Earnings+More - Don’t believe the hype

Don't believe me if I tell you. Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

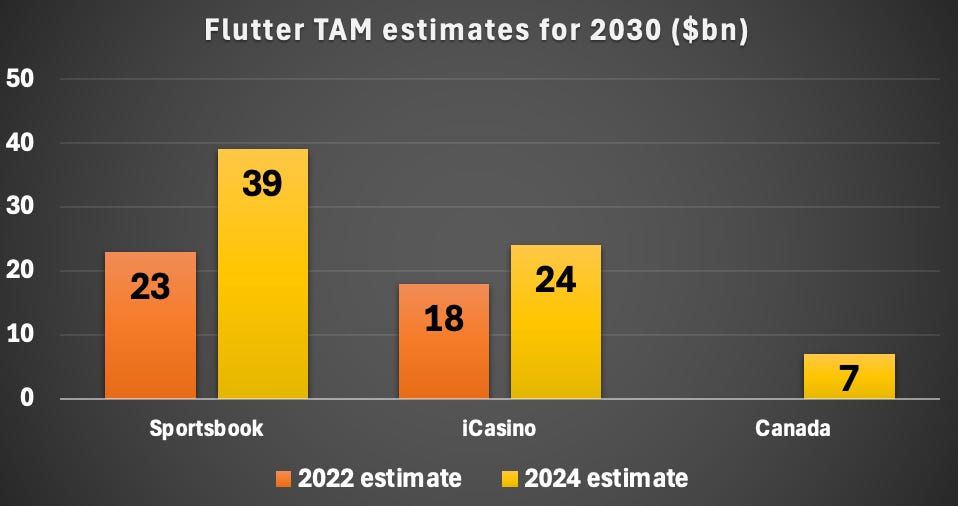

Hype reportTell me lies, tell me sweet little lies: Questions have arisen over the assumptions relied upon by Flutter last week in its TAM estimates for the US sportsbook and iCasino markets, after it upgraded its estimate for the size of the opportunity in 2030 by 75% to $70bn.

🔮 Flutter takes a stab at calling the size of the NA online market in 2030 On the call, FanDuel CEO Amy Howe made the point that neither of its assumptions on sportsbook or iCasino penetration rates had changed between 2022 and this new estimate.

Shaky ground: But Chris Krakcik, MD at EKG Gaming, noted his concerns on LinkedIn last week about some of the underpinning for Flutter’s numbers, especially when it comes to iCasino expansion and the implied GGR per adult.

The other stumbling block is the implied per adult participation. With a “reasonable” assumption for the over-21 population of the US of 275m by 2030, the $63bn of US TAM implies per adult spend of $177 for sportsbook and $349 per adult for iCasino.

Anchor, man: He noted Flutter “rightfully” is optimistic about the trajectory of the US market and its place within that market. But the implied level of GGR per-adult spend in the updated TAM “do not seem to be anchored or even proximate to any non-New Jersey comps.”

Kero is a premier micro-betting provider, powering more than 150 operators across the globe. More Flutter takesTalking turkey: It is FanDuel’s current dominance of the US online space that impressed the analysts and which, said the team at Wells Fargo, will see it “continue gobbling up OSB market share.”

Morgan Stanley suggested the read-across for DraftKings was positive, arguing that just by matching FanDuel’s higher win rates it would highlight DraftKings’ “upside potential.” But it is less than good news for BetMGM, Caesars and Penn/ESPN Bet.

Juggling: Meanwhile, CBRE suggested parent Flutter was well-placed to manage the balancing act of leaning into the US opportunity, pursuing further M&A, returning cash to shareholders and still maintaining low enough debt levels that “preserves plenty of dry powder for new opportunities.” +MoreESPN Bet has enjoyed its first weekend of operations in New York after a soft launch late last week. It means New York is now back to its full complement of nine operators. DraftKings has been fined $200,000 by the SEC for posting financial information selectively on social media ahead of an upcoming earnings release. FanDuel has renewed its multi-year retail sports-betting agreement with IGT, with the supplier’s PlaySports offering being the exclusive provider for North America through September 2028. Betting exchange Sporttrade has launched in Arizona, its fourth state. 888Africa has become the official sports-betting partner of Portuguese soccer club SL Benfica in Mozambique and Angola. Sega Sammy has received regulatory approval from the Nevada Gaming Commission for the acquisition of GAN. Positives for PlaytechB2Boost: Having recently disclosed the sale of Snaitech to Flutter for €2.3bn, Playtech got around this morning to disclosing its H1 earnings, which showed revenue up 5% to €907m and adj. EBITDA up 11% to €243m. Rock on: The company said the performance of the continuing B2B business was “very strong” with revenue up 14% to €382m, helped by a 42% increase in the Americas – largely CaliPlay – to €142m.

What Flutter gets: The B2C business saw flat revenues at €532m while adj. EBITDA fell 6% to €131m. Within that, Snaitech revenues fell 1% to €484m with retail down 2% and online off by 1%. Revenue at Sun Bingo and other B2C was up 17% to €39.9m. Diary note: Playtech will host a call with analysts later this morning, which E+M will report on later in the week. Catch a falling StarHang tough: “We've had a tough time, for a long time,” said incoming CEO Steve McCann as Star Entertainment was finally able to publish its delayed H2 earnings, which saw the company post a loss after tax of A$1.69bn ($1.17bn).

The losses included a A$1.44bn writedown caused by trading conditions as well as regulatory changes derived from the recent Bell II enquiry. The trading performance in the second half of FY24 deteriorated with revenue down by 10% to A$1.68bn.

Earnings in briefXLMedia: The gaming affiliate said revenue from its continuing, largely North American-focused, business plummeted over 38% to $10.4m. Adj. EBITDA was down 72% to $0.9m.

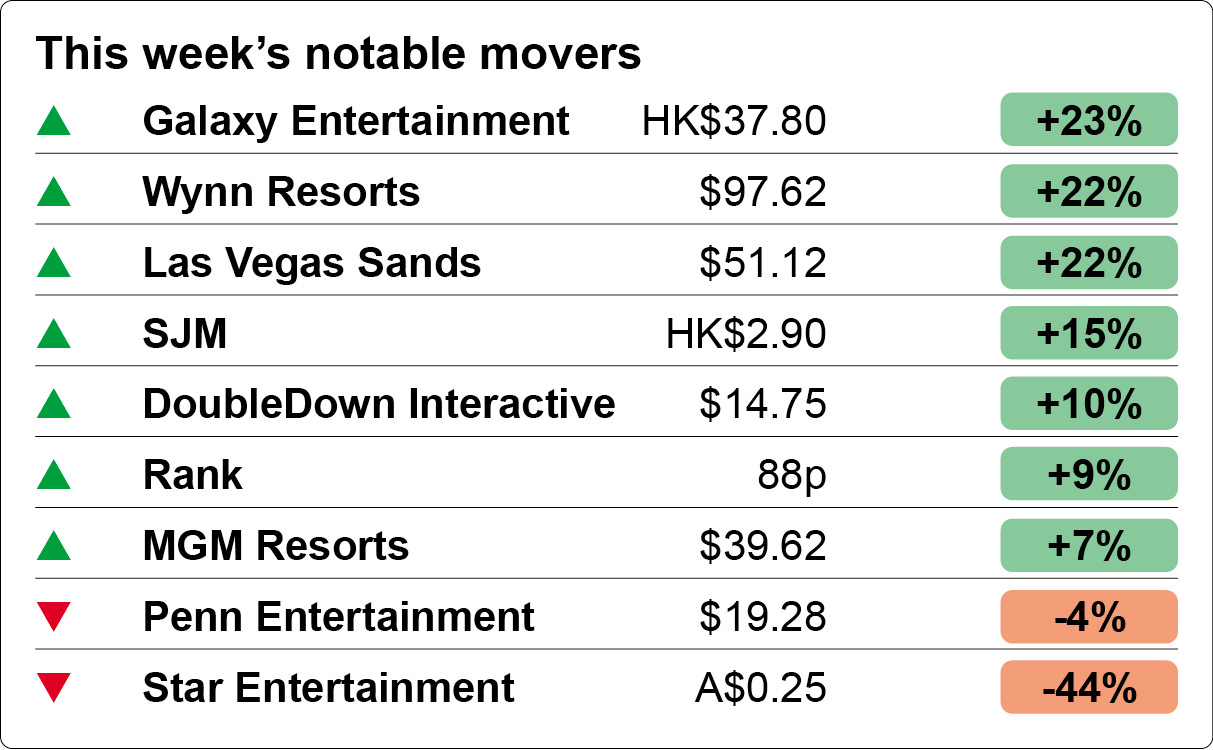

Shares weekFireworks: The long hoped-for stimulus package announced by the Chinese government last week in a bid to jumpstart the country’s economy lit a fire under Macau-related stocks this week.

Bull signal: A note from Morgan Stanley last week pointed out the recent Macau lows were similar to previous lows going back to 2011, adding that “every time it returned to at least double the prior market cap.” And then there were nine: Such was the improvement this week for Wynn Resorts that the company has now joined the elite list of gaming sector companies worth over $10bn.

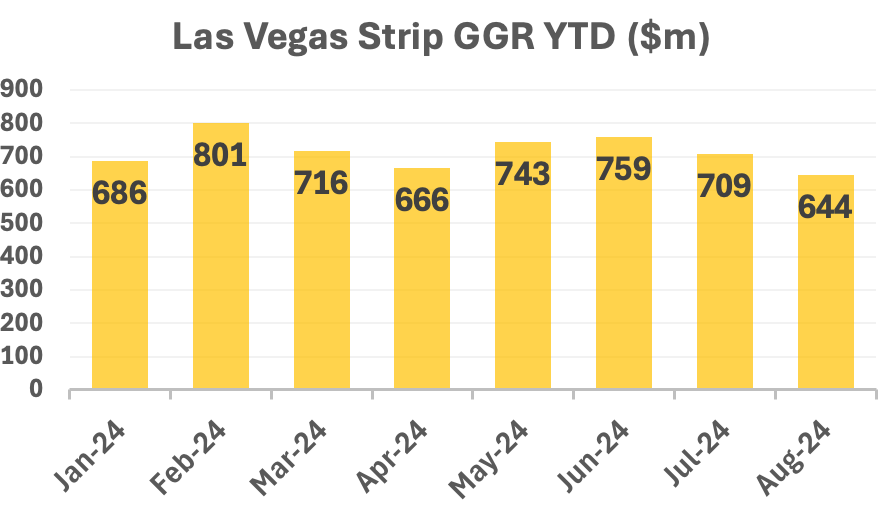

Metric’s new multi-tenant sportsbook technology provides a shortcut to crafting a bespoke, premium sportsbook from the ground up, complete with operator-owned IP and built on highly performant technology, free of technical debt. Our philosophy is to deeply understand our partner’s business and treat it with similar care to our own. We aim to collaborate with ambitious brands to help them realise their long-term growth potential in regulated markets, globally. For sports betting businesses looking to finally take control of their sportsbook, there is no faster route to competing on product and price. To find out more, visit www.metricgaming.com By the numbers – Las Vegas StripDeflating balloon: Tough comps particularly with baccarat hold left the analysts at Macquarie suggesting the “hyper growth” was now slowing.

🎈Is the party over on the Las Vegas Strip? Data pointsThe North Carolina sports-betting regime has brought in $62m in tax revenue in its first six months of operation, according to Sterl Carpenter, the deputy executive director of gaming compliance and sports betting at the state’s Lottery Commission.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Cash machine

Thursday, September 26, 2024

Flutter splashes the cash on its investors ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dragon clash

Wednesday, September 25, 2024

L&W shares crash as Aristocrat wins preliminary injunction ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Leading edge

Monday, September 23, 2024

What Flutter brings to FanDuel ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A selling club

Friday, September 20, 2024

Playtech's top team incentivized to sell more assets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Under the radar

Wednesday, September 18, 2024

Fliff is making waves ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Marketing Weekly #211

Sunday, December 22, 2024

Marketing a Virtual Patient: The Quest to Eliminate Medical Error • What if You Could Reduce Returned Products With Just Some Lines of Text? • How to Manage an Omnipresent Social Media Strategy • 3

Salesforce Now Hiring 2,000 Sales Execs To Sell AI

Sunday, December 22, 2024

And the top SaaStr news of the week To view this email as a web page, click here Salesforce: Actually We're Going to Hire 2000 Sales Execs Now To … Sell AI So it was just the other day Salesforce

Sunday Thinking ― 12.22.24

Sunday, December 22, 2024

"When someone shows you who they are, believe them the first time."

Chokepoints in the AI boom

Sunday, December 22, 2024

Plua: Why 2025 looks like a brighter year for VC, key signals for allocators and more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch December

Brain Food: The Right Grip

Sunday, December 22, 2024

FS | BRAIN FOOD December 22 2024 | #608 | read on fs.blog | Free Version Welcome to Brain Food, a weekly newsletter full of timeless ideas and insights you can use. Before we dive in, a last-minute

🤖 Google Search “AI Mode” Dropping Soon

Sunday, December 22, 2024

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 12 spicy takes

Sunday, December 22, 2024

Prediction markets, phone addiction, ESOP plans and other such things. 🎄

Recruiting Brainfood - Issue 428

Sunday, December 22, 2024

Merry Christmas everybody - it's the Brainfood Christmas Special, so we bear gifts and reflections from the world of TA / HR on the year 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Simple hack to get 4x more shares

Sunday, December 22, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

I built an online tool site in 5 minutes

Sunday, December 22, 2024

AI tools are getting even more incredible