Net Interest - Free Money

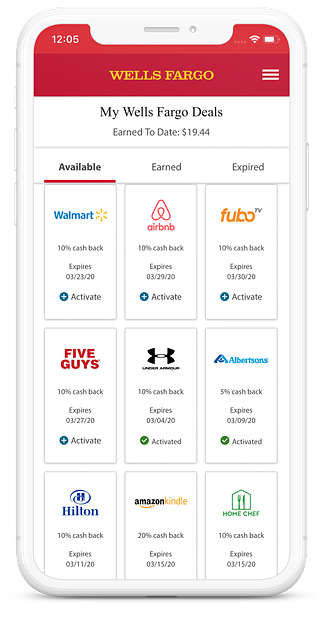

A few weeks ago, I visited Bicester Village for the first time. If you're not familiar, it's a designer outlet shopping center in the English countryside, about 15 miles north of Oxford. Clapboard boutiques line its walkways, selling luxury brands at a discount: Boss, Gucci, Ferragamo, Versace and many more. There’s nothing especially English about it – architecture is Scandi-American, brands are European – yet the place has become a must-stop destination for tourists. Among Chinese visitors, it ranks behind only Buckingham Palace as the most-visited site in the UK. Many take the 47-minute train ride from London Marylebone (where announcements are made in Mandarin and Arabic), stopping first at the Samsonite store close to the Village entrance to buy luggage they fill from up to 150 other outlets before heading on to Heathrow. I’m normally an online shopper, but this place won me over. Its cultural significance as an homage to global consumerism makes it worth a visit alone. And the bargains! Most goods are sold with up to 40% off the original retail price. Right now, a summer sale promises 70% off. I had an additional motivation: My American Express app was offering me an extra 10% discount at most Bicester Village outlets and a further 15% discount at one of my favorite stores. I saved the offers to my card and went shopping. We’ve focused before on the nexus between marketing and payments, most recently in The Points Guy about frequent flier programs. American Express has partnerships with Delta and British Airways allowing it to offer miles as an incentive to use its card. As a marketing strategy, it’s genius. Reward programs generate profits for both card issuers and airlines while encouraging loyalty to both, a significant positive sum outcome. With points in the mix, airlines, consumers and banks all end up as winners: Airlines make money selling rewards; consumers enjoy the indulgence of free travel; banks recruit new customers and profit from more spend on their card. But there’s a fourth stakeholder in the mix these programs don’t directly benefit: merchants. The program is indifferent as to whether the consumer shops at Home Depot or Lowe’s. To satisfy this market segment, American Express launched a tailored product in 2010. Via its app it could promote certain offers to cardholders, sponsored by merchants – “Spend $75 or more, get $15 back”. Again, everyone’s a winner. The merchant gets directed traffic, the card issuer promotes activity on their card, the customer gets “free money”. My trip to Bicester Village rewarded me with £82.33 of credit. The advantage in this model is that the merchant pays their share of the outlay as a marketing expense. In a world where payment fees are coming under pressure and rewards competition is rising, this gives greater scope to offer value back to consumers. Amex didn’t come up with the idea for card-linked offers itself. That came from a startup called Cardlytics, founded by two former Capital One employees in 2008. They recognised that card issuers have a trove of data helpful for merchants to target specific consumer segments and that by running the discount through a credit card, the merchant avoids the hassle of needing to program POS systems to recognize and correctly credit a discount. For the consumer, the process removes nearly all friction: After accepting the offer, they don’t need to fumble with a rewards program and can instead pay with their usual method of payment. Since launching its own version, Amex has had a decent run at it. In 2021, the company reported that eligible US cardholders earned $392 million in statement credits from offers. Amex funds around 30% of that, with the rest subsidized by merchants. But the program is not ubiquitous and remains a lot smaller than frequent flier schemes. Only around 10% of cardholders activate offers, with 3-4% being redeemed. Now, Amex has signed up to Cardlytics. The company will maintain its proprietary offers program, but will additionally operate on the Cardlytics platform alongside other leading issuers. On the face of it, Cardlytics is a unique franchise. Its banking partners include Bank of America, JPMorgan, Wells Fargo, US Bancorp and PNC, collectively covering over half of US card transactions; in the UK, it works with Lloyds and Santander. As a marketing channel, Cardlytics can utilize spend data to offer more targeted campaigns than traditional online platforms like Facebook and Google. Yet for all its promise, the company has been unable to wrangle a sustainable business out of its platform. Its stock price is down 95% from its high in 2021. To understand what’s going on in the world of “free money”, read on. Subscribe to Net Interest to unlock the rest.Become a paying subscriber of Net Interest to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Britain's Newest Bank

Friday, July 26, 2024

The Rise of Revolut ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Private Equity for the Masses

Friday, July 19, 2024

The March Towards “Democratization” ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Smashing the Monopoly

Friday, July 12, 2024

The Latest Challenger to Take On Chicago ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Trump Trade

Friday, July 5, 2024

Previewing the Privatization of Fannie and Freddie ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Housing the Young

Friday, June 28, 2024

The Crisis in the Structure of British Housing ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Don't Overlook this Sector Billionaires are Quietly Investing In

Thursday, February 27, 2025

The Billionaires' Energy Secret (You Can Get In) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Giveaway: Set Sail on Your Next Adventure 🚢

Thursday, February 27, 2025

Enter to win a chance to win a free trip from Virgin Voyages. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤖 OpenAI's ex is doing just fine

Thursday, February 27, 2025

Intel looks to be falling apart, a humanoid company 15-timesed its valuation in one year, and what the DeepSeek shakeup actually means | Finimize TOGETHER WITH Hi Reader, here's what you need to

"Impoundment," explained

Thursday, February 27, 2025

Congress's power of the purse vs. presidential power View this email online Planet Money A Constitutional Conflict Over “Impoundment” by Greg Rosalsky A constitutional conflict is brewing over

The New Nuclear Weapon - Issue #510

Thursday, February 27, 2025

FTW: AI is no longer just a tool—it's the new battleground for global power. The Geopolitical AI War is here. Who will push the button? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Annoying Path to Privacy Herd Immunity

Thursday, February 27, 2025

Plus! Robots; Competition; Model Moderation; Eggs; Sentiment The Annoying Path to Privacy Herd Immunity By Byrne Hobart • 18 Feb 2025 View in browser View in browser In this issue: The Annoying Path to

Social Security COLA Estimates Tick Higher

Thursday, February 27, 2025

Sticky inflation could give retirees a raise ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are you 62+ and in need of cash?

Thursday, February 27, 2025

A reverse mortgage may be just the thing ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📉 This tech stock missed the rally

Thursday, February 27, 2025

Baidu fell further behind China's tech rally, European defense stocks bulked up, and the truth behind your sports gloop | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Issue #273: Now I'm getting emotional

Thursday, February 27, 2025

plus Monty + 'DuckTales' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏