The Pomp Letter - Bitcoin Is The New S&P 500

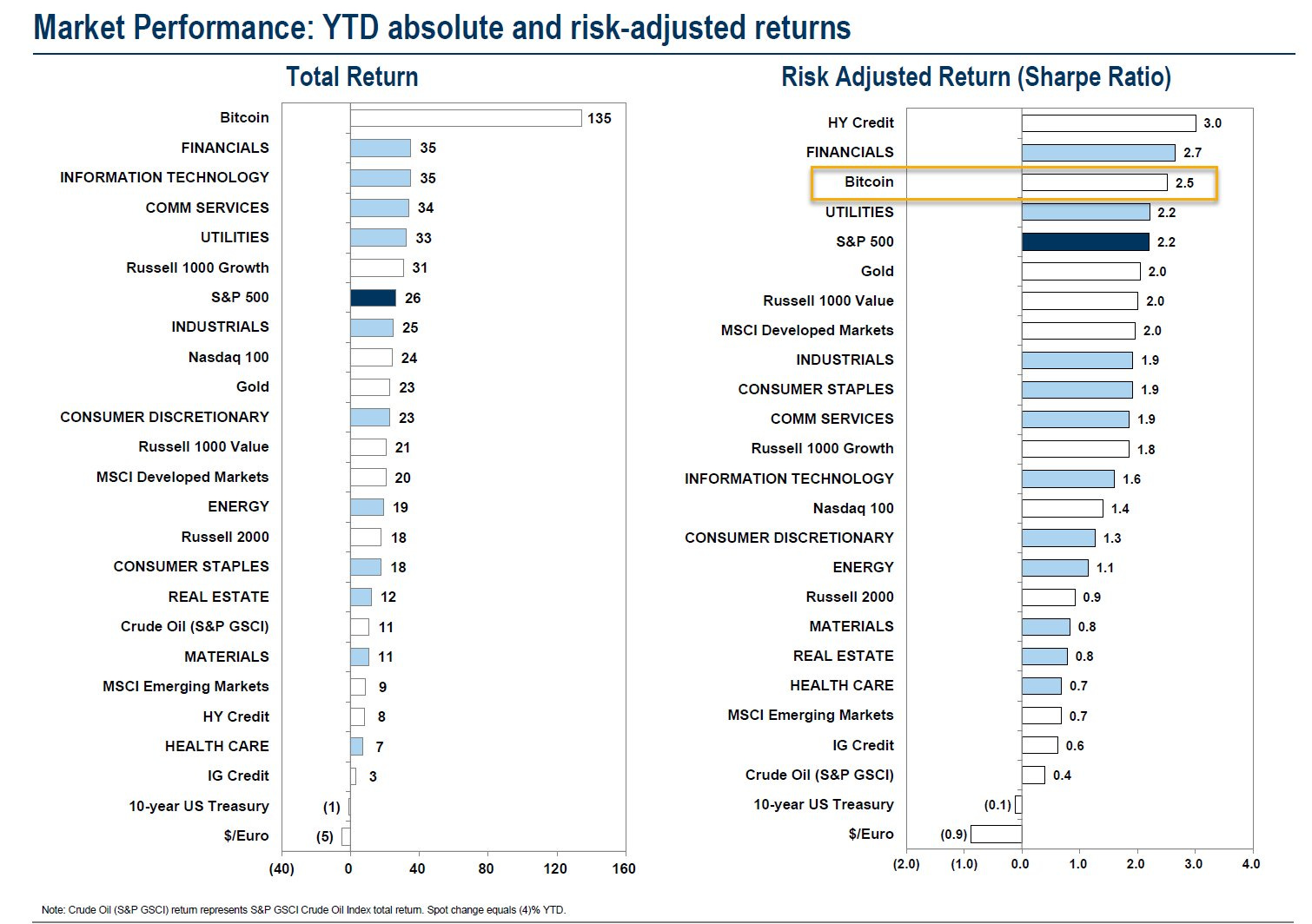

To investors, The S&P 500 has been the standard measurement of “the market” for decades. Most hedge fund investors benchmark their performance against the index and media outlets reference the index price movements as a signal for market sentiment. This has been happening since 1957 when Standard & Poor’s expanded their index to include the current structure — a market capitalization weighted index of the 500 largest stocks. Over time this index has become the measurement stick, so lets take a look at how hedge funds did in 2024. Bloomberg’s Nishant Kumar assembled a list of select hedge funds and their performance last year: The list is not comprehensive — Robert Citrone’s Discovery posted a 52% increase in 2024 — but this list gives us a good barometer for how the hedge fund industry has stacked up. Simply, it was a good year for hedge funds but many of them failed to best the index. Warren Buffett and Berkshire Hathaway were in a different spot. Berkshire returned 25.5% compared to the S&P’s 23.3% return, which marks an important milestone for the value investor — outperforming the index gives Berkshire shareholders hope their capital is better positioned than in the main index. But beating the S&P 500 index last year may not be as notable as people want you to believe. For example, gold outperformed the S&P 500 index as well. This signals to me that the “real return” of the stock market may not be what investors think it is. Gold, a precious metal with no earnings, should only be increasing in value due to investor interest in protecting their economic value from inflation, debasement, and economic chaos. So if gold is outperforming the S&P 500, it begs the question “how much of the S&P return is attributable to monetary debasement?” We will never get the perfect answer, but it isn’t hard to see that a larger percentage of the return is from debasement than people like to admit. If investors are not outperforming the main index, then they are definitely losing economic value when measured against an asset like gold which can’t be intentionally debased. This brings me to bitcoin. The digital asset is gold on steroids. It has all of the same sound money principles, but it also boasts a finite supply. This helped bitcoin produce a ~ 120% return in 2024. Safe to say that bitcoin destroyed the S&P 500, Berkshire Hathaway, and gold. On top of the outperformance, bitcoin also has a higher sharpe ratio than stocks or gold. So here is my proposal — bitcoin should replace the S&P 500 in every investors mind as the true benchmark for their returns. You don’t need to spend millions of dollars per year employing hedge fund employees to get the bitcoin return. You can simply buy the asset and hold it. It is simple market exposure. And bitcoin has now become one of the most important financial assets. For example, I was recently talking to the CIO of a well known macro fund and he told me that the first thing the team checks in their process is global liquidity and the second thing is bitcoin’s price. Bitcoin is THE macro asset in the world. It is most sensitive to global liquidity. It is accessible by anyone in the world with an internet connection. And bitcoin is the only large asset that trades 24/7/365 with deep liquidity. Bitcoin is the new S&P 500. The older generations may find this idea perplexing. It may even anger them to read it. But the truth is that bitcoin has already replaced the S&P 500 as the benchmark performance indicator for the younger generation. They have grown up with bitcoin. They all recognize it as the apex predator of financial markets. If you can’t beat bitcoin, then you should just buy bitcoin. And my guess is that bitcoin is going to replace the S&P 500 as a benchmark for traditional investors over time as well. It will have to start with LPs because fund managers are not incentivized to adopt a benchmark that is nearly impossible for them to beat. Bitcoin has been growing at a 80% compound annual growth rate for the last decade. Over the last 5 years, the asset has compounded at 67% annually. I don’t think many hedge funds can claim similar performance over time. Regardless of whether you use bitcoin as your benchmark or not, this is where the world is headed in my opinion. You are better off using the new metric in your analysis — it will force you to think more clearly and become a better investor. I have written about this before. I will continue to hammer the point home. You must change your point of reference. Most people think of the “bitcoin standard” as a hyperbitcoinization. Maybe that happens or maybe it doesn’t. But I do know that bitcoin is becoming the standard on which all investments must be measured against. Hope you all have a great end to your week. I’ll talk to you on Monday. -Anthony Pompliano Founder & CEO, Professional Capital Management Jordi Visser Highlights How Bitcoin & Artificial Intelligence Are Accelerating Together Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we discuss important themes of investing for the next decade, all the value that is flowing into the digital world, bitcoin, artificial intelligence, traditional economy, national debt, and more. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Bitcoin Metric Overview To Start 2025

Thursday, January 2, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My Top 10 Books From 2024

Wednesday, January 1, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Message from Anthony Pompliano 🙏🏼

Tuesday, December 31, 2024

Hey - thank you for being a free subscriber to The Pomp Letter. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Can We Mine Bitcoin In Space With Solar Panels?

Monday, December 23, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Should You Be Worried About The Bitcoin Price Crash?

Friday, December 20, 2024

READER NOTE: On Monday, 12/30, I am hosting a free webinar for anyone trying to transition into a new job in the bitcoin and crypto industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Sunday Thinking ― 1.5.25

Sunday, January 5, 2025

"You don't have to be perfect to help people. All you do is have to be real."

TA #178: ✅ ❌ What's In, What's Out in 2025

Sunday, January 5, 2025

[Ann's version] Click here to read this on the web. Ann Handley's biweekly/fortnightly newsletter, "Total Annarchy" What's in, what's out: Ann's list Welcome to Issue 178

New year, new PE?

Sunday, January 5, 2025

Plus: Sourcing deals amid the AI rush & more Read online | Don't want to receive these emails? Manage your subscription. Log in The Weekend Pitch January 5, 2025 The Daily Pitch is powered by

Brain Food: Stick to the Basics

Sunday, January 5, 2025

Wisdom is prevention ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🔮 What's Next For AI in 2025?

Sunday, January 5, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Recruiting Brainfood - Issue 430

Sunday, January 5, 2025

Global Economic Outlook 2025, 5 Hiring Trends TA has got to know, Google's Whitepaper on Generative AI Agents and one amazing industry acronym to know...SEOaLLM ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When is $9 better than $9.89?

Sunday, January 5, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack When is $9 better than $9.89? If your purchase is based on emotion, then leave out the cents.

How to Convey Madness

Saturday, January 4, 2025

Since the early 20th century, writing has become simpler. More direct. But Edgar Allan Poe shows how a paragraph about madness should feel MAD.

Guest Post: AI in 2025: A Combinatorial Explosion of Possibilities, but NOT AGI

Saturday, January 4, 2025

opinion paper

What are 7-figure skills?

Saturday, January 4, 2025

Make $30000/month without any guesswork