LB&I had been auditing them forever. How could they have missed these issues?” a supervisory agent within the Criminal Investigation Division told ICIJ on the condition of anonymity. “It was just an instance of CYA,” the agent said of LB&I’s referral, using the acronym for “cover your ass.” In statements to ICIJ, the agency defended LB&I, emphasizing that its cases are extremely complex and said that “there are major differences between a large international corporation and any other for-profit enterprise.” “The accounting profession operates under a professional code of conduct as well as under the purview of oversight review boards outside of the IRS related to the preparation of certified audited financial statements,” IRS spokesperson Robyn Walker told ICIJ in a written statement. “These internal controls and checks and balances generally limit the opportunity for criminal activity. Instead, noncompliance for this population often presents itself in the form of disputes between the IRS and the taxpayers as to whether a taxpayer’s position is consistent with laws and regulations.” A key part of the IRS’s mission is to enforce U.S. tax laws. Tax crime investigations and prosecutions allow the agency to show that cheating carries consequences — and thus persuade taxpayers to voluntarily comply with the law. ICIJ reviewed data showing small numbers of cases that LB&I flags as potential crimes to investigate. Last year, the office flagged just seven instances of possible crimes to investigate further — the most since 2017, when it flagged eight.

|

Learn All Our Investigative Tricks

|

|

Score a copy of our Citizens’ Guide to Following the Money and Holding the Powerful Accountable, free with a paid subscription. The e-book gives you all the tools and tricks our reporting team uses to scrutinize power. |

|

|

That’s seven cases of possible crimes among all of the large corporations and ultrawealthy people that the office oversees. Last year, Fortune 500 companies brought in $18 trillion in combined revenue, and trillions of dollars more flowed through the investment partnerships favored by the ultrawealthy. The low number of referrals from LB&I has left investigators in the agency’s criminal division frustrated. “Those are ridiculous numbers,” Don Fort, a longtime IRS agent who led the Criminal Investigation Division before leaving in 2020, told ICIJ of LB&I’s referrals. “In my experience, it’s an ingrained culture where they don’t like to serve summonses, they don’t like to do fraud referrals.” The sources of investigations opened by the IRS’s criminal investigators between 2014 and 2020 illustrate the small role LB&I plays in the agency’s criminal cases. During that period, according to the referrals data reviewed by ICIJ, LB&I sent criminal investigators no more than 40 fraud referrals. In comparison, according to a separate dataset, the IRS opened roughly 260 times as many criminal investigations from information it received from federal agencies outside the IRS, including federal prosecutors. The agency opened nine times as many criminal investigations from reading news stories. ICIJ acquired this additional data regarding the sources of criminal investigations from Robert Warren, a former IRS agent and assistant professor of accounting at Radford University in Virginia. Warren says that over the past 13 years, IRS criminal investigators have spent only a fraction of their time pursuing cases primarily related to tax crimes. Instead, the investigators frequently chase cases such as drug crimes, cryptocurrency schemes, and money laundering. Warren says this is a distraction from the agency’s core mission. Many IRS criminal investigators are uninterested in chasing tax crimes due to a perceived reluctance of prosecutors to issue indictments and the generally light punishments that tax convictions often fetch, he says. “If they can put in the same amount of work on a case that gets a higher rate of return, they’re going to go with the higher rate of return,” Warren told ICIJ. In 2020, then-IRS Commissioner Charles Rettig oversaw the establishment of the Office of Fraud Enforcement, which helps the civil divisions develop tax fraud cases. Rettig told ICIJ that when he arrived at the agency, he was shocked to discover only 7 percent of the IRS’s criminal investigations had come from the civil divisions, which include LB&I. “To me, the civil side isn’t doing their job” if they can’t detect these possible tax crimes, Rettig said. Olson, the former IRS taxpayer advocate, expressed concern about where the fraud enforcement office fell in the IRS’s organizational chart: within the Small Business and Self-Employed Division. She worries that this may send the message that the IRS is more interested in finding crimes among less powerful taxpayers. “It should be a separate operational unit,” Olson told ICIJ. Damon Rowe, a career IRS criminal investigator who ran the fraud enforcement office until retiring from the agency in 2022, disagreed, saying the office’s place did not bias it in favor of any one division. Rowe told ICIJ that while the office saw plenty of potential criminal cases coming from the small business division, he sensed a cultural aversion within LB&I to flagging possible crimes among corporations and the ultrawealthy. His inability to meaningfully lift LB&I’s criminal referral numbers remains a major regret from his time running the fraud enforcement office, he says. “I get that these cases are hard, but that doesn’t mean that they shouldn’t try,” Rowe said. “If LB&I believes there’s an infraction, they’re more willing to work it out with the taxpayer rather than call over a fraud enforcement agent to take a look.” The Treasury Department’s Inspector General for Tax Administration has apparently taken notice of LB&I’s differing approach. The watchdog office opened an investigation in 2022 to determine whether the division gives large corporations preferential treatment, according to sources familiar with the inquiry. In an email, the inspector general told ICIJ that the inquiry is ongoing and that its report on the matter should be released by the end of this fiscal year. The office did not elaborate further. The IRS’s “Revolving Door”Officials interviewed for this story pointed to numerous contributors to LB&I’s comparatively light approach, and not everyone agreed on the causes. In addition to the division having to follow more cumbersome rules, current and former agents cited a culture of acquiescence after being beaten down for years by wealthy taxpayers and their high-priced accountants and lawyers. The representatives of these people and corporations often seek to gain an advantage by accusing IRS agents of breaking protocols or laws, and have enlisted lawmakers to attack the agency’s enforcement actions. One current LB&I agent, however, disagreed that culture plays any role, saying his managers supported him taking a firm stance toward big taxpayers. The agent, who spoke on the condition of anonymity, said it was insufficient resources — not timidity — that caused the office to shy away from taking a hard line on egregious tax dodging. He described a case in recent years in which an LB&I manager declined to advance any criminal investigation involving a major tax dodge by a wealthy individual. The agent described the case as a “dead bang” — in terms of easily proving criminal intent. “It pissed me off,” the agent said of his office declining to refer the case to criminal investigators. “It was because we didn’t have enough people to chase it.” Every current and former IRS official interviewed for this story said leadership is key in setting the tone for how LB&I approaches the most powerful taxpayers. Some agents expressed concerns about the seeming friendliness and familiarity of LB&I managers with the representatives of taxpayers under audit. Some agents, as well as legislators and watchdog groups, singled out the prevalence of high-ranking officials at the IRS who previously worked for the major accounting and law firms that go head-to-head with LB&I every day. A closely related concern is the prevalence of former IRS agents and managers who went on to represent rich people and large corporations. In many cases, these former IRS agents and executives bring the arguments of wealthy taxpayers directly to IRS officials they know well as friends and former colleagues. Last August, the IRS’s watchdog, the Treasury’s Inspector General for Tax Administration, released a report warning that the movement of employees between the IRS and accounting firms and big companies raises “impartiality concerns.” The report identified no direct correlation between the employees’ work assignments and the companies they came from or left the agency for. But it found that nearly 500 employees in LB&I, the Office of Chief Counsel, and the appeals office had received income from a major accounting firm or large corporation before or after their time at the IRS. Some executives also received retirement income from a large accounting firm during their time at the IRS and properly reported it in their financial disclosure forms, the report said. “It undermines trust in government and our tax system when IRS employees go back and forth between government service and lucrative jobs with big accounting firms and other giant corporations,” Sen. Elizabeth Warren (D-Mass.), told ICIJ in a statement. “We need stronger ethics rules across the board for government officials and to close the revolving door.” The IRS finds itself in a difficult position in this regard. Experts agree that with its new funding from Congress, the agency must attract top talent from major accounting and law firms who earn far more than the agency can pay. An ICIJ review shows that top executives in LB&I commonly switch hats from regulating the wealthiest taxpayers to working for them. A review of LB&I executive lists covering the past 13 years shows that out of 114 top executives named, at least a quarter either had worked for a major accounting firm, a tax consulting firm, or a major tax law firm shortly prior to joining the IRS or left the IRS for such private sector roles. In a statement to ICIJ, the IRS said it needed private sector talent and that safeguards are in place to prevent conflicts of interest. “The tax law is complex, and the IRS needs insight from those in the tax community to help the agency tackle complex issues and share valuable insights that can complement the work of career government employees,” IRS spokesperson Robyn Walker told ICIJ in a statement. “People from the private sector provide important viewpoints and unique expertise needed to help the IRS run the tax system. This takes on even more importance as the agency works to build compliance work in high-risk corporate and high-wealth areas.” “Given the intricacies and evolving nature of the nation’s tax code and the economy, it’s impractical to assume only current IRS in-house employees can be executives,” the statement added. The agency also said it has a “strong system of checks and balances in place to ensure fairness in its compliance activities,” including a review process to make sure that decisions are shielded from outside influences. The IRS’s current chief counsel, Margie Rollinson, has gone through the revolving door twice. In 2013, after more than two decades at EY, the Big Four accounting firm formerly known as Ernst & Young, Rollinson took a senior post at the IRS chief counsel office, overseeing more than 60 attorneys. She returned to EY in 2019 and then recently rejoined the IRS after the Senate confirmed her nomination for the chief counsel job at the end of February. During her first stint at EY, Rollinson advised Hewlett-Packard Co. on a major offshore tax scheme, according to records obtained in a Senate investigation into the technology firm’s tax avoidance efforts. The Senate Permanent Subcommittee on Investigations found that, with EY’s apparent support, Hewlett-Packard used a loophole to avoid paying taxes on billions of dollars in income. “We believe it’s egregious,’’ then-Subcommittee Chairman Carl Levin (D-Mich.), said at the time about the offshore tax maneuvers. The agency noted that during the senate confirmation process, Rollinson pledged to recuse herself from matters involving her past clients in her first four years at the IRS. She also committed to a four-year buffer after leaving the agency during which she will avoid working for firms whose clients she dealt with at the agency. The IRS Independent Office of Appeals, tasked with impartially deciding taxpayers’ challenges to IRS findings, is headed by Elizabeth Askey, a former principal at PwC, another Big Four firm. The appeals office can have extensive influence over how much a company will ultimately owe the IRS and is known to frequently slash the tax bills of multinational corporations challenging audit results. A 2016 article that Askey co-authored while at PwC argued that LB&I was too aggressive with wealthy taxpayers and large corporations. Askey and her co-authors criticized LB&I for using the term “campaign” in publicizing its enforcement priorities, arguing that it “suggests a military style assault on perceived tax noncompliance.” The IRS said that Askey has a strong record in “fairly serving the interests of both taxpayers and tax administration.” It noted that the agency’s taxpayer advocate recently recommended that the appeals office hire more employees from the private sector to ensure fairness and impartiality. “External hires help Appeals maintain an arms-length relationship with the rest of the IRS,” the agency told ICIJ. 💡 Follow us on Apple News and Google News to make sure you see our stories first, and to help make sure others see our breaking news as well. Fulfilling A CommitmentMichael Welu is proud of his more than three decades at the IRS. He sports a custom golden ring with the agency’s logo that he had a jeweler make after his retirement nearly two years ago. The walls of his home office are lined with his awards and recognitions from the agency, and he drinks from a coffee mug emblazoned with the emblem of IRS Criminal Investigation, one of the offices he worked closely with. He says he is speaking out publicly for the first time because he wants the agency to do better in its pledge to stand up to the county’s most powerful taxpayers. Even with the agency’s new billions, he says, it will need a significant culture change to fulfill this commitment. Welu says that solutions can be as simple as teaching agents from an early stage that as long as they follow all protocols, they should not be afraid to take a firm stance with an uncooperative wealthy taxpayer. He believes the agency must also pursue the firms that formulate and sell tax evasion schemes to major taxpayers.  The walls of Michael Welu’s home office are lined with awards and recognitions from his time at the agency. Image: Stephen Mally / The International Consortium of Investigative Journalists. Welu also thinks that procedures for information gathering should be streamlined and made more equal across offices. To get serious about going after high-end tax cheats, he says, the agency will have to train its managers to be unafraid of conflict with big taxpayers who don’t cooperate. To do this, they’ll need support from the very top ranks, including the IRS commissioner and the Office of Chief Counsel. “These are difficult cases,” Welu said, “but they can be done.” Contributors: Denise Ajiri, Jelena Cosic and Delphine Reuter

Help us spread the word! Please forward this email to family and friends. Was this email forwarded to you? Sign up for free to receive original reporting like this in your inbox every day.

|