My Takeaways From The Bitcoin Conference Speakers

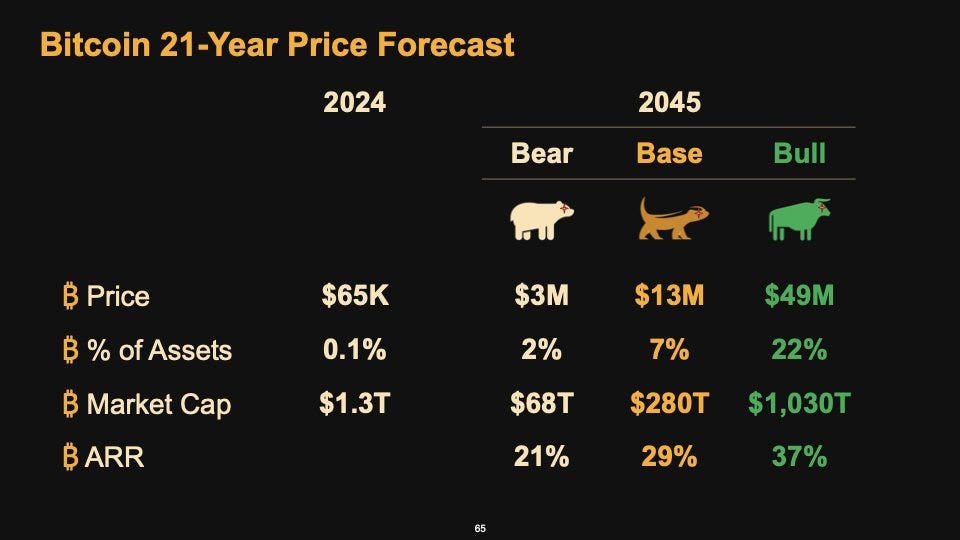

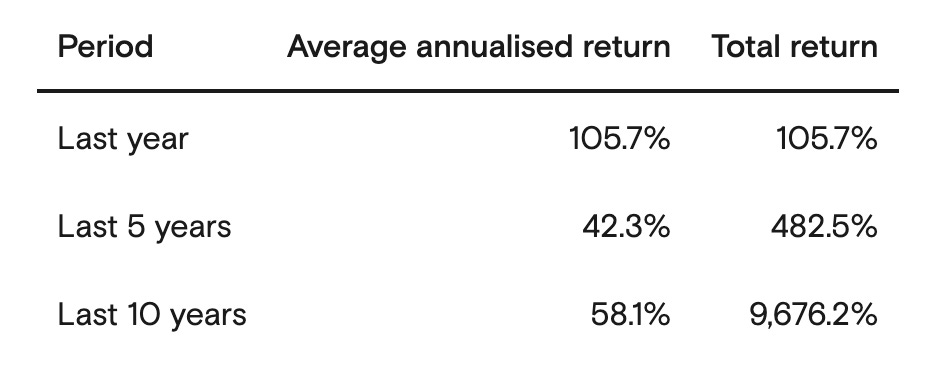

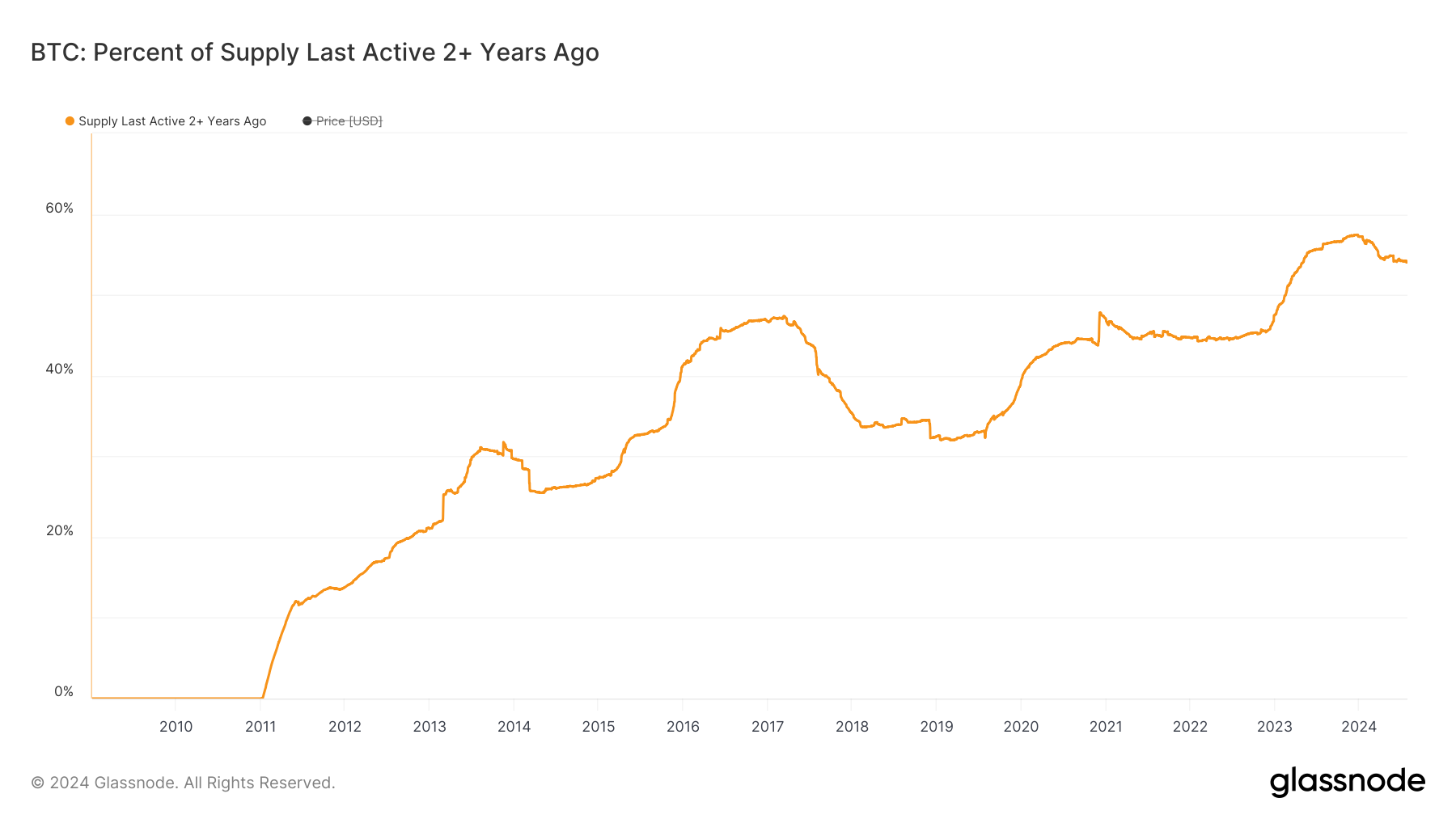

Today’s letter is brought to you by Domain Money!Wondering where to go for financial advice? Domain Money makes financial planning simple. No hidden fees and no sales pitches - you get a personalized roadmap to your goals, from dream vacations to retirement. Flat-fee advisors create a plan tailored to you, with zero pressure to invest. Don’t be like most people who’ve never had a real conversation about their financial plan. Book a free strategy session today here. While I'm not a Domain Money client and they are paying me, I've seen first hand the value of their service through the free plan they did for one of my brothers. Yes, I might have an interest in promoting Domain Money, so just like any major financial decision, it's important you understand what the service is and if it's right for you so make sure to see this important disclaimer. To investors, The Bitcoin Conference did not disappoint. There is way too much to cover in one letter, so I am going to focus on the four speeches that I believe are most noteworthy. First, Microstrategy’s Michael Saylor gave a presentation on bitcoin, including his vision on how the asset can improve financial markets and his bull and bear case for the future asset price. You can watch the full presentation here. Saylor used annual rates of return between 21% and 37% for the next 21 years to determine his three potential price outcomes. It may surprise some to see Saylor’s bear case of $3 million per bitcoin, but remember this is over the next two decades. That would put bitcoin’s annual return at approximately 2x the S&P 500 each year. The annualized return for the last 5 years is over 40% and you can see the year-by-year returns below. Given the asset has a fixed supply, and the dollar continues to be debased at a healthy rate, it doesn’t seem crazy for bitcoin to increase in price by 21% a year for the next two decades. Next, Presidential candidate Robert F. Kennedy Jr. gave a rousing speech that called for the United States to purchase 4 million bitcoin as a strategic reserve asset. His plan would be for the country to purchase 550 bitcoin per day until the full 4 million are purchased. This sounds like a great idea on the surface, but I highly doubt it is mathematically possible. You can see that more than 50% of bitcoin’s circulating supply has not moved in over 2 years and the general trend is that bitcoin is becoming more illiquid over time. This means it is hard to see a world where one country will be able to acquire ~ 20% of the bitcoin total supply. Again, the general strategy and idea are compelling, but it is more likely that the United States could acquire 1 million bitcoin, which would still make them one of the largest bitcoin holders in the world. On Saturday, former President Donald Trump gave his highly anticipated speech. He hit almost every major talking point that the audience wanted to hear, including comments saying the cardinal sin of bitcoin was selling your bitcoin and professing that “bitcoin is going to the moon.” Here is a summary from Reflexivity Research’s Will Clemente of the main talking points: Notably, Trump did not call for purchasing more bitcoin at the national level. He chose to advocate for the US government to hold on to the approximately 200,000 bitcoin that is already in the government’s possession. Instead of calling this bitcoin a “strategic reserve,” Trump chose to call it a “strategic stockpile.” Although that may sound like semantics, it suggests that Trump is not planning to back the US dollar with bitcoin or any other type of reserve activity. This idea of a strategic stockpile from the leading Presidential candidate immediately makes me think other Presidents and countries around the world are going to be creating their bitcoin strategy this week. They can’t allow the game theory to leave them on the wrong side of history. Another interesting point during Trump’s speech was the reaction to Trump’s promise to fire SEC Chairman Gary Gensler. You can see the Presidential candidate was shocked by the crowd’s support, so he chose to repeat the line with a degree of showmanship. This was another sign that Trump is quickly ramping up his pro-bitcoin support in an effort to court the growing voter cohort. Speaking of political support for the industry, it is important to remember that everything we are hearing so far is talk. It is ultimately action that matters. Promises sound great. We won’t know till after the election whether any political candidate will actually do what they say they are going to do. Lastly, Senator Cynthia Lummis followed Trump’s speech with a major announcement — proposed legislation that would require the US government to buy 1 million bitcoin (worth ~ $68 billion). Her thought process is that these bitcoin would be held for a minimum of 20 years and could help bring down the US debt. Lummis stated “This is our Louisiana purchase moment,” which refers to the prescient investment of $15 million the US made to purchase 530 million acres of land from France in the early 1800s. Overall, the bitcoin conference was filled with many amazing speakers and lots of announcements. The Bitcoin Magazine team did a fantastic job from the various talks. You can watch them all online by clicking here. Hope everyone has a great start to their week. I’ll talk to you tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here. James Davolos is a Portfolio Manager at Horizon Kinetics. In this conversation, we discuss oil & gas coming together with bitcoin mining & AI data centers, what is going on down in Texas, how the companies work, impact on artificial intelligence, bitcoin mining, data centers, and where the world is headed. Listen on iTunes: Click here Listen on Spotify: Click here How Bitcoin Miners Are Embracing The AI Revolution Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

The Presidential Bitcoin Conference Begins

Thursday, July 25, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Thursday, July 25, 2024

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Wednesday, July 24, 2024

Open this on your phone and click the button below: Add to podcast app

Ether ETFs Launch Today - Everything You Need To Know

Tuesday, July 23, 2024

To investors, The Ether ETFs will begin trading today. These are the second set of crypto ETFs that have been approved by the SEC for trading. The approval of an asset other than bitcoin is a milestone

Five Charts That Show Crypto Is Hitting Its Stride

Monday, July 22, 2024

Listen now (2 mins) | To investors, President Joe Biden announced yesterday that he would not be seeking re-election in November. This is the latest development in an already chaotic Presidential

You Might Also Like

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Simple hack to get 4x more shares

Sunday, December 22, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible

How to Describe a Hallucination

Saturday, December 21, 2024

If hallucinations defy the grasp of words, how should we try to describe them?

+28,000% Engagement with Pinterest?

Saturday, December 21, 2024

Exploding impressions and engagement