Why Is Bitcoin's Price Dropping Right Now?

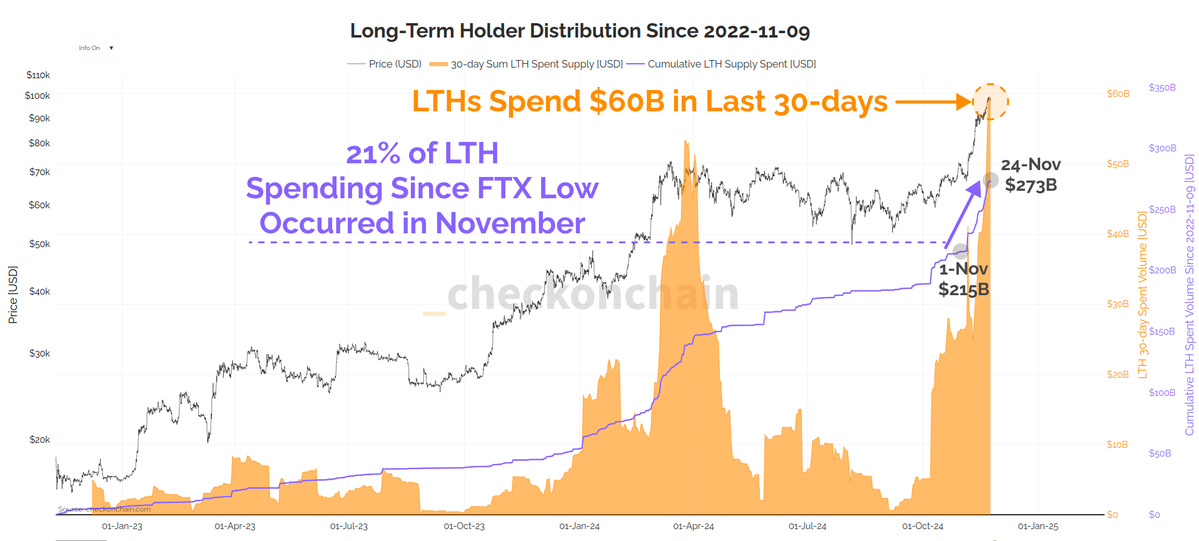

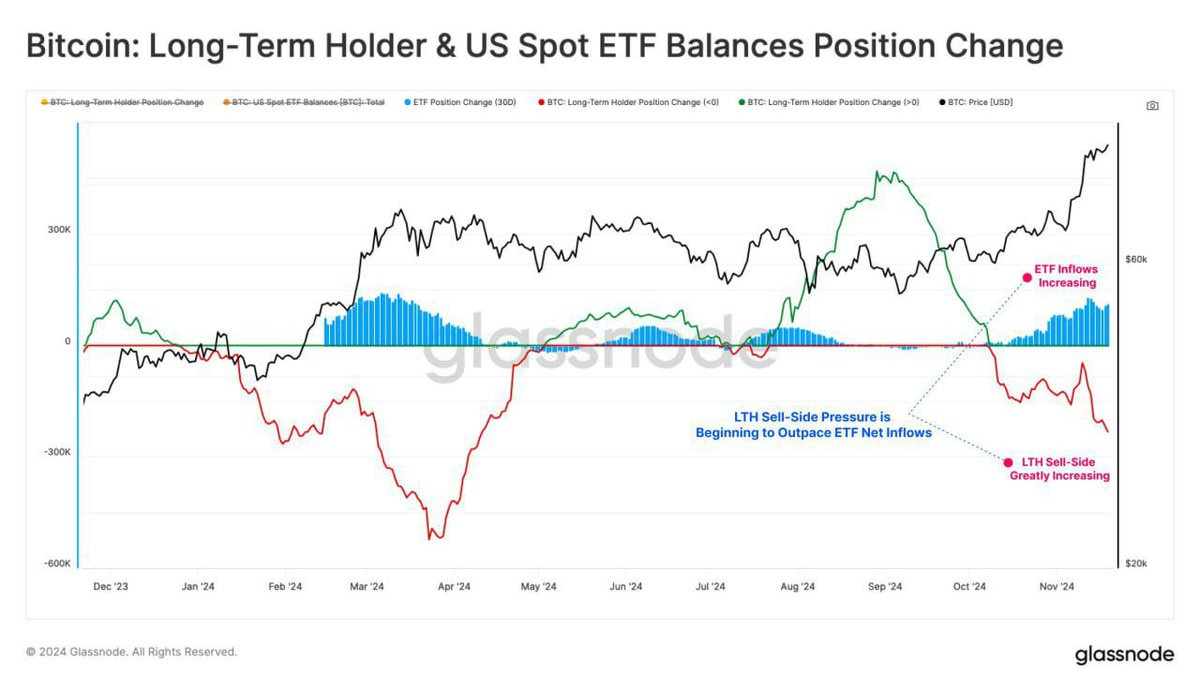

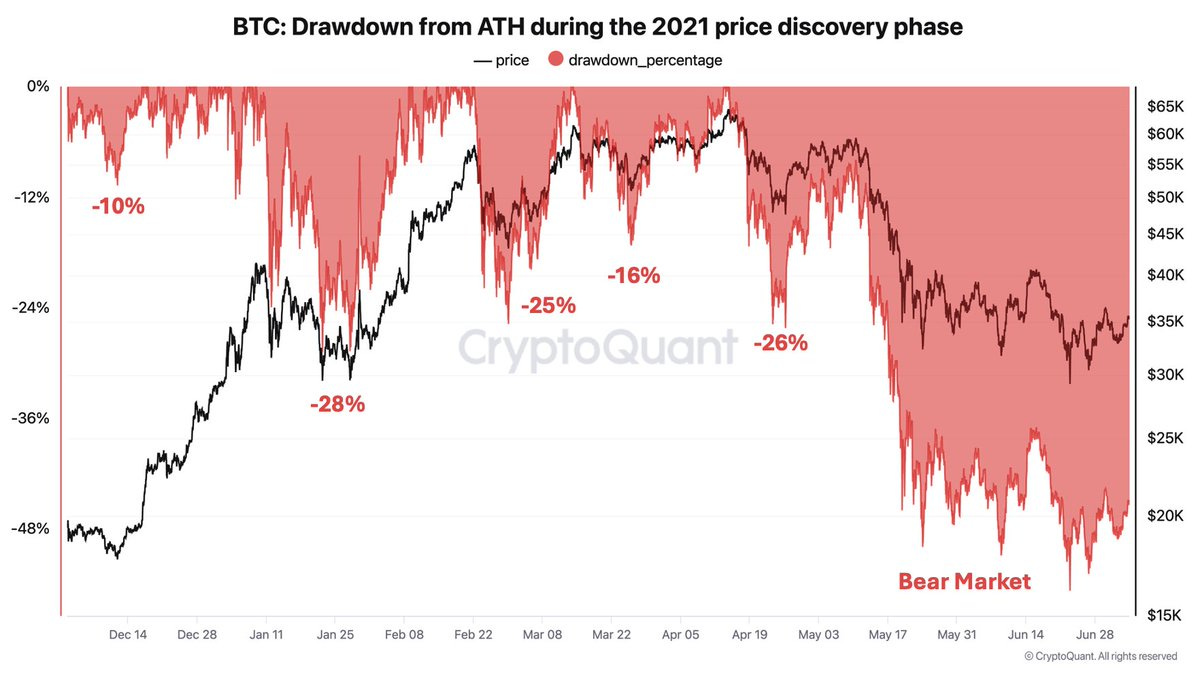

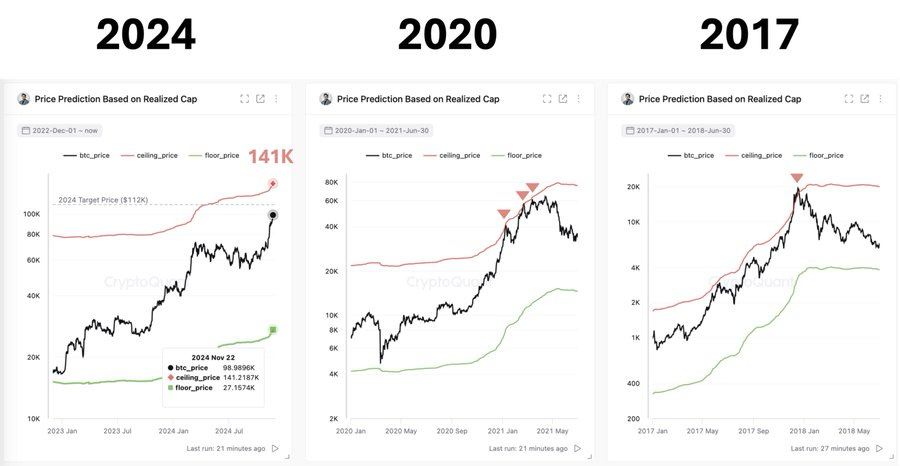

Today’s Letter is Brought To You By Range!Looking for a tax strategy to offset those BTC gains? Range has you covered -- they have rebuilt wealth management from the ground up, offering investors like you a modern all-in-one comprehensive suite of financial services. With Range, you get everything in one place—investments, taxes, estate, real estate, equity, and cash flow. No more piecemealing your way to generational wealth while hunting for the right connections to manage all aspects of your money. The traditional industry has you convinced that you have to pay ridiculously high fees to get sophisticated wealth management. Let them know you’re done. You’ve found Range. The search is over. To investors, Bitcoin is crashing to levels not seen since….a week ago. No, seriously. That is what has happened over the last 24 hours. Bitcoin has traded down under $92,000 and people are freaking out all over the internet. But bitcoin was hitting a new all-time high of $92,000 just a week ago. It is always funny how bad our memories are. First, we should remember that bitcoin had the highest weekly close in history on Sunday night. So why is the price going down right now? Because there are more sellers than buyers. That sounds simplistic, but that is the truth. Checkmate, one of my favorite bitcoin on-chain analysts, points out “Long-Term Holders have distributed $60B worth of supply in the last 30-days. Out of all the LTH supply moved since the FTX bottom, 21% of it has happened in November. This is the heaviest profit taking we have seen so far this cycle.” You would expect the price to fall further if long-term holders are selling this much, so why haven’t we seen a larger drawdown? The ETFs are buying up a ton of the supply at the same time. Kyle Doops explains “Long-term Bitcoin holders sold 128K BTC, but U.S. spot ETFs absorbed 90% of the selling pressure. Strong institutional demand is fueling BTC’s rally, bringing it closer to the $100K milestone.” This doesn’t mean that we are in the clear though — Joe Consorti highlights a potential scenario worth watching: “Bitcoin has tracked global M2 with a ~70-day lag since September 2023. I don't want to alarm anyone, but if it continues, bitcoin could be in for a 20-25% correction. (Bitcoin in orange and money supply in white).” I don’t think investors can time markets with a high-degree of accuracy, so I wouldn’t try to do it. Plus, if we use Thanksgiving 2020 as a guide, bitcoin has the potential to cool off for a week or two before ripping higher to all-time high records at an accelerated rate. But maybe you don’t believe history rhymes. Ki Young Ju writes “even in a parabolic bull run, Bitcoin can see -30% pullbacks. Such corrections repeatedly occurred during the 2021 price discovery from $17K to $64K. This isn’t a call for a correction—just manage your risk and avoid panic selling at local bottoms. We’re in a bull market.” Ki Young Ju explains the “bitcoin market seems too early to call a bubble. The market cap hasn’t increased significantly relative to cumulative on-chain capital inflows. Based on the current realized cap, it could rise to $141K. The realized cap has been steadily increasing every day.” So what is the big takeaway from all this data? Take a deep breath — everything is going to be alright. Bitcoin doesn’t go up in a straight line. Yes, the price of the asset is falling. It may fall further. But the long-term trend is still intact. I would not be surprised to see bitcoin hit a new all-time high before the end of the year. It is a holiday week. Relax. Enjoy time with your family and friends. The world will keep spinning. Bitcoin will keep producing blocks of transactions. And the government will keep printing money. So bitcoin will go higher over time. Hope you have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Small Business Uses Bitcoin To Improve Employee Retention & Product Quality Mike Coffey and Julie Denton-Price are the owners of BlueCotton, a small retail-grade screen printing business in Bowling Green, Kentucky. They previously plugged their business into the bitcoin network in a very unique way, and it is changing the lives of 130 employees. In this conversation we discuss, why they did it, how the employees earn bitcoin, and what the impact has been. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Microstrategy of X is coming — Here Is An Interesting One

Monday, November 25, 2024

Listen now (6 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Crypto-Related Public Companies Are Still Undervalued

Friday, November 22, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Thursday, November 21, 2024

Open this on your phone and click the button below: Add to podcast app

Public and Private Companies Want Bitcoin Because It Keeps Going Up

Wednesday, November 20, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The United States Should Print $250 Billion & Buy Bitcoin

Tuesday, November 19, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏