The income needed to purchase a typical U.S. home has increased by 79% in just 5 years

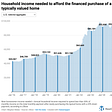

The income needed to purchase a typical U.S. home has increased by 79% in just 5 yearsThe problem is that incomes haven’t kept up with housing costs.To investors, Home affordability is the worst it has been in decades. The problem is so bad that I decided to do something about it just over a year ago — I cofounded ResiClub, the leading residential real estate analytics and content platform, with Lance Lambert, who I believe is the best residential real estate reporter in the country. Our thesis is simple — you can’t solve a problem if you don’t understand it well. Below is a guest post from Lance where he explains just how bad home affordability has become in the United States. You can subscribe to ResiClub and receive a free daily email about the housing market here: Subscribe to ResiClub Strained housing affordability isn’t just squeezing household budgets—it’s holding back the entire U.S. economy. Some of the nation’s most talented workers are unable to move to the top job markets where they could contribute the most. That loss of mobility means less innovation, fewer startups, and slower economic growth. At the same time, high housing costs are forcing many Americans to delay starting families—or have fewer children than they otherwise would—reshaping the country’s demographic future. And with more household income tied up in housing payments, consumer spending in other areas suffers, further dampening economic momentum. America’s housing affordability pinch isn’t just a personal problem—it’s a national one. Here’s the annual U.S. household income needed to purchase a typically valued $356,776 U.S. home:

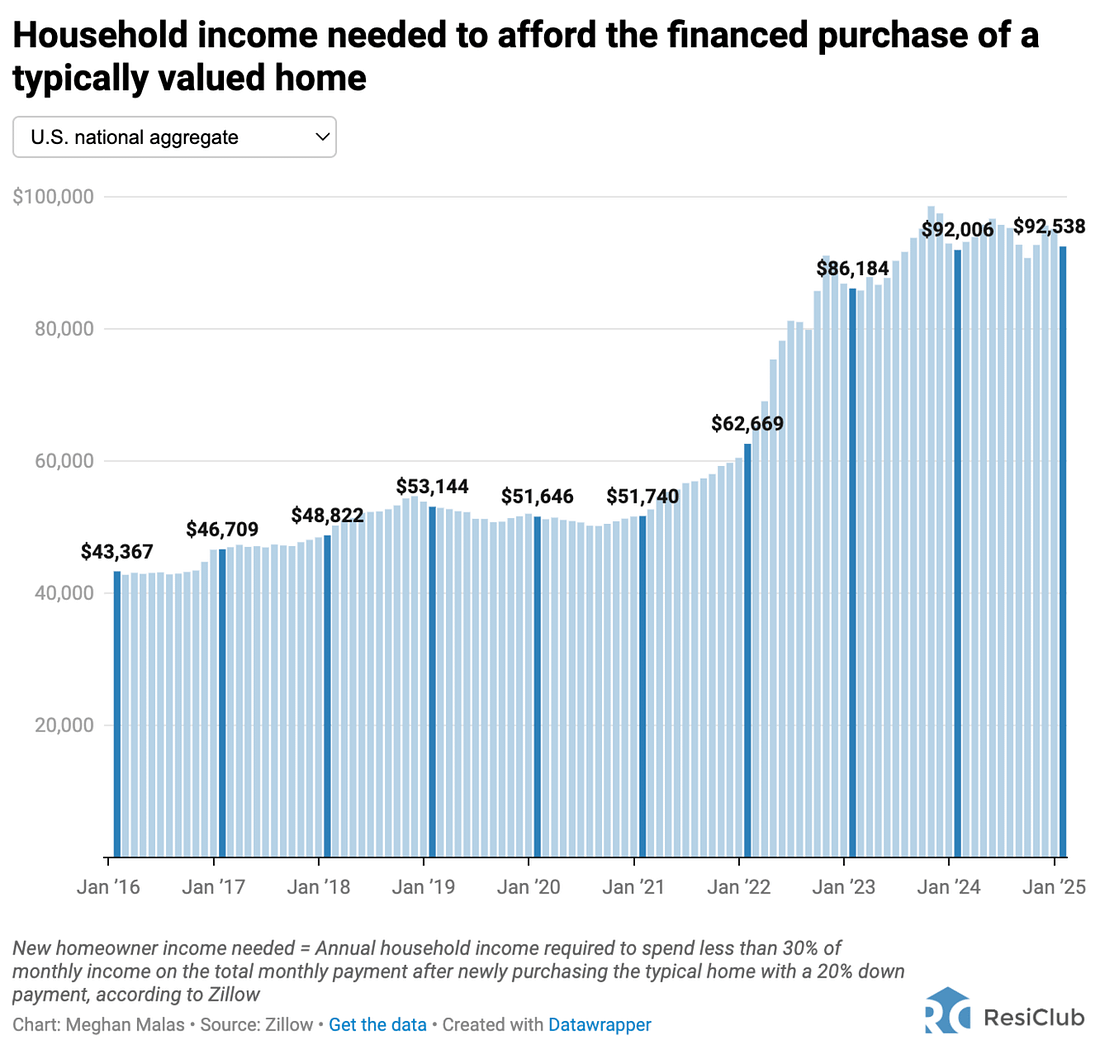

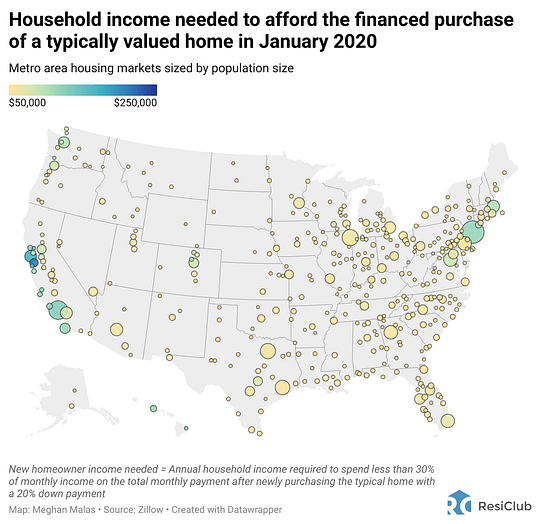

That’s a +79% shift in just 5 years. And here’s the thing: This is a very conservative methodology. Zillow calculation assumes a 20% down payment and the homebuyer spends less than 30.0% of their monthly income on the total monthly payment. This is a financed purchase, of course. For typical home value, Zillow economists used the latest Zillow Home Value Index reading. Click here to view a searchable version of the chart below displaying the analysis in 400 metro area housing markets [best done on a desktop] How did we get here? During the Pandemic Housing Boom, housing demand surged rapidly amid ultralow interest rates, stimulus, and the remote work boom. Federal Reserve researchers estimate “new construction would have had to increase by roughly 300% to absorb the pandemic-era surge in demand.” Unlike housing demand, housing supply isn’t as elastic and can't quickly ramp up like that. As a result, the heightened pandemic-era demand drained the market of active inventory and sent national home prices soaring. The typical U.S. home value measured by the Zillow Home Value Index in January 2025 ($356,776) is still a staggering +44% greater than in January 2019 ($247,106). That overheated home price growth, coupled with the ensuing mortgage rate shock, with the average 30-year fixed mortgage rate jumping up from under 3.0% to over 7.0%, has created the fastest ever deterioration in housing affordability. This affordability squeeze has been broad-based. Click here to view an interactive version of the January 2020 map below. Click here to view an interactive version of the January 2025 map below. The problem, of course, is that incomes haven’t kept up. While the annual U.S. household income needed to purchase a typical U.S. home has increased by +79% between January 2020 and January 2025, average weekly earnings of U.S. workers have risen by +25%, and overall U.S. consumer inflation has grown by +23% during the same period. What’s the impact of this housing affordability deterioration on the housing industry?The biggest immediate impact of this affordability deterioration is that across the country existing home sales have been constrained since mortgage rates spiked in 2022. Some of that’s the result of suppressed housing demand, but a lot of it is due to the fact that many homeowners who’d like to sell their home and buy something else simply can’t afford to do so or don’t want to part with their lower monthly payment/mortgage rate. I hope you enjoyed this guest post from Lance Lambert, cofounder and Editor-in-Chief of ResiClub, your gateway to the US housing market. You can subscribe to ResiClub below to receive a free daily email about the residential housing market. - Anthony Pompliano Founder & CEO, Professional Capital Management The Best Performing Stock Of Last Year Embraced Bitcoin Simon Greovich is the President & CEO of Metaplanet. This conversation was recorded at Bitcoin Investor Week in New York. In this conversation we discuss Metaplanet buying bitcoin and becoming the best stock of the year, the best tools are for acquiring bitcoin, economic conditions in Japan, getting exposure to global markets, growth expectations, educating Wall Street, and how people can help. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Investors Have Been Using Stocks To Hide From Inflation

Monday, March 24, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Economic Data Is Wrong And The Fed Should Have Cut Rates

Thursday, March 20, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Will The US Government Acquire More Bitcoin?

Wednesday, March 19, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Stock Market Is Not Crashing - Here Is Proof

Tuesday, March 18, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

612376 is your Substack verification code

Tuesday, March 18, 2025

Here's your verification code to sign in to Substack: 612376 This code will only be valid for the next 10 minutes. If the code does not work, you can use this login verification link: Verify email

You Might Also Like

👯Got ya feelin' social

Tuesday, March 25, 2025

The 2025 State of Social Media report is here View in browser Masters In Marketing If you remember MySpace Tom, it's time to update your social media knowledge. (And take your Metamucil with me.)

💓 Build a business with a purpose

Tuesday, March 25, 2025

How your values, culture, and passion can power your business. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Read this if you're making LESS than $1000/month online...

Tuesday, March 25, 2025

First our guest will reveal a "trifecta" of rule-bending strategies... View in browser ClickBank Hi there, Just a quick reminder to register for tomorrow's 30 Day Commission Challenge

♦️ Why your brand needs an ideology to stand out (and how to develop one)

Tuesday, March 25, 2025

And why some brands are like political parties... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Boost your brand with influencers beyond social

Tuesday, March 25, 2025

Key strategies to stay ahead and thrive this year ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 25th 2025

Tuesday, March 25, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Drunkdeer (trends) Chart Drunkdeer specializes

We’re Back: Q1 Was a Record for Tech Acquisitions in Dollars

Tuesday, March 25, 2025

But Deal Count? It Isn't Close to 2021 To view this email as a web page, click here saastr daily newsletter We're Back. Q1 Was a Record for Tech Acquisitions in Dollars. But Deal Count?

ChatGPT Gets a Personality Upgrade 🎤

Tuesday, March 25, 2025

and Meta gets rejected (ouch)!

The Farmer's Dog has its day

Tuesday, March 25, 2025

VC stands by cleantech; natural, organic products get a boost; The Bot Company grabs $150M for AI robotics Read online | Don't want to receive these emails? Manage your subscription. Log in The