Not Boring by Packy McCormick - Rox

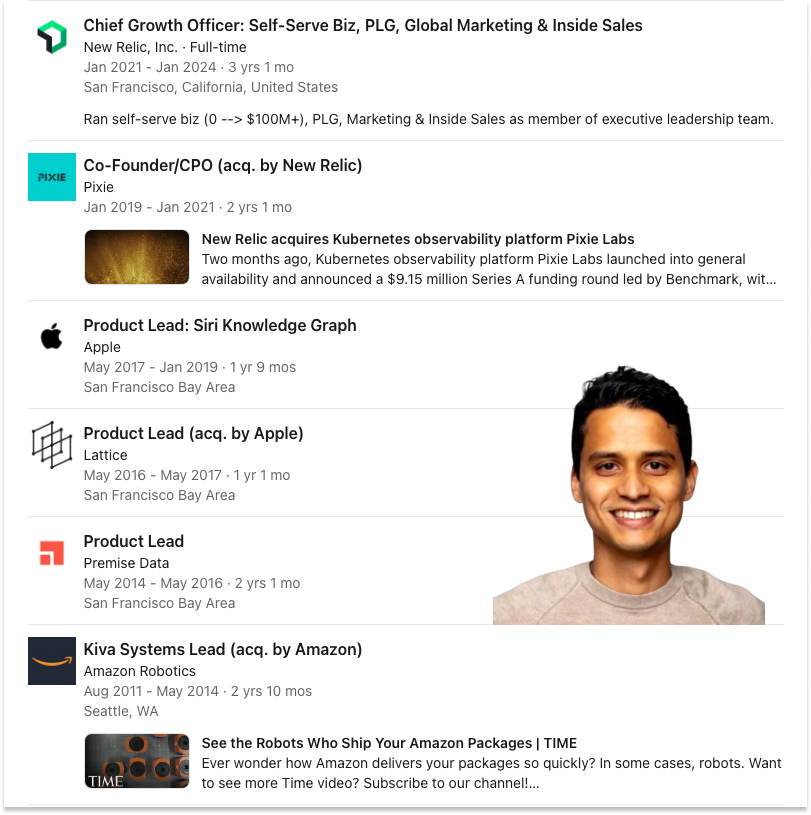

Welcome to the 145 newly Not Boring people who have joined us since last week! If you haven’t subscribed, join 235,378 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Tegus There’s only a small handful of tools I use every time I write a Deep Dive. Tegus is one of them. It’s the best way to understand a company or industry like the insiders do, in their own words. If I’m writing about, say, an AI application for revenue teams, I spend hours on Tegus reading interviews on its market and competitors. It would be longer, but Tegus now summarizes and bullets each transcript right at the top of each one. Tegus is full of transcripts of conversations with insiders and executives in any industry you can think of. It boasts 75% of the world’s private market transcripts. If you want to learn about AI, energy, space, biotech, name it, from the people who actually work and buy in those markets, Tegus is the spot. With Tegus, you gain access to the pulse of the private markets – with perspectives and detailed financials you won’t find anywhere else. There’s a reason the world’s best private market investors use Tegus, and as a smart, curious Not Boring reader, you can get access to the Tegus platform today: Hi friends 👋 , Happy Tuesday. And Happy Thanksgiving to my fellow Americans. It’s a short week so I’ll keep the intro brief: I write Deep Dives on specific companies to learn where the world is going from the smartest people willing to teach me. The most fun ones change my mind. By that measure, this Deep Dive on Rox was incredibly fun: I think AI applications might actually be able to dig moats, as just one example. I hope you learn as much reading it as I did writing it, and that it gives you plenty to chew on while you’re not chewing on turkey. Let’s get to it. RoxTo start, I need to clear the air: I did not expect to be writing a Deep Dive on “an AI-native Salesforce.” AI applications are fascinating and I love using them, but I’ve struggled to imagine any individual AI application surviving seven to ten years to IPO when AI moves so fast. CRMs are not fascinating and I hate using them. CRMs are my go-to punching bag when writing about boring software. It's a safe target. I hate offending people, but everyone is in on the CRM joke. And Salesforce, for all of its flaws, has staying power. Just because I don’t like the software doesn’t mean that the company is doomed to fail. Painful software plus good distribution and high switching costs is a hard combination to kill. All to say, the combination of an AI-application reimagining the CRM to take on Salesforce wasn’t something that interested me in the abstract. But in August, Ramp CEO Eric Glyman texted asking if he could introduce me to a founder. No details, just his endorsement. Rox.com had no information. Something about agents. But I figured if Eric said Ishan was stellar and the company was compelling, it would be good. Imagine my surprise, then, when Ishan told me within the first minute of our Zoom: “We’re building an AI-native Salesforce.” On the outside, I smiled and said something like “Oh, cool!” and on the inside I was like: Salesforce’s ticker is literally CRM. It is CRM. The company is worth $324 billion, making it the world’s 28th most valuable, even if no one really knows what it does. A rare combination of big and boring. I can actually correctly explain Urbit, but I can’t tell you how little I care to explain Salesforce. But I’m a polite guy, and I didn’t want to disrespect Eric by hanging up on his friend, and the call was only supposed to be 30 minutes, three of which had already passed, so I figured I’d stick around, learn a little bit, and politely pass on writing about Rox. Forty-two minutes and two “do you have a hard stop? I can keep going” later, after asking questions like, “But what are we all going to do with ourselves?” and “Have you considered only working with one company in each category and taking equity instead of cash?”, I knew: I was actually going to write a Deep Dive about the AI Salesforce. A big part of the reason I write Deep Dives is that by studying specific cases deeply, I can get a better sense for where things are heading more generally. There’s no better teacher than a really smart person who’s dedicated the next decade of their life to working on one particular problem. Ishan is really smart, with a rare combination of skills. He can build and he can sell, the two most basic functions of a company. Engineer at Amazon Robotics, Product Lead on Siri, co-founder of Pixie, Chief Growth Officer at a public company, New Relic. One person I spoke with, whose taste in talent I trust as much as anyone’s, put it simply: “Ishan is just a force of nature entrepreneur.” Investors agree. The company launched publicly last week having already raised $50M to date: a mostly self-funded pre-seed last December, a Sequoia-led Seed in February, and a General Catalyst-led Series A earlier this month. One reaction might be to dismiss the flurry of fundraising as a sure sign of an AI bubble. What one-year-old company could possibly warrant $50 million? Before meeting Ishan, that’s what I would have done! Another might be to try to understand what these intelligent people see about the future that we can learn from. Now that I’ve met Ishan, that’s what we’re going to do. I now believe dozens of companies being built today will be responsible for the workload that millions of employees across tens of thousands of companies currently handle. More importantly, Rox showed me how they’ll do it. So this is a Deep Dive on what that future might look like and how we’re going to get there. As we go through, there are three themes I want you to keep in mind:

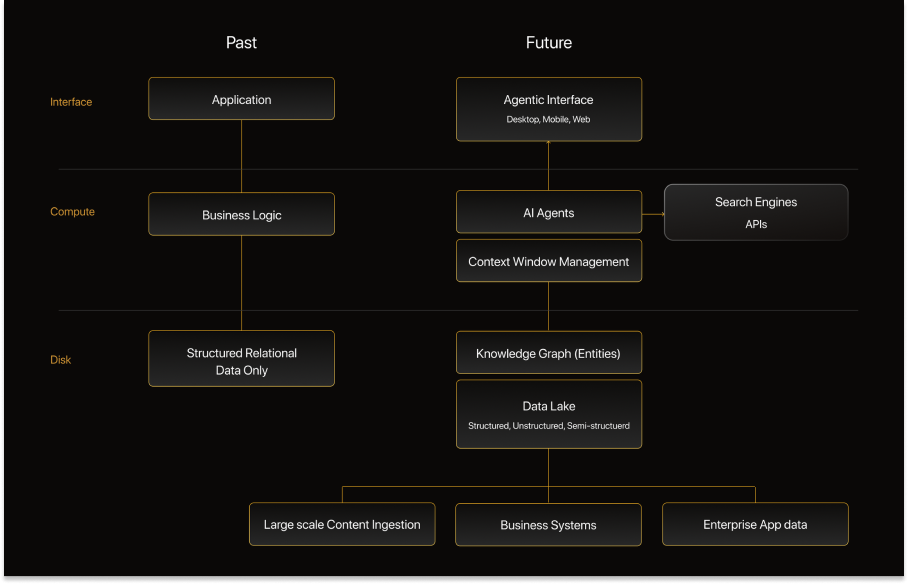

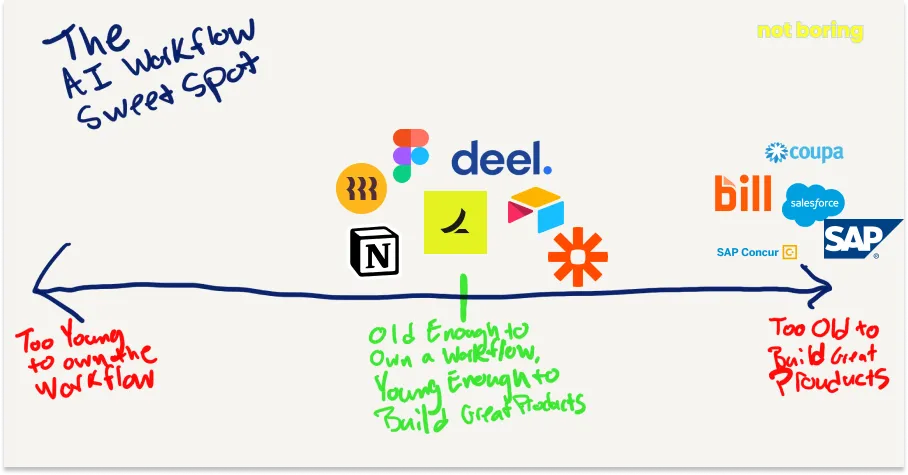

So why now? Why Now?Here’s something that I didn’t realize, because I didn’t care to, but is actually interesting: Salesforce, the 800 lb. system of record for revenue teams, is losing its place as the system of record. That’s not to say that people aren’t using Salesforce – everyone is. There’s almost no choice but to. When Ramp CTO Karim Atiyeh started the company, he swore, “We’re not going to use Salesforce. I hate Salesforce. We’re going to make our own stuff.” No company is better at making their own stuff than Ramp. If anyone could break the tyranny of Salesforce, it’s Ramp. Today, Ramp uses Salesforce. It’s just to say that Salesforce is no longer where the most valuable data lives. “The underlying data that drives Salesforce left Salesforce five years back,” Ishan explained. It moved to the data warehouse, provided by companies like Snowflake. In fact, 40% of all data in data warehouses is customer data.” That stat knocked me out of my indifference. Even if you don’t care about the CRM, the CRM cares about you. 40% of all data in data warehouses is customer data. It makes sense – business can be boiled down to two functions, building and selling, and selling increasingly involves knowing evermore about the people to whom you’re selling – but still. 40% is a lot. And it’s moving. So why is all that data leaving Salesforce and heading to the data warehouse? Sales has started to move from an upfront, commit-based model to consumption-based models. Think Stripe: the more payments your company runs on Stripe, the more you pay Stripe. Think Ramp: the more payments your company makes with Ramp, the more Ramp earns. Think OpenAI: the more your company pulls intelligence from their APIs, the more you pay them. “Now, numbers on contracts are just words,” Ishan says, “Your salesperson has to sell value day in and day out.” That requires different data types, and different data sources. Now, instead of just knowing whether a company is in the pipeline or closed-won, for how many seats, and when the contract is set to renew, your salesperson needs to know how much your customers are using which of your products and whether they’ve experienced issues, among other things. All of this flows into the data warehouse. Before starting Rox, Ishan talked to more than 300 teams, and found that 90% of them had already built an internal replacement for Salesforce on top of their data warehouse with customer-level analytics to help their go-to-market teams more proactively manage their accounts. “In our view,” writes General Catalyst, “the best companies have been forced to invest millions to rebuild their revenue operating systems in-house in order to remain competitive.” So Ishan asked a question similar to the one a lot of founders ask right before starting their companies: “Do we feel like every team needs to rebuild their CRM in the warehouse?” He answered in a similar way, too: “No, we should build it for all of them.” The opportunity: build the anti-Salesforce. While Salesforce built a closed system that companies had to adapt to, and many ultimately outgrew, Rox is building an open system that adapts to companies' existing and evolving data infrastructure. The company's warehouse-native architecture means customers keep their data in their own infrastructure and maintain control, rather than being locked into another vendor's black box. Reading that, one question you might be asking yourself is: “Won’t Salesforce just respond, do it themselves?” A lot of companies have said they’re replacing Salesforce. None has succeeded. Plus, Marc Benioff has talked a lot about agents. Maybe they’ll win the AI shift, like they catalyzed and won the move to the cloud. I don’t think so, and here, my analysis isn’t particularly sophisticated. As plainly as possible: the software just kind of sucks. When I wrote about Ramp’s AI Opportunity in June, I used Salesforce as a foil, the kind of company that owns a valuable workflow but is so bad at developing software that people enjoy using that it wouldn’t benefit from AI. Having learned more about data’s migration to the warehouse, I believe that more strongly now. One of the biggest advantages Salesforce has is becoming obsolete, at least as far as tech-forward companies, the type that Rox is targeting, are concerned. Worse than obsolete, actually. Because Salesforce is heavily positioned in the old model, it is more susceptible to counter-positioning from a company like Rox. Rox's open approach is one that Salesforce can’t embrace without hurting its existing business, but it’s one that’s compelling to modern companies already building on top of the data warehouse. The more deeply companies integrate Rox into their data infrastructure and workflows – because they trust that it is their own system of record, and because Rox can help train agents on their data securely - the more valuable it becomes. Of course, Salesforce isn’t in imminent danger. The system of record is one of the most defensible positions in software; it has high “switching costs,” in 7 Powers terms. Plus, there’s just that sunk cost thing: because Salesforce is so brutal to implement, most companies that use it have spent so much time and money implementing Salesforce that they’re unlikely to rip it out. Stockholm Syndrome as a Moat or something. But I think Salesforce is unlikely to win the next shift, which means there’s an opportunity for a company that builds software that customers actually like to take the lessons from what Salesforce does well and apply them to modern software that serves modern companies. That leads to the next question: but aren’t there a thousand companies going after this opportunity? The internet is now littered with AI-native would-be Salesforce killers of all shapes and sizes. Companies are promising that they’ll write more effective outbound, handle all of your inbound, even replace salespeople altogether. Isn’t this the problem we started with? That AI will undoubtedly handle an increasing amount of the work that sellers do today, but that with so much competition and noise, it’s practically impossible to take an informed view on which, if any, specific AI-native company will win and endure? The paradox at the heart of Rox is that AI for Revenue Teams is so obviously going to be a big category that it’s really hard to imagine who the big winners might be. This is the paradox at the heart of every applied AI company. So it’s worth diving even deeper here before we answer how Rox plans to resolve it. The AI Shift, Increasing Returns, and Path DependenceTo understand how Rox might resolve this paradox, we need to understand something deeper about AI and timing. AI is the Big Why Now, the platform shift that is launching a thousand startups. Apart from the fact that data is moving from Salesforce to data warehouses, there is a broader once-in-a-Techno-Economic-Paradigm opportunity to build new systems of record for two reasons:

Current AI Can Make Sense of Unstructured Data. Data was already moving from structured systems like Salesforce to unstructured data warehouses. Now, AI models can make sense of this chaos and deliver it in useful ways. With the advantages of a structured database becoming less relevant, the structure is now a liability; it’s too heavy. It requires too much manual work from the user, when they could and should be doing more productive things. Instead of taking a call and then manually entering notes into Salesforce, now you can just upload all of your emails, texts, and Gong calls and enter it into a new system. Even with current models, a well-built system can just make sense of it all. Unstructured data is what AI does best. Still, as we discussed, convincing companies to move to a new system is hard when they’ve invested so much money, time, and effort in the old one. How do you convince them to start uploading their emails, test, and Gong calls into something new? And I think the answer is as simple as: Companies Just Want to Buy AI. This shows up in revenue numbers, earnings transcripts, everywhere. AI is the hot new thing, and both consumers and companies are willing to spend to get it – even if they’re just spending experimental budget, at first. That experimental budget is a crack, a wedge, a small opening. There is, right now, thanks to AI, an opportunity to sell products to companies that may otherwise have been happy sticking with their old software and building internal tooling around it. This rush to buy AI creates a couple of challenges, though. First, revenue is easy but potentially not sticky, something I wrote about as far back as May 2023 in Small Applications, Growing Protocols and expanded on in When to Dig a Moat.

Second, while there is no uncertainty that AI is a big thing, there is a lot of uncertainty about how models will improve – that things are moving so fast – that it feels like a leap of faith to bet on any one application now. There are hundreds of Sales AIs in the market today. Plus, it’s really hard to figure out which companies will win because the best product doesn’t always win and success is often dependent on small, random events–on luck. BUT, you have to compete now, because in these moments, cracks open that don’t open often, and the companies that win – whether or not they have the best product today, whether or not they were just lucky, whether or not you build something better in the future – get locked in. This dynamic - where early moves matter more than perfect execution - is exactly what economist W. Brian Arthur explored in Increasing Returns and Path Dependence in the Economy. In one key paper in the 1994 collection, he writes:

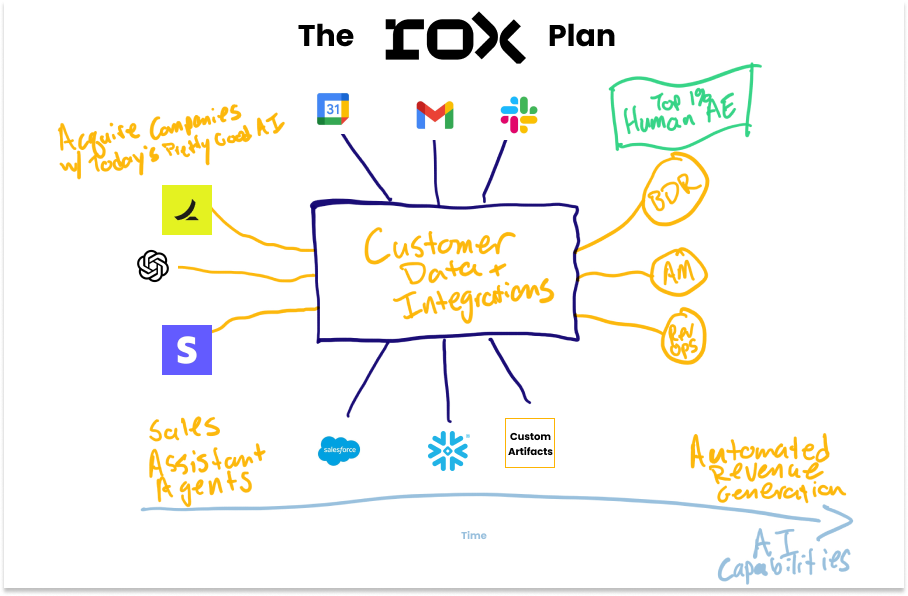

In English: early, small, and often random, events set a system on a path that self-reinforces and becomes hard to change. The outcomes at any given time are strongly influenced by the historical choices or events that led there. Customers are sufficiently motivated by the AI hype today that they are willing to buy new tools. This creates a once-in-a-paradigm opportunity to get into the core of customers’ workflows and become their system of record. Once they make the switch and try something new, if it’s better enough than what they’re using now, they might not switch again. The best product might not win. The one that gets in the door, shows some value, and becomes locked-in might. In an environment like this, early strategy matters a lot, because decisions today will lock in winners for years to come. You can’t afford to wait to build a product in a nascent market even if you think AI isn’t yet good enough to do everything that companies are promising it will. So you need to play now, while the shift is happening, but the space is incredibly competitive, full of companies overpromising based on what AI might enable at some point in the future. Arthur argues that luck plays a key role in determining the winner, but what struck me reading that book is that luck should be hackable. In other words, companies should be able to make their own luck and pull the world onto their path. That is what Rox is doing, and it’s the best way to think about its strategy. The Rox StrategyHow do you create path dependence? Salesforce is the definition of path dependence: it’s not the best software, but it’s locked in. The lesson from Salesforce is that you need to get customers to add integrations and data to your system of record. That is Rox’s goal, too. Rox is a fuzzy acronym for Revenue Operating System. That is the long-term goal, to “run the world’s revenue.” The official name is Rox Data Corp. It was a data company before it was an AI company, and data remains the most important thing. “For us, AI is a means to an end,” Ishan told me. “My life is about using software and technology in a pragmatic context of driving productivity gains in the economy.” The company’s proximate goal is to build a new system of record for revenue teams. The way the company uses AI today is an implementation detail in service of that proximate goal. How it will use AI in the future, when AI is stronger, will be a consequence of achieving that proximate goal. The game right now is being useful enough, early enough to get customers to connect their data. This is how I’ve come to think about Rox’s strategy, and I think a version of it may be broadly applicable to all sorts of applied AI companies:

In other words, use pretty good AI to acquire customers and embed in their workflow so that you’re best positioned to offer them increasingly powerful agents as models improve. Let’s break it down in more detail. Rox’s strategy starts with this premise: AI is really good today but not great, and not nearly what it will be. That sounds like an obvious premise, but it’s not consensus. 11x, which sells “Digital Workers, Human Results for Sales, RevOps, and Go-To-Market Teams,” just announced a $50 million Series B led a16z after a $24 million Series A led by Benchmark in September. The company’s manifesto is the opposite of what Rox’s would be if they’d written one: “While others offer tools that merely assist human sales teams, 11x delivers complete revenue generation through autonomous AI workers that operate at scale.” That may be the right approach! I am not here to tell you that Rox is better than 11x or vice versa. The market will decide that. I’m here to learn, and analyze Rox’s strategy, and, to start at least, Rox’s strategy is to “merely assist human sales teams.” Rox doesn’t want to replace people; it wants to make the best better. Now that Rox has launched publicly, its website has more information than when I first encountered it. This is what it greets you with: Rox is built to help the top sellers at the top companies – Ramp, OpenAI, and MongoDB are among Rox’s first customers – do more of what they do best, the human side of selling that will probably never go away, the stuff you see on Mad Men. Taken ad absurdum, in the future in which Rox succeeds, you can imagine one incredibly talented seller supported by thousands of AI agents selling billions of dollars worth of business. In this future, the pool of best sellers is shaped something like the NBA – a few hundred of the obviously best, stratified even within that, demanding eye-popping sums and earning their companies even more. But that’s the future. We’ll get there. Today, Rox offers companies swarms of agents – one agent per account, each tasked with knowing as much as possible about that single account based on internal and external information. With that information, it can alert sellers in the right way at the right time, surface opportunities, and do things like helping to draft emails. It will not, for now, do the selling. The idea is to make these agents so useful so quickly that companies add more integrations and data sources to make them even more useful, which gives Rox the opportunity to cement itself in the workflow, build the system of record, and maybe, one day, topple Salesforce. “What takes a great seller 15-25 minutes of research on Google and LinkedIn, Rox accomplishes in one second,” according to Max Freeman, the VP of Sales at Ramp. That saves time, makes his team more proactive, and helps the sellers sell. Rox contractually obligates itself to provide value out of the gate. The company writes its contracts such that if customers don’t get a 2x ROI on Rox in the first 90 days, they can cancel. Today, customers make their money back on new opportunities created, at-risk customers saved, and growth from high-potential customers. If Rox does what it says it does, the company is betting that people will feed it more data and integrations so that it can make them even more efficient. But a 9-figure valuation for a one-year-old company suggests investors see something beyond mere efficiency gains. I think it’s this: Rox is using the fact that companies are willing to buy AI as a foot in the door to prove usefulness to get more data and integrations to build the system of record and earn customer trust and usage and learn so that Rox is ready when AI gets really good. This isn’t just good strategy, it’s grand strategy. In On Grand Strategy, John Lewis Gaddis defines the term as “the alignment of potentially unlimited aspirations with necessarily limited capabilities.” Grand strategy requires an honest assessment of those limited capabilities as they are today, not as you want them to be. “Napoleon lost his empire by confusing aspirations with capabilities; Lincoln saved his country by not doing so.” In Rox’s case, the capabilities of AI agents as they stand today are that they:

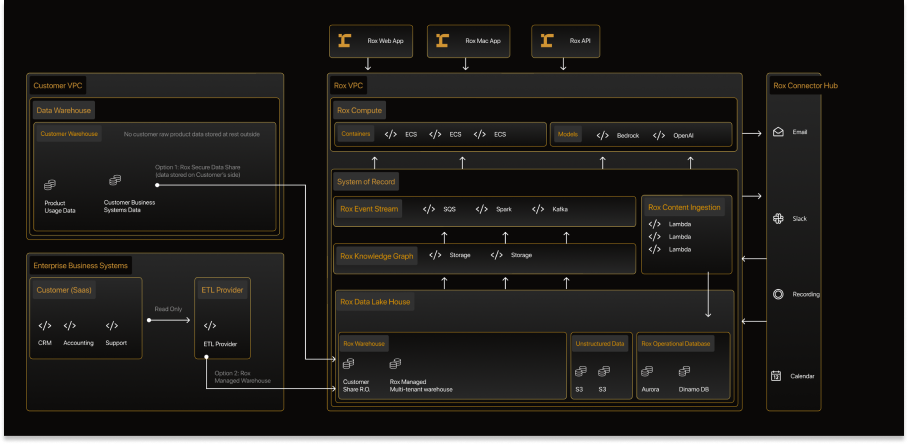

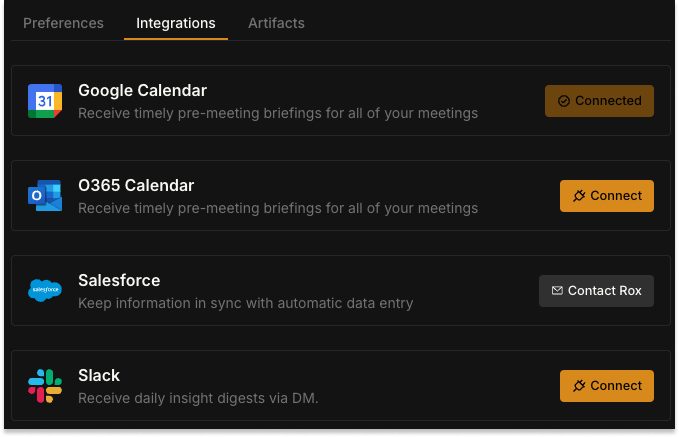

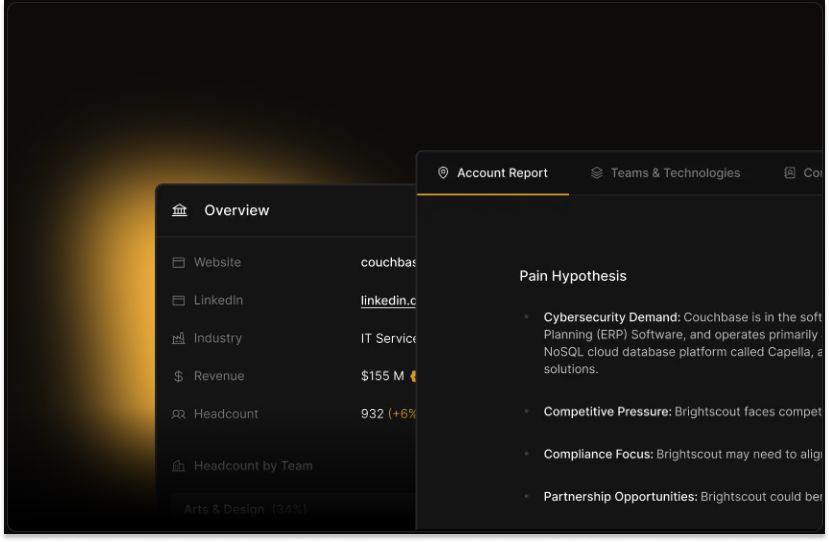

Today, in other words, AI is a means, not an end. A capability, not an aspiration. Rox’s approach, as Ishan described it, is to “build whatever you need to build to get companies to feed your system of record.” Instead of promising agents that will sell for you, they build agents that will help you sell. Instead of helping sellers go after new customers, Rox helps them “go after the most unglamorous piece – their existing customers.” This, Ishan tells me, is who “80-90% of revenue comes from.” It’s also who companies have the most data on. And it’s the group of companies worst-served by existing systems, which are focused on contract-based versus consumption-based sales. This approach addresses the two big concerns I’ve had about AI application companies, turns them into advantages, even. “First, revenue is easy but potentially not sticky, something I wrote about as far back as May 2023 in Small Applications, Growing Protocols.” In Rox’s case, AI support agents are the small applications, and the data and workflows are the company’s own “protocol” which gets more valuable with time, integrations, and more applications from Rox itself. Like a protocol, it is open – companies will build on Rox if it’s the best place to build, and leave and take their data with them if it isn’t. “Second, there is so much uncertainty about how models will improve – that things are moving so fast – that it feels like a leap of faith to bet on any one application now. There are dozens, if not hundreds, of GTM AIs in the market today,” including well-funded ones like 11x. Proving value early and often, incrementally at first, is a way to manufacture increasing returns and path dependence. Small early wins at high velocity compound. Overpromising and underdelivering does not. So what does Rox promise, and do, today? Rox’s Current CapabilitiesRox’s product today is straightforward: agents assigned to each of a seller’s accounts collect and monitor internal and external data and surface the most relevant bits to the seller. Typically, I would explain exactly what and how the product does, but I think Rox’s launch video does a really good job, so I’d encourage you to watch it.  Rox doesn’t promise the moon, but it does what it promises. Kiran Nagra, Ramp’s Sales Leader for Account Management, says in the video: “If they say, ‘Our product is going to do X,’ I open the platform and it already does X.” Promise that agents will help do a limited number of things, and then deliver on that promise. For now, those are straightforward but hard-to-build-well features like tracking relevant information about customers, adding it to their profile, and making suggestions to include the most relevant in an upcoming call. That last piece – the upcoming call – requires that sellers integrate their calendars. If Rox is useful enough pre-calendar integration, if it does what it says, then sellers are more likely to add their calendars, to see what else it can do. Next, says Ishan, comes “email, Salesforce, Slack, support tickets, then the full data warehouse.” If each makes sellers more effective, and saves them time, then they’ll add the next. "The hardcore engineering," he said, "lies in connecting all of that into one real-time system of record." You can read the Docs if you want to learn how they do it. There are other product features, too, each of which feeds Rox with data. It can record calls and add them to your account, which is table stakes – a tool that exists in many point solutions – but more valuable as part of a system of record. Using OpenAI’s voice APIs, sellers can talk directly to Rox, to ask it questions or get briefed on the day ahead. Even that, also becoming table stakes, is a way for Rox’s models to learn how sellers think in order to, eventually, build better and better sales agents. For all of this to work, to grow to those future aspirations from current capabilities, Rox has to deliver. Currently, that looks like saving sellers 8+ hours per week, delivering a 35% increase in customer engagement via more targeted messaging, and that 2x ROI on Rox spend that the company promises to deliver. Max at Ramp told me that Rox’s ability to deliver what it promised stood out. “The market of GTM AI has become so saturated with nonsense, but Rox is really legit” he said. “We’ve got 66 sellers in Rox. Their feedback has been overwhelmingly positive. It’s truly given us an edge in making our sellers operate more efficiently without doing more mundane tasks.” As one example, he said that a seller on the large accounts team was preparing for an onsite with a big customer the next day. He clicked on the account in Rox and saw that KKR had just invested in the company, and that the company had hired a new CRO. Two insights: ownership transition (with a potential connection) and leadership change. Those are the types of things sellers need to know. The types of things that would have taken 15-25 minutes to learn before that take a second with Rox. “It tripped me out, honestly,” Max said. A great seller would not have gone into the onsite without knowing those things. He would have figured it out on his own. But those extra 15-25 minutes not doing manual grunt work are 15-25 more minutes he can spend doing things that only a great seller can do, like talking to customers. “Ramp is a high intensity, high volume, high velocity shop,” he said. “If you’re on eight to ten calls a day, this gives you the ability to have a point of view or hypothesis before entering every call.” Rox chose to work with companies like Ramp – high intensity, high volume, high velocity shops – because those are the ones for whom the product is most immediately valuable. As Rox says on its website and in its launch video, it exists to make the best better. That applies to both companies and sellers within those companies. The Rise of the BestAnother important piece of ensuring that your ambitions match your capabilities, and to making your own luck, is to be targeted in your use of limited resources. Broadly speaking, Rox could have pursued three categories of customers:

Today’s Largest Companies don’t make sense for some of the reasons we’ve already discussed. They’re probably not building their own products on top of the data warehouse, may not have the urgency of a smaller company, and are likely to die with their Salesforce boots on. The third approach - Small Startups – is almost the default for startups thanks to Stripe’s success getting in with developers early and growing with them. That that approach worked for Stripe, though, was due to a much more specific reason than most people realize: SMBs were a perfect first customer because, with lower spend volumes, they weren’t as sensitive to take rates as Adyen’s larger customers, which meant Stripe has always had a higher average take rate. In Rox’s case, small companies aren’t the right target: they probably don’t have a real sales org yet, nor do they yet have the best salespeople. “You want to raise the ceiling of what someone incredible can do versus raise the floor on what a shitty salesperson at a small company can do,” as one person colorfully put it. Instead of taking Stripe’s approach, Rox is targeting companies like Stripe itself: tech-forward enterprises with enough scale that Rox matters. Smaller organizations can, in the famous words of YCombinator, “Do things that don’t scale.” Scaling companies definitionally need to do things that can. “We have deep founder-market fit in businesses at scale,” Ishan explained, “businesses doing $100M or even $1 billion in revenue. We want to become essential, which happens at a certain number of reps and revenue.” Ishan calls their approach selling to these companies “Palantir-style”: “We want to help business owners when they’re in extreme pain or when there’s extreme priority.” In the beginning, like Palantir, that also means getting to work closely with the best people at the best companies to develop the product, another benefit to the focus on the best. Kiran at Ramp said that Rox co-founder Diogo Ribeiro has been building alongside her since Ramp started using Rox. “He’s flying out to NYC for the team’s offsite next week,” she said. “He already did that once a month ago.” If the long game is to collect the data – not just the moment in time data, but an ongoing understanding of the way that the best sellers think and operate – in order to train better models for revenue teams, there’s no substitute for working with the best. Gold in, gold out. The other half of working with the best is working with and for the best sellers inside the best companies. Speaking with Ishan, Kiran, Max, and others around the company it was hard not to get the sense that AI tools – Rox specifically, but more generally, too – will 1000x the capabilities of the top people and replace mediocre ones. Max put it bluntly:

Kiran agreed. Her SMB AE team is now responsible for both onboarding customers and managing the relationship over the long-term, a double job that she says is “now possible because of tools like Rox.” To measure the ROI of Rox, she began piloting it with a few reps on her team, and “started to see ROI from those reps, so I piloted giving them larger books, then I piloted the new double role using Rox.” Not only did it work, “My reps were asking me, ‘How early are these guys? Can I invest?’” If reps are more efficient with Rox – can spend more time building relationships with and educating customers – she can increase their book size, which means more money for them. Once there’s enough proof that it’s really working, “I can hire 6 fewer people than the 18 I have earmarked.” More money for the best sellers. More profitability for Ramp. And the ineffable speed that comes from maintaining a small, high-performing team instead of hiring more and more people who each do a little bit less than the last one. I think this is a preview of the world to come: the best will get better, the rest will need to find something that they’re better at doing. This is not a value judgment – that’s obviously disruptive to many people – but it feels clear that this is how things are going to be. AI won’t take your job. The best people using AI will obviate the need for it. Strategy vs. Execution“The best people” is a theme you hear over and over again when talking to Rox: both in terms of their customers and their employees. Small teams of talented people move fast, and speed wins. The other thing I thought when I read Increasing Returns and Path Dependence in the Economy is, “This is the technical explanation for the advice to build and iterate fast.” In other words, given a shared starting point, the company that is able to try more things more quickly and get to the better solution faster should increase its chances of becoming the winner. Speed creates more surface area for luck. Step 1: set the right strategy. Step 2: execute violently against it. It’s messier than that, of course, because Step 2 informs Step 1 in a never-ending loop. But roughly, that’s the formula for success. We’ve talked a lot about Rox’s strategy so far, but what also stood out in my conversations is how this team executes. There are the metrics: already, less than a year old, 95% of which was spent in stealth, the company has blown past the $1 million ARR mark. Its customer list is full of discerning customers including Ramp, OpenAI, MongoDB, NVIDIA, Databricks, Coreweave, Confluent, and Ishan’s old company, New Relic. All of that came before the company launched, which it did last week via announcements, through which Rox and others did the talking, and an open beta, through which the product has been able to speak for itself. Letting anyone sign up and test a product like Rox’s this early is, as Jonathan Haas put, “the strongest endorsement of their confidence in this product as anything,” because it means fully exposing the product to the public instead of a small group of partners, putting a ton of load on Rox’s infrastructure, and incurring big inference bills with no guarantee companies will convert. Since launching, Rox has onboarded over 1,000 companies into their public beta. But the metrics never do justice to the je ne sais quoi that you get from a company that just ships really fast against a really high quality bar. Rox has the je ne sais quoi. Every time I interview people for a deep dive, I ask, “If you read this piece and it’s missing X, you’ll be like ‘Man, he missed the point.’ What’s X?” Kiran said that two things stick out with Rox: Empathy - deeply understanding customer needs – and Speed of Execution. “A lot of people are trying to fix the same problems,” she said. “Being first doesn’t always matter. Velocity and speed of execution can overcome that.” I swear I didn’t tell her about the Path Dependence thesis. “Seeing someone shipping at that velocity Ramp did, interacting in the same way Ramp did with customers,” she added. “It’s Ramp’s playbook.” The playbook is actually fairly simple, if hard to execute: get insanely smart people who work obsessively hard on a hard problem in a big market pointed in the right direction for the future. Ishan credits the small size and high caliber of the team with the company’s velocity. He buckets the 14-person team into three categories (all engineers, for now, to sell without a large sales team, Rox’s founder use Rox):

There are echoes of Ramp here, too – the international intelligence gold medalists, AI savants, and former and future founders. More than pedigree, though, there’s something about a small team of people at the top of their game executing rapidly and responsively with customers that’s hard to describe but obvious to observe. Rox has it. That kind of team is insanely productive. It’s the kind of team that Rox is today, and wants to help more of the best companies become and remain in the future. The Future of the Free MarketI knew I liked Ishan pretty quickly once I started talking to him, but I really knew when he described himself as an “owner/operator/capitalist,” and said this: “My life is about driving productivity in the free market.” He had, he told me, “a visceral understanding of the impact of technology on humans.” When New Relic acquired his startup, Pixie, he ran product before realizing that if he wanted to change the company’s fortunes, he’d have to change how it sold. He became Chief Revenue Officer. When he took over, the company was doing $800 million in subscription revenue. But he saw the writing on the wall for subscription-based businesses, so he drove that business to zero while building up a $1 billion consumption-based business, as a public company, during COVID. As part of the transformation, he took his team from 1,600 people to 600 people… and grew sales by 30%. He earned a lesson: “There are a lot of folks who unfortunately need to be reskilled or are not critical. You can make the best quota-carrying people more productive, and then employ fewer people.” Harsh truth, but if your goal is to drive productivity in the free market, an important one. The Acquired guys are fond of saying that “companies are just founders extended… It’s very hard for me to point to a truly great company where the DNA isn’t like a lever on the founder’s personality.” While it’s early in Rox’s journey, it’s clear that Rox is Ishan extended, and Rox is a leveraged way for Ishan to drive productivity in the free market. So understanding Ishan’s vision is instructive in determining what the future might look like if Rox succeeds. To that end, there’s another 40% stat that I’ve been saving. When we first spoke, Ishan pointed out that “40% of business spend is GTM.” It is a huge chunk of the global economy. Rhetorically, he asked, “Can they be 5-10% more efficient? Can we return 5-10% savings to the CEO and the CEO.” Confidently, he answered, “I’ve done that, twice, at scale, without a fully built-out system like Rox.” With Rox, he thinks, the efficiency gains will be more dramatic. Smaller teams, more revenue, higher margins. Grunt work: eliminated. Human touch: elevated. This is where I started asking him questions like, “What are we all going to do with ourselves in the future?” And, “Will all sales just be bot-to-bot.” Some of it will be, he thinks, but there will be human winners, those with the “creative force.” “Most businesses have a few people coming up with change and driving it,” he says. “They will get more and more empowered.” Within revenue teams specifically, he plans to drive this empowerment with Rox. As we’ve discussed, the proximate goal right now, while AI isn’t that good yet, is just to earn the data and integrations, to become the system of record. Over the next year, he wants to save sellers 20 to 30 hours every week while making them 50% more effective. But that’s not the ultimate goal. The ultimate goal is to use that data to train models on what and how the best companies at the best sellers sell in order to deliver full automation, when the time is right, for the things that the best humans don’t need to do so that they have the tools and resources to amplify what they do best. The models aren’t there yet, but they’ll get there. Everything other than building relationships and educating customers – the non-human stuff – will mostly be delivered by agents. The opportunity for Rox is building the best team and best product with tech-forward customers to own the application layer for this as underlying models get good enough to fulfill the grand promises companies are making about their capabilities today. This is another update to my mental model of AI: even as the foundation models themselves get smarter, there’s reason to believe that there will be a ton of value in the application layer. Intelligence doesn’t equal usefulness. Here’s a thought exercise that one of Rox’s investors put to me:

Even in my first conversation with Ishan, I was convinced Rox had what it takes to win, that by playing the long game, it could build the data and workflows to make AI useful to sellers. That’s why I kept asking if he had a hard stop, so I could flood him with questions about the future he saw so clearly, the one that he’s working to bring about. One category of questions was, essentially, if everyone uses Rox, is there any alpha in Rox? If every company had access to really smart, really useful sales agents, wouldn’t the advantage disappear? Wouldn’t the customers just get hit with the same perfectly targeted messages at the same perfect time? Wouldn’t customers just be overwhelmed with equally good messages and ignore all of them? Would all sales just be bots selling to bots based on product specs? Wouldn’t developer agents working with sales agents just build solutions tailored to those specs? What are us humans going to do with ourselves when the AI takes our jobs? Pulling me out of my existential tailspin, Ishan told me he believes that there will inevitably be winners and losers. “The alpha will be an arbitrage on information: what information you have about your customers and how proactive you are in using it,” he explained. Information is half the battle – the best companies will have more and better customers, so they’ll have more and better information, and their advantage will compound. The other half is what you do with it. For that, the human element remains. “Non-killers are going to go away,” he predicts, “and killers are going to be supercharged. It’s the same with companies: I do believe that there is a class of companies that will not survive.” What will those companies look like? “You need to judge by the person driving the bus.” The world in which Rox succeeds is not a world in which humans disappear. It is a world in which humans are amplified, for better or worse. Rox will succeed because Ishan and the small, exceptional team he’s built will wield agents to amplify their human strengths. The Acquired framing is useful here: companies are just founders extended. Great companies are force multipliers on their founders’ vision and capabilities. With tools like Rox, everyone will be extended. Agents will be force multipliers on your vision and capabilities. What became clear to me early in my conversations with Ishan is that Rox is a master class in Applied AI strategy: how to manufacture path dependence by taking the long view and matching current capabilities to future aspirations. What’s become clear to me writing this piece is that those same lessons might apply to people, too. A world full of highly capable agents is coming. The best will get better. But you know it’s coming. You can make your own luck if you take the long view and double-down on your unique capabilities today in anticipation of their future amplification. Pretty heady stuff for a piece on boring CRM software! Thanks to Claude for editing and to Ishan, Eric, Max, Kiran, and everyone else who shared their insights for this piece! That’s all for today. Have a great Thanksgiving. We’ll be back in your inbox with a Weekly Dose on Friday. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #121

Friday, November 22, 2024

Starship 6, Milei, Mechanical Qubit, Muscarinic Receptors, Gensler ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[untitled]

Tuesday, November 19, 2024

remixing music creation ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #120

Friday, November 15, 2024

Nuclear Plans, Nanotechnology, Evo, AlphaFold 3, Crowdsourced Networks, CRISPR Tomatoes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Trump Bubble

Friday, November 15, 2024

Fixing the machine that builds the machines that builds the machines ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Dose of Optimism #119

Friday, November 8, 2024

Trump Whale, Underwater Drones, Endometriosis, EDIT-B, Sugar Study, Identity Politics, Jupiter ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Are secondaries a liquidity mirage?

Saturday, March 29, 2025

Also: The impact of China's $138B high-tech fund; How is PE navigating 2025?; Real estate returns are improving. but fundraising has been harder... Read online | Don't want to receive these

'Lean Into Your Heart: Let Your Passion Drive You'

Saturday, March 29, 2025

We spoke with award-winning producer and director Mike Tollin about his Philly roots, the leadership shift between producing and directing, the values that guide his life, and what truly makes for

2.5x more sales without acquiring new users

Saturday, March 29, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

Winners and Losers?

Friday, March 28, 2025

The dust has (mostly) settled. Google's March 2025 Core Update is officially complete ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Sam Altman Says Your Silly Image Editing Is Melting Its GPUs

Friday, March 28, 2025

You're an Amazon whiz... but maybe not an email whiz. Omnisend makes setting up email for your brand as easy as click, drag, and drop. Make email marketing easy. Hey Reader, First, our prayers and

A Tale of Two Crypto Markets

Friday, March 28, 2025

Calmer Seas Are Ahead

Google's AI - Your "travel agent"

Friday, March 28, 2025

It's booking vacations and paying your bills.

Disruptive Marketing Tactics, Instagram Measurement, Meta Ads Branding Controls, and More

Friday, March 28, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo The weekend is almost here, Reader! Before you unplug, here's one last round

Q&A: How startups should sell AI

Friday, March 28, 2025

VC secondaries home in on trendy startups; real estate funds hit 22 months to close; taking PE's pulse Read online | Don't want to receive these emails? Manage your subscription. Log in The

Influence Weekly #382 - This Is What A $300 Million TikTok Strategy Looks Like

Friday, March 28, 2025

E-Commerce Veteran Shares Key Insights After Spending $10M On Influencer Marketing Campaigns