Earnings+More - Take me to the Rivers

And it gets bigger, baby, and heaven knows. Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

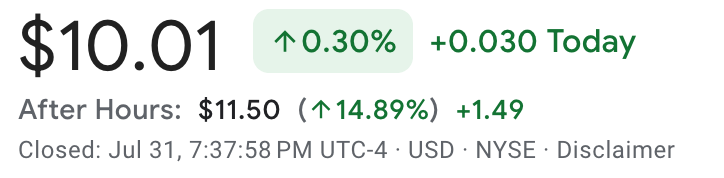

Rivers deepHarder, better, faster, stronger: Rush Street Interactive shares are up nearly 15% in post-close trading as the CEO Richard Schwartz proclaimed its “approach is working” after another quarter of beating analyst expectations.

👀 Rush Street shares up nearly 15% AMC Nine of the above: Schwartz noted that RSI saw 50%+ growth in nine separate markets. Not coincidentally, he said nine of RSI’s 19 markets globally featured iCasino.

Slicing and dicing: CFO Kyle Sauers noted the advances came despite marketing costs declining 10% YoY and expenditure as a percentage of revenue falling to 16% from 24% in Q223. But he noted marketing spend would increase again in H2.

No IL effects: Sauers said the new graduated tax structure in Illinois was “better” for RSI with the impact being less than feared at less than $2m of annual impact. He noted he believed the “competitive intensity” in the state would decline in response. LatAm TAM: Revenue from Latin America was up 79% YoY, with the “vast majority” coming from Colombia, helped by the country’s recent appearance in the final of the Copa America tournament.

Tell me what’s your flavor? Asked whether RSI would look at buying more elements of its tech stack, Schwartz pointed out it already owns “almost all” of its back end.

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management. Say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish! Complete your first licensing application 50% faster, get real-time alerts for immediate compliance actions, and slash legal fee costs by up to 90% with no more duplicate tasks. Click here to connect with us and discover how much more you can accomplish with OneComply. No pressure, GavComfort blanket: CEO Bill Hornbuckle said the appointment of Gavin Isaacs as CEO at BetMGM JV partner Entain was “comforting,” adding he would “do wonders for that business and ultimately the market.”

Keep the faith: Referring to Monday’s somewhat disappointing trading update from BetMGM, he said the company had previously stated 2024 would be an “investment year” and that the company had recognized it had lost share in OSB and that was impacting the position in iCasino where market share is “precious.”

Cinemascope: “Big picture, we love what BetMGM has done for our brand,” he added. “We love the long-term prospects.”

Rooms with a view: CFO Jonathan Halkyard opened proceedings with the analysts by pointing to the contribution made by the partnership with Marriott, which he said brought in 410k of room bookings in the YTD.

Off grid: Hornbuckle noted “some softness” later in the year with Formula 1, saying MGM is “hoping and believing that this race will continue to pace up.”

By the numbers: Revenues for the quarter came in up 10% to $4.33bn helped by a 37% improvement at MGM China. Adj. EBITDA was up 4.8% to $1.17bn. Hornbuckle said MGM’s Macau operations were trending above the 80% recovery seen in the market generally. +MoreStake.com has made a move into the regulated Italian market with the acquisition of Baldo Line, the company behind IdealBet. Stake said the deal was “pivotal” as the company pushes further into the regulated space following the acquisition of the Betfair Colombia license in Nov23.

WynnBet has stopped taking bets in New York, paving the way for the transition to ESPN Bet, according to PlayNY. Penn said previously it hoped to launch in the state by fall after it bought the license in February. By the numbersLas Vegas: Strip GGR rose 4% YoY in June to $759m, helping Q2 revenue to a 5% increase. Locals revenue was up 6%. The analyst at Truist said the results were “encouraging as Vegas continues to power through any broader macro weakness.” Visitor volume was up 1.2% YoY. Macau: Revenue rose 11.6% YoY to $2.31bn in July, a 5% sequential increase. The figure is 24% down on the pre-pandemic numbers. Bally’s true BritBrit on the side: Bally’s international interactive unit was propped up by 9% growth in the UK business but this failed to offset what analysts at Macquarie said were “strong declines” in Japan and other markets, which meant the segment saw 7% decline overall to $229m.

By the numbers: Total revenues rose 2.5% to $622m while adj. EBITDA was static at $130m. B&M gaming rose 3% to $343m while North America online revenues nearly doubled to $49.2m.

Flag day: Following the recent deal with GLP to fund the development of the permanent casino in Chicago, Reeves said Bally’s was “fully ready to plant our flag in the heart of the city.”

Standard response: Reeves said the agreement reached with Standard General last week “provides a clear path to increased revenue, cash flow and value accretion.” Earnings in briefVICI: Total revenues for the gaming REIT rose 6.6% YoY to $957m while AFFO increased 10% to $592m. Ed Pitoniak, CEO, noted that the company had invested $950m over the quarter, including $700m into a reinvestment program at the Apollo-owned Venetian in Las Vegas. VICI will conduct its earnings call later today, Thursday. Codere Online: This year will be a pivotal one for Codere Online, according to CEO Aviv Sher, with the company revising its outlook for adj. EBITDA profitability of between €2.5m-€7.5m from revenues, which it expects to be 22% ahead of previous guidance at a midpoint of €210m.

Bluebet: Following the completion of its merger with Betr as of the start of July, the company said it will be creating a “profitable, leading Australian wagering operator” as it showed net win up 19% to A$17.7m. The US business continues to be under strategic review. Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Caesars rewardedThe morning after: Caesars enjoyed an 8%+ share price bump on Wednesday after what the analyst at CBRE termed a “clean beat” on consensus adj. EBITDA estimates that had the scribes purring at the Las Vegas and digital performances.

JMP analysts noted that the Caesars share price has been “weighed down” since late 2021 when it reached the heady heights of $119 vs. the current share price of nearer $42 by an iffy balance sheet, a poor B&M performance and the scale of the digital investment.

🚀 Caesars up nearly 17% in the past week Join hundreds of operators using OpticOdds for trading, risk management and Same Game Parlay analysis. Real-time data and trading tools for sports betting + fantasy operators. Built by those who have done it before. Looking to join the fastest growing data provider in the sports betting industry? Join the team now. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Reign over

Wednesday, July 31, 2024

DraftKings pulls the plug on its NFT experiment ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Ain’t nothin’ goin’ on but the rent

Tuesday, July 30, 2024

Gaming REIT 'could not withhold consent' on Boyd bid for Penn ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🚀Apollo into orbit

Monday, July 29, 2024

IGT/Everi combination snapped up by private equity giant ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Keep ’em guessing

Friday, July 26, 2024

Boyd Gaming CEO keeps door ajar for possible Penn deal ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Proof of the pricing pudding

Tuesday, July 23, 2024

Competition on price is becoming keener in US OSB ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

The Profile: The CEOs attending psychedelic retreats & the crypto founders getting ‘debanked’

Sunday, December 22, 2024

This edition of The Profile features crypto entrepreneurs, 'psychedelic' CEOs, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤔A lingering suspicion...

Sunday, December 22, 2024

Plus, what stands in most marketers' way... hey-Jul-17-2024-03-58-50-7396-PM Here at Masters in Marketing, Caroline, Laura, and I have interviewed some very bright minds from some very bold brands.

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏