|

Ahead of the next new iPhones in a few weeks – potentially in Zune brown "bronze" – the new Pixel hardware looks good. And it's interesting how their approach to AI on the smartphone almost seems the opposite approach of Apple's. Smartphones may finally be diverging down different paths... Also diverging from Apple's approach in XR are Meta and Snap, both of which should also have some new AR glasses to show off around the time that new iPhone it unveiled, it sounds like... One thing that doesn't seem like it will be coming anytime soon? A true Vision Pro competitor from Meta. Apple, meanwhile, seems busy playing whack-a-mole with EU regulations around the App Store. Or are they playing a different game? Certainly Spotify and Meta are, but it's not really clear what that game is in their muddled and conflicting message to the EU. Could be worse. You could have released a movie trailer with fake movie critic quotes because you used AI to look them up... Will this help or hurt Megalopolis' "Verified Hot" chances, do we think? Only Comcast knows... At least that project will still (presumably) see the light of day, the same can't be said for sure about Venu. That's in such dire straits that even the written-word media business is looking downright awesome by comparison. As you can see, there were fewer actual Spyglass posts this week and far more links that I didn't get to. This is because I've been working on something behind-the-scenes, which hopefully you'll start to see the fruits of such labor starting next week... 🌍 Sent from London, England

Remains of the Week📲 Changes Atop the App Store – Matt Fischer, who has run the App Store since 2010, just a couple years after it launched, is leaving Apple after 21 years. His statement reads like "yeah, I don't want to deal with this shit" with regard to the changes being forced upon the store by the EU (and soon, perhaps, the US?). But it's worth noting that he also oversaw Apple Arcade, which doesn't appear to be going all that well. There will now be two App Store teams, the second in charge of "alternative distribution" which also reads like Apple believes that will be ramping at some point soon... [Bloomberg 🔒] 🏔️ Edgar Bronfman Submits Bid for Paramount – A deal full of plot twists gets a twist ending too. We'll see if the committee thinks this offer is good enough to derail the Skydance deal (it was just upped to $5.5B to better compete – with some, um, interesting backers – and now $6B!), but Bronfman is having quite the week – he's also the chairman of Fubo which just convinced a judge to stop the launch of Venu, the competing sports streamer. Is Bronfman about to add CBS (and its NFL rights) to his empire? Or is he just pissing off everyone in Hollywood? This deal will never end. Ever. [WSJ 🔒] 🤺 Somehow ‘The Acolyte’ Will Not Return – Not exactly a surprise, but still mildly disappointing simply because of the tease of Darth Plagueis (and to a lesser extent, Yoda). Once again, no pay-off there. Unless someone else takes up that storyline down the road... The harsh reality here is that outside of a few nice fights and hints of interesting dark side characters, that the show just wasn't any good. Some criticisms may have been unfair, but plenty wasn't. [Deadline] ⚖️ 'Hackquisitions' Are Altering AI Deal Terms – No surprise that VC lawyers have started adding terms to deal docs that account for the possibility of what I've been calling "hackquisitions" – effectively acquisitions of AI companies by 'Big Tech' in all but name (because they'd never ben allowed to make such deals in the current regulatory environment). [The Information 🔒] 🛍️ The Man Who Remade Retail – Myron E. Ullman III had a fascinating career touching so many companies. While he started in tech at IBM, he was eventually tasked with modernizing Macy’s. Then he was at DFS, the duty-free retailer, which LVMH bought, making Ullman second in command at the luxury giant. Major health issues sidelined him from day-to-day, so instead he helped Starbucks by joining its board, eventually becoming Chairman. J.C. Penney was probably his biggest turnaround success though, until he was fired, in part under pressure by Bill Ackman — yes, that Bill Ackman — which led to Apple’s retail chief, Ron Johnson taking over. Which was a total disaster. He was fired and Ullman was put back in place, literally undoing everything Johnson put in place. Ullman passed away earlier this month, he was 77. [NYT] 👁️ Worldcoin Is Battling With Governments Over Your Eyes – The concept sounds interesting enough, but my god the optics – pun very much intended – here are just awful on a few fronts. First and foremost, who thought the giant orb for retina scanning was a good idea? Meanwhile, people were weirded out by Amazon's palm scanning technology so we think now is the right time for retinas? Perhaps not, which is why it's largely being done in third-world countries? Okay! Again, there might be decent ideas and even intentions behind all of this, but they really need to rethink the strategy for building this out. [WSJ 🔒] 📰 Google Set to Subsidize the News in California – A $250M slug of capital sounds great (unclear how much is actually from Google and/or fully committed), and I hate to be cynical here, but do we really believe this is going to be the thing which saves journalism in the next decade? More likely is that it quietly goes away just as all those Meta/journalism deals do... I don't think the idea of making any of 'Big Tech' pay for surfacing news content makes any sense, and will always backfire as we've seen elsewhere, but this is creates weird incentives too and ultimately is unlikely to be tenable. So... congrats? [NYT] 💻 Apple May Do a Foldable MacBook Sometime or Never – Wait, isn't every MacBook technically a "foldable"? Yes. But the analysts are talking about a giant foldable screen here, of course. Which, sure, I'm sure there are some experiments and prototypes in this area, but the notion that such a device would launch in one or two or even three years from now seems silly. A foldable iPhone and/or iPad mini (or are they the same device a new 'iFold' hybrid which is sort of the angle Google seems to be taking with Pixel Fold?) sure. But a full laptop? No way. But these folks are always way off on their timetables. [MacRumors] ⚡️ Bolt, Indeed – While the first report on this "round" was perhaps a bit too matter-of-fact in its framing, which Eric Newcomer rightfully called out, the follow-up reporting with the details is even more wild – including from Newcomer, which reprinted the email sent to Bolt investors in full. I would say it's all bonkers, but it's really far beyond that. It's so beyond bonkers that I'm not even sure it's real? The cherry on top: The draft proposed deal also included “moonshot goals” that would require Bolt to invest $15 billion in Love at a $1 trillion valuation if Love convinces 1 million merchants to use Bolt’s “checkout everywhere” product.

The numbers are so bananas that it gets a bit muddled, but that's Bolt, the company which would be valued at $14 billion here investing $15 billion at some later date if Love, another company started by the Bolt founder, gets 1 million merchants to use Bolt. That investment from Bolt would give Love a $1 trillion valuation. Who says no? [The Information 🔒] 🙏 The Mike Lynch Yacht Tragedy – The loss of life here is obviously tragic. But the story itself is almost unbelievable on a few fronts. A massive $40M sailing yacht (with supposedly the second highest mast in the world) gets hit by a water spout (tornado over water) while docked and sinks in, by at least one account, 60 seconds. So fast, that it's now being investigated (yes, shades of White Squall). The entire reason everyone was on the boat was to celebrate Lynch's acquittal from the fraud case against him in the US, which would have put him in jail for decades. And most shockingly, his co-defendant in that case, Stephen Chamberlain, was struck by a car and died just two days before Lynch went missing. [NYT]

Potent Quotables"We look for Ferraris with flat tires."

-- London Fund CEO Ashesh Shah, talking about why his firm is perhaps the only named one so far investing in the Bolt deal mentioned above. And that "investment" would seem to be in the form of marketing credits.

The Quick & the Read- Disney has announced their committee to pick the next CEO to replace Bob Iger after the last CEO to replace Bob Iger didn't work out so well. But they seem to be in good hands with James Gorman, who both led Morgan Stanley and did the same thing for them. And the candidates – at least the internal ones – seem pretty well known already, it's just a matter of picking the right one this time. [Variety]

- Everything about Nicolas Cage playing John Madden in a David O. Russell movie is weird. Which probably gives it a greater shot of being great than if it were a straight-down-the-middle Madden biopic. But also, how the hell is he playing Madden and not the famously eccentric Raiders owner Al Davis?! [Deadline]

- Apple producing some of the iPhone Pro models in India this year is big news for a few reasons, but the two biggest would seem to be a continued diversification away from Chinese manufacturing and the boosting of iPhone sales potential in India itself. [Bloomberg 🔒]

- macOS Sequoia seems likely to launch alongside iOS 18 in just a few weeks. This makes sense since it seems both stable and Apple is clearly now already focused on the '.1' releases of iOS and macOS featuring the first iterations of Apple Intelligence, which should ship this fall. [MacRumors]

- Speaking of, Microsoft looks to be joining Apple in pushing touted AI features into 2025 as that's likely when the now infamous 'Recall' feature in Windows will be ready. [The Verge]

- But hey, at least Teams is now one app if you're into that sort of thing. Which I'm not. [The Verge]

- At first glance, Uber teaming up with Cruise may seem like a bid to take on Waymo, which is getting all the buzz in the world with its full roll-out in SF. And I'm sure there's some of that, but Uber also has a partnership with Waymo, so instead perhaps this is lining up the anti-Tesla alliance, for whatever they're going to announce in the space. If they ever announce anything in the space... [Uber]

- Speaking of, at least from the perspective of bank loans, Elon Musk's deal to takeover Twitter is already one of the worst in history, and certainly the worst since the financial crisis. But just like VCs, banks want access to Elon's other deals – notably, SpaceX – so they grin and bear it. [WSJ 🔒]

- Alex Cooper takes 'Call Her Daddy' from Spotify to SiriusXM for upwards of $125M, another big podcast coup as they try to build out their premium podcast layer [Variety]

- Speaking of podcasts, Apple's player now works on the web? [9to5Mac]

- While it perhaps started slow out of the gates, it would seem that Netflix is ramping up its ad sales at a good pace. And that has perhaps pushed the stock to an all-time high, giving it a $300B market cap. When I wrote this look into the company and stock just over 7 years ago, it had a $60B market cap. [Deadline]

- Big Tech tapping old power stations to build out AI infrastructure obviously makes a ton of sense but the hiccup is that while these facilities are close to needed power hook ups (obviously) and water sources (for cooling), they're not typically close to high-speed fiber as they're often far outside built-out residential/commercial zones. Still, feels like that's more fixable than the former connections. [Financial Times 🔒]

- Back in the digital realm, it would seem that Meta has a new web crawler out there, creeping around the web to wrap data in its web. [Fortune]

- Every social network that lives long enough eventually degrades into MySpace as services cram more stuff in. Remember when Instagram was for sharing pictures? Feels like long ago. Now you can add music to your IG profile. I'll be pinning "Glory Days" to my profile and waiting until I can change my background to black with moving skull and crossbones GIFs. [The Verge]

- There's peak streaming and then there's Chick-Fil-A entering the streaming race. Beak streaming? [Deadline]

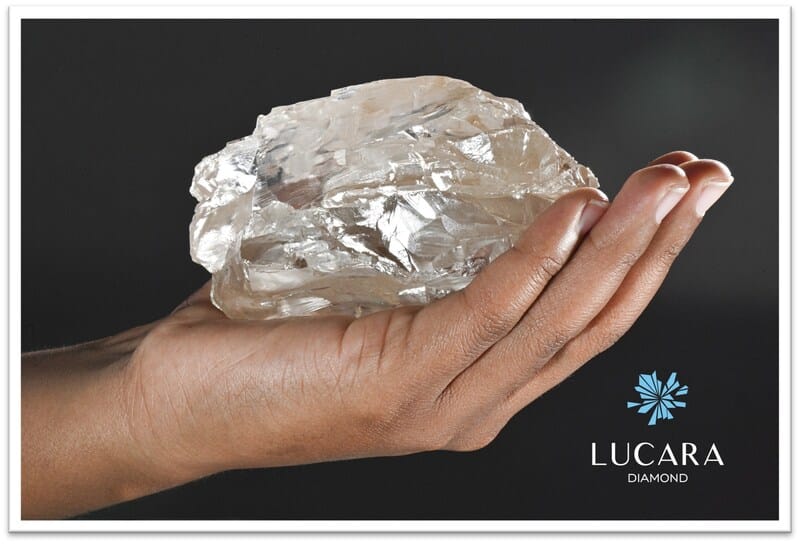

One 💎 Thing...Take a look at the 2,492-carat diamond that was just unearthed in Botswana. Using x-rays, no less! It's said to be the second largest ever, bested only by the 3,106-carat Cullinan Diamond, which was discovered in South Africa almost 120 years ago. That diamond was ultimately "cut into several polished gems, the two largest of which — the Great Star of Africa and the Lesser Star of Africa — are set in the Crown Jewels of Britain." The nicknames of these massive gems are sort of fun, can't wait to hear what nickname this one gets. Oh yes, and the value placed on it. The Cullinan is said to have been worth $150M, with the previous second-largest stone (The Lesedi La Rona Diamond – found in the same mine as this one, no less) at $85M. This one is closer in size to the Cullinan, but it's unclear if it will yield the "highest quality" gems so far.

|