Aziz Sunderji - The Week in Review

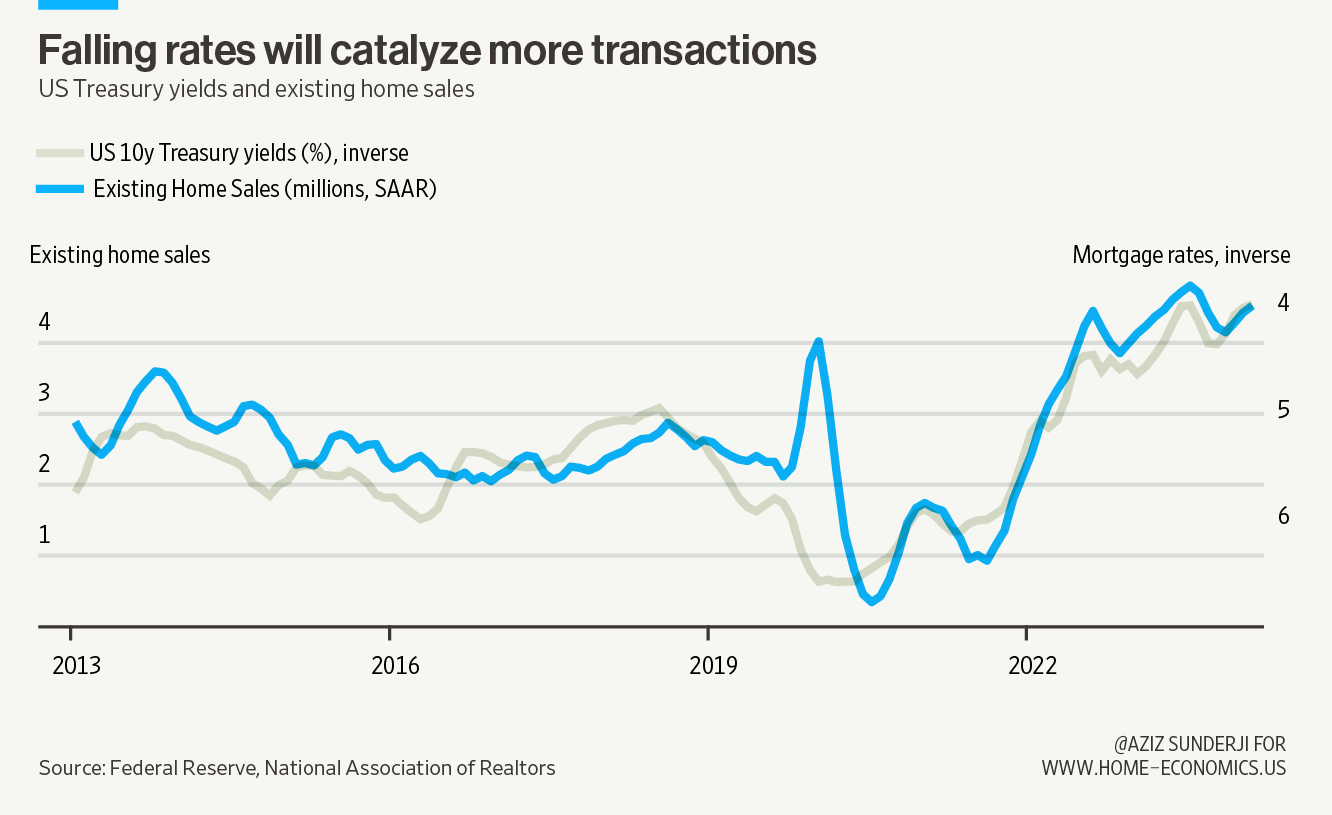

Welcome back to Home Economics, a newsletter about the American housing market. This is The Week in Review, my weekly recap of macro and real estate news. Articles with a ◎ are free. Those with a ◉ have free previews but are only accessible in full for paying subscribers. Upgrade your subscription here: There were lots of interesting responses to the article I published ◎ last week about why New York City is shrinking, especially on the version the Financial Times posted ◎. Many comments looked like this one: “I have a theory. NYC is ugly, dirty, crowded and rude. That's why people are leaving.” Leaving aside the “people leaving” part, the description of this city is accurate. Here’s a text my wife sent me yesterday morning: This is pretty humdrum news. Feces in public places in New York is like traffic in LA. But the commenter on the FT website is not wrong. This is an undeniably dirty and crowded city. Why do people choose to live here? I think the main reason is economic opportunity. Jobs for the highly skilled, or at least the highly educated, are in big cities. New York is the biggest. Sure, New York also has amazing “culture”—world-class museums, music venues, restaurants, etc. But this is downstream from the economy. The density of highly educated, curious people creates the demand for culture here. A big economy provides the high incomes to pay for it. The evidence I presented in my article suggests a few explanations for accelerating emigration of New Yorkers to other cities: retirees seeking the sun (mostly in Florida), and lower income young people moving to more affordable cities like Atlanta, Philadelphia, and Charlotte. But the largest contingent of emigrants are young, childless, highly educated, high-earning people moving from New York to San Francisco, LA, Chicago, Boston, and DC. These are relatively expensive cities with big economies—and lots of jobs. New York has always been dirty and crowded, and filled with rude people. What may be changing is that other cities are starting to offer equally compelling economic opportunities—without the poop on the subway stairs. The main piece of economic data next week is Case-Shiller home prices on Tuesday. The index should show prices continuing to rise, but at a slowing pace. Inventory is climbing, homes are lingering on the market longer, and sellers are cutting prices. Don’t look to lower mortgage rates to boost prices—they’re already stretched compared to incomes and rents. Subscribers can download the housing economic data calendar here ◉. News: Existing home sales rose As I wrote above, lower mortgage rates are unlikely to boost home prices. Incomes are more important than rates in determining prices, and the reason rates are dropping is because the outlook for incomes is weaker. Instead, it’s more likely that lower rates catalyze more transactions. Even if mortgage lock-in wasn’t the only driver of lower transactions over the past 18 months, it surely contributed—so a decline in rates should go some way towards spurring activity. News: New home sales rose sharply The Census Bureau reported that sales of new single-family houses in July 2024 were at a seasonally adjusted annual rate of 739,000, a 10.6% increase over the prior month. I was surprised by the strength of new home sales, but I am not alone: the volume of sales crushed consensus expectations (the median forecast was for 623,000). Still, the direction makes sense: the new home sales market is benefiting from the same mortgage rate tailwinds as the existing home sales market, with the additional allure of builder financing and other bells and whistles. For homebuilders, there are undeniably some worrying trends. There is a large and growing inventory of unsold homes (not started / under construction). Sales numbers are helped as builders construct more affordable (read: smaller) homes, cut prices, and offer other incentives. Even so, homebuilder stocks continue to rip. Equity analysts are “overweight” the big firms like D.R. Horton and Lennar, based on orders forecasts and still-thick margins. Ultimately, builders are mostly an interest rate play, and rates are moving in the right direction. Todoist. After using the built-in Reminders app on Apple devices for the past couple of years, I’ve switched back to this excellent dedicated task list manager. It’s really simple, much more pleasing to look at, and has lots of nice features. Here’s one Todoist feature that my household has started using: we have a shared project. When my wife has a task she needs me to do, rather than texting me (invariably leading me to subsequently ask her, what was that thing you texted me about?), she adds it to our shared Todoist project, and tags me as the “assignee”. It’s an easy way for her to put something in my inbox without sending me a distracting text message—and when I have time to knock off tasks, they’re all sitting there waiting for me in one place. Todoist, for Apple devices, here. I hope you’re having a great weekend, Home Economics is a reader-supported publication. Please consider upgrading to a paid subscription to support our work. Paying clients receive access to the full archive, forecasts, data sets, and exclusive in-depth analysis. This edition is free—you can forward it to colleagues who appreciate concise, data-driven housing analysis. |

Older messages

Why is New York City Shrinking?

Tuesday, August 20, 2024

Who is leaving, and where are they going? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Week in Review

Sunday, August 4, 2024

Week of July 29th — Recession Risks Rise ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Week in Review

Saturday, July 27, 2024

Week of July 22 – Home Sales Slump ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Runaway Rents in Big American Cities

Monday, July 22, 2024

Rents are rising quickly in some big cities ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are YIMBYs Wrong about the Housing Crisis?

Wednesday, July 17, 2024

Cameron Murray is skeptical about upzoning's potential ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Weekend: Introducing the Butt Mullet Dress 👀

Sunday, March 9, 2025

— Check out what we Skimm'd for you today March 9, 2025 Subscribe Read in browser Header Image But first: Join the waitlist for a new premium Skimm experience Update location or View forecast

Starting Thursday: Rediscover Inspiration Through Wordsworth

Sunday, March 9, 2025

Last chance to register for our next literary seminar starting March 13. March Literary Seminar: Timothy Donnelly on William Wordsworth Rediscover one of the most influential poets of all time with

5 little treats for these strange and uncertain times

Sunday, March 9, 2025

Little treat culture? In this economy?

RI#266 - Down the rabbit hole/ What is "feels-like" temp/ Realtime voice tutor

Sunday, March 9, 2025

Hello again! My name is Alex and every week I share with you the 5 most useful links for self-improvement and productivity that I have found on the web. ---------------------------------------- You are

Chaos Theory: How Trump is Destroying the Economy

Sunday, March 9, 2025

Trump's erratic, chaotic governing style is dragging down the economy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Chicken Shed Chronicles.

Sunday, March 9, 2025

Inspiration For You. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“Hymn of Nature” by Felicia Dorothea Hemans

Sunday, March 9, 2025

O! Blest art thou whose steps may rove ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Claim Your Special Men's Health Offer Today!

Sunday, March 9, 2025

Subscribe to Men's Health today! Men's Health logo Get stronger, smarter, better 1 year of print mag + digital mag access Men's Health Magazine is the essential read for active, successful,

The 2025 Color Trends You *Should* Be Wearing Right Now

Sunday, March 9, 2025

They pack a playful punch. The Zoe Report Daily The Zoe Report 3.8.2025 The 2025 Color Trends You *Should* Be Wearing Right Now (Trends) The 2025 Color Trends You *Should* Be Wearing Right Now They

6 Most Common Tax Myths, Debunked

Saturday, March 8, 2025

How to Finally Stick With a Fitness Habit. Avoid costly mistakes in the days and weeks leading up to April 15. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY Six of