This is the weekly free edition of The Diff, the newsletter that tracks inflections in finance and tech. Last week’s subscriber-only posts:

Software Mittelstand and Software Keiretsu: Mittelstand and Keiretsu are two different forms of businesses—family-owned B2B companies with close state relationships, and diversifide clusters of companies centered around a bank. They have interesting echoes in American software businesses.

Maneuver and Attrition in PR: PR strategies either relentlessly hammer the same message or constantly upend the narrative. There’s a science to it.

Mid-Sized Tech Companies as Arms Dealers: A new kind of deal I’ve been seeing recently is large tech companies partnering with other companies specifically to thwart a competitor. As every big company tries to commoditize its complement, this has implications for smaller tech companies and for big tech’s suppliers and customers.

Lucky or Smart?: Robinhood investors and recipients of options grants are two groups that prospered during the great Covid rally. Both groups got very lucky indeed.

Lemonade: Solving the Market for Lemons

Lemonade filed their S-1 earlier this week. Let’s dive in.

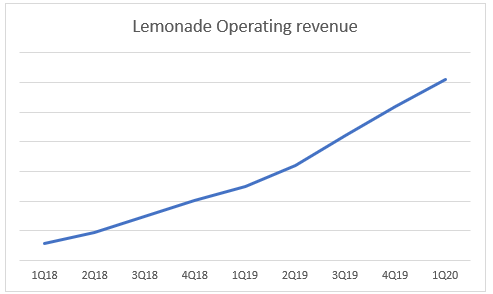

The way to understand every Softbank investment is to ask: if I saw a graph of their revenue, without a label on the Y axis, would I be excited? Here’s such a graph:

|

Not as good as this classic Softbank piece:

|

Much less this one:

|

The Y axis would technically tell you that Lemonade did around $25m in revenue in Q1 2020, for an annualized revenue run-rate of about $100m. Not huge for an insurance company, but it’s a start.

However, Lemonade is not an ordinary insurance company—or rather, insurance is not an ordinary industry. Every company faces some kind of constraint, and financial companies often have regulation-driven limits on how much business they can do relative to the capital they hold. That’s an annoying limitation for a growth company: it means they constantly need to raise dilutive equity capital to support their growth, even if that growth is profitable.

(It’s convenient for everybody else; in the developed world, you can generally assume that every insurance company is creditworthy, and that the risk you run when you make a claim is that they’ll find an excuse not to pay, not that they won’t come up with the money. So your due diligence consists of reading the fine print, not assessing a balance sheet.)

Fortunately for Lemonade, there are ways around this. Very broadly, the three things you need to sell insurance are the ability to underwrite risk, a way to reach customers, a balance sheet. Every company in the insurance industry needs some of the above (even brokers need enough capital to pay the bills between commission checks), but new entrants can choose how much of each problem they’d prefer to solve.

Lemonade is a bundle of bets, one on a theory of human behavior, one on a definite tailwind, and one on a probable opportunity.

The theory is that small insurance claims are a market for lemons. Policyholders know whether or not their claim is legitimate, insurers don’t, so insurers tend to treat policyholders as potential fraudsters, which is annoying to everyone but least offensive to people who are actually committing fraud. Lemonade wants to avoid this adversarial dynamic. In an interview (worth reading alongside the S-1), their founder talks about working with Dan Ariely to avoid the negative side of the tit-for-tat relationship.

The big tailwind is that reinsurers are overcapitalized. Anecdotally, reinsurers are not asking how to get more capital, but they’d really like to find something to do with their existing capital. This means Lemonade can grow using someone else’s balance sheet.

The uncertain one: Lemonade thinks the industry doesn’t acquire enough customers online, and that this locks them out of low-premium policies. But Lemonade is also betting that they can convince customers to spend more over time.

Lemonade’s entry point into the market is renter’s insurance. They underwrite through a chatbot, accept claims through another chatbot, and offload the vast majority of their risk to reinsurers through one- to three-year contracts. This is a good way for Lemonade to split the difference between getting paid to underwrite well and getting punished for bad luck: as contracts roll over, they can renegotiate terms based on the average rate of losses—but they’re not fully on the hook if a natural disaster hits a city they’re active in, leaving them liable for a huge number of hard-to-investigate claims.

Reinsurance is a way to avoid one of the sad truths of insurance: a bad decade is because of bad underwriting, but a bad day is because of bad luck.

This gives us two different “top-line” measurements for Lemonade. One is the gross volume of business they write; that’s the top-line in the sense that it’s the amount of money customers are paying to Lemonade. That was $38m in Q1. But Lemonade also reports a much more conservative view of how much business they do: their adjusted gross profit is essentially whatever customers paid them, less what they paid for reinsurance, claims, payment processing fees, and direct costs of commissions and taxes.

Lemonade’s adjusted gross profit, the money that comes in and isn’t going to flow right back out, was $5.4m in Q1 and $13.1m in all of 2019. So, this is a fairly small business. Lots of customers (729k at the end of Q1), lots of growth (customers were up 96% year over year), some levers to improve things—but very, very early.

Underwriting and Growth

Aside from Nicolas Bourbaki and the King James Bible, great writing never comes from committees. And S-1s are written by a committee with mutually-hostile members: the founders are introducing their beloved creation to the world, the lawyers are trying to keep the founders from getting sued, and the bankers want a good price for the IPO and as few unpleasant surprises as possible. So it’s a pastiche. But certain pieces of the S-1 have a distinctive founder-y voice, which makes me strongly suspect that CEO Daniel Schreiber and COO Shai Wininger spent more than a little time reading Farnam Street and perhaps LessWrong.

The introduction and founder’s letter are peppered with historical tidbits (they trace the industry’s origin to John Graunt’s 1662 mortality tables), behavioral economics, and snappy catchphrases (“We are risk takers, not thrill seekers,” “We are transparent, except when we are not.”). There’s even some bullet-biting. In their transparency point, they note that transparency has diminishing returns, which is not something you want to start saying when you stop being transparent.

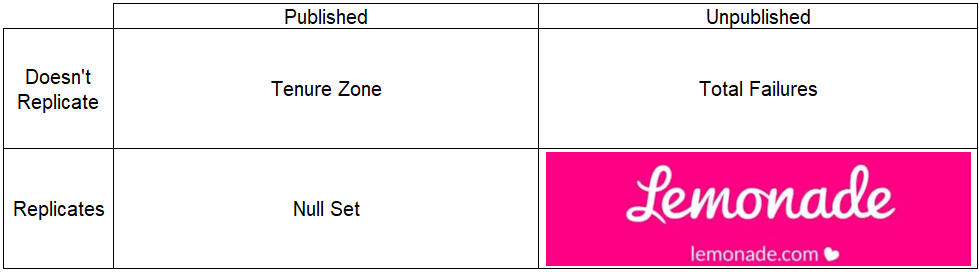

The behavioral economics references are not just for show, either. Since they use a chatbot rather than an agent, they miss some of the datapoints agents might use for underwriting—tone, appearance, awkward pauses, vague answers. But the chatbot does collect signals—allegedly, 1,700 of them. And there are plenty of ways to use someone’s in-app behavior to estimate their risk. Anything from how quickly they interact with the app, how many typos and mis-clicks they make, to their phone’s battery level could be an input. Lemonade talks up their frequent code updates and relentless testing, so you might think of them as occupying a 2x2 matrix in the space of behavior economics ideas:

|

Lemonade wants to measure user behavior at three points in time:

When they get a customer, to know how much to charge them

When they get a claim, to know whether or not it’s legitimate. A selling point for Lemonade is that claims get resolved and paid very quickly, in seconds—and one advantage of this is that it discourages customers from tacking on additional damaged items to a single claim to get more money once they realize they’ll get paid.

When Lemonade upsells or cross-sells.

The third piece is essential to understanding the Lemonade bull case. Their renter’s insurance product is incrementally cost-competitive only because overhead dominates their competitors' costs, and Lemonade’s cost structure is more fixed. But in 2019 they spent $175m in operating expenses to produce $13.1m in gross profit, which is not a sustainable model. At their current operating cost run-rate, they’d break even on renter’s insurance if they had 8.6 million customers, or 20% of all households that rent.

There’s an easier way, and it’s part of their plan: they offer condo and homeowner’s insurance, with a higher price point. So far, the customer count is low (12k), and they note that 10% of those customers “graduated” from renter’s insurance—impressive until you look at how many total customers they’ve upsold a total of 1.2k out of over 700k active users. Over time, that number will rise—they’re growing fast, most of their customers are new, and they say that moving to a new place is a catalyst for buying an insurance policy, so most of their new customers won’t be in a position to upgrade for several years anyway.

A business model predicated on renters upgrading to homeowners is a business model that assumes young people will be able to afford families. Not a great macro bet when the record numbers are the wrong direction. So Lemonade is hedging with proxies for family formation: they’re doing pet insurance. They also mention the possibility that they’ll expand into auto and life insurance, too.

They’re doing this in part as a tacit concession that their competitors are on to something.

Competitors include Allstate, Farmers, Liberty Mutual, State Farm, and Travelers. The S-1 points out that these companies have recognizable brands and offer other kinds of insurance, which Lemonade doesn’t. So one part of the bet Lemonade makes is that upselling is easier than cross-selling. They’re both hard. One reason they list Travelers as a competitor, rather than Citi, is that Travelers was spun out of Citi when the cross-selling story didn’t materialize:

|

As many tech companies have realized, offering multiple product lines doesn’t just add a revenue channel: it helps control churn, too. And that’s a serious problem for Lemonade, which reports 75% year-one retention and 76% retention from year one to year two. (Even that metric doesn’t include the customers who Lemonade boots from the system; 13% in year one, 5% in year two.) Putting these churn rates together gives Lemonade an all-in annual churn of about 33%. This is partly offset by upsells: their three-year-old customer cohort spends 56% more than they did when they started, so assuming this trend holds Lemonade’s dollar churn is a better-but-bad 23%.

Marketing

Lemonade is a marketing machine. Sales and marketing expense is their single biggest operating line item, and they’re selling hard across multiple channels, with a presence in social and paid search, and a decent SEO position as well. (SimilarWeb says one of their top-referring keywords is “deep questions to ask,” which is not exactly a high-intent keyword but which is competitive with lots of lifestyle sites.) And they have some lead-buying deals with other sites, including Geico. These are a small share of traffic, but such deals usually have a healthy conversion rate.

Lemonade talks up their marketing efficiency, and says they earn back their spend in a little over two years assuming a 20% gross margin (last year: 17%). This doesn’t account for churn or upsells, so the actual payback period is longer, although the very long-term churn for upsold customers is probably lower.

One marketing angle they use is a charitable donation program: they donate excess underwriting profits to good causes. Last year, this amount totaled $600k, out of $116m in gross premiums written. This is one part of the S-1 where they cite behavioral economics in a prudently vague way. Scope insensitivity is a powerful tool: knowing that your insurance company donates some of your premium to charity is more meaningful than doing the math and realizing that for their entry-level $60/year policy, the average expected charitable donation is thirty-one cents.

Conclusion

Lemonade was last valued at $2bn, or around 100x their current gross profit run-rate. There are parts of their model that are really impressive; the underwriting model is solid, their marketing is top-notch, and their growth is undeniable. They’ve grown by expanding a market; 90% of their buyers are buying a new renter’s insurance policy rather than replacing an existing one.

But Lemonade doesn’t fit in with what public markets look for right now. It’s a company whose unit economics can work, but are still unproven because of the lag between when policies get sold and when they get upsold. They’ve built a great product for a small market, and they’re promising to go after a huge one, but that’s more of a Series C pitch than an IPO pitch.

They raised $300m in a round led by Softbank just over a year ago. Softbank is already in the business of funding giant pivots, whereas public markets tend to punish any dramatic shift in strategy. Lemonade has $274m in cash on hand and had negative operating cash flow of $78m last year; margins are ticking up, and their cash burn rate is slightly lower on an annualized basis for Q1 despite continued growth.

So, why raise now, and why IPO?

My suspicion is that this is yet another marketing channel. Lemonade doesn’t need cash, but they do need attention. IPOs tend to increase name recognition, and the daytrader market is in the middle of a bubble. Lemonade may have concluded that they could IPO any time, but if they’re going to use Robinhood to get a free brand ad in front of 10 million people, they’d better act fast.

A Word From Our Sponsors

Here’s a dirty secret: part of equity research consists of being one of the world’s best-paid data-entry professionals. It’s a pain—and a rite of passage—to build a financial model by painstakingly transcribing information from 10-Qs, 10-Ks, presentations, and transcripts. Or, at least, it was: Daloopa uses machine learning and human validation to automatically parse financial statements and other disclosures, creating a continuously-updated, detailed, and accurate model.

If you’ve ever fired up Excel at 8pm and realized you’ll be doing ctrl-c alt-tab alt-e-es-v until well past midnight, you owe it to yourself to check this out.

Elsewhere

Zoom’s Transpacific Problem

Zoom closed the accounts of several US-based Chinese users, who were hosting Zoom meetings about the Tiananmen Square Massacre. They’ve apologized, reinstated the accounts, and promised to improve their process. Zoom is in a very unenviable position: their product development mostly happens in China, so they’re risk-averse about offending the Chinese Communist Party. But their users are mostly in the US. If they don’t have a way to control which country chat participants are in, they can’t comply with Chinese law without violating US norms.

Their stated plan is to build tools that allow them to ban users or countries from joining particular chats, i.e. their compromise is to comply with Chinese law in a way that generates fewer US news stories.

(An interesting note about Zoom’s blog post: they describe the meetings as “June 4th commemoration meetings,” which is a microcosm of the problem. It sounds evasive—but the term “June 4th” is also blacklisted in China.)

Drawdowns

One of my favorite categories of financier: anyone who has been through several drawdowns to roughly zero and subsequently bounced back. In the 60s, conglomerateur Jimmy Ling cobbled together Ling-Temco-Vought, in an incredible rise-and-fall; in 1955, he was handing out prospectuses at the Texas State Fair, and by 1969 LTV was #25 on the Fortune 500. But in the middle of that wild ride, Ling got hit with margin calls and had to sell all but a dozen of his shares in 1962. He levered up, bought it back, and stayed in control for another decade or so before being ousted. More recently, Victor Niederhoffer has had two giant drawdowns, but keeps coming back to trade.

And now Charif Souki is selling a ranch for $220m to meet margin calls. Souki worked as a banker in the 70s and 80s, made enough to retire at 34, spent enough to come out of retirement and run restaurants for a while, launched Cheniere energy in 1996, saw its stock price drop below $1 in the early 2000s, rode the energy bubble up, almost got bankrupted on the way down, left the company in 2015, started something new—and is once again in a drawdown, having sold half his stock to satisfy margin loans.

As I noted a few months ago, America’s supply of completely insane risk-takers, and the financiers who back them, is a key national advantage:

Let’s suppose the shale industry gets completely wiped out. Whiting is the first, but there are dozens more. Does US energy production drop permanently?

I doubt it. Some crazed oil entrepreneur in Houston or Williston or Oklahoma City, will decide that $9/bbl is a fine price point for taking another flyer. He’ll liquidate his assets and start drilling again. And he might fail, but there will be another risk taker after him, and another after that. At some point, some irrational risk-taker will nail the timing, perceived risk will drop, and we’ll be back where we started. US capital markets are where risk-seeking capital goes, and the energy industry remains a fantastically high-capacity capital sink. In the long run, you can’t outrun geology or politics, but over a shorter time period you can’t outrun the combination of deep capital markets and risk tolerance.

Chris Cox Returns to Facebook

Facebook’s former chief product officer, who quit in 2019 over disagreements with Mark Zuckerberg about encryption and product interoperability.

He’s back.

The perennial debate over Facebook is whether Mark Zuckerberg is making different moderation and privacy decisions because he’s deeply committed to a vision of open communications, or because he likes hanging out with the President. Personally, I suspect that phone calls and in-person meetings with Donald Trump are not a highlight of Zuckerberg’s day, and that resolving a contentious issue for a product used by 2.6 billion people can make up to 1.3 billion people very unhappy. An early employee rejoining the company is a datapoint in favor of the tough-but-principled viewpoint. But it will be interesting to see if this means a bit less encryption and fewer product integrations.

Reopening and Stay-Opening

Tokyo plans to lift business restrictions on June 19th, as reported new cases nationwide have dropped from hundreds per day in April to dozens per day in the last few weeks.

Meanwhile, in the US, Steve Mnuchin says we can’t afford another shutdown. The results of reopening have been uneven; case counts in Texas (partially reopened May 1st) are rising, but Georgia (restrictions relaxed May 12th) is stable, and Indiana (some restrictions lifted May 4th) are declining. Long lags, low testing, and uneven compliance make it extremely hard to make fine-grained measurements of the effects of lockdowns on infection growth. But the effect on economic activity is easy enough to spot.

Covid-19 has been a microcosm of dysfunctional political debates: most of the conflict would be less of a conflict with faster and more competent implementation and measurement. As it is, there’s enough data—and enough questions about data quality—for anyone to make whatever case they choose.

Short Laws

The 1994 techno-thriller Interface imagines a Presidential candidate secretly fitted with neural implants that allow him to respond focus groups in real time. The real-world version is Twitter, which sounds less cool but is a lot more practical. Twitter shifts the US system of government closer to direct democracy for whatever issue has the most attention at a given time, with the very positive side effect that laws can be written tersely and optimized for sharing.

Now the question is: did Amash write the bill term-paper style, messing with formatting and cutting lines until it hit the four-page limit?

Tech Astroturf

I think of partisan media as a sort of electoral college: You choose who to listen to, and they’ll give you a worldview in which voting a certain way makes all the sense in the world. But that system is not a stable equilibrium, because it creates an incentive to manipulate the media. The Verge showcases examples of this from tech companies feeding quotes to journalists by way of sympathetic interviewees. The Verge treats this as bad and hypocritical—it’s against Facebook’s rules to lie about your identity on Facebook, but they do it to the media. But it also illustrates the interaction between monopolies and externalities. There is no The Media Inc. that worries about the side effects of astroturfing. There are just journalists on deadlines. Facebook can crack down on this behavior on its own platform, but the media, collectively, can’t.

Partner Banks

A16Z has a writeup on partner banks, who rent their balance sheets and regulated status to fintech companies. It’s a very meta business: tech companies are used to supplying simple and clean interfaces for complex systems, but as it turns out the banking system is too complex for many of them.

Hertz’s Plan to Wipe Out Slightly More Shareholders

Hertz filed for bankruptcy on May 22nd, and their stock hit $0.56. A few weeks later, the stock was at $5.53, for no particularly good reason (it’s now down to $2.06); Hertz’s bonds are priced at a level implying that shareholders will be wiped out, and the business was challenged even before Covid-19. But they’re requesting permission to issue up to $1bn in equity. It’s unclear whether or not they’ll be able to do this; the experts interviewed by the Journal can’t think of any precedents where a bankrupt company even tried. Even so, if $3bn of bonds trade at 40 cents on the dollar, $1bn of equity doesn’t get those bonds up to par, so a successful offering would just mean slightly more shares go to zero.

Petition argues that the debtors are doing their duty here, and it’s hard to disagree. There’s demand for Hertz stock, Hertz has stock to sell, and markets are where supply and demand meet. This could easily be a moot point; the offering has to be completed a) in the wake of yesterday’s 6% drop in the market, b) after yesterday’s 18% drop in Hertz’s stock price, and c) before Robinhood users get bored.

(Disclosure: I own a small position in Hertz puts, as part of a basket of bets on similar weirdly-priced bankrupt companies, but I have no particular edge in any of these situations. The sophisticated version of this trade would have been to buy the puts and also buy some Hertz debt, but when I put on the trade, I asked myself: what could possibly improve Hertz’s position so much that the debt would meaningfully appreciate? Now I’ve seen one more obscure hypothetical turn into an actual risk.)