The Fed Is Well Positioned To Fight Off A Recession

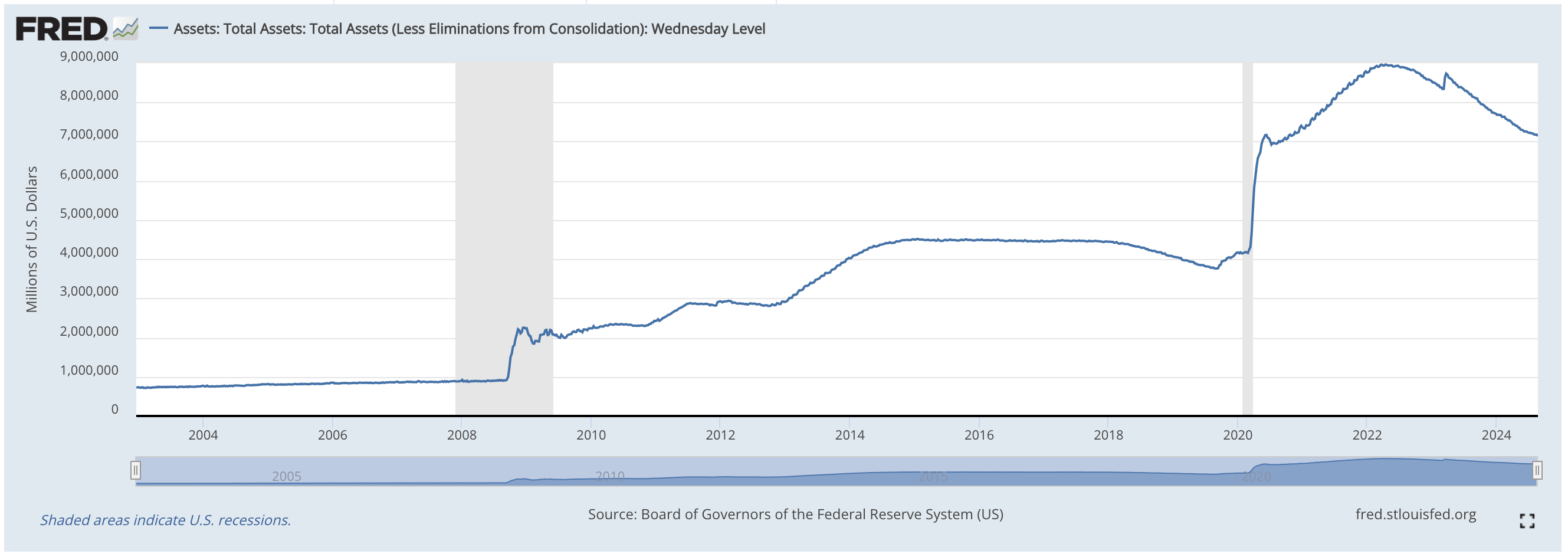

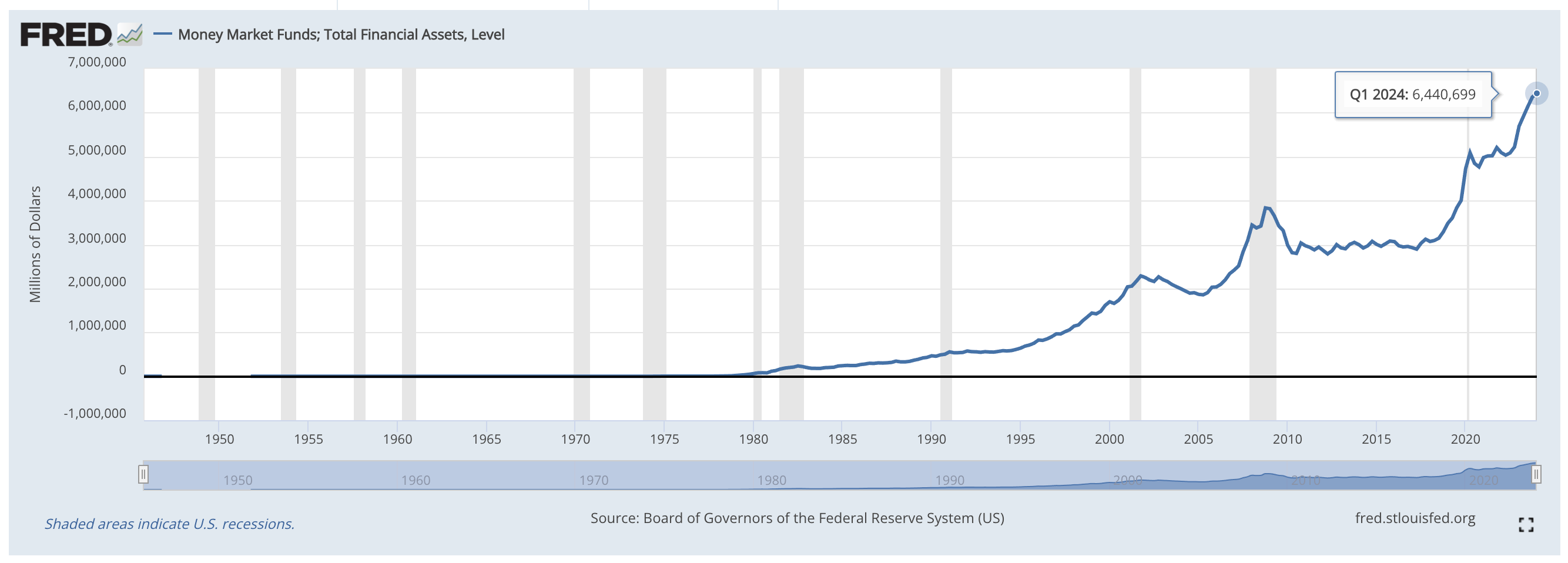

Today’s letter is brought to you by Unbound Golden Visa!What if you could use Bitcoin as a tool to unlock future freedom for you and your family? Well, now you can. Unbound is the Portuguese Golden Visa Fund that invests in local companies 100% owned by the fund, which in turn invest in Bitcoin via SEC-compliant ETFs. The Portuguese citizenship by investment program is the top European choice. With extensive experience, the team facilitates EU citizenship, unlocking freedom across 27 countries. This incredible offering went viral receiving hundreds of applications in 48 hours. I recently spoke with co-founder Ale Palombo about this initiative here. To unlock your future visit Unbound’s website or simply write to hi@unboundcap.com. To investors, There is a debate raging over whether the US economy is headed towards a recession or not. Investors and market commentators are watching unemployment, inflation, consumer spending, and various other metrics to predict any potential economic pain ahead. I don’t think this is the right way to evaluate the market right now. Regardless of whether the economy slows down or not, the Federal Reserve has positioned itself well to accelerate economic activity over the next 12-24 months. Interest rates are currently over 5% and the central bank was able to sell almost $2 trillion of assets off their balance sheet since 2022. This means the Fed was able to restock their ammunition. When they are called back into the fight, we will watch the money printer get turned back on and a few hundred basis points of interest rates will disappear. I explained this situation to Phil Rosen late last week: The noteworthy aspect of financial markets at the moment is we are at or near all-time high prices in stocks, crypto, and gold. This has happened without the Fed stimulating the economy or asset prices. Once the quantitative easing playbook is turned back on, we should expect asset prices to respond favorably. Speaking of quantitative easing — the central bank has perfected this playbook since the Global Financial Crisis. I believe they are quicker today to cut interest rates and print money than they have been historically. You saw this in 2020 when the Fed conducted two emergency rate cuts to bring the market to 0% rates. There was trillions of dollars printed via monetary and fiscal policy within weeks as well. The combination of a central bank having numerous tools at its disposal, along with a faster response time in deploying those tools, means that a recession will have a harder time persisting. And we should expect lower rates to lead to higher asset prices. History is largely undefeated on this point. Cheaper capital is coming to the market. Which also means a portion of the approximately $6.4 trillion sitting in money market funds will likely want to find a new home in equities. Whenever I hear a loud roar of investors talking about a recession, I start thinking the opposite is probably true. I would think the same if everyone was yelling that no recession is possible right now. Real damage occurs when the market is caught offsides in either direction. The more people who think a recession is coming, the lower likelihood we will see that outcome. The various trends and data points suggest asset prices should be higher 12 months from now. I wouldn’t want to be on Team Recession at the moment. What do you think? Are you changing your portfolio at all? Feel free to respond to this email and I’ll do my best to respond to each of you. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Daniel Batten is the Co-Founder and Managing Partner of CH4 Capital. Daniel is an ESG investor and believes bitcoin mining is one of the most important technologies when it comes to the environment. In this conversation, we talk about what is holding back sovereign wealth funds from investing 1% of their assets into bitcoin, ESG decision making process, what it will take to educate them, and what the impact of sovereign wealth funds and countries will have. Listen on iTunes: Click here Listen on Spotify: Click here Daniel Batten Explains What Will Convince Sovereign Wealth Funds To Buy Bitcoin Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

My Takeaways From A Trip To Saudi Arabia

Monday, August 26, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Monday, August 26, 2024

Open this on your phone and click the button below: Add to podcast app

Taxing Unrealized Gains Is An Insane Idea

Wednesday, August 21, 2024

Today's letter is brought to you by Domain Money! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi Technologies Surprises With Big Q2 Results

Tuesday, August 20, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Market Problems Aren't Solved With Government Solutions

Tuesday, August 20, 2024

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

How to Describe a Hallucination

Saturday, December 21, 2024

If hallucinations defy the grasp of words, how should we try to describe them?

+28,000% Engagement with Pinterest?

Saturday, December 21, 2024

Exploding impressions and engagement

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar

The best books about AI&ML, 2024 edition

Saturday, December 21, 2024

For Your Holiday Reading

How to control your audience

Saturday, December 21, 2024

And turn them into raving fan-customers

$166K MRR - simple employee scheduling tool..

Saturday, December 21, 2024

+ What do you think?

Your SaaS New Year’s Resolutions for 2025

Saturday, December 21, 2024

Here are Your Top 10 New Year's SaaS Resolutions To view this email as a web page, click here saastr daily newsletter Your SaaS New Year's Resolutions for 2025 By Jason Lemkin Thursday,

Presence Over Pressure: Leading with Confidence in Chaos

Saturday, December 21, 2024

We spoke with Jon Giesbrecht, the Director of Mental Performance and Player Development for the Vancouver Bandits, about how mindfulness and emotional regulation elevate performance in basketball,

Our full 2025 outlooks

Saturday, December 21, 2024

Also: Understanding the ins and outs of benchmarking; Where top-performing VCs place their early-stage bets; Read our latest emerging tech reports... Read online | Don't want to receive these