Earnings+More - Vibe shift

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

Mood swingTurbo charged: The leading companies in the sector enjoyed large double-digit gains last week, led by a 25% leap at DraftKings, a 16% uplift for MGM Resorts and an 11% boost for Flutter Entertainment, which saw the company’s value rise to over $50bn for the first time.

All things go: Shares prices across the sector rode the coattails as some of the biggest names added billions to their market caps. DraftKings saw its value soar by 15% on Friday to $26bn. This despite having seen its 2024 adj. EBITDA whittled away to $181m vs. the already downgraded forecast of $240m-$280m.

MGM Resorts was up 16% for the week following its earnings after market close on Tuesday. It is now worth just shy of $12bn.

Isle be there for you: Also reporting last week was Wynn Resorts, which enjoyed a near 10% uplift after it made clear its Al Marjan project in the UAE was all systems go. See ‘Quick takes’ below.

Slipstream: A beneficiary of the renewed investor interest in the sector was Flutter, the home of DraftKIngs’ rival FanDuel. It saw its value soar to $53bn as it enjoyed a near 6% leap on Friday in the wake of its major competitors’ earnings.

Calendarized: Also enjoying the reflected glory this week were Rush Street, up 21%, set to report on February 26, Caesars Entertainment (+11%), up in symphony with major rival MGM and which reports on February 25, and Penn Entertainment (+6%), which reports on February 27.

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences. Book a meeting with the GeoComply team at SBC Rio (booth #A250) and learn how their advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more! GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction. +More

Earnings this week

The long take – DraftKingsPart of the playbook: Pitching that 2025 will be a “make or break year” for DraftKings, the Deutsche Bank team admitted that had also been their 2024 prognosis but “the concept of structural hold emerged, and the market mistook sports betting for table games and slots.”

Hinge and bracket: Where this is important, the DB team argued, is that the DraftKings story “hinges almost entirely on its ability to meet its guidance benchmarks” and any missteps are “unlikely to be well received and confidence would wane.”

Cash is Kings: This is the backdrop, the analysts suggested, against which the company’s plans to raise more debt should be viewed. As of the end of Q4, DraftKings has cash in hand of $790m and it will be generating ~$850m of free cash in 2025.

Quick takesItalian tender: The tender for new online concessions was recently extended to September this year and the team at Jefferies suggested the structure of the new regime could be the catalyst for further market consolidation.

Discount tents: Even as the shares put on over 11% last week, the analysts at CBRE suggested that shares in Wynn Resorts are not getting enough credit for the current operations, let alone for the Al Marjan project.

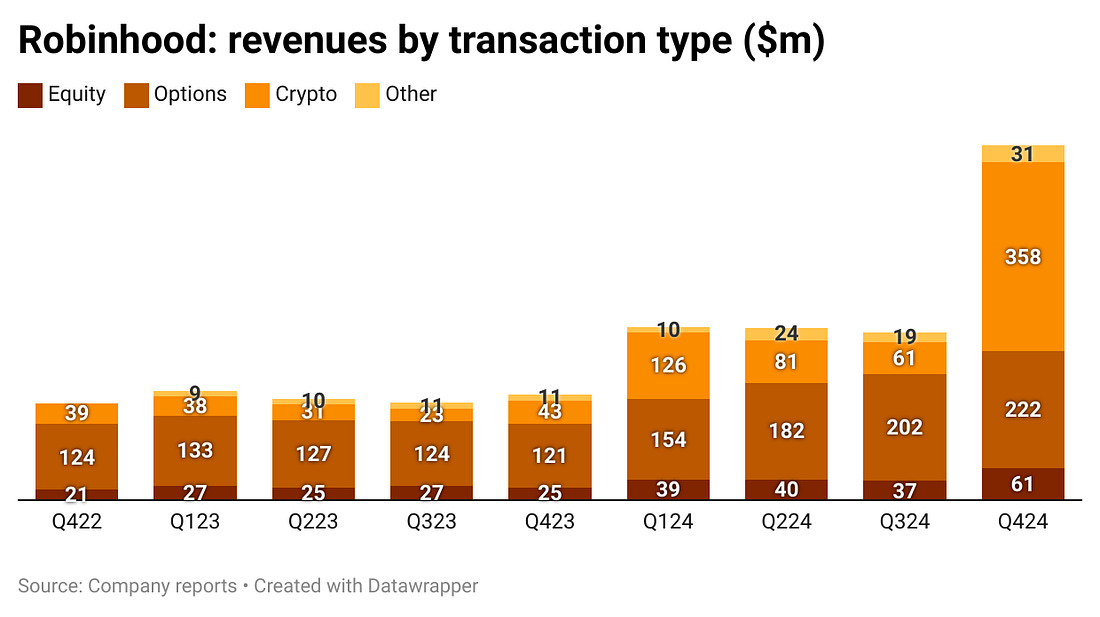

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today. The teardown – RobinhoodEverything on it: Vlad Tenev, CEO at Robinhood, made the pitch for his company to be the ‘everything trading’ app during the company’s Q4 call last week. with prediction markets potentially being the next leg to that story.

Token gesture: On the call, it was clear that management sees a clear runway for further growth in crypto trading. Robinhood currently lists ~20 tokens vs. the 250 listed by Coinbase.

Pedal to the metal: Echoing his comment on prediction markets, Tenev said that, pending "regulatory clarity,” Robinhood would be accelerating its crypto offering. The company has readied a separate app, Robinhood Wallet, a non-custodial crypto wallet that Tenev said was the “gateway to thousands of additional coins for our customers.”

Where is this heading? Crypto is part of Robinhood’s “everything trading” ambitions. What its customers “really love,” Tenev added, was the capability to trade any asset class in one place, whether that is equities, options, crypto and “soon a comprehensive suite of event contracts.” EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions. To find out more, go to www.edgeboost.bet Upcoming earnings

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs. EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. An +More Media publication. For sponsorship inquiries email scott@andmore.media. You're currently a free subscriber to Earnings+More. For the full experience, upgrade your subscription. |

Older messages

Coming into focus

Thursday, February 27, 2025

Anticipating the disruption of 50-state sports prediction markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Kickstart

Thursday, February 27, 2025

Light & Wonder deal could provide the M&A spark ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Decline and fall

Thursday, February 27, 2025

UK horserace betting's problems are manifold ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Hammer blow

Thursday, February 27, 2025

New Jersey near enough doubles the rates of OSB and iCasino taxes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Exit stage left

Friday, February 14, 2025

Gavin Isaacs resigns from Entain with immediate effect ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

80% less time on social reporting sound good?

Thursday, February 27, 2025

Get Forrester's Total Economic Impact™ of Sprout. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Social proof in email marketing, National Toast Day, and the art of CTAs

Thursday, February 27, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Python Weekly - Issue 688

Thursday, February 27, 2025

February 27, 2025 | Read Online Python Weekly (Issue 688 February 27 2025) Welcome to issue 688 of Python Weekly. We have a packed issue this week. Enjoy it! The #1 AI Meeting Assistant Summarize 1-

Free download: 5 ways to improve your proposals

Thursday, February 27, 2025

A free resource for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

From living in a car to $1.4M in 5 months

Thursday, February 27, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From living in a car to $1.4M in 5 months Taro Fukuyama and 2 of his friends from Tokyo

I'm launching a meme coin live RIGHT NOW

Thursday, February 27, 2025

(All for charity dw) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Midnight Society Bows Out While ChronoForge Aims for a Bigger Stage 😮

Thursday, February 27, 2025

PlayToEarn Newsletter #260 - Your weekly web3 gaming news

WTF is open-source marketing mix modeling?

Thursday, February 27, 2025

Marketers should be wary of open-source programs promoted by purveyors with a walled garden history. February 17, 2025 PRESENTED BY WTF is open-source marketing mix modeling? Marketers should be wary

👀 What Content Is AI Citing?

Thursday, February 27, 2025

Another parasite SEO gift for you 🧙✨🎩 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏