Popular Information - Trump's $48 billion corporate giveaway

The next 104 days will have a dramatic impact on the future of the United States and the world. There are many powerful forces that will seek to manipulate the public with lies, deceptions, and distractions. Popular Information will work tirelessly to debunk these false claims and bring you the facts. We will not cover this election like a sporting event. We understand the stakes, and we respect you as a citizen. You can support this work — and help it spread far and wide — by upgrading to a paid subscription. In an interview with Bloomberg Businessweek published earlier this month, Trump said that, if he wins a second term, he would push to slash the corporate tax rate:

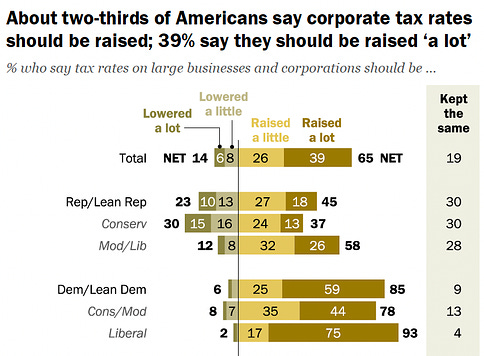

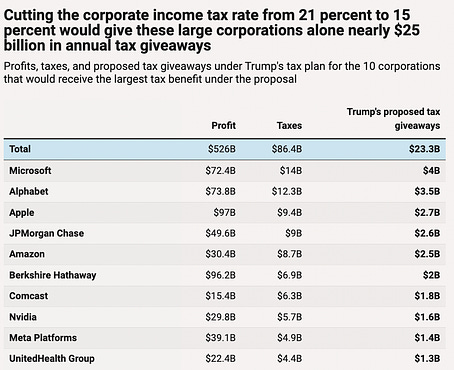

Trump correctly stated that he signed legislation in 2017 sharply reducing the corporate tax rate in his first term. The top rate was 35%, not 39% as Trump claimed, but it was still a very large cut. The reduction cost over $1.3 trillion over 10 years. According to the Congressional Research Service, corporations used the windfall mostly for "a record-breaking amount of stock buybacks, with $1 trillion announced by the end of 2018." Stock buybacks are a way of increasing stock prices by reducing supply, which in turn benefits wealthy investors and executives with stock options. Previously, Trump has been cagey about his plans for the corporate tax rate in a potential second term. Last September, when asked in an interview if it was true he’d cut the corporate tax rate to 15%, Trump responded: “I’d like to lower them a little bit if we could.” In January, the Trump campaign put out word that he was not interested in cutting the corporate tax rate further. Trump's spokesman, Jason Miller, said Trump's priority was preserving the 2017 cuts and then securing additional tax cuts for the working class. “In my most recent conversations with the president, he said that he really wants to focus more on small businesses than corporations,” Stephen Moore, an economic advisor to Trump, told the Washington Post. “I think he’s fine with the corporate rate where it is. He wants to keep intact the tax cut we did in 2017.” The campaign's eagerness to shift attention away from corporate tax cuts is understandable; corporate tax cuts are very unpopular. Research shows that just 14% of Americans want to lower corporate taxes. In contrast, 65% of Americans say they are in favor of raising the corporate tax rate. The policy is even unpopular among Republicans — only 23% support lowering the corporate tax rate. Nevertheless, Trump has confirmed he will push for a 15% corporate tax rate in a second term. Let's look at the impact of such a policy. A 15% tax rate would mean a multi-billion dollar windfall to the nation's largest and most profitable companies An analysis by the Center for American Progress (CAP) Action Fund, a progressive non-profit organization, found that reducing the corporate tax rate from 21% to 15% would "[g]ive the largest 100 U.S. companies (the Fortune 100) a total estimated annual tax cut of $48 billion." These companies collectively "reported $1.1 trillion in profits in their last annual report." To put the scope of the tax cut in perspective, the $48 billion cost is "larger than the entire FY 2024 U.S. Department of Education K-12 budget." The benefits to some individual corporations are stunning. Microsoft, Alphabet (Google), Apple, JP Morgan Chase, Amazon, and Berkshire Hathaway would all reduce their tax bill by $2 billion or more annually. The annual benefit to the 10 companies that would benefit most exceeds $23 billion. This is more than double the combined annual budget of two critical federal agencies, the National Cancer Institute and the National Center on Aging. The five largest oil and gas companies — Exxon Mobil, Chevron, Marathon-ConocoPhilips, Phillips 66, and Valero Energy — generated over $93 billion in profits last year. Those companies would get a combined $2.5 billion windfall under Trump's proposal. The CAP Action Fund analysis was performed by looking at the "federal income tax expense" listed on publicly filed documents. This isn't the exact same as federal taxes paid, but it provides a reasonable proxy. Corporations do not release their annual tax returns. The Tax Foundation, a non-profit group focusing on tax policy found an even larger cost using a slightly different methodology. The non-partisan group found that lowering the corporate tax rate to 15% would "reduce federal revenue by $673 billion from 2025 to 2034." |

Older messages

Arkansas has the worst voter registration rate. Republicans are pushing to make registration harder.

Wednesday, July 24, 2024

This story is being published in partnership with American Doom, a newsletter that focuses on right-wing extremism and other threats to democracy. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Top Sinclair anchor resigned over concerns about biased and inaccurate content

Tuesday, July 23, 2024

Eugene Ramirez, the lead anchor of Sinclair's national evening news broadcast, resigned in January over concerns about the accuracy and right-wing bias of the content he was required to present on

A guide to the coming attacks on Kamala Harris

Monday, July 22, 2024

On Sunday at 1:46 PM Eastern Time, President Joe Biden announced he would end his campaign for reelection. Seconds later, the attacks on Vice President Kamala Harris began. Harris is not yet the

Weigh in

Thursday, July 18, 2024

Here are a few highlights from Popular Information's reporting over the few weeks: Today, however, I want to hear from you. What's on your mind?… ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The extraordinary duplicity of Musk's $180 million donation to support Trump

Wednesday, July 17, 2024

Billionaire Elon Musk will reportedly spend $180 million to encourage former President Donald Trump supporters in swing states to vote absentee, a practice Musk has publicly described as "insane,

You Might Also Like

China's Silk Typhoon, tied to US Treasury break-in, now hammers IT and govt targets [Thu Mar 6 2025]

Thursday, March 6, 2025

Hi The Register Subscriber | Log in The Register Daily Headlines 6 March 2025 ab hurricane typhoon China's Silk Typhoon, tied to US Treasury break-in, now hammers IT and govt targets They're

On My Mind: Diptyque Dupes and My Zara Home Wish List

Thursday, March 6, 2025

Plus: 50 percent off our favorite cooling memory-foam pillow. The Strategist Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate

Why a successful food creator quit her popular YouTube channel

Thursday, March 6, 2025

PLUS: Why don't more publishers offer ad-free content to paid subscribers? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Open Thread 371.5

Wednesday, March 5, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What A Day: Chainsaw & Order

Wednesday, March 5, 2025

The Supreme Court slapped down Trump's attempt to cancel $2 billion in foreign aid contracts. Will he listen? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

An important update on our legal strategy to gain access to DOGE records

Wednesday, March 5, 2025

This could be one of our most challenging and consequential investigations ever, and we're counting on your financial support to ensure that we have the legal and reporting firepower to get to the

Unpacking Trump's Address to Congress

Wednesday, March 5, 2025

March 5, 2025 EARLY AND OFTEN In Address to Congress, Trump Pleasures Himself and His Base By Ed Kilgore Photo: Ben Curtis/AP Photo Before Donald Trump's first joint address to Congress since

GeekWire Mid-Week Update

Wednesday, March 5, 2025

Read the top tech stories so far this week from GeekWire Top stories so far this week Anthropic, which opened a Seattle office last year, now valued at $61.5B after raising $3.5B Anthropic is adding

Longly is the New Bigly

Wednesday, March 5, 2025

Trump's Speeeeeeeeech ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Looting Of America’s Affordable Housing Fund

Wednesday, March 5, 2025

Private equity firms are diverting billions from a Great Depression-era mortgage program — and making huge profits. Forward this email to others so they can sign up Going forward, along with our midday