In December of 2019, which feels like quite a lifetime ago, I posted ten predictions about themes I thought would be important in the 2020s. In the immediate weeks after I wrote this post, it started to dawn on everyone - gradually and then suddenly - that the Novel Coronavirus found in Wuhan was not going to be a normal news cycle. And so, for a few years, any kind of forecast you could make about the 2020s had to take a back seat for current events.

But today, we’re at the halfway point through the 2020s, and not to downplay Covid or anything, but we’ve actually returned to something like our old story arc. So let’s check in and see how we’re doing.

For readability, I’m not going to quote the whole text of each prediction - but I encourage you to click through to the original piece, which I have left untouched, as I do for all of my posts.

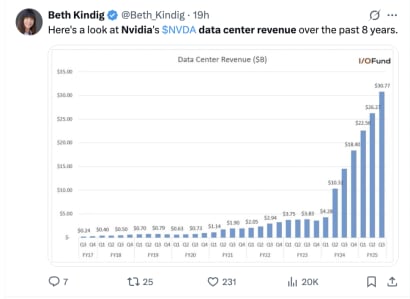

“The issue is that AI is really expensive. It’s more compute intensive, more data-intensive, more resource-intensive in general. The rewards will be immense, but AI businesses will face heavy fixed and variable costs. So there’ll be a huge advantage to being the market leader; more so than in the previous generation of SaaS businesses.” … “The scale advantages in AI businesses may simply become a new frontier for capital-as-a-moat funding strategies, and there’s a real danger that enterprise software could turn into Softbank 2019 v2.0. That’s life if you’re going horizontal, but it’s dangerous if you’re going vertical.”

So, I made two parallel predictions in the original call - one of which approximately played out, but the other didn’t.

The part I got right was “AI is going to be really compute and capital intensive, and capital-as-a-moat will continue to be a thing.” We absolutely did get this, and we’re now a couple of years into a giant Capex cycle for that exact purpose.

I got two things wrong, though. First, I was imagining this in a context of application companies themselves having to raise and spend all of this money, which isn’t what happened - instead, it’s the frontier models and the cloud giants burning capital, while application companies like Cursor and Replit reap the benefits. Second, I was wrong about this being a vertical market story - what’s actually happened was AI workloads taking over the most horizontal slices possible, like search, writing code, customer support.

And then there’s one last bit that I’m going to cheat and give myself half credit, which was the call about lots of term structure being required to fund all of this. Well, I can’t say I got the call right exactly, but the invention of the GPU-backed loan (or whatever the structure variant) has got to count for something.

“If you went forward in time to 2029, you’d be surprised that the phones are more or less the same. The 2×5 inch glowing glass rectangle will remain more or less similar as our common interface with the internet and with the world. Nicer in some ways, and they’ll have some genuinely cool AR features, but other than that? We figured out the phone. It’s gonna stay put now.

What’s inside the phone will be radically different, for sure – the “re-nationalization” of technology into Western and Eastern tech stacks will place some really interesting pressures on the hardware under the hood. It’ll be especially interesting to see what happens to the Android ecosystem as these pressures intensify.”

Correct, although this was a pretty boring prediction. When I think back to the time of writing this, there was some real hype around AR/VR and new form factors - the Oculus Rift S shipped that year; the rumour mill about Apple shipping smart glasses had kicked into rhythm. And there was a narrative around AirPods being the true gateway into native AR that was a fun thesis. But all in all, the phone was clearly staying put as the device and it’s clearly stayed that way.

Rereading this, I’m a bit disappointed that my hope for cooler vision features out of the iPhone haven’t materialized. Maybe we’ll get them in the back half of the decade, as Apple flexes its on-device computing advantage for making AI useful in the real world. I hope so, that’d be neat.

“In the next decade, watch for this rivalry to take shape. … Each city’s tech scene will come to resent the other’s more and more, and allegiances will be hard to shake: NYC will resent SF for its endless reservoir of technological and tech-cultural capital; SF will resent NYC for being a place people actually want to live. But most importantly, both tech scenes will come to resent each other for being more alike than different with each passing year.”

Our first F. Clearly failed here; this didn’t happen, it’s not going to happen. I will note that there was that little storyline about “Miami vs SF” for vaguely similar reasons, but doesn’t count as redemption. I’ll leave it there; that prediction was a zero.

(If this is happening and I just don’t know about it, please let me know!)

“Over the next ten years, after our current hangover gets truly washed out, a new one is going to emerge that’s a lot stronger, a lot darker, and a lot more true to the original vision than many people would like to admit: crypto as a part of “Dissident Tech”. … Expect the crypto community to retrench and double down on a core value proposition: crypto as a tool for political and societal dissenters. This means people who don’t really care what the price of Bitcoin is; they actually care about it being uncensorable. That means people who are doing illegal things, it means people on the wrong side of governments, or it could simply mean freedom-oriented people. But the narrative will turn really sharply once the core value proposition embraced genuinely becomes ‘be un-censorable’, as opposed to ‘get rich’.”

Ok so, there were three parts to this prediction and I get some pretty divergent grades when you break them down.

The first guess was, “Crypto winter for quite some time; it’ll come back as Dissident Technology before Number Go Up technology.” F! Or at least, like, D minus. That is not what happened.

The second guess was specifically around ghost guns and payments. There has been some story here; not the literal headline I’d imagined, but the Supreme Court hearing around regulating gun 3d printing under firearm rules did key into crypto payments as part of that grey market ecosystem.

The third part, though, I think I nailed, and that’s on the topic of privacy itself. There is zero doubt that privacy and free speech has come to the forefront as a major global issue for our time. And it’s pretty obvious to anyone paying attention that the origin of this energy came from in and around the crypto community, from the Free Ross movement to the un-cancellable movement. I don’t think it’s a coincidence at all: the social ethos of that community was a critical incubation ground for what’s now a full-blown reactionary movement, and I’m not sure it gets going in the same way had crypto not been around in 2021-2022.

So, I’m going to cheat and take a hybrid midterm grade of “D on the literal call, but B on the broader story.”

“I think that the narrative that American higher education is going to collapse in a matter of years is just totally false. There are so many structural forces holding the system in place, and (for most middle or higher income families) so much professional and reputational risk associated with not going to college, that the undergraduate experience isn’t going anywhere.

Grad school, on the other hand, is a totally different story. I’m going to write a whole newsletter about this in the new year but for the time being, I think both “classes” of grad school – professional degrees and research degrees – are going to be disrupted pretty dramatically, and pretty soon.”

Mixed bag here. On the one hand, there was this trend five years ago around “ISAs fully replacing college for most people” that I thought was nonsense, because it completely misunderstands the societal role of college. Yes, it has quietly become more acceptable for specifically motivated and capable people to skip straight to building things, but for the most part, the undergrad education pillar is unchanged and it probably stays that way for a long time. I think that was a pretty easy call so it shouldn’t contribute much to the overall grade on this one.

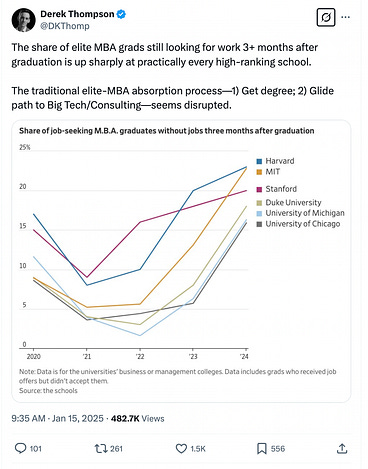

Grad school, on the other hand, remains ripe for a wave of disruption that we haven’t seen play out yet. Two months following the original post, I wrote down my thoughts on the graduate student industrial complex in Can Twitter Save Science?, and I remain a big fan of that piece as a coherent expression. And the big Trump shakeup of the NIH budget for university overhead, if it goes through, will have a massive impact on how these places actually function.

And it does look like the shine is starting to really come off of the MBA-to-consulting pipeline, among other job pathways:

On the other hand, the guess I’d made around the big trend being “Companies going all-in on post-undergrad vocational training programs” doesn’t look like it has legs, at least not that I’ve noticed. Still, these are early changes and the system still has a lot of inertia that’s still in place. So overall I’m giving myself a C here: we haven’t seen the rate of change that would be necessary for this prediction to earnestly come through by the end of the 2020s. But some of the trends are right, so we’ll see in five years.

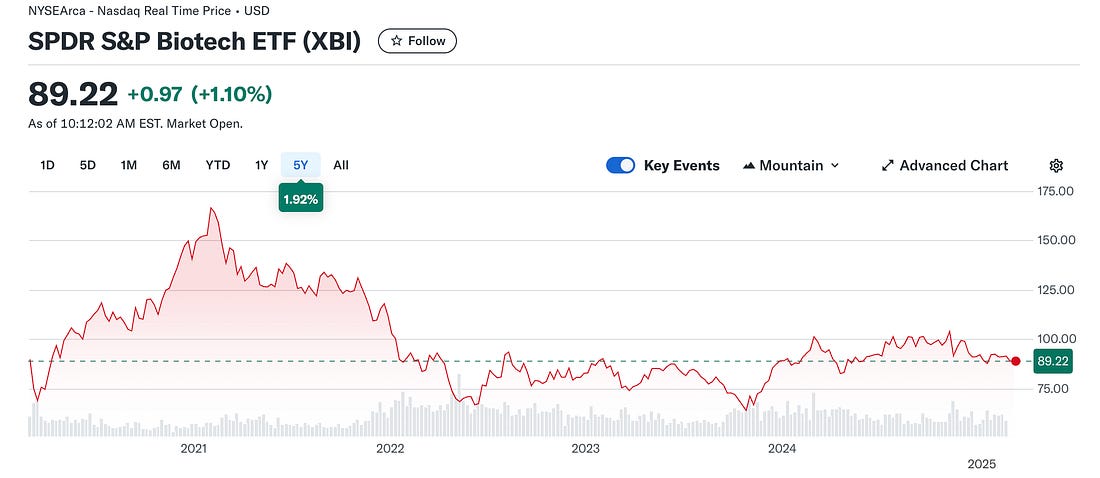

"Biotech is really an ideal sector for mass speculation. It impacts everybody, and it’s inside everyone and everything: the TAM of “biology” is infinite. It’s incredibly complex, so it’s easy for novices to grasp onto a story and its importance without understanding the reality of it. And it’s full of high-leverage potential: it’s totally plausible that biological breakthroughs in health, manufacturing, fuel, etc could generate tens or even hundreds of billions of dollars of value.”

OK so, technically there was a speculative bubble in biotech right after I wrote this:

But, like, that doesn’t count and we all know it. That was an everything bubble; biotech just went along for the ride.

However, I absolutely stand by this call some time in the next five years, or maybe ten, because of this guy:

In a couple years, I think we’ll have made enough progress on AI applied to scientific discovery that people’s expectations around “what is possible in life sciences” to reset pretty dramatically. The less comprehensible it is to retail investors, the better. I’m giving myself an “Incomplete” here because it is actually too early to tell for this one.

“Act One of Google was building the world’s greatest search engine, with the world’s greatest business model. Act Two of Google was colonizing the infrastructure of the internet, like a technological British Empire, in order to protect and fuel its crown jewel capital. The 2020s will be Act Three. As the decade begins, Google may well face the biggest real opponent they’ve ever fought – the United States – at a moment where its internal morale and purpose are crumbling and adrift. They print money, but if you ask me, they’re at risk.”

Welp,

I think I got this one more or less right. At the time I was writing this, everyone was really negative on Amazon and Facebook, who’ve since done fabulously. Google, on the other hand, had a vaguely uneasy feeling about it but was clearly in everyone’s conventionally good graces. Sure enough, the worries I expressed in that prediction have totally played out, culminating in the DOJ calling for Google to forcibly divest Chrome this past November.

The line I regret the most in this piece was “They engage in by far the most actually anticompetitive behaviour of any tech giant”. In hindsight, I wish I’d written instead, “Aside from Apple, who is far worse, but gets away with it.” I’ve learned a lot in the past five years about how critical Google’s work supporting Chrome has been to keeping the web healthy, and in a better state than the dark days of the browser wars.

The thing is, they’re still… doing fine? The stock is up 150% since I wrote this (along with its peers), so it’s hard to argue that the company is “in trouble” by that standard. Moreover, a little paper out of Google called Attention is All You Need went on to redefine the entire field of software and technology, and you hear a lot fewer voices today saying Google wastes their entire R&D budget. But maybe that underscores the point further: Google helped break open what’s now possible with LLMs, and Gemini is quietly pretty good. But it’s clear that Google isn’t disproportionately enjoying the outcomes here: all of its peers have gained as much or more in strategic options and value.

Overall I’m going to give myself a good grade on this even though Google clearly isn’t going to go out of business or anything like it - the trend was correct.

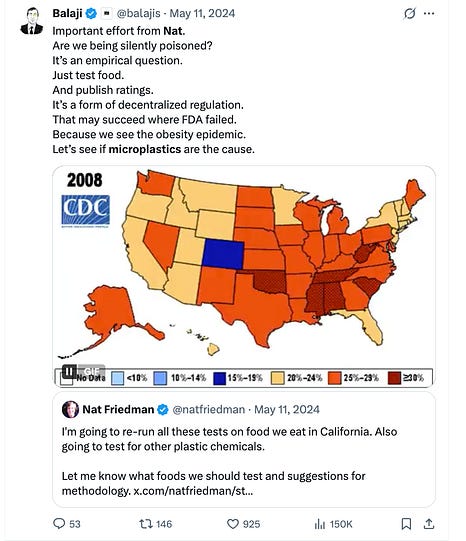

“At some point in the 2020s we’re going to have another Leaded Gasoline crisis. We’re going to learn that some sort of chemical or microscopic thing that’s inside everything, all around us, actually has some horrible health effect we never knew about before. My pick for what it’ll be? Microplastics – particularly the microplastics inside clothing, like athleisure. The funny thing is, we already know that all of the fancy microplastic stitching and fabric material we put inside athleisure are terrible for the environment. That stretchy, comfy feeling comes at at an affordable price point, but a terrible environmental one – we already know this. But no one cares. We’ll start caring, though, when it turns out that they’re hazardous to us in some way we never understood before.”

Two parts to this one, and I’m gonna go ahead and say I aced them both. First all, there’s the moral panic component to it - which isn’t about ethics exactly, it just means, “This is going to become a popular cause”, and I should’ve originally articulated it that way, but that’s what I meant and I think it reads pretty clearly. Some people who’ve been ahead of the curve on this, like Nat Friedman, have already made a big impact on elites thinking of this as a problem. But as far as popular awareness is concerned, there’s no more obvious sign of “Things we are eating are poisoning us” as a popular meme than our friend here:

Moreover, I’m also going to claim credit for the prediction that the actual source of most microplastics in food - as far as we understand it - is actually from our clothes. For all our focus on processed food preparation, which is important for lots of reasons, the real source of this stuff is external.

Anyway, I’ll claim my first and only A grade for this one. I’ll need it for my GPA though, cause the next one was another clunker on my part:

“We really haven’t yet seen the real extent of what the internet will do to political campaigning. I’m betting that the next creative wave isn’t going to come from the campaigners, but instead from opportunistic hustlers on the outside who figure out how to hijack them. … Hustlers and entrepreneurs, even more than politicians themselves, will figure out the formulas for how to force the media to cover you as a campaign story, almost certainly to the detriment of the primary process itself.”

Nope! Got that one totally wrong, at least so far. This did not remotely happen, as I’d imagined it. I will give myself a D as opposed to an F just because Trump himself has proved willing and able to keep doing all kinds of merchandising schemes as a part of his campaigning and executive style. But I had imagined a situation where the political establishment would actually lose some amount of control over what elections actually are to the reflexive power of social media and entrepreneurial hucksterism. That didn’t happen at all, so, bad grade for me.

#10: A real startup scam is going to seriously spook the Silicon Valley community.

Grade: A-

“I’ve long believed that the real mystery of Silicon Valley isn’t the outsider question, “How is Silicon Valley so wild and crazy”, but actually the insider question: “How is Silicon Valley so stable?” It’s built on speculative finance, it’s full of experiments whose outcome you can’t know for years, and it has to move fast enough and fluidly enough that (at early stage anyway) it effectively works on the honour system despite the FOMO environment. It’s so interesting how, in this environment, there aren’t any scams like this. … One of the important components of Silicon Valley working well is early stage investors willing to write checks without really having to worry about the downside – the worst you can lose is 1x your money. Financially, that’ll be true, scam or not. But reputationally? If a high profile scam becomes the talk of the town, there’s nothing scarier than everyone else knowing that you fell for it.”

I really struggled with what grade to give myself for this one. On the one hand, the prediction clearly came true, hilariously so, at a bigger scale than I could’ve possibly imagined.

That being said, I did describe something somewhat different from this in the prediction: a situation where investors fall in love with a genius founder(s), the founders illegitimately raise lots of money and abscond with it, and investors are left having to answer for “how did you fall for this?” And that is definitively not what happened with FTX. This wasn’t a fundraising scandal; unless you argue (correctly I guess, but pedantically) that FTT token was a fundraising instrument. You can absolutely argue that this prediction did not come perfectly to pass, on those grounds, and I’d accept that.

But the part of the prediction that did go right, in the funniest possible way, was the second-order consequences of “Why were you so captivated by this guy”. Which, in some ways, was the spookiest. It’s not just that everyone loved SBF, it’s that, 1) specifically, Sequoia Capital gave him the highest possible blessing you can get in tech, and 2) we had this amazing storyline of his genius transcending normal human rules. (There was that great story in the Michael Lewis book of SBF at Jane Street betting max-aggressive on every single round of the intern game, which everyone interpreted as “This guy is built different” but in respect may have suggested an alternate reading, “Maybe he’s bad at bet sizing?”)

But even funnier was the narrative of how good SBF was at League of Legends - how he’d be playing during VC pitch meetings, and the magic was working so powerfully that this was taken as a strong vote of confidence.

As it call came crashing down, the absolute funniest part was the revelation that his League of Legends rating wasn’t even that impressive, and anyone could’ve looked and seen that. The scriptwriters get extra points for making AOC deliver the crushing blow.

Nothing actually broke (as predicted), but the chill was very real, in exactly the way we’d thought: he became a pariah not only for how he ran his company, but for breaking a very sacred promise that Silicon Valley collectively makes to itself: that whatever happens, success or failure, we’re not going to spook the magic. Instead, now we’ll forever have the amazing artifact of baffled Matt Levine: “You’re just like, well, I’m in the Ponzi business and it’s pretty good.”

That’s it for now - I’ll check back in another five years for my final report card. How do you think I did? If you wildly disagree with any of these grades, I’d love to hear from you.

If you’ve made it this far: thanks for reading! I’m back writing here for a limited time, while on parental leave from Shopify. For email updates you can subscribe here on Substack, or find an archived copy on alexdanco.com.