The Pomp Letter - Bitcoin Is The Vibe Shift

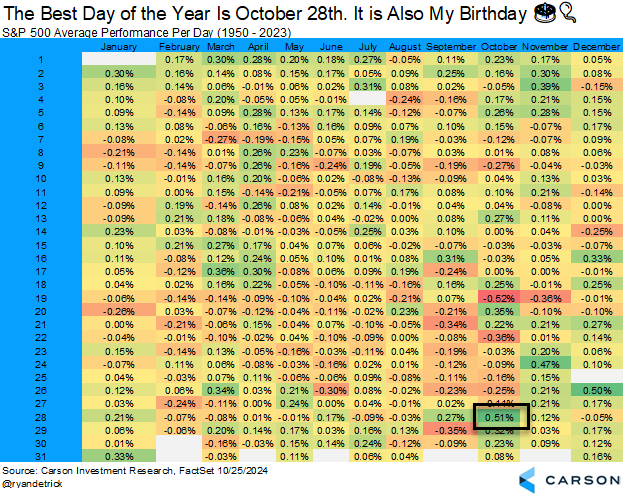

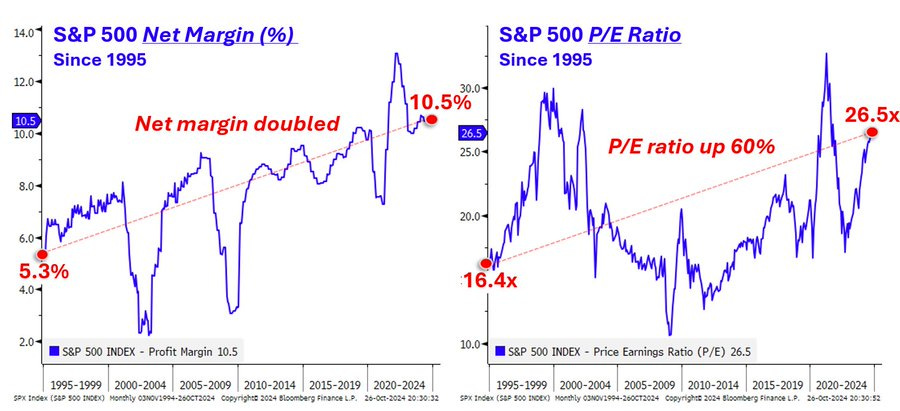

To investors, There is a vibe shift underway in America. It is hard to describe, but you know it when you see it. Take this yard sign as an example. My friend Based Beff Jezos tweeted this photo from a home in Los Angeles. This yard sign would be expected in the American South, but it is shocking to see in Southern California. That is part of the vibe shift. But the vibe shift is happening in financial markets as well. The talk of an incoming recession has died down and investors are becoming more optimistic. Carson Research’s Ryan Detrick points out today is historically the most bullish day of the year for stocks. Investors getting more bullish doesn’t mean that stock prices have to go up. Instead, stocks could become overvalued and suffer a significant future decline. The P/E ratio is one statistic I see doomsayers pointing to as proof that stocks are in for a rude awakening. Matt Cerminaro brought up a great point over the weekend:

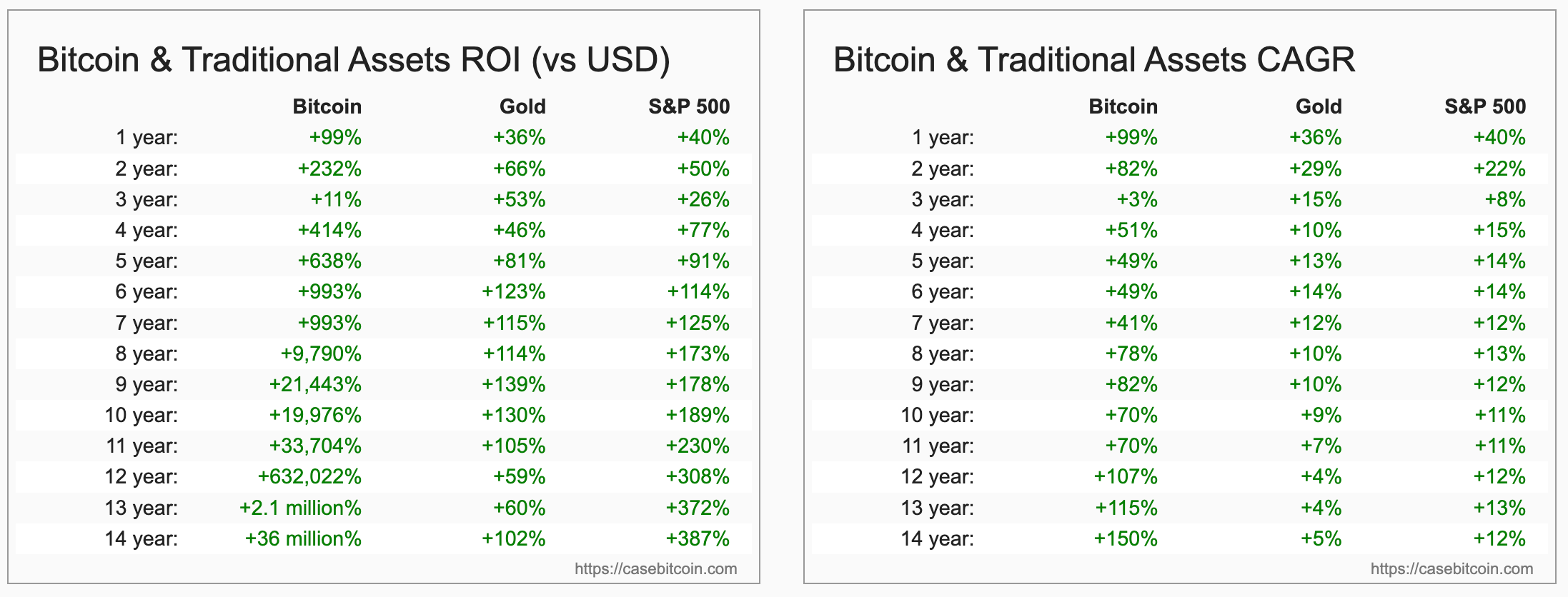

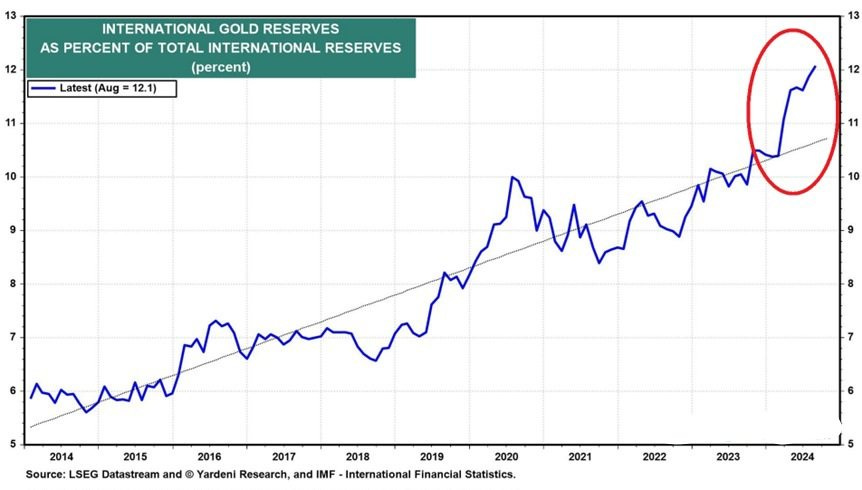

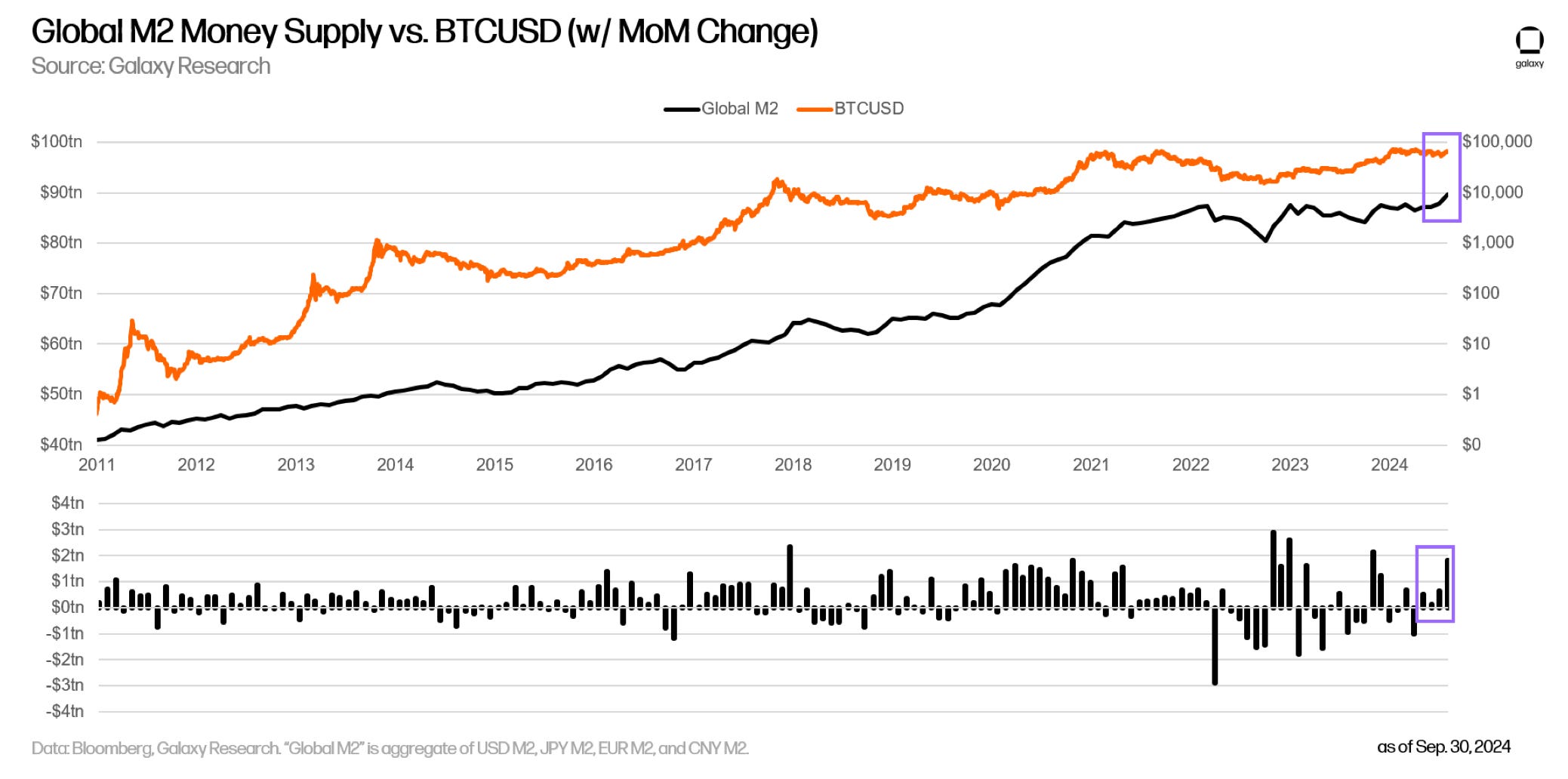

This is important to understand about historical comparisons. Valuations may be changing, but the underlying businesses have been improving as well. If companies make more money, then they should be worth more to an investor. But is the vibe shift only happening in equities? No. You can see it in bitcoin as well. Let’s compare bitcoin, gold, and the S&P 500. You can see that gold and the S&P have very little difference in returns according to the 5-year compound annual growth rate. It is bitcoin that stands out on a 1-year, 5-year, and 10-year timeframe. You could make a strong argument that allocating gold and equities over the last 5 years has been a wash, but buying bitcoin would have transformed your portfolio. Many buyers of gold are not allocating for pure price appreciation though. Win Smart highlights that “central banks now hold 12.1% of global gold reserves, the highest level since the 1990s.” So what do you think happens when these central banks start allocating to bitcoin? Gold is a story of the past, bitcoin is a story of the future. Take a look at bitcoin compared to the M2 money supply. Galaxy’s Head of Research Alex Thorn shows that bitcoin has not caught up to the recent money expansion. This doesn’t mean you shouldn’t own gold. It doesn’t mean you shouldn’t own stocks. It just means that a vibe shift is underway. Investors who have chosen to allocate to a digital store-of-value are continuing to outperform over the long run. If it works for individuals, it is only a matter of time before governments start implementing the strategy. That is when the real fun will begin. Until then, don’t get lulled to sleep by sideways summer. We should be coming out of hibernation soon and decision-makers become much more interested after prices have increased. As Mark Yusko always says, “people are really good at buying the things they should have bought and selling the things they are about to need.” Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management 🚨 READER NOTE: I am co-hosting a conference with Lance Lambert and ResiClub on residential real estate in NYC on Friday November 8th. We have many industry experts speaking about the housing market, impact of interest rates, effects on the US economy, and what investors should know moving forward. The event has been quite popular, so remaining tickets are limited. If you would like to attend, please grab your tickets: Click here Navy SEAL Becomes Humanitarian And Save Lives I spoke with Ephraim Mattos about his life journey, which is inspiring to say the least. Ephraim is not only one of America’s greatest warriors, but he also wrote an incredible book about his transition to become a humanitarian. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Goldman Sachs Thinks We Will Have A Decade-Long Bear Market — I Disagree With Them

Tuesday, October 22, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Are Prediction Markets Telling Us Who The Next President Will Be?

Monday, October 21, 2024

Listen now (2 mins) | REMINDER - Crypto Investor Day Is This Week! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Your Invited To Our Crypto Event This Week

Sunday, October 20, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Stocks Have Done Something Crazy Every 20 Year Period...

Sunday, October 20, 2024

Today's letter is brought to you by Domain Money! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Stablecoins Are Eating The World

Sunday, October 20, 2024

REMINDER - Crypto Investor Day Is One Week Away! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏