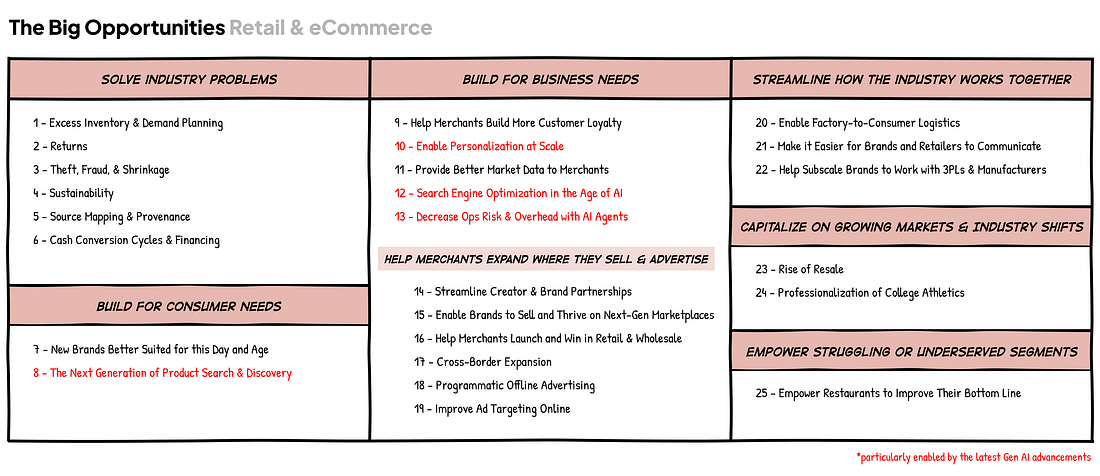

One of the primary goals of this newsletter is to spotlight some of the big opportunity areas emerging across markets.

Until now, we’ve done this primarily through the weekly digest (which you can still expect every Sunday). Going forward, we’ll also share occasional posts pulling in insights from top investors and industry insiders on big problems and opportunities they see across areas they focus.

In this first installment, we’re focusing on the Retail (and eCommerce) space, drawing from the wisdom of over a dozen top investors and operators. I’m especially excited about this one since its a space we focus heavily on at Equal Ventures, and we’re eager—along with the experts featured here—to see more startups tackling these challenges.

This post is very much the result of a “breadth-first search”: we’ll highlight a wide range of opportunities at a higher level. Founders and investors can go down a deeper rabbit hole to uncover potential strategies and solutions that could be best suited for any of these areas.

This collection isn’t exhaustive— it’s a starting point. If you see an angle we’ve missed or an area you think is worth exploring, drop a comment below!

Since this is the first post in this initiative, I’d love to get your feedback. If you have suggestions or requests for future topics, just reply to this email or drop a comment.

Without further ado, here are some of the major problem and opportunity areas we believe builders should keep on their radar.

A huge thank you to Marshall Porter (GP at AlleyCorp; ex-US CEO at Gympass, CSO at ShopRunner), Tehmina Haider (Partner at L Catterton; ex-Chief Growth Officer at Harry’s), Adrian Alfieri (CEO at Verbatim; Angel), Alex Malamatinas (MP at Melitas Ventures), Brian Sugar (MP @ Sugar Capital; Founder of POPSUGAR), Chaz Flexman (CEO at Starday Foods, Angel), Chelsea Zhang (Principal at Equal Ventures), Jodi Kessler (Venture Partner at 3L Capital), Jordan Buckner (Founder of Foodbevy & Joyful Co.), Qasim Mohammad (Director at Wittington Ventures), Sib Mahapatra (CPO at Branch; Angel), Simran Suri (Investor at Maveron), Sophia Dodd (Investor at Equal Ventures), and Yuriy Dovzhansky (Partner at Visible Ventures).

Excess inventory is a significant challenge across the retail sector. In the fashion segment alone, an estimated 2.5-5 billion items of excess stock are produced annually, representing $70-$140B in unsold stock. This problem extends across all retail categories. Surplus stock ties up cash, increases storage costs, and leads to heavy discounting – eroding profitability.

On inventory planning, one of my friends who's the CEO of a very large retailer said they’re still doing it with 25 year olds, an Excel spreadsheet and intuition. We have enough data now that we should be able to do better than that.

– Marshall Porter, GP at AlleyCorp

A variety of factors contribute to this issue, including inaccurate demand forecasting, supply chain disruptions that trigger over-ordering, shifts in consumer preferences, and the inherent unpredictability of seasonal demand. Marshall proposes one solution that could reduce this burden further down in this post (#20).

In 2024, total returns for the retail industry were estimated to reach $890B. This has more than doubled in the past five years as eCommerce penetration rises and consumers consider free returns to be the norm.

Returns is a nearly trillion-dollar problem. Now there are many, many causes of the return problem. There's sizing and fit, there are damages, there are customers that are abusive. There's a whole stack of solutions that need to address that problem and it's not a one-company solution thing.

– Marshall Porter, GP at AlleyCorp

The multitude of reasons driving this issue necessitate a whole ecosystem of vendors. These providers can equip merchants with tailored solutions to address the various challenges, with the intent of reducing return rates and minimizing their impact on the bottom line.

Theft and shrinkage costs merchants over $112B annually. These issues take shape in many forms, including shoplifting, employee theft, organized crime, fraudulent returns, fake chargebacks, and more. Fraudulent and abusive returns practices have been especially growing in recent years, with 93% of retailers reporting it to be a significant issue and a recent report estimating that just fraudulent returns cost the industry over $100B in 2024.

Given the various forms that theft takes in the sector, this is another area where there is a need for a multitude of solutions to help merchants with the various issues.

Waste is a massive issue across the sector. The retail supply chain is estimated to contribute 25% of all greenhouse gas emissions globally. Over 5 Billion tons of returned goods, many of them still usable, are sent to landfills every year. The scale of the problem is immense.

Enterprises and investors understand the scale of the problem but new innovations and transformation are needed to drive change.

Our fund is in close proximity to several large businesses that have a meaningful carbon footprint. These companies have publicly committed to reducing this like many others in the world. We’ve been thinking through what the new economies and technologies are that can help to drive towards that goal, like the emergence of new markets around carbon credits.

– Qasim Mohammad, Director at Wittington Ventures

There is massive waste in the space, and it's obviously bad for the environment, but it's also economically a waste. There's not going to be one solution that solves this. But clearly, there's a lot of economic and material waste in the industry. A lot of stuff that gets made that never gets sold or used. That's why I think there are so many more opportunities in the recycling of resources.

Can you use things more? Can you have multiple users? How do you increase the turns that you are getting on physical products? Because if you're able to do that, [merchants] can make a lot more money. Clearly, brands are hurting and retailers are hurting. Everyone is hurting when we have a lot of waste.

And it's good for the world if we can actually have better utilization. That is the biggest thing that I would love to see in the next five years — actually seeing more true economic utilization of all the stuff that's out there and not just greenwashing.

– Chelsea Zhang, Principal at Equal Ventures

Opportunities to drive less waste also extend to offering better products to consumers, which can last longer and require less replacement.

This idea of fewer, better, more durable things—focusing on quality over quantity and reducing waste in the system—is something we’re hopefully on the cusp of. It’s essential for the environment, and it benefits consumers and brands alike. Hopefully, we’ll see more of this in the coming years.

– Jodi Kessler, Venture Partner at 3L Capital

Many retailers face challenges around accurately identifying, tracking, and verifying the origin, journey, and authenticity of products throughout the supply chain. This can have meaningful implications across retail operations, from compliance and sustainability to brand trust and operational efficiency.

There are several hard problems to solve, like being able to give enterprises more visibility into source mapping and where your stuff is coming from. And how do you better control those risks in your supply chain? I think that's really interesting.

… There's a white space for someone to make that process more automated and less analog and make the solution more ubiquitous for the market in general. We haven't really seen stuff like that yet, but we continue to remain excited.

– Qasim Mohammad, Director at Wittington Ventures

Players across the retail value chain can often be cash-constrained as they need to pay suppliers and manufacturers for inventory before they can sell the goods to generate revenue. Many merchants have to turn to financing to purchase inventory or for marketing spend – which can be extremely expensive and be a bottleneck to growth.

A number of other costs also arise in ongoing operations, that can lead many brands to be in situations where they are cash poor:

The top challenge is navigating the financial hurdles of scaling, particularly around distribution and retailer deductions. Brands often underestimate the complexity and cost of working with national distributors or large retail chains. This can lead them into negative cashflow situations, where they’re actually losing money as a business by selling to these “customers”.

…I wish there was more innovation around creating accessible financing options for emerging brands. While CDFIs and alternative lenders like Aion Financial are helping fill some gaps, many founders still lack the resources to scale efficiently. I wish to see more financing options for brands along their entire lifecycle.

– Jordan Buckner, Founder at Foodbevy and Joyful Co.

Many legacy companies have struggled to develop products and evolve their brands to resonate with modern consumers. This has created massive opportunities for a new wave of brands.

New generations, or even people of the same generation, are increasingly looking for better-for-you clean label alternatives to the established brands. And so there are certain subcategories and categories that are ripe for disruption. We were early in prebiotic soda with OLIPOP. We were early in cereal with Magic Spoon. An area I think is interesting right now is household cleaning products and detergent. One of our recent investments is in that space. Fragrance is interesting. There are several categories where I still think there's opportunity to innovate and challenge the established brands. Some key emerging themes we are focused on include gut health, fem care, and global foods.

…There's an opportunity for brands and companies that appeal to Gen Z and Gen Alpha both in terms of being cleaner label but also in terms of just the branding, positioning, and maybe price point.

–Alex Malamatinas, Managing Partner at Melitas Ventures

Tehmina Haider of L Catterton shared some of the ways that she identifies categories ripe for disruption and breakout brands:

Within the world of fast moving CPG, opportunities exist where brands–and the products they offer–have lost touch with evolved consumer needs and preferences. Sometimes when I'm seeking to identify disruption opportunities I walk around a store–in a figurative or literal sense–to assess how well aisles are merchandised and visual appeal. Aisles that look and feel outdated are typically where there is real opportunity for disruptive innovation to capture significant market share.

Most aisles tend to have a big upheaval let’s say once a decade. So the question is, how do you identify when that will happen? We invest heavily in consumer insights to identify secular shifts in consumer preferences so we tend to have a clear point of view across categories, but we still have to ensure we see when the shift is likely to take place in store, as it is typically highly advantageous for a brand to be at the forefront of these shifts.

Data can help you assess when these shifts are coming. On the one hand, a firm grasp of online trends–in branded DTC and Amazon–can validate that consumers are seeking and even willing to pay a premium to options they see in store. Syndicated panel data is also helpful, particularly when you see a young, diverse buyer base for what might seem on face to be a niche offering.

Examples of categories where these shifts have happened are baby formula, deodorant and hot sauce. In hot sauce for example, the original perception was that consumption was niche and linked to interest in specific ethnic food categories. But actually, if you looked at who's buying hot sauce, it was incredibly diverse, and folks were stocking their fridges with multiple SKUs for use across different occasions. , So the underlying buyer demographics and patterns were an indicator of potential mass market appeal.

– Tehmina Haider, Partner at L Catterton

The advent of Gen AI is creating opportunities for completely re-imagined product discovery and purchasing flows.

These range from personalized AI shoppers and planners to agents transacting on your behalf, to purpose-built applications leveraging new capabilities to aid in the search for new products.

Imagine a shopping experience that feels like it’s always two steps ahead. You’re planning a trip, and instead of scrolling through endless options, your favorite store curates outfits based on the weather, your itinerary, and your past purchases. Got an event coming up? It suggests items that work with pieces you already own. It’s like a personal shopper who’s got you covered, all powered by AI.

– Brian Sugar, Managing Partner at Sugar Capital

It would definitely make the consumer's life easier—if I could just say, “Hey, I need a humidifier.” and poof, there appears the best humidifier at a price point that I'm comfortable with. It's sort of like Amazon on steroids.

– Jodi Kessler, Venture Partner at 3L Capital

With dupes and clones popping up as soon as new products launch, brand building and loyalty is more important than ever across the industry:

Any time a brand launches a new SKU, within weeks, you can go find that SKU on Temu and you can actually see there are even local manufacturers that are launching those same dupes of things. And so, where can you find defensibility as a brand now? And how can you meet your consumers where they are and how can you earn their loyalty? Answers to all those questions have really, really changed.

– Simran Suri, Investor at Maveron

Despite how important this is, many merchants lack the tools to adequately engage their existing customer base and develop more loyalty.

Retaining customers has become as costly as acquiring them. Today’s customers expect personalized experiences, exclusive perks, and loyalty programs that go beyond standard offerings, demanding constant investment. However, loyalty programs often fall flat if they aren’t meaningfully aligned with what customers value, making it challenging for brands to differentiate. When retention efforts are ineffective, brands face rising churn and a reliance on high-cost acquisition tactics, creating a cycle that erodes profitability and weakens customer relationships

…Many brands struggle to unify customer data across different channels and platforms, creating fragmented views of their customers. This prevents brands from delivering consistent and personalized experiences, as customer data is scattered across social media platforms, e-commerce sites, email, and in-store systems. Without a single source of truth, brands miss out on meaningful insights that could drive retention and loyalty.

– Brian Sugar, Managing Partner at Sugar Capital

Merchants have long looked to offer personalization to individual buyers to enhance customer experience and improve conversion. However, this has been hard for most due to issues in unifying and operationalizing their data.

The latest Gen AI tooling, however, creates a big opportunity for merchants to offer a high degree of personalization at scale if they can sort out their data problems.

A lot of companies have tried but struggled with personalization at scale. We've always had a lot of data, and now with an additional LLM or AI layer that's sitting on top of it, I think there's a big opportunity to offer this. Where you're showing me what I care about most. That's certainly been a challenge and a technology limitation for brands.

– Jodi Kessler, Venture Partner at 3L Capital

While many brands claim to offer personalized experiences, few actually deliver. Ineffective use of customer data, outdated technology, or limited resources mean that personalization often fails to go beyond product recommendations. Customers increasingly expect a seamless, relevant experience that adjusts to their needs in real-time, but this is rare to find.

As an example, Starbucks excels at making each interaction feel unique through its app, using data to craft rewards, offers, and recommendations that resonate personally. This approach doesn’t just enhance loyalty; it makes each customer feel like the brand is thinking about their needs. Imagine if brands could shape every product around customer data, creating items that customers not only want but feel are designed specifically for them. This kind of high-touch personalization can elevate perceived value and create a must-have appeal.

– Brian Sugar, Managing Partner at Sugar Capital

I’m really interested to see if the current generation of A/B testing providers can make the jump to automated personalization at the level of one person, one experience. Existing tools do a great job personalizing based on certain behavioral and device signals, but we still manually design and configure experiences for each segment. With generative AI, you start to imagine tools that create completely bespoke user journeys based on a user’s acquisition channel, browsing behavior, history, and other signals. The tool I’m imagining can write copy, edit photos, even spin up video content on the fly that creates the perfect experience for hundreds or thousands of individual personas.

– Sib Mahapatra, Co-Founder of Branch

Many historical providers aggregate and offer industry data from different channels like point-of-sale systems, receipt data from consumers, and credit card sales data. However, as the number of channels that merchants sell on increases, and trends evolve faster than ever, there is a need for new data solutions that can offer more granular and omni-channel data. Merchants also need better tooling to effectively leverage this data in their own operations.

…having extremely localized data is really, really important. Especially now considering how spending patterns and habits might change with the election and all the policies that a Trump administration would bring. In Tribeca for example, you can get your groceries at Trader Joe's, you can get your groceries at Whole Foods, you can get your groceries at Target. It's very different demographics that go to all three. How does that change how a brand should be structuring their go-to-market strategy, their pricing, their marketing, their messaging, all that? We’d love to see a little bit more of that [granularity].

– Simran Suri, Investor at Maveron

The amount of data available has of course grown rapidly in recent years, but there are still gaps, especially in signaling data sources, and more so in data ingestion and interpretation. For example, there's essentially no syndicated data available for ethnic grocery, which is becoming a key bellwether for food trends given demographic shifts in the US, and even credit card panel data often is slow to integrate and report on small, rapidly growing brands. That data could have immense value for many constituents.

More important in my mind, however, is how companies will find more sophisticated ways to ingest and interpret data. Businesses that did this well in the early days of DTC were able to build superior GTM strategies; today, companies that find ways to leverage AI to unite and interpret disparate data sources will be advantaged across their businesses–from supply/inventory planning to product development to marketing messaging and efficiency and beyond. The opportunity is massive, and teams that show agility in adopting new tools and adjusting processes will experience material advantages.

– Tehmina Haider, Partner at L Catterton

Although a treasure trove of data is captured across the industry, the challenge lies in accessing and sharing it in a way that benefits all parties without compromising the interests of those who contribute the data.

There does seem to be an opportunity around generally solving the data side of the data silo problem. In retail, all the incumbents would benefit so much if there was a conducive way of being able to derive more instantaneous general insights about sales and other things [industry-wide]. You already have Nielsen and stuff like that, but something that's just a little bit more ubiquitous, omni-channel, more instant, and easily accessible.

Frankly, more data should be used for many use cases, whether it's loyalty or marketing. But everyone guards their data so much. It's still hard to have the industry benefit from a ‘rising tides raise all ships’ [mentality] because nobody lets their ships out into the ocean because they don't want theirs to get hit by somebody else's.

– Qasim Mohammad, Director at Wittington Ventures

There are countless ways that brands can leverage improved industry data to better operate and serve customers:

Imagine if brands didn’t just rely on trends but could actually respond to them in real-time. AI can analyze what’s popular—styles, colors, features—and help brands adjust their product lines fast. If a limited-run item is a hit, AI can alert the team so it’s back on the shelves before demand fades. This isn’t just responding to what’s already selling; it’s spotting what people want and getting it to them while it’s hot.

– Brian Sugar, Managing Partner at Sugar Capital

AI is going to change search and customer acquisition. Typical SEO strategies may not actually be effective anymore.

– Simran Suri, Investor at Maveron

Search Engine Optimization (SEO) has been one of the most important channels for digital growth and acquisition over the past decade. Countless businesses were built on the backs of organic search acquisition and an entire ecosystem emerged to help merchants optimize and win on this channel.

As more consumers and businesses leverage LLMs and Gen AI, there is a big opportunity to enable sellers to optimize their placements in this new age. In addition to optimizing on pure search, Gen AI is also creating new types of shopping workflows that will require its own type of optimization:

Brands and merchants are going to have to adapt to the changing ways that consumers are finding and engaging with them. Perplexity recently announced that they're now integrating Shopify. Basically, you search for a product, and it provides a listing and then a little button to buy now. That is massively going to change the way people buy. You can have an AI agent just complete that transaction — so you're taking that consumer interaction with the brand out of it.

…for brands it partially removes some of that experiential UI layer like your website. It can erode a brand's relationship with a customer. It could negatively impact things like how customers are discovering you, but then also your ability to upsell and to build brand affinity. So I think AI has the potential to really change both shopping behavior and consumers’ relationships with brands.

– Jodi Kessler, Venture Partner at 3L Capital

Many brands and retailers are aware this wave is coming. Although historically many retailers have been seen as tech laggards, several are realizing they will need to start early in order to not be left behind in this wave.

…there have been a lot of examples in retail where companies that were either slow to adopt or weren't active participants in those technological advancements were oftentimes left in the dust by their competitors. I think that is probably a small part of [the motivation].

…As an example, in Fashion, Apparel, and Accessories, we've seen qualitative-based search as a big-use case, where, for example, consumers are searching for products based on an occasion, rather than at the item level. And there have been a lot of pretty public and large early-stage financings that are bolstering that approach. There is a significant risk that if slow-moving retailers don’t test and incorporate these new approaches, they may be left behind by the rest of their peer set.

– Yuriy Dovzhansky, Partner at Visible Ventures

One of the most promising opportunities for AI lies in its ability to empower brands by streamlining business management and operations. From logistics and marketing to overall workflow optimization, many tasks still require significant manual effort from merchants. AI-powered agents have the potential to revolutionize these processes, taking on repetitive tasks and automating key areas to improve efficiency, reduce workloads, and allow businesses to focus on growth and innovation.

There have been headwinds in consumer over the last three years, to say the least. A compounding factor is that many brands, and venture-backed brands especially, made poor decisions on G&A and were consequently far less resilient. [The question is] whether a brand can meaningfully reduce overhead with generative AI tools and agentic AI especially. I think you can. Not only personnel overhead, but also software overhead. You may not need an ERP. Maybe you just need your five agents that do different things. Branch is already among the most efficient companies in our cohort on a revenue and contribution margin per FTE basis, but when we ran a survey about automation opportunities to our team, most believed that half their workflows could eventually be automated.

On an absolute basis, agents will fuel operating leverage that improves the overall cashflow outlook for most brands. I think you will see some of that get competed away because brands will just spend it against each other on marketing. But it still improves the threshold for brand profitability, and also improves the relative attractiveness of the category relative to pure software, where margins will compress. It will basically be harder to mess up.

– Sib Mahapatra, Co-Founder of Branch

Consumers spend an incredible amount of time on social media, with most estimates putting the average time for users to be over two hours daily.

As a result, creators on these platforms have become an immensely important channel for discovering and promoting products. A report by Goldman estimated that the Creator Economy was valued at $250B in 2022 and estimated to grow to $480B by 2027.

Despite the size, many investors and operators highlighted how difficult it still is to work with creators en masse and how opportunities still exist to improve and streamline these workflows.

Despite how big creators are in the market, and [the market] keeps growing at some ridiculous CAGR every year, it's still too hard. The biggest brands have teams that could be 5, 10, 20 people whose entire job is to just find creators and work with them. That tells you this is too hard.

…Part of it is just that the tooling hasn't existed previously. You had to go to an agency, the agency has certain relationships, but not all of them. And you just get sort of this highly fragmented world that frankly is a perfect setup for a marketplace to exist.

– Marshall Porter, GP at AlleyCorp

With the continued importance of creators, many are excited about the opportunities to work with creators on new types of commerce experiences.

Imagine scrolling through your social feed and getting recommendations from creators you actually trust—people who give practical advice on styling, caring for items, and making them your own. And if you really want, you can book a quick consult with them to get tips directly. It’s like getting real advice from a friend, not just another ad.

– Brian Sugar, Managing Partner at Sugar Capital

And the opportunity extends to those that can enable creators with strong audiences to build and launch their own brands:

When you look at where the power is now, if you think about audiences, we spend so much time on TikTok and Instagram. Social media creators are incredibly powerful and I think we're going to see more and more creators launching brands. If you're a follower or a creator with a million followers, it's really easy and super tempting to go launch a brand.

And so you look at sort of the iconic case of the Glossier and Skims at this point. Based on audiences that Emily [Weiss] and Kim [Kardashian] have, they've done a remarkable job building these incredible brands that are beloved. I think that's merely a harbinger of what's going to come.

– Marshall Porter, GP at AlleyCorp

I think a great example here is Lemme, Kourtney Kardashian Barker's supplement brand. It's at the intersection of really high-growth secular tailwinds in consumer around supplements and vitamins through very interesting form factors like gummies, lollipops and chewables. They’re powering it with the celebrity piece. Those two things coming together helped Lemme to really break out as one of the top wellness stories in the US today.

– Qasim Mohammad, Director at Wittington Ventures

For a long time, Amazon was the only retail marketplace that really mattered for most brands in the U.S.. Post-Covid, however, there are now dozens of third-party marketplaces that are sufficiently scaled. This fragmentation presents new opportunities for sellers but also adds complexity, as merchants must plan, manage, and win across multiple channels simultaneously.

Next-Gen marketplaces – the non-Amazon marketplaces of the world – are starting to gain traction. There is a fairly obvious opportunity there. Anything that enables people to be successful from a Third-party perspective has an opportunity. I'm not sure which marketplaces are going to win, but there are clearly going to be a few more that reach scale over the next five years, and it seems extremely logical to think that an Amazon-like cottage industry is going to evolve around each of them and they are going to be different.

The big one obviously is Walmart.com, which seems to be the most obvious choice. TikTok Shop was looking good, but now maybe not so much. Target.com, BestBuy.com, and HomeDepot.com – these are all ones with significant GMVs in their primary channels that seem to have decent potential for third-party marketplaces.

– Chelsea Zhang, Principal at Equal Ventures

Some retail partners do a good job of giving you promotional capabilities on their online stores and others don't. There is definitely an opportunity to make it easier for a given retailer to tell Branch, “Hey, would you like to promote your listing? Here's how you self-serve that.” We spend a ton of money on Amazon ads, so why doesn't every retailer have an easy-to-use ad platform?

We don't have anything like that on West Elm or Crate & Barrel. We've talked to a few other partners. There should be an easy way for us to toggle demand on other platforms in the same way we can do it on Amazon and for DTC.

– Sib Mahapatra, Co-Founder of Branch

Although marketplaces present new distribution opportunities, they also create high platform risk which creates its own set of challenges.

Many brands rely heavily on third-party platforms, such as social media and major marketplaces, to connect with customers. While these platforms provide reach, they also limit control over customer data and interactions, distancing brands from direct relationships with their own customers. This dependency inflates acquisition costs and makes it difficult to build lasting loyalty and deep customer understanding. Ultimately, brands are forced to compete on crowded platforms without the ability to nurture personalized experiences that create strong customer loyalty.

– Brian Sugar, Managing Partner at Sugar Capital

Getting a brand’s products onto retailers’ shelves is notoriously difficult. As many digital-first brands look to navigate the shift to offline, there is a big opportunity to help them expand into wholesale and retail.

There are a lot of brands that have really great consumer engagement, loyal followers, strong brands, and strong messaging. But it's almost a bit of a black box to figure out how to get into retailers, how to get into wholesalers. And a lot of these companies, for better or worse, they are venture-backed and they spend a lot of money and cycles trying to figure that out.

…this long tail of CPG in particular tends to get really overlooked and they are forced to sell on Amazon as a result, which oftentimes is not economically efficient or good for their brand. That's a huge pain point.

– Simran Suri, Investor at Maveron

One of the hurdles in expanding offline is the mechanism by which retailers select brands to work with, and especially how individual category buyers can make or break whether a brand is selected:

The way retailers make decisions around what to bring in and just how that operates is really difficult in that it's still very 1:1 human driven. I think that holds back a lot of innovation in retail.

It’s a challenge for retailers and anyone dealing with mass consumer preferences to separate their own personal opinions or biases with what actually might resonate with the end consumer. And so just systematically how that changes is going to be something that I think unlocks a lot of innovation correctly. But I don't understand how it gets solved for today.

…a big challenge that everyone deals with is the turnover at retail on the buyer side. You spend time building a relationship, setting yourself up for that one moment that you have to pitch. And then you realize that the person you’ve developed that relationship with is gone and you’ve got to restart the education process and hope it works out. If you think about the buying cycle of retail with line reviews once a year and another 3-6 months from award to set date, missing out on one of these could cost you 18 months of revenue opportunities

– Chaz Flexman, CEO at Starday Foods

However, getting into stores is just the first part of the challenge. Brands need to drive velocity once they’re in stores to remain on shelves. This remains a segment where innovation is needed as brands aim to drive sales beyond just consumers naturally coming across them while walking by.

I think a lot about how once you have products in store, how do you start to help drive velocity?

…Whether that's figuring out how you get secondary placement or optimizing out-of-stocks. There are also not a lot of tools on the advertising side or the marketing side to drive trial or velocity. Yes retailers have their own ad networks but truthfully until you're at full penetration with multiple SKU's that's not really accessible to your smaller to medium sized brands. You basically have Ibotta or Mammoth. You've got Instacart. You've got in store marketing, demos, and you've got trade spend and that's kind of it.

Figuring out other ways to drive throughput and actually have a place where you can spend dollars to drive ROI would be huge.

– Chaz Flexman, CEO at Starday Foods

Digital platforms connect individuals across the globe but selling in different geographies presents massive challenges for merchants. Enablement plays in this space can unlock large demand and natural growth opportunities:

This goes back to after my first three years at Gilt. I begged for the opportunity to help build Gilt internationally and I think I just wore the leadership team down to the point where they said, “Fine, go do it.” And when you really get into the data, what you saw was demand incoming for what Gilt had, and initially, we couldn't do anything with it because we didn't ship [overseas].

We initially launched Borderfree (owned by Global-e) as the enablement tool and the conversion rates were just abysmally low because what you had was a global product that was designed for local audiences.

…one of the big unlocks for us was that we brought China in-house. We took it off Global-e and started to serve it ourselves with our own logistics, our own payments… and our conversion rates tripled and the business more than tripled, quite literally overnight. And so that became a $50 Million dollar business in a hurry. Despite no marketing spend.

…And then you talk to a retailer today using the Global-e platform, they're all at 1% [conversion]. And so we think there's a 10-20% opportunity here [of overall revenue] if you can deliver the right experience. Cross-border that meets what those customers want. That's exciting. And when you think about if paid marketing doesn't work and if you're struggling to find growth channels domestically, there's a whole green field internationally. But you have to deliver the right experience to really realize that opportunity.

– Marshall Porter, GP at AlleyCorp

As reaching customers online becomes more expensive, many marketers are looking to switch spend back to traditional and real-world channels. However, the infrastructure to tap these is often not as streamlined as in the digital world.

If you get out of the world of Facebook and Google, there's a broader opportunity to take traditional brand channels and make them more measurable. Make them feel more like direct response and more familiar to a marketing team that has grown up in this era.

For example, Tatari has done a really good job of making linear TV advertising feel more like buying Facebook and Google ads. It's not perfect. They're kind of like half agency, half platform, but fundamentally what they're doing is trying to take this weird type of inventory and make it seem more legible. Make the feedback loop tighter, which is good inherently because you have more confidence to build your spend. TVAds.AI is doing the same across CTV.

But also just from a familiarity perspective perspective, there are lots of marketers that can use the Facebook dashboard and Google, but they would not know how to interact with linear TV if you didn't give them this platform. So how do you do that for billboards? Out of home generally? I hear there’s now an ad network for fortune cookies? And so taking brand advertising and quantizing it, making it more scalable and measurable, is the opportunity that springs out of the saturation in Facebook, Google and traditional direct response.

– Sib Mahapatra, Co-Founder of Branch

Privacy and regulatory changes over the past few years have made it harder for advertisers to effectively target and acquire customers online.

This shift has led many to divert ad spend to other channels (like creators), but there remains an opportunity for players that can help marketers advertise more effectively online.

I think everybody knows this now, but eCommerce is generally challenging these days. After Apple's iOS changes, customer acquisition costs have generally increased and Facebook and Instagram are more expensive than they were. Acquiring customers through these platforms and selling online is generally not as attractive a business model as it was before.

And so, to the extent that somebody can crack the code to make it sort of cheaper or more affordable to acquire customers, that could be really interesting.

– Alex Malamatinas, Managing Partner at Melitas Ventures

…it was pretty inevitable that these channels were going to get more expensive over time as more brands, more competition onboarded to them. The direct model is an arbitrage, not a strategy, and was destined to compress because scaled channels are auctions. And of course, the privacy regulations and the technical barriers to effective targeting have not been helpful.

…with that said, I think you can partly solve that with new tooling. Incrementality testing has been a big focus for the past several months. [To see whether] what the platforms are telling you, as far as attribution and ROAS goes, if that's actually true. And surprise, it's usually not. So better tooling for attribution is a big part of the path forward for digitally native brands. To be clear, I don't think the best providers are some of the usual suspects that say we've got a proprietary magic pixel. They don’t have anything that Facebook or Google couldn't give you already. But in a world without deterministic, pixel-based attribution, incrementality testing seems like a more fundamental way of achieving clarity on where spend actually drives results. Maybe a modern MMM approach or some blend of those two models could be different.

– Sib Mahapatra, Co-Founder of Branch

For decades, the process of ordering and delivering products manufactured overseas has remained virtually unchanged: brands and retailers place large orders months in advance based on projected demand, then store the merchandise in domestic warehouses until it sells. Now, however, a new paradigm is emerging—one that has the potential to radically transform this longstanding model.

No one's really rethinking logistics. And I think this is less something in the power of a brand, although you've seen brands like Quince do it really well. But there should be a player that can enable Factory-to-Consumer logistics.

The current status quo is that if I'm going to make something in Asia, I'm going to put it on a truck and send it to Shenzhen or Hong Kong and then I'm going to ship it to Long Beach. I'm going to pull it off the boat in Long Beach, I'm going to put it on a train to Chicago and that's probably going to go on another train to Louisville or Cincinnati, where it's going to get on a truck to go to my warehouse, I'm going to stock it on the right shelf with my labor in the warehouse, on the right shelving in the warehouse. Then hopefully, it gets ordered.

I've got inventory risk there, so we're still hoping it gets ordered. When it gets ordered, I'm going to take it off the shelf, I'm going to pick it, I'm going to pack it, I'm going to put it back on a truck to go to a plane to go to a truck, to probably go to another truck to go to a house.

We can just short-circuit that entire broadly accepted logistics supply chain with what Quince is doing and what Temu and Shein have done as well. I've been surprised by how few brands have gone that path. I think there's a whole opportunity on the brand side.

– Marshall Porter, GP at AlleyCorp

Implementing factory-to-consumer logistics requires significant operational changes and the development of new capabilities across the supply chain that upstarts can help enable. If widely adopted, it can dramatically shorten lead times for retailers, eliminating the need to plan and order months in advance. This shift, in turn, has the potential to solve several other critical challenges across the industry:

It just completely reinvents the supply chain. Not just for the purpose of reducing logistics costs, but there are really material impacts on the P&L of a brand. When you can say, “Look, now instead of needing to buy things nine months ahead of time or three months ahead of time, I can do it in two weeks.” I have less inventory risk, my cash conversion cycle is so much faster. It has really big impacts on the bottom side of the P&L. And that's what I get excited about.

– Marshall Porter, GP at AlleyCorp

Many brands have limited visibility into their retail partners’ inventory levels and procurement plans. This can lead to struggles in planning and managing relationships across the supply chain.

A lot of inefficiency arises from the lack of coordination and real-time communication between brands and their suppliers. Delays in production or shipping often stem from outdated methods of forecasting demand and managing inventory. Without an agile supply chain, brands are unable to respond quickly to market changes, leading to excess inventory or stockouts.

– Brian Sugar, Managing Partner at Sugar Capital

Managing inventory from the retailer’s side and the brand's perspective, and getting visibility on inventory and consumer sales traction, is a big issue. There's not a lot of transparency nor real-time data that's readily available.

– Alex Malamatinas, Managing Partner at Melitas Ventures

Companies that can arm brands with better visibility can be immensely valuable.

Companies like Treater are impressive to me. They are using data to say, “This is where we think you're out of stock right now based on historical performance and based on what other stores are selling.” And then they're actually going to email the store managers directly and say, “Hey, we think they're out of stock” and help you fix voids or out of stocks or [point out] that inventory could just be sitting in a back room. You don't know it yet, but it's driving these lower sales and velocity numbers when you certainly shouldn't have that. This also tells you what store velocities are just lower - so you can run a demo or promo or even understand what audience segment that product is not resonating with.

– Chaz Flexman, CEO at Starday Foods

This is the one piece of the value chain that I still hear a lot of complaints about. There's clearly a very big gap between matching subscale brands with 3PLs and manufacturers. There should soon be good enough technology, whether it's being adopted by the 3PLs or the manufacturers. And maybe it's not actually a tech layer opportunity. Maybe you can be a great service provider and be a much better provider because you are leveraging tech.

But this is 100% still a gap and it's probably the most clear gap out there that a lot of people are still trying to solve… I think that piece of the industry is still very inefficient and dysfunctional.

…On the 3PL side, [the problem is] that I don't know what my 3PL is doing. I don't have a lot of visibility into pricing. It's very unclear to me what my inventory levels are. That still is a complaint. And not to say that all 3PLs are bad. There are better 3PLs but this is still an industry-wide problem.

On the manufacturing side, if you're a subscale brand, how do you get manufacturers to work with you, and then how do you find a consistent partner? If someone were to solve that or make it easier for brands to do it in a consistent way and not just like a wrapper around it, a lot of brands would be very interested in that type of solution.

– Chelsea Zhang, Principal at Equal Ventures

The global secondhand apparel market was estimated to be $230B in 2024 and is anticipated to grow to $350B by 2028.

Resale continues to be an area of interest for us given strong and growing consumer demand for secondhand, and of course, a material opportunity to reduce the environmental footprint of our collective consumption. But resale is a difficult category to make work for businesses that serve primarily as intermediaries, especially in categories beyond luxury which stands out because unlike most products, which depreciate quickly, resold luxury items often retain most if not all (or even more than) original MSRP. Public company performance in this category hints at this challenge.

Existing resale models have struggled to find ways to effectively distribute value across the multiple participants in the resale value chain. Intermediaries struggle to make unit economics work. Think about it this way: you’ve got a pair of pants that is worth a specific amount today on the resale market…if the pants get sold, what are the required transaction costs, from seller acquisition to buyer acquisition to sorting to photography/merchandising and shipping? How much value goes to the seller? The intermediary that facilitates the sale? How do you make this work for lower value items when many transaction costs are relatively fixed per item?

Winning models will have to find ways to build an approach that unlocks adequate dollars on lower cost items, whether through advantaged ways to unlock supply and/or demand, automate item processing and/or more novel approaches to access profit pools beyond the obvious. We’re starting to see emerging players get traction here, and we remain bullish on opportunities to invest in the space.

– Tehmina Haider, Partner at L Catterton

An obstacle to resale has been that much of the inventory sits offline and is yet to be digitized, limiting the amount of products available for resale:

There historically hasn’t been enough inventory online to drive the volume that a lot of these retailers and brands expect from the resale programs. We've seen a lot of companies attempting to address this problem by digitizing closets. The challenge and the hurdles of bringing this inventory online are huge and, frankly, the process hasn’t been that intuitive or seamless for the end consumer. We’re seeing several promising approaches to figuring out this problem and believe that it will be one of the main keys to solving a long-standing resale pain point. Resale continues to be a sector we're very bullish on, it just needs time to mature, and I think we'll see that through a combination of continued adoption among brands and consolidation among service providers.

– Yuriy Dovzhansky, Partner at Visible Ventures

A different opportunity around resale has been to develop enablement tools for professional resellers—those who purchase excess inventory, deal in grey goods, or buy and sell used products for a profit:

There are a lot of opportunities in the reseller enablement layer. Anything that enables the best resellers to scale will see a lot of traction. A lot of these resellers, if they are successful, are clearly looking for ways to scale and make more money and increasingly take on more inventory. So structurally, whether it's a 3PL, whether it's financing, there's a lot of demand there. I think the biggest question is, what is the right way to help this segment in a way that is sustainable?

– Chelsea Zhang, Principal at Equal Ventures

College athletes in the U.S. had historically been barred from earning income by NCAA rules. However, recent rulings now allow athletes to monetize their Name, Image, and Likeness (NIL) as well as earn an income directly from colleges.

College sports is a massive market in the U.S. – with over $15B in revenue generated by athletic departments and the segment generating further revenue through merchandise sales. The professionalization of college sports is underway as a result as companies capitalize on opportunities to further engage fans and enable college athletes to scale and monetize their own brand & fan bases.

This is an extremely fast-paced space that is undergoing significant structural changes. There is a lot of gray area at the moment, but eventually there will be compelling opportunities to build the infrastructure that supports universities, athletes, investors, and regulatory bodies. Compliance and revenue-sharing platforms will be crucial for tracking compensation, avoiding legal pitfalls, and ensuring transparency. As schools adapt to broader roster flexibility and a more competitive transfer market, there is a growing need for integrated solutions that combine contract management, predictive analytics, and personal branding tools for athletes. This will enable universities to operate more efficiently while empowering athletes to maximize their earning potential and effectively manage their personal brands.

Another significant opportunity lies in group licensing deals, enabling athletes to negotiate endorsements collectively and leverage union-based bargaining power to secure more advantageous terms.

– Sophia Dodd, Investor at Equal Ventures

Restaurants are a notoriously difficult business with low margins. Increasing costs of raw goods and labor have further put pressure in recent years. This creates a big opportunity for enablers that can drive a meaningful impact on a restaurant’s P&L.

On the restaurant tech side, these fast food chains and restaurants are generally pretty inefficient and they don't utilize technology enough. Businesses like PreciTaste can improve the efficiencies and improve the experience for consumers. They can ensure the food is there and warm and also improve the economics for the restaurants themselves.

– Alex Malamatinas, Managing Partner at Melitas Ventures

Marshall Porter is a GP at AlleyCorp where he leads the Diversified Technology team. AlleyCorp invests across sectors and stages but has a particular focus on companies from Pre-Seed through Series A. Marshall was previously US CEO at Gympass, President of Spring, CSO at ShopRunner, and GM & SVP at Gilt Groupe.

Tehmina Haider is a Partner focused on consumer investing at L Catterton. Founded in 1989, L Catterton is the only global private equity firm focused on consumer growth investments. L Catterton has made over 275 investments to date, leveraging deep category insight, operational excellence, and a broad network of strategic relationships to help build many of the world's most iconic consumer brands. Tehmina was previously the Chief Growth Officer of Harry’s Inc.

Adrian Alfieri is the Founder & CEO at Verbatim. Verbatim is a growth agency that specializes in generating demand through best-in-class content engines. Adrian is also an active angel investor.

Alex Malamatinas is Founder & Managing Partner of Melitas Ventures. The firm invests in early stage (Seed and Series A) opportunities with a primary focus on better-for-you branded consumer products.

Brian Sugar is Founder & Managing Partner of Sugar Capital. Sugar Capital invests in seed-stage companies at the intersection of technology and commerce. Brian was previously the founder of POPSUGAR.

Chaz Flexman is Co-Founder & CEO of Starday Foods. Starday is leveraging an AI-driven approach to building the next great food conglomerate. Prior to Starday, Chaz was a part of the founding team of Pattern Brands, VP at PCH International, and a Partner at A16Z.

Chelsea Zhang is a Principal at Equal Ventures, where she leads the firm’s focus on retail & supply chain investments. Equal writes $2-3m checks at the Seed stage in companies transforming retail, supply chain, insurance, and climate.

Jodi Kessler is a Venture Partner at 3L Capital, a growth equity firm backing companies across Commerce, Enterprise Software, and tech-enabled services. The firm typically invests in companies after Series B and writes checks of $10-30M.

Jordan Buckner is the Co-Founder of Foodbevy and Joyful Co. Foodbevy is a leading community for emerging F&B founders to navigate the complexities of growing a brand. Joyful Co. develops gift boxes that connect people through thoughtful, high-quality products.

Qasim Mohammad is a Director at Wittington Ventures focused on venture investing. Wittington is the private family office of the controlling shareholder of some of Canada's largest businesses across retail, real estate, and more. He runs a publication called Fire Ant focused on the future of commerce.

Sib Mahapatra is Co-Founder & Chief Product Officer at Branch. Branch makes it easy for teams of every size to create an office they’ll love – from ordering and assembly to space planning and pickup.

Simran Suri is an investor at Maveron, an early-stage Venture Capital firm focused on investing in consumer businesses. Maveron writes checks of up to $10m with a sweet spot of investing in Series A rounds.

Sophia Dodd is an investor at Equal Ventures, where she takes a generalist lens to investing. Equal writes $2-3m checks at the Seed stage in companies transforming retail, supply chain, insurance, and climate.

Yuriy Dovzhansky is a Partner at Visible Ventures. Visible invests in early-stage companies that make the everyday extraordinary, with a particular focus on 3 verticals: eComm Software, Healthcare, and Consumer AI.

Credit to Lenny Rachitsky who inspired the format of this post with his expert insight series around growth and product management.