Hi y’all —

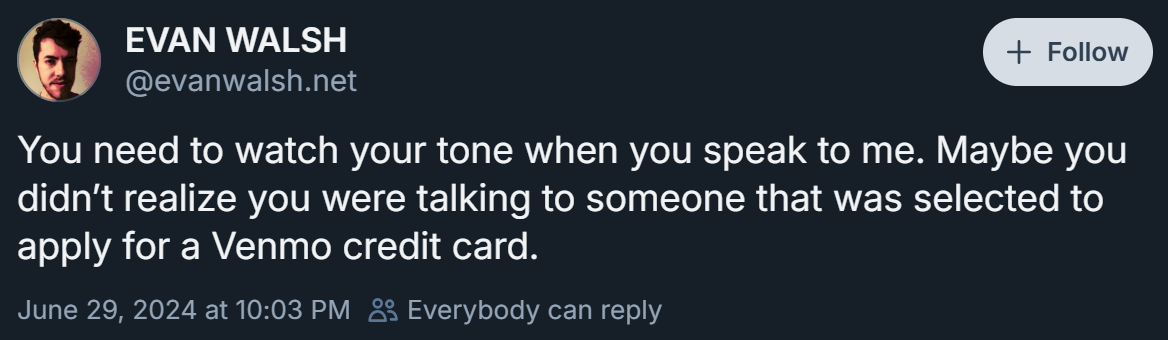

In these unprecedented times — amid tariffs and the Supernatural reunion — there's one thing I can count on. And it's that every two weeks, Venmo will email me about its credit card.

"You've been invited to apply for the Venmo Credit Card," reads one subject line, which I received on both Jan. 27 and Jan. 11. "You've been selected for a $200 bonus offer with the Venmo Credit Card," reads another, which I got on Nov. 9, Dec. 11 and Dec. 24. "You have excellent approval odds for the Venmo Credit Card," crows a third, which I received on March 1.

It's nice to be wanted, but this is getting ridiculous.

It's not just Venmo, either. Although its missives are the most frequent, I receive emails from Wells Fargo and even cardstock mailers from American Express to the same effect. I'm suspicious of them all.

What does being "prequalified," "preapproved" or "invited to apply" for a credit card really mean? What's the point?

Jennifer Doss, executive editor at CardRatings.com, says the companies aren't sending me compliments because I'm just sooo amazing. They're using flattering language to persuade me to apply for their products.

Credit card issuers make money from interest, annual fees, late fees and interchange fees, the last of which are fees merchants pay to credit card companies every time a customer uses their card for a transaction. In 2021, interchange fees generated about $31.6 billion.

It's basic business: The more customers a company has, the more transactions they make, the more revenue it can earn. They want me to apply. And in a sea of other emails and competing offers, one easy way to stand out is to make me feel exclusive.

In reality, Doss says preapprovals happen when a credit card issuer evaluates someone's credit profile using a soft pull "just to see" if they meet its predetermined criteria for a certain product. They're similar to prequalifications, which customers may initiate themselves or require a bit more information to generate.

The terms are used interchangeably, but "neither mean that you're guaranteed for approval," she says.

While it's not a total shot in the dark — Doss says credit card issuers have "processes in place to make sure they're targeting the appropriate candidates" — it's far from a sure thing.

"You have a very good shot," she adds. "The issuer has already looked at your credit profile, and there's probably a really good chance that you will be approved for the credit card. But whatever term you use, there's never an actual guarantee."

Opening a credit card typically requires a customer to legitimately apply, which involves signing off on a hard inquiry into their credit so an issuer can review their payment history, income and so on. I can't be approved until all of that happens.