Coin Metrics - How-ey Can Get Out of Here

Get the best data-driven crypto insights and analysis every week: How-ey Can Get Out of HereKey Takeaways:

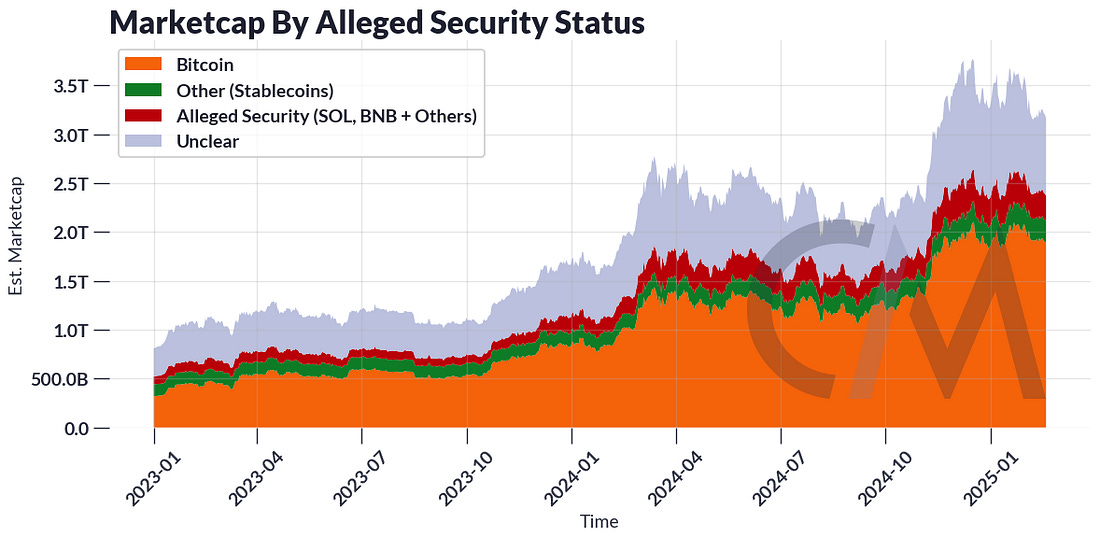

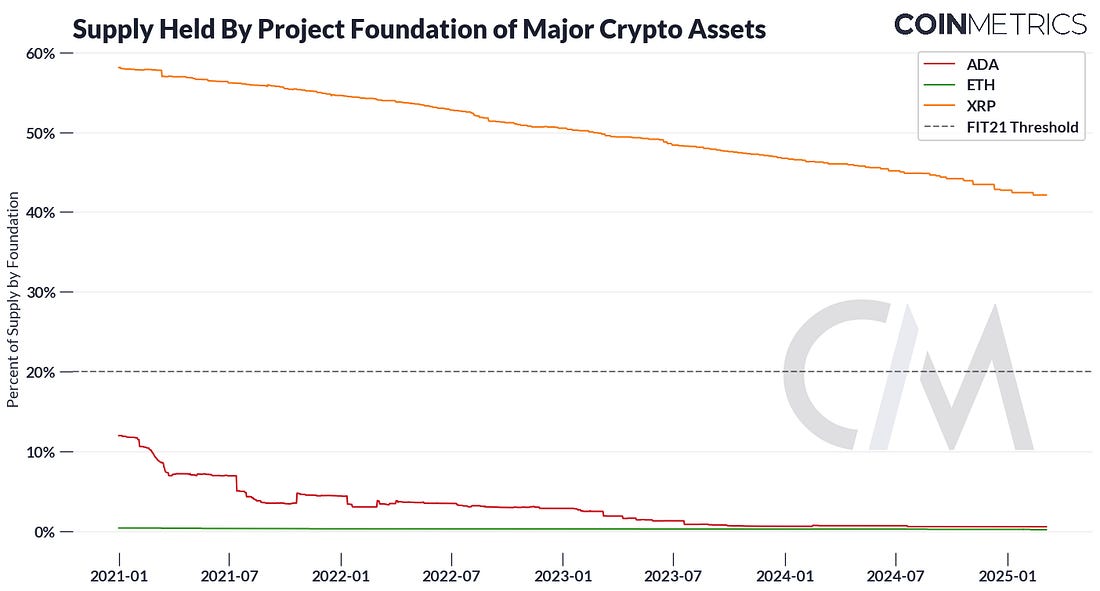

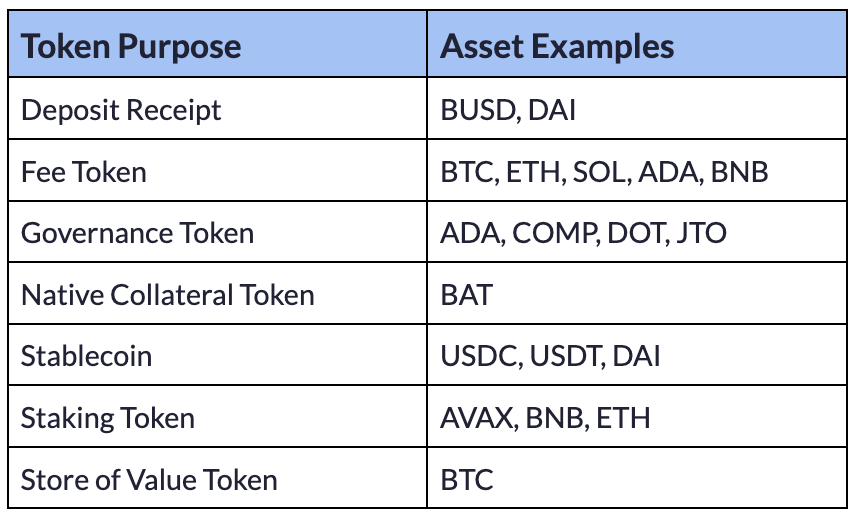

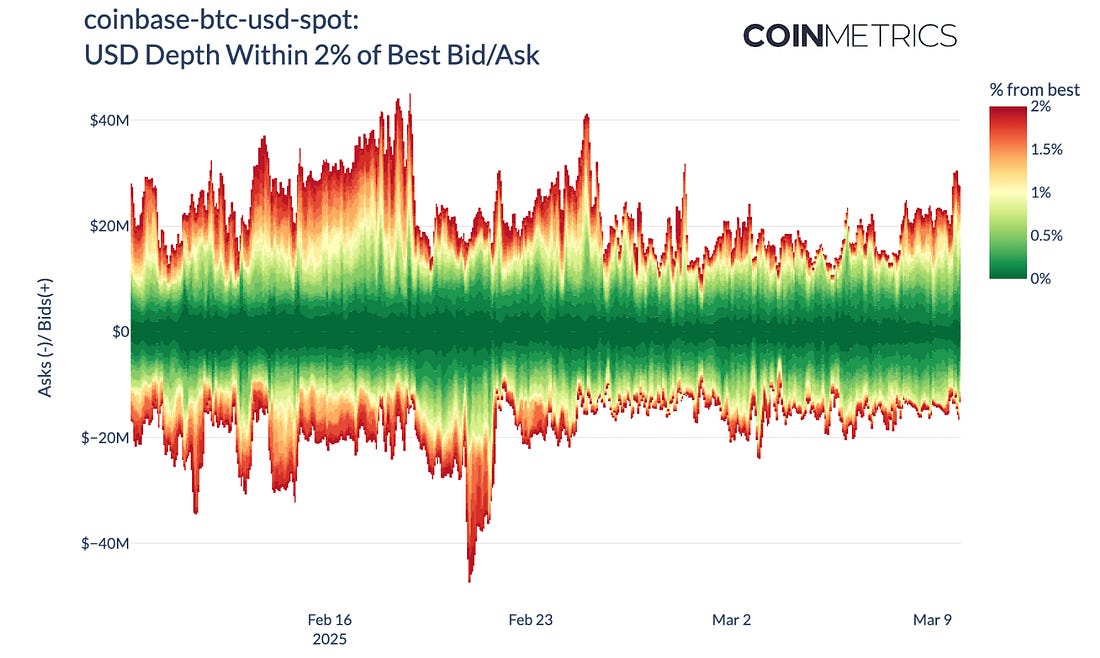

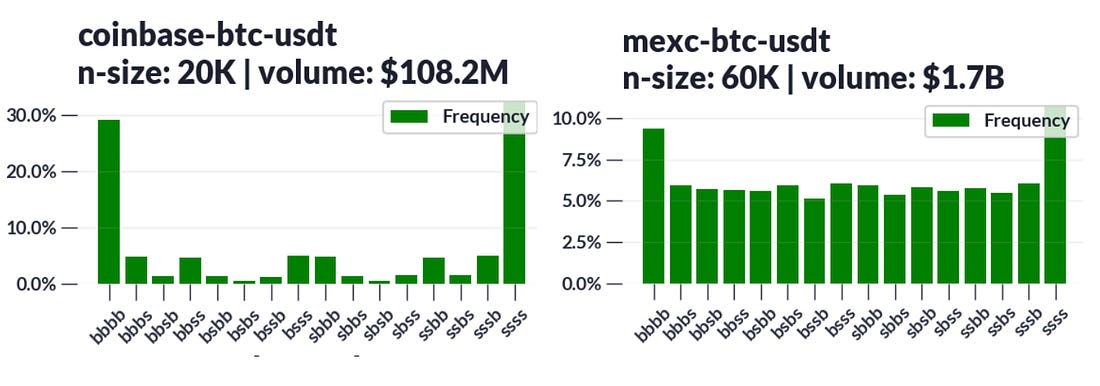

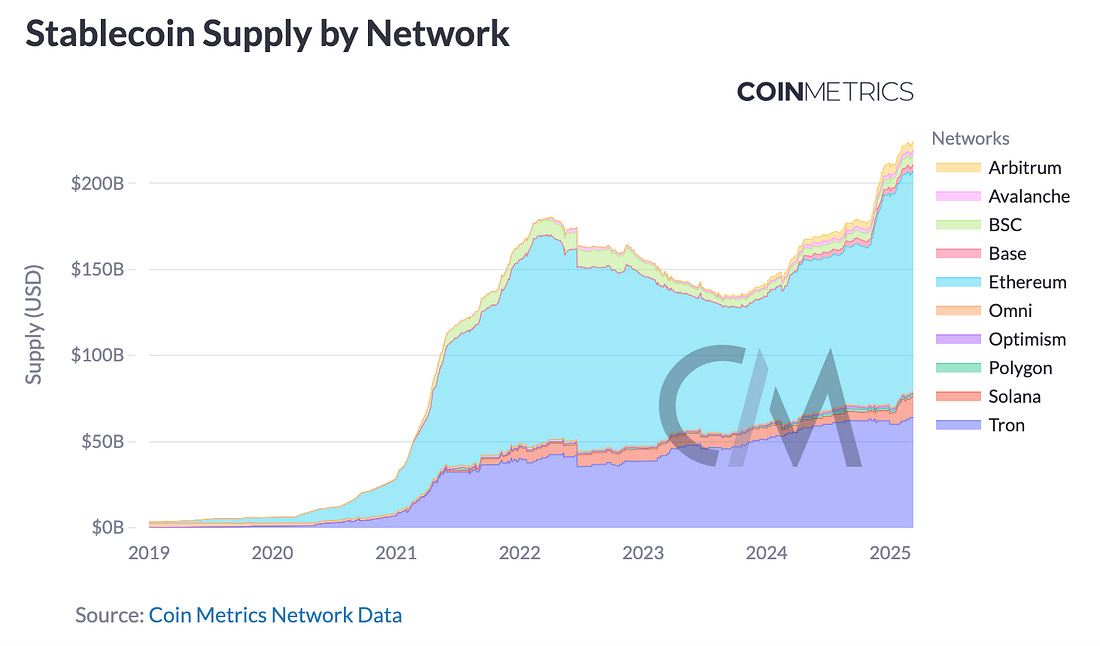

IntroductionThe distinct properties of crypto assets have fueled debate over how they should be regulated under US securities law. Under previous regimes, the Securities and Exchange Commission (SEC) has alleged tokens such as XRP, ADA, SOL, and several others to be unregistered securities and have sued crypto exchanges and trading platforms for selling unregistered securities. Some in the crypto industry argue that the SEC has not provided enough regulatory clarity and was “regulating by enforcement”, as evidenced by enforcement actions against Coinbase and Kraken, among others. Under new leadership, the SEC is signaling a less adversarial regulatory approach. This shift is supported by two articles published by SEC Commissioner Hester Peirce in an effort to engage with the community. The first, titled "The Journey Begins," explains how the SEC is reconsidering its regulatory approach to crypto and describes its plan to establish more explicit regulations. The second, titled "There Must Be Someway Out of Here," offers a series of questions to explain how to approach the enforcement of these regulations. In this issue of Coin Metrics’ State of the Network, we'll address some of Commissioner Pierce’s questions and demonstrate how on-chain data can clarify regulatory ambiguities. Testing Howey By Tracking Common Enterprise OwnershipThe regulatory classification for crypto assets has serious implications for a large segment of the market. Of crypto’s roughly $3T market cap, about 25% are assets whose security status is unclear (including ETH, which previous SEC chair Gary Gansler notoriously avoided classifying explicitly), 8% were alleged to be securities in previous SEC lawsuits (includes SOL, BNB, ADA, and others), with the remaining 7% to be on-chain derivatives including stablecoins. Note that stablecoins were not exempt from being alleged as a security under the previous regime, as indicated by the SEC’s allegations against BUSD. Source: Coin Metrics Network Data Pro Recall that the SEC has historically leaned on the Howey Test to classify whether or not an asset is a security. The Howey Test consists of the requirement that an "investment contract" exists when there is the (1) investment of money (2) in a common enterprise with a (3) reasonable expectation of profits (4) to be derived from the efforts of others. We’ll take for granted the tokens themselves are investment contracts, rendering them eligible for the Howey Test*. For some background on how the Howey Test and subsequent guidance by the SEC can translate into on-chain metrics, check out From Orange Groves to Orange Gold. Public blockchains make disclosing the vested interest of a common enterprise possible to do in real-time. If a common enterprise were to disclose their addresses, we can track the level of ownership they have within the ecosystem, such as foundation held supply and the flow of funds across different entities (e.g. exchanges). By combining this power with a clear threshold, such as the 20% from the proposed FIT21 Act, we may arrive at an unambiguous classification of whether a token is a security. Source: Coin Metrics Network Data Pro However, there are caveats. Some projects do not disclose the amount of the token's total supply that they own. There are also technical challenges that make auditing high throughput blockchains, such as Solana, difficult. In Solana's case, 12.5% of its supply was disclosed to belong to the foundation at inception, although the sheer size of data it produces (~one day of Solana data is the equivalent to roughly one year of Bitcoin data) make it challenging to audit in real-time. *This is the basis of the SEC’s “embodiment” theory in past lawsuits. But it’s still possible for an asset to be *sold* in a securities offering even though the asset itself may or may not be a security, as was the case on the XRP decision. A Utility Based Approach to Crypto Asset ClassificationThe range of uses for crypto assets has grown tremendously in size and complexity. These functions include facilitating transaction fees, granting voting rights in on-chain governance or securing a proof-of-stake (PoS) network. To keep track of these developments, we created a classification system for crypto assets based on their economic context of use. Regulators can use this structured framework as a complement to the Howey Test to better understand a token’s utility and the overall structure of the crypto industry. Source: Coin Metrics Asset Profiles There are many instances where a single asset serves multiple purposes. It’s valuable to understand a token's utility in the context of the operations it supports, rather than in isolation. A recent report by a16z Crypto delves into the distinction between network tokens and company backed tokens, emphasizing that they derive value from open vs closed systems. For instance, ETH and BNB share the purpose of being a fee token and staking token. However, they should likely be approached differently as BNB is intrinsically tied to the operations of the Binance ecosystem, including the exchange and BNB Chain, whereas ETH functions as a means to transact on and secure a decentralized network with no central oversight. Governance tokens also introduce a unique dynamic, as tokenholders can vote to expand their own utility. In the case of Uniswap, the proposal for turning on the “fee switch”, a mechanism for accruing protocol revenue to the tokenholders, would risk implicating the UNI token as a security. This creates a dilemma where a decentralized community has to weigh the rewards of ownership with legal risk where the rules are not known. Clearer regulations could provide a pathway for these tokens to capture value in a compliant manner. By leveraging utility-based classifications alongside on-chain data, policymakers can develop a more tailored regulatory framework to assess different crypto assets, determine whether they fall under securities laws, and facilitate capital formation for decentralized protocols. Monitoring the Crypto Markets for Fairness, Order, and EfficiencyAnother major focus of the regulatory discussion revolves around the trading of securities and non-securities in secondary markets and the extent to which regulators can monitor activity taking place on these platforms to maintain fair, orderly and efficient markets. Crypto markets operate with an inherent degree of transparency due to exchanges such as Binance or Coinbase exposing their trading data via API and the ability to leverage on-chain exchange data from public blockchain ledgers . We connect to real-time feeds of several exchanges, capture the state of the orderbook at any given time (orderbook snapshots), and aggregate them to form the basis for essential liquidity metrics, such as bid-ask spreads, slippage and order book depth. Exposing data in these forms allows us to understand how liquidity is distributed, how efficiently trades are executed, how markets respond to large shifts in supply and demand, and the execution across “off-chain” and “on-chain” trading venues. Source: Coin Metrics Market Data Feed, Orderbook data Maintaining a 24/7/365 connection to these exchanges pose many challenges, as we documented in our API Quality score in our Trusted Exchange Framework. Not all exchange APIs are created equally: outages still happen and data exposed via API can be incomplete. Regulatory agencies or any other parties interested in monitoring the market must balance between connecting to exchanges directly or outsourcing this to organizations who’ve already built the infrastructure to plug into these APIs. Finding Evidence for Market ManipulationOrderbook data can also offer visibility into forms of market manipulation and irregular trading behaviour. For instance, we can identify trade permutations that deviate from organic market activity and are associated with wash-trading. In well-behaved markets (coinbase-btc-usdt), trade sequences tend to feature consecutive buy and sell orders, reflecting natural shifts in market supply and demand. In contrast, markets exhibiting signs of wash trading often display an unnaturally uniform distribution of orders, suggesting inflated market activity rather than genuine market-driven trading (mexc-btc-usdt). Source: Coin Metrics Trusted Exchange Framework 2.2 This methodology can be extended to less liquid markets, where there is more incentive to inflate market activity. ConclusionAt its core, the spirit behind securities law is to smoothen the information asymmetry between privileged parties and the public. Crypto’s ingrained cypherpunk values of free-market, permissionless innovation often seem at odds with the SEC's mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. But, these two do not have to be in conflict because both technology and law enforcement ultimately exist to serve the people. At Coin Metrics, we have over 6 years of experience in studying blockchain data and understand its immense potential to promote transparency. We’ve also become intimately aware from collecting data across several protocols that not all crypto projects adhere to standardized or comprehensive disclosures. Data can play an integral role in surfacing the many bad actors that disrupt the mission of building a more interoperable financial system. While this report only addresses a fraction of the questions on the SECs agenda, we welcome the Crypto Task Force to leverage on-chain data to develop clear, thoughtful regulations that will foster a thriving crypto industry. Network Data InsightsSummary HighlightsSource: stablecoins.coinmetrics.io As markets cool off, aggregate stablecoin supply has stabilized around $223B. Ethereum and Tron hold 85% of total supply, while Solana and Base have expanded to $11.8B and $3.6B, respectively. Coin Metrics Updates

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bybit Burglarized For a Billion

Thursday, February 27, 2025

Analyzing the Bybit hack with on-chain data ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏