Earnings+More - Watered down

There's only good in leaving with a suitcase full of load. Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

Risk of dilutionThe kicker: Any bid from Boyd Gaming for Penn Entertainment would be dilutive for its share price, unless it was paid for in cash and/or if any joint bid with Flutter involved the monetization or other “surfacing of value” for its 5% stake in the US online leader. Watering down: Such is the view of the analysts at Morgan Stanley, who have warned that Boyd Gaming should be wary of pursuing a “dilutive” bid for rival Penn Entertainment “for the sake of growth.”

Tag team: Yet, among the “credible” bid rumors from this summer was the potential for Boyd to team up with Flutter, with which it currently has a long-term market access agreement as well as a 5% stake.

Mind the gap: In upgrading Boyd to an Overweight rating, the MS analysts said its current valuation discount to the rest of the sector was “staggering,” given it still owns ~90% of its real estate (vs. the opco/propco models of most of its peers) and the Flutter shareholding.

Sticky situationIt’s too late, baby, now it’s too late: The Boyd upgrade came in a sector note, which suggested the gaming sector has been “stuck” in the last two years amid sluggish fundamental, high and rising interest rates and “late cycle” economic concerns.

That was then: The team noted current concerns that weaker discretionary spending means there are renewed fears over a hard landing in the US. Gaming was previously seen as being recession proof – that is, until the financial crisis in 2008 when casino visitation and spend/visit declined in all markets.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. +MoreSpreadex: Star Sports has expressed an interest in picking up selected elements of the Sporting Index business, where the bid to buy the business from Spreadex is the subject of a Competition and Markets Authority review.

Betsson said it is considering issuance of €100m of new three-year bonds, with the net proceeds being used to pay off an existing bond as well as potential M&A. Superbet and Huddle have agreed a partnership that will see the integration of the supplier’s SGP, player props and micro-betting markets. Earnings in briefEntain: Ahead of investor meetings this week, Entain issued a brief update saying the momentum from Q2 has continued into the current quarter, with online NGR growth ahead of expectations and UK & Ireland returning to YoY growth “earlier than expected.” Allwyn: Revenue rose 5% YoY to €2.15bn but adj. EBITDA fell by 11% to €340m, though excluding the investment made in the UK National Lottery it was up 4%. The company said it saw strong organic growth in Austria, Czechia, Greece and Cyprus.

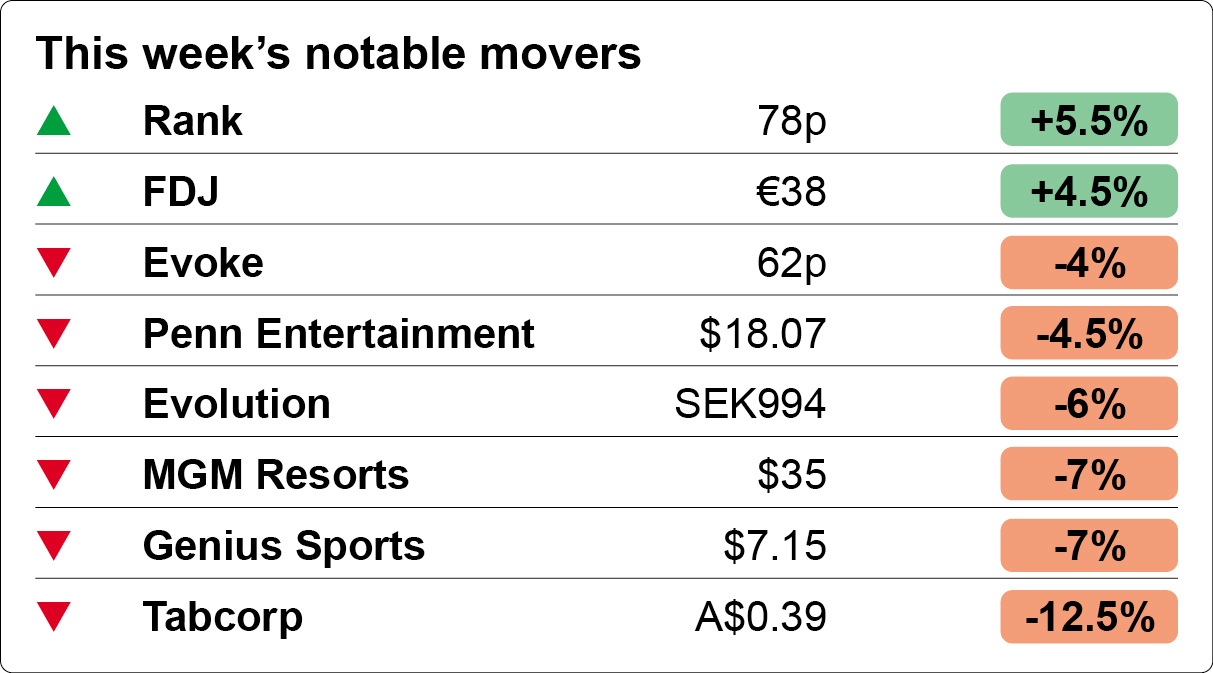

Analyst takes – Light & WonderA rising tide: The team at Jefferies said, after meeting with management, they believe earnings momentum is continuing to build, with the analysts suggesting the digital and social gaming segments of the business as key beneficiaries from the B&M progress. Shares weekPain, no gain: In a bad week for equities generally, with questions over a hard or soft landing in the US to the fore, the sector managed only small gains on the week, with Rank enjoying a 5.5% uplift helped by a note from Peel Hunt. Tabcorp was the worst performer for the week, failing to recover any ground with investors after announcing it would not meet its 2025 targets and reporting an impairment charge that led to a A$1.36bn ($907m) after tax loss.

Fallen idols: The out-of-favor UK-listed Entain and Evoke continue to languish. Entain, up less than 1% last week, and Evoke, down nearly 4%, continued to trade well below their highs for the year.

Kero is a premier micro-betting provider, powering more than 150 operators across the globe. By the numbersNew York: Sports-betting GGR was up 27% to $125m on handle that was up 29% to $1.44bn. FanDuel remained the market leader on 42%, down slightly YoY, while DraftKings kept up with the pace on 32%.

Ohio: Sports-betting GGR rose 48% YoY in July to $55.1m on handle that was up 44% to $476m. FanDuel led with 38% of GGR, followed by DraftKings on 32%.

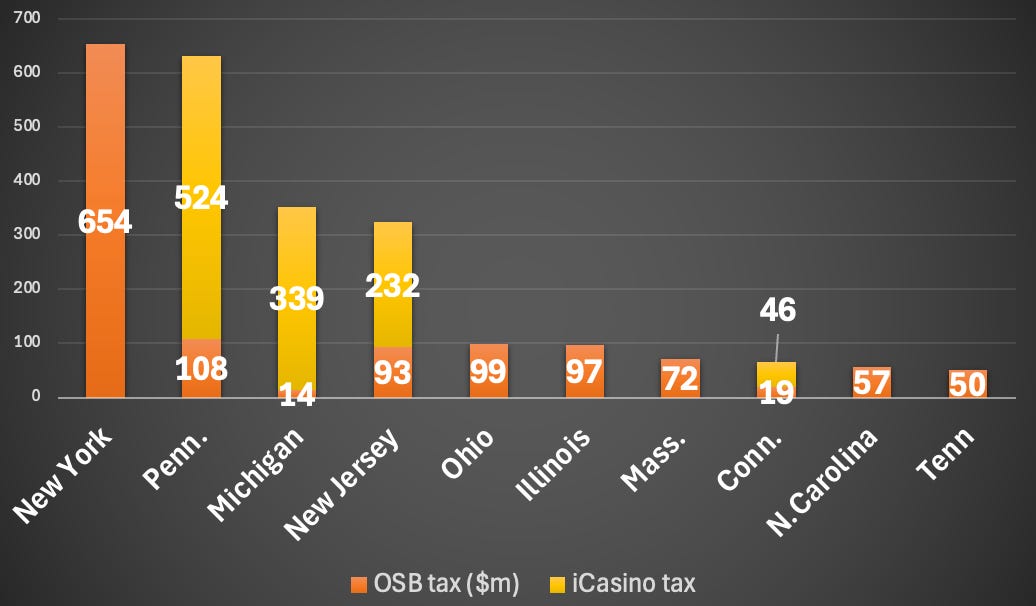

Arizona: The June data is finally in and showing GGR up 94% YoY to $31.6m. FanDuel led with 44%, followed by DraftKings on 34%. Colorado: Sports-betting GGR was up 31% in July to $32.5m on handle that rose 14% to $320m. Taxing situationEye opener: Two posts on X from Alfonso Straffon, ex-Deutsche Bank analyst, displaying the YTD taxes paid by operators on OSB and iCasino elicited a variety of responses, but primarily the extent to which New York and Pennsylvania lawmakers are likely happy with their decisions on tax rates.

Where’s my cut? Michigan is perhaps the most curious state within the top 10, with a total of $353m almost wholly coming from iCasino taxes while OSB generated a mere $14m.

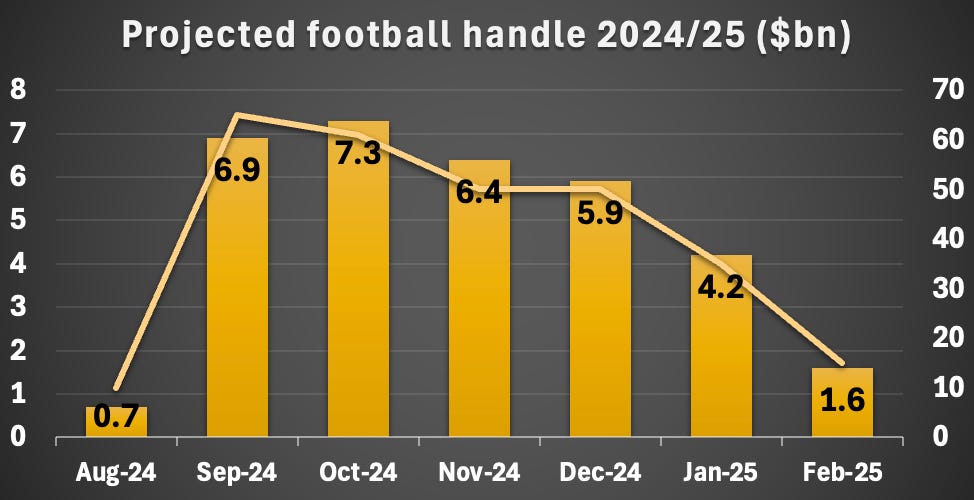

Like, totally: Overall, Straffon noted the blended tax rate for iCasino in the YTD stands at ~25% while for OSB it is at 21%. Across the 34 states tallied the total tax take in the YTD stands at ~$2.8bn, with 42% coming from iCasino and 58% from OSB. 🤫 Top 10 sports betting and iCasino tax takes 2024 YTD Getting to $33bnPaper lion: The team at JMP broke down their estimate for handle on the just kicked off football season by month. Between August and February, they estimate $33bn will be wagered across the whole season with the peak in September and October, when they suggested operators will share $14bn of handle.

🏈 All kicking off Ounew, multi-tenant platform is off to an auspicious start… Live for over 100 flawless days:

Anyone that has endured a maiden platform launch can attest to just how significant that is. We’ve built a powerful new tool for the industry, and we're looking to collaborate and grow alongside our partners, deploying our cutting-edge tech to launch unique and engaging new products. Get in touch to find out more. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Back to the drawing board

Friday, September 6, 2024

DraftKings will seek 'other solutions' after player surcharge retreat ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Kissing frogs

Wednesday, September 4, 2024

Supply side M&A chatter gets louder ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Selective amnesia

Friday, August 30, 2024

DraftKings surcharge reversal 'forgotten' with Simplebet M&A ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bun fight

Wednesday, August 28, 2024

Brazil could be be a market opening like no other ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The fateful eight

Monday, August 26, 2024

Eight companies in the sector are worth more than $10bn ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Simple hack to get 4x more shares

Sunday, December 22, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible

How to Describe a Hallucination

Saturday, December 21, 2024

If hallucinations defy the grasp of words, how should we try to describe them?

+28,000% Engagement with Pinterest?

Saturday, December 21, 2024

Exploding impressions and engagement

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar

The importance of pillar pages for SEO

Saturday, December 21, 2024

88% of SEOs believe topical authority is very important to their SEO strategy, according to a Surfer SEO study. One of the most effective ways to strengthen your topical authority is by creating pillar

The best books about AI&ML, 2024 edition

Saturday, December 21, 2024

For Your Holiday Reading

How to control your audience

Saturday, December 21, 2024

And turn them into raving fan-customers

$166K MRR - simple employee scheduling tool..

Saturday, December 21, 2024

+ What do you think?

Your SaaS New Year’s Resolutions for 2025

Saturday, December 21, 2024

Here are Your Top 10 New Year's SaaS Resolutions To view this email as a web page, click here saastr daily newsletter Your SaaS New Year's Resolutions for 2025 By Jason Lemkin Thursday,