DeFi & L1L2 Weekly — 🧪 Pump.fun is reportedly testing its own AMM. The SEC approved the first yield-bearing stabl…

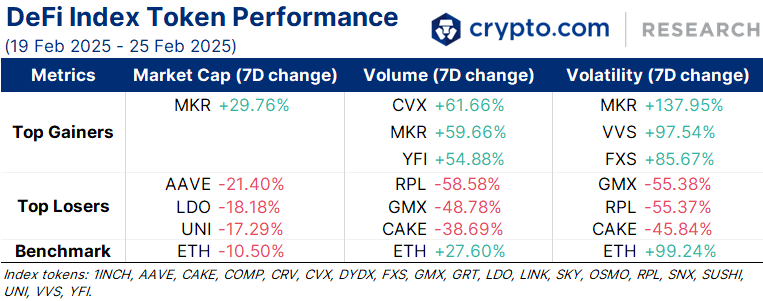

DeFi & L1L2 Weekly — 🧪 Pump.fun is reportedly testing its own AMM. The SEC approved the first yield-bearing stablecoin, YLDSPump.fun is reportedly testing its own AMM; the SEC approved the first yield-bearing stablecoin, YLDS; the Ethereum Foundation launched the Open Intents Framework.Weekly DeFi IndexThis week, the market capitalisation index dropped by -13.97%, while the volume and volatility indices increased by +6.49% and +1.54%, respectively.

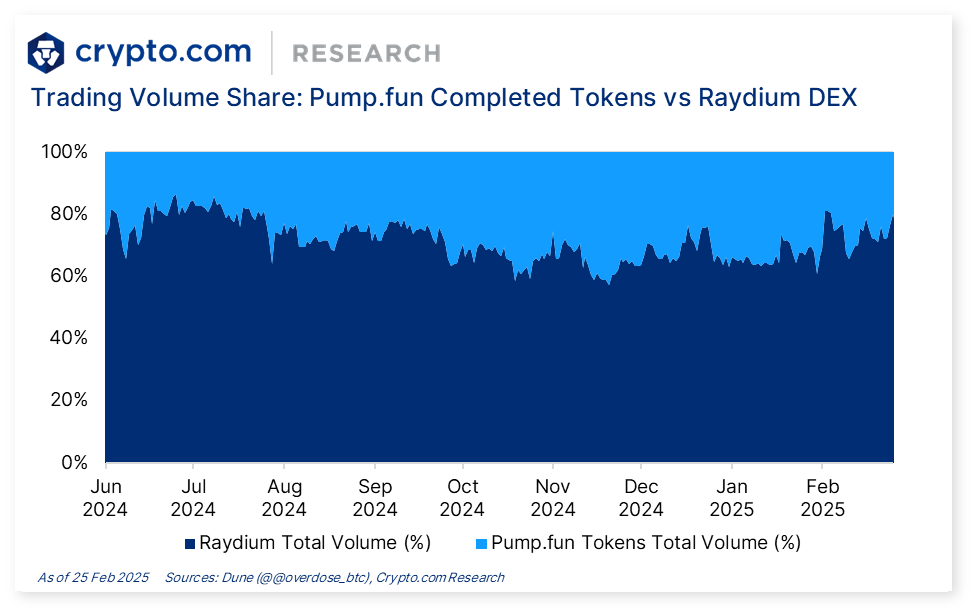

Chart of the WeekSolana meme coin launchpad Pump.fun is reportedly testing its own automated market maker (AMM), which would enable users to trade tokens directly on the platform. The move would allow Pump.fun to collect additional trading fees and offer more incentives, but it risks disrupting Pump.fun’s partnership with Raydium since meme coins from the former account for around 20% of Raydium’s total trading volume. Raydium's RAY token dipped around 40% in response to the news. News Highlights

Recent Research Reports

Interested to know more? Access exclusive reports by signing up as a Private member, joining our Crypto.com Exchange VIP Programme, or collecting a Loaded Lions NFT. Recent University Article

AuthorResearch and Insights Team DisclaimerThe information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report, nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.The brands and the logos appearing in this report are registered trademarks of their respective owners.We’re all ears.Your feedback has always helped us provide insightful crypto market trends. Tell us how we can improve this newsletter further by taking a quick survey below (it will only take less than a minute). Thank you! Thank you for reading! We hope you find our Weekly DeFi and Layer 1 & Layer 2 News Update enlightening! Hungry for more? Visit our Research Hub and University to access other insightful crypto research! Share with a friend if you like our email! Thanks for reading Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming! Subscribe for free to receive new posts and support my work. Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming is free today. But if you enjoyed this post, you can tell Crypto Trends from Crypto.com: Market, DeFi, NFT, Gaming that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Weekly active addresses on L2s were 5x higher than on Ethereum; Ethena plans to launch iUS…

Wednesday, January 8, 2025

Weekly active addresses on L2s were 5x higher than on Ethereum. Ethena plans to launch iUSDe for financial institutions in February. Solayer launched the Solayer Foundation and LAYER governance token ͏

📈 US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed…

Monday, January 6, 2025

US spot BTC and ETH ETFs saw a $35 billion and $2.7 billion net inflow in 2024, respectively; Crypto.com signed an MoU with Dubai Islamic Bank; Crypto.com launched Crypto.com Custody Trust Company ͏ ͏

You Might Also Like

Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Thursday, February 27, 2025

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📉 Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation alloc…

Thursday, February 27, 2025

Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation allocated 45000 ETH to DeFi protocols. Standard Chartered established a JV to issue a HKD-backed stablecoin ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📉 Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation alloc…

Thursday, February 27, 2025

Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation allocated 45000 ETH to DeFi protocols. Standard Chartered established a JV to issue a HKD-backed stablecoin. ͏ ͏ ͏ ͏

XRP investors buoyed by Donald Trump’s Ripple posts and SEC’s ETF acknowledgment

Thursday, February 27, 2025

As Trump's posts stir optimism, SEC's acknowledgment of XRP ETFs heightens anticipation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

USDT/USDC Prepaid Card’s Popularity Is Soaring – FinTax Reminds You to Be Aware of Related Risks

Thursday, February 27, 2025

In recent years, with the rapid development of the cryptocurrency market and digital payment technologies, several exchanges and wallet service providers have launched their own USDT/USDC prepaid card

SEC replaces Crypto Assets Unit with Cyber and Emerging Technologies Unit

Thursday, February 27, 2025

Laura D'Allaird leads the SEC's new unit to combat AI-driven fraud and bolster cybersecurity compliance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions will launch its LION token on 27 Feb; Yuga Labs sold its IP rights of the Meebits N…

Thursday, February 27, 2025

Loaded Lions will launch its LION token on 27 Feb on the Cronos EVM chain. Yuga Labs sold its IP rights of the Meebits NFT collection. Doodles plans to launch a new token, DOOD, on Solana. ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: Hong Kong Recognizes BTC and ETH for Investment Immigration, SEC Discusses Staking, Argentina…

Thursday, February 27, 2025

According to the statistics of SoSovalue, as of Thursday, twenty state-level administrative regions across the United States have initiated relevant legislative procedures. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin surges to $99K as Coinbase defeats Gensler’s SEC lawsuit pending Commission approval

Thursday, February 27, 2025

Coinbase's settlement with SEC sets precedent in crypto regulation, sparking debate and potential legislative clarification. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: USDe Faces Largest Single-Day Redemption, SEC Concludes Investigation into OpenSea, and Bi…

Thursday, February 27, 2025

Since the implementation of the new priority fee allocation mechanism on February 12th, Solana's annualized inflation rate has increased by 30.5%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏