European Crypto ETPs are becoming popular

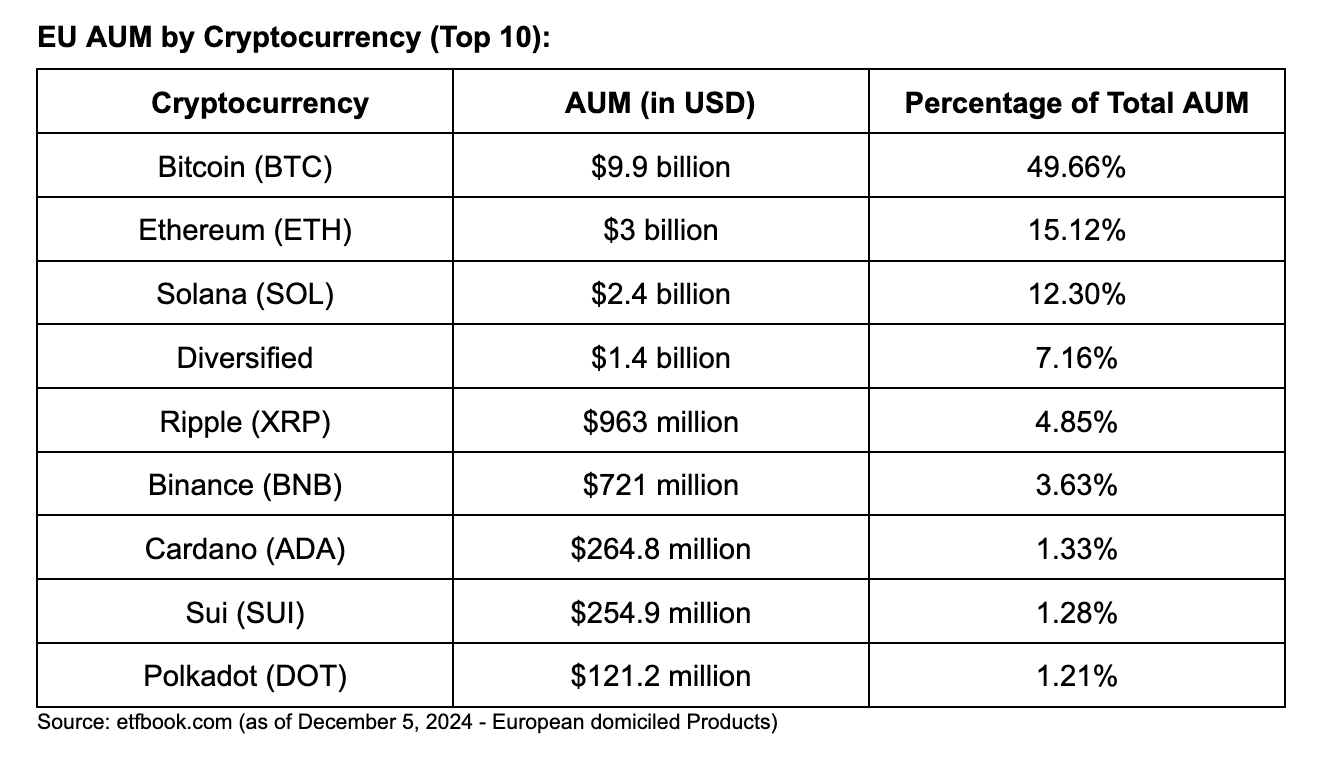

To investors, Crypto is an international sport. People around the world want to allocate to digital assets. They buy spot bitcoin and crypto assets on crypto-native exchanges. They buy US-based public equities related to the industry. They buy US-based ETFs. And they buy internationally listed ETPs that give them exposure to crypto assets. This last point—the internationally listed ETPs—is an area that gets very little coverage so I asked the team at DeFi Technologies to put together a guest post on the state of crypto ETPs outside the United States. Here is what they said: The Rise of Crypto ETPs in EuropeWhile ETFs in the U.S. often dominate discussions—especially following the landmark introduction of Bitcoin ETFs earlier this year—Europe has quietly built a decade-long lead in digital asset exchange-traded products (ETPs). In 2015, Johan Wattenström’s XBT Provider launched the world’s first Bitcoin ETP on Nasdaq Stockholm (later acquired by CoinShares), creating a regulated pathway for investors to gain Bitcoin exposure through traditional financial markets. By listing on Nasdaq Stockholm, Sweden set a precedent for integrating digital assets into traditional markets, emphasizing compliance, full collateralization, and transparent custody solutions. Over the years, the regulatory landscape for crypto ETPs in Europe has continued to mature. The upcoming Markets in Crypto-Assets (MiCA) Regulation, set to take full effect in 2025, promises a harmonized framework for digital asset issuers across all EU member states. MiCA ensures enhanced investor protection, institutional clarity, and a unified market, further cementing Europe’s leadership in digital asset ETPs. A Market Driven by Diversity and Innovation Today, European issuers such as Valour, CoinShares, and 21Shares provide access to a broad spectrum of digital assets through regulated products listed on traditional stock exchanges. These include not only Bitcoin and Ethereum but also altcoins, staking-enabled ETPs, and even large-cap memecoins. This diversity reflects Europe’s commitment to addressing the needs of an increasingly sophisticated crypto investor base. Bitcoin accounts for $1.97 trillion of the $3.66 trillion global crypto market cap, but the remaining $1.69 trillion highlights significant opportunities for regulated altcoin investments. This potential is reflected in Europe’s crypto ETP landscape, where Bitcoin ETPs hold 49.66% of total AUM, leaving considerable room for growth in altcoin-focused products. Investor interest is particularly strong in alternatives like Ethereum, Solana, and diversified crypto baskets. Notably, Valour’s Solana ETP has surpassed $400 million in AUM, while newer products like SUI and DOGE ETPs have gained traction, nearing a combined $40 million in AUM in Sweden alone in less than two months since their listing. The introduction of staking-enabled ETPs has further driven growth, enabling investors to earn staking rewards while holding regulated products within traditional brokerage accounts. Breaking Down the Numbers Total Market Snapshot:

$695.75 million: Net inflows over the past six months, indicating steady growth and increased investor interest. Insights from the Data

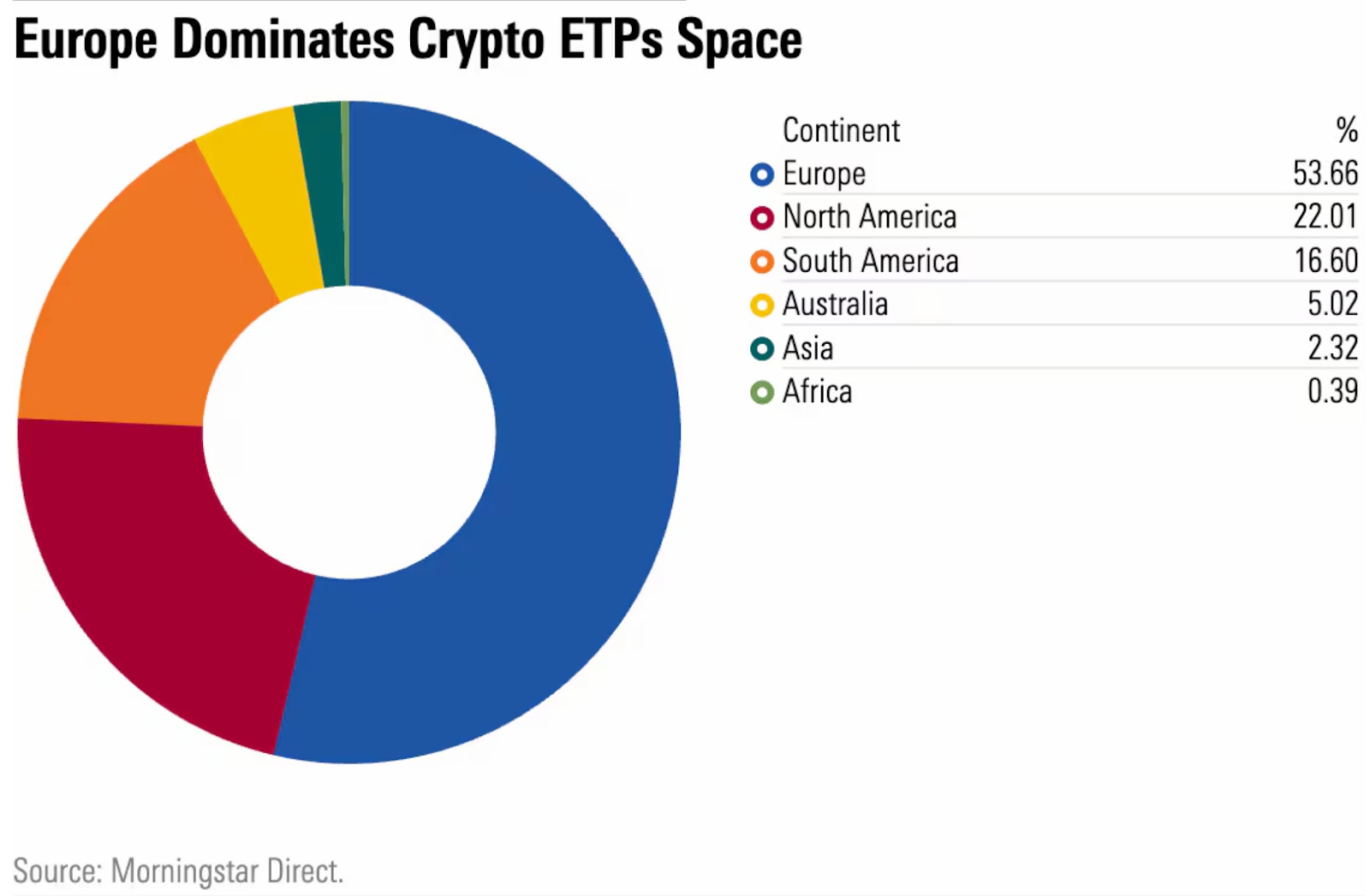

Key Trends Shaping the MarketMarket Share: Over 50% of global crypto ETPs are listed on European exchanges highlighting the region’s pioneering role in regulated digital asset investments according to Morningstar. Diverse Offerings: European issuers have launched products tied not only to Bitcoin and Ethereum but also to altcoins, DeFi indices, and even memecoins such as Doge. Europe has cemented its position as a leader in the global crypto ETP space by offering a diverse range of digital assets tailored to institutional and retail investors. The combination of regulatory clarity, market innovation, and sustained growth signals a bright future for crypto ETPs in the region. With the implementation of MiCA on the horizon, Europe is poised to expand its influence further and set the standard for regulated digital asset investment products worldwide. I hope you enjoyed this guest post from Curtis Schlaufman, VP of Marketing & Communications, and Rafael Recavarren, Head of Corporate Development, at DeFi Technologies (OTC: DEFTF, CBOE CA: DEFI), which owns the asset mangement firm Valour. At Valour, they are excited to be a key player in the European market alongside several other great peers. Today, they have made a significant stride by launching 20 new products—our largest single-day rollout yet. These offerings include projects like Sei, World Chain, Render, Aerodrome Finance, and THORchain, reflecting their dedication to innovation and digital asset ETP market expansion. Hope everyone has a great day. I’ll talk to you tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Anthony & Polina Pompliano Discuss Bitcoin, Microstrategy, the national vibe shift, and Daniel Penny Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss Microstrategy owning 2% of all bitcoin supply, Daniel Penny case, UnitedHealthcare CEO shooting, the vibe shift happening in America, politics, and asset prices. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Does Microstrategy Own Too Much Bitcoin?

Tuesday, December 10, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

These Two Companies Show Creative Dealmaking Is Coming To The Market

Tuesday, December 10, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Tuesday, December 10, 2024

Open this on your phone and click the button below: Add to podcast app

Bitcoin Hits $100,000 But There Is Lots Of Work To Do

Tuesday, December 10, 2024

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Announcing Bitcoin Investor Week!

Tuesday, December 10, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏