The Pomp Letter - The Trump Trade Is On

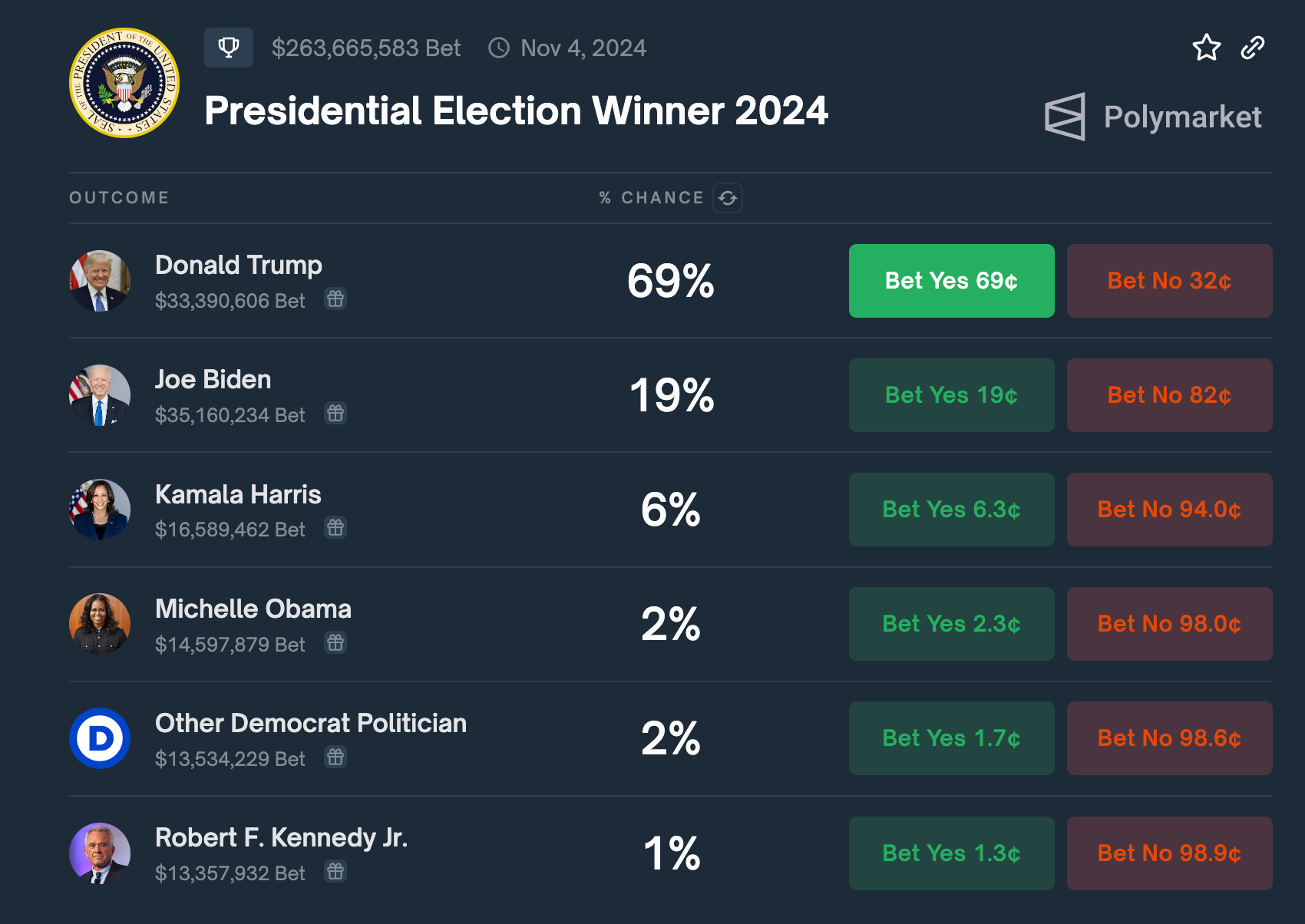

Today’s letter is brought to you by Domain Money!Wondering where to go for financial advice? Domain Money makes financial planning simple. No hidden fees and no sales pitches - you get a personalized roadmap to your goals, from dream vacations to retirement. Flat-fee advisors create a plan tailored to you, with zero pressure to invest. Don’t be like most people who’ve never had a real conversation about their financial plan. Book a free strategy session today here. While I'm not a Domain Money client and they are paying me, I've seen first hand the value of their service through the free plan they did for one of my brothers. Yes, I might have an interest in promoting Domain Money, so just like any major financial decision, it's important you understand what the service is and if it's right for you so make sure to see this important disclaimer. To investors, The market is starting to price in a President Trump victory in November. To understand the perceived “Trump Trade,” we must first remember that Trump’s odds of winning the election has now reached at least 69%. Next, we must understand how the proposed policies and likely Trump victory would impact assets, industries, and markets. The best description I have seen came from Alex Kruger, a well-known economist and trader from Argentina:

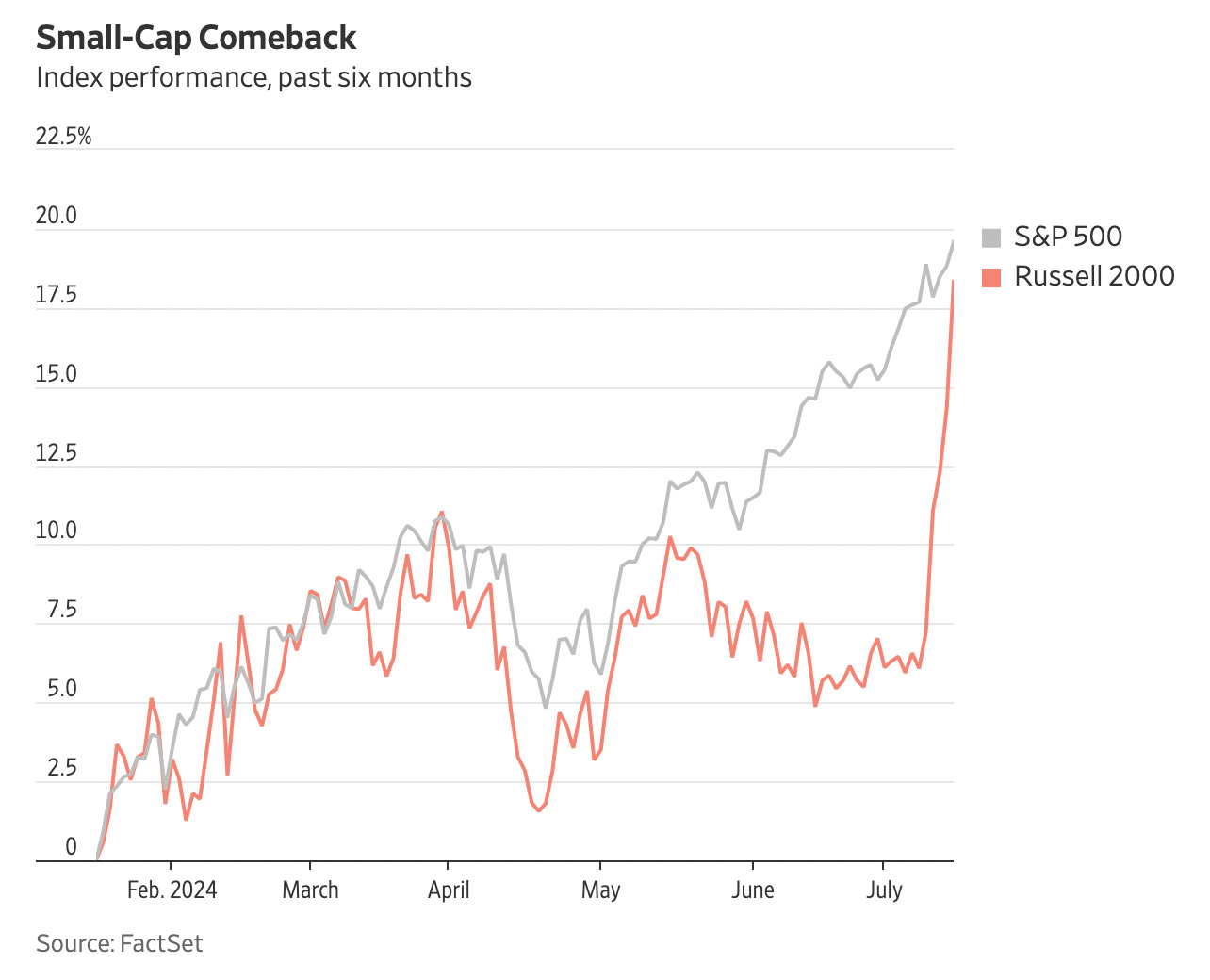

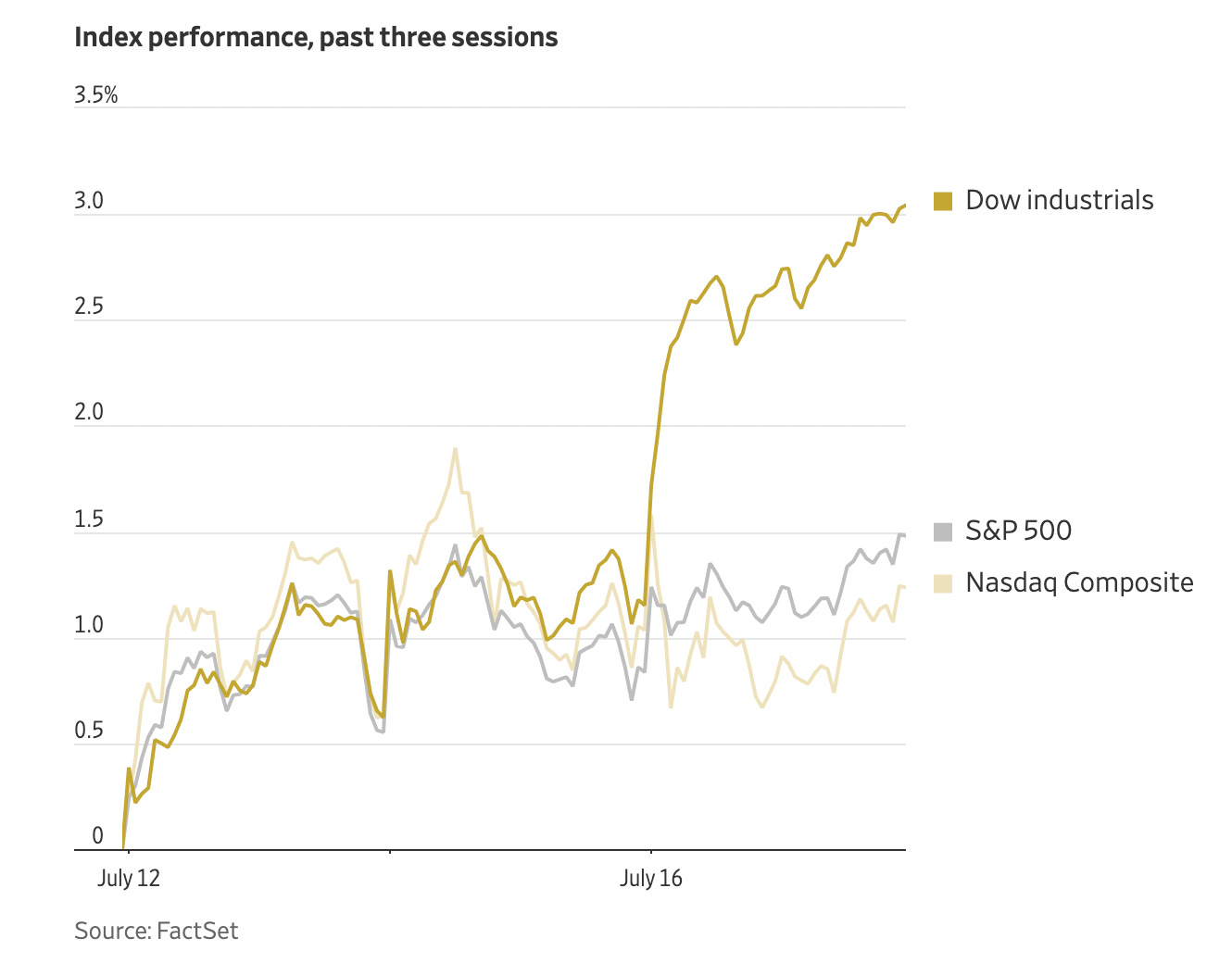

The idea of a Trump Trade is not theory though — you can see it starting to show up in the data. Take the Russell 2000 as an example. Hannah Miao of the Wall Street Journal points out the small cap index has lagged the S&P 500 significantly for the last 6 months, but that has drastically changed in the last few days. The Russell 2000 has almost fully caught back up to the large cap index now. This is not the first time that we have seen something like this occur — investors showed a relative strength in small caps vs tech back in 2016 when Trump was elected and they are showing the same relative re-rating over the last few days as well. This can also be illustrated by those going long Russell and short Nasdaq 100, according to Holger Zschaepitz. Additionally, you can see that industrial stocks have doubled the performance of the S&P 500 in the last three trading sessions. John Melloy at CNBC highlights a rapid change in future interest rate expectations by traders as well. Melloy writes:

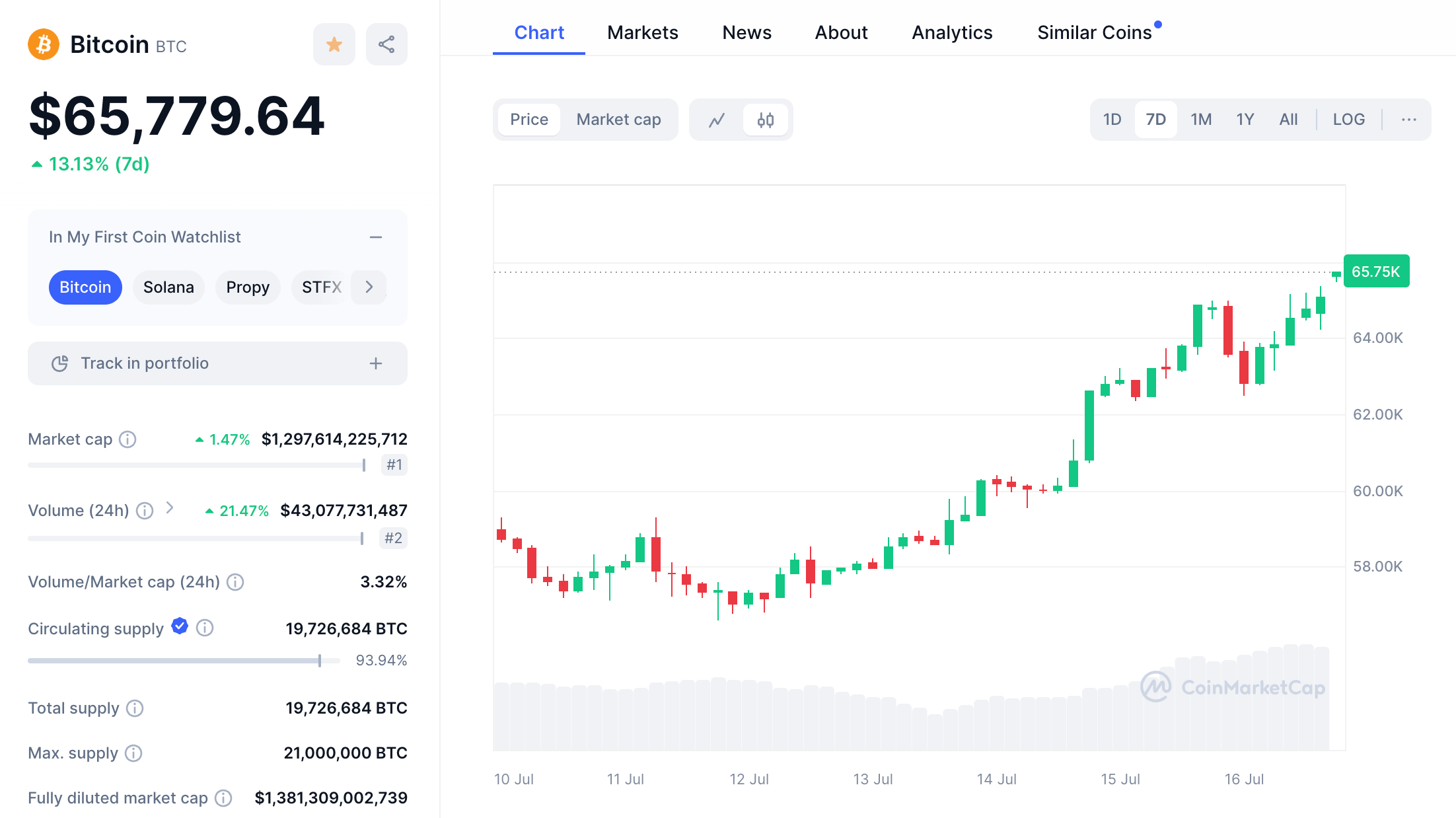

Prediction markets like Kalshi are also showing a significant increase in interest rate cut expectations recently. Odds now stand at 81% for a rate cut by September according to the market. Bitcoin, one of the best free market signals that we have, has increased in price by more than 13% over the last 7 days. This type of strength has historically been reserved for significant changes in investor expectations, which is obviously happening as Trump’s odds of victory continue to grow. So market participants are expecting interest rate cuts and the odds of Trump winning are kickstarting re-allocation of assets in various parts of the market, but I want to give a word of caution — we have seen plenty of false starts on various trades or trends in the past. For example, the Russell 2000 strength may disappear if these companies can’t produce the earnings necessary to support the current excitement. Interest rates will remain sticky with one hot inflation reading. And bitcoin can be volatile depending on who is tweeting at any given time. While it can be fun and exciting to try nailing the Trump Trade, the best investing strategy is usually to think long-term, minimize your trading/decision-making, and chill. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. Kian Sadeghi is the Founder & CEO of Nucleus Genomics. In this conversation, we talk about DNA sequencing, how he is disrupting the old school companies, why he believes so much in giving power to the people, taking control of your health with your DNA, regulation, ethics, and more. Listen on iTunes: Click here Listen on Spotify: Click here Nucleus CEO on Genetics Behind Intelligence Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Trump Survived & Asset Prices Are Responding

Monday, July 15, 2024

To investors, Everyone has likely seen the footage of the attempted assassination of President Trump from this weekend. It was surreal to see the footage spread at warp speed around the internet within

Podcast app setup

Friday, July 12, 2024

Open this on your phone and click the button below: Add to podcast app

Value Created vs Value Captured

Friday, July 12, 2024

Listen now (3 mins) | READER NOTE: There are over 800 Bitcoin-only businesses and 2500+ Bitcoin-focused companies with thousands of open job roles. Next week I'm hosting a webinar with

I've Been Building A New Investment Firm For The Last Two Years

Thursday, July 11, 2024

Listen now (2 mins) | To investors, For the last two years, I have been quietly building Professional Capital Management — a new investment firm. The new firm takes a very different approach to

Bitcoin Must Be Embraced By Both Political Parties

Tuesday, July 9, 2024

To investors, The beauty of bitcoin is that technology is apolitical. It doesn't care what political party you pledge your allegiance. It doesn't care what rules politicians put in place.

You Might Also Like

The Profile: The CEOs attending psychedelic retreats & the crypto founders getting ‘debanked’

Sunday, December 22, 2024

This edition of The Profile features crypto entrepreneurs, 'psychedelic' CEOs, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤔A lingering suspicion...

Sunday, December 22, 2024

Plus, what stands in most marketers' way... hey-Jul-17-2024-03-58-50-7396-PM Here at Masters in Marketing, Caroline, Laura, and I have interviewed some very bright minds from some very bold brands.

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏