Canada Loses 'AAA' Credit Rating As Federal Debt Reaches Historic Levels | | | - Fitch Ratings Inc. has stripped Canada of its AAA credit rating and downgraded the country to a AA+ rating with a stable outlook.

- The credit rating agency said it sees Canada's debt-to-GDP ratio stabilizing over the medium term.

- Since the pandemic, Canada's AAA rating has come under the microscope as federal spending on COVID-19 aid measures climbed to more than $150 billion and pushed Ottawa's debt load to historic levels.

- In March 2019, a year before the COVID-19 pandemic took hold, Fitch released a report warning that high debt at the federal and provincial levels could soon become "Incompatible" with Canada preserving its top-notch rating.

- The Triple-A credit rating, which is the highest possible rating, was something Prime Minister Justin Trudeau's Liberals highlighted in their 2019 election platform and in previous budgets.

- Until this week, Canada and Germany were the only two G7 countries that had AAA credit ratings.

- While Fitch Ratings has downgraded Canada, the two other credit rating agencies, Moody's and Standard & Poor's, have retained their AAA ratings on the country for the time being.

|

Fed caps bank dividend payments and suspends share-buybacks for third quarter after stress tests | | - The Federal Reserve on Thursday voted to require large banks to preserve capital by suspending share repurchases and cap dividend payments in the third quarter.

- A senior Fed official said this could be "Binding" for some banks.

- The stress tests cover 34 banks including five foreign firms.

- The Fed released two studies-a traditional stress test set in February before the pandemic and an analysis of bank capital under three ways the economy might evolve in coming quarters amid the public-health crisis, roughly a V-shaped, U-shaped and W-shaped scenarios.

- The traditional stress test showed that all large banks remain well capitalized.

- Under the very worst of the COVID-19 scenarios, "Many" banks would be operating within their stress capital buffers and one quarter of the banks would be getting close to minimum capital standards, Brainard said.

- The Fed said it would require banks to reassess their capital needs and resubmit capital plans later this year.

|

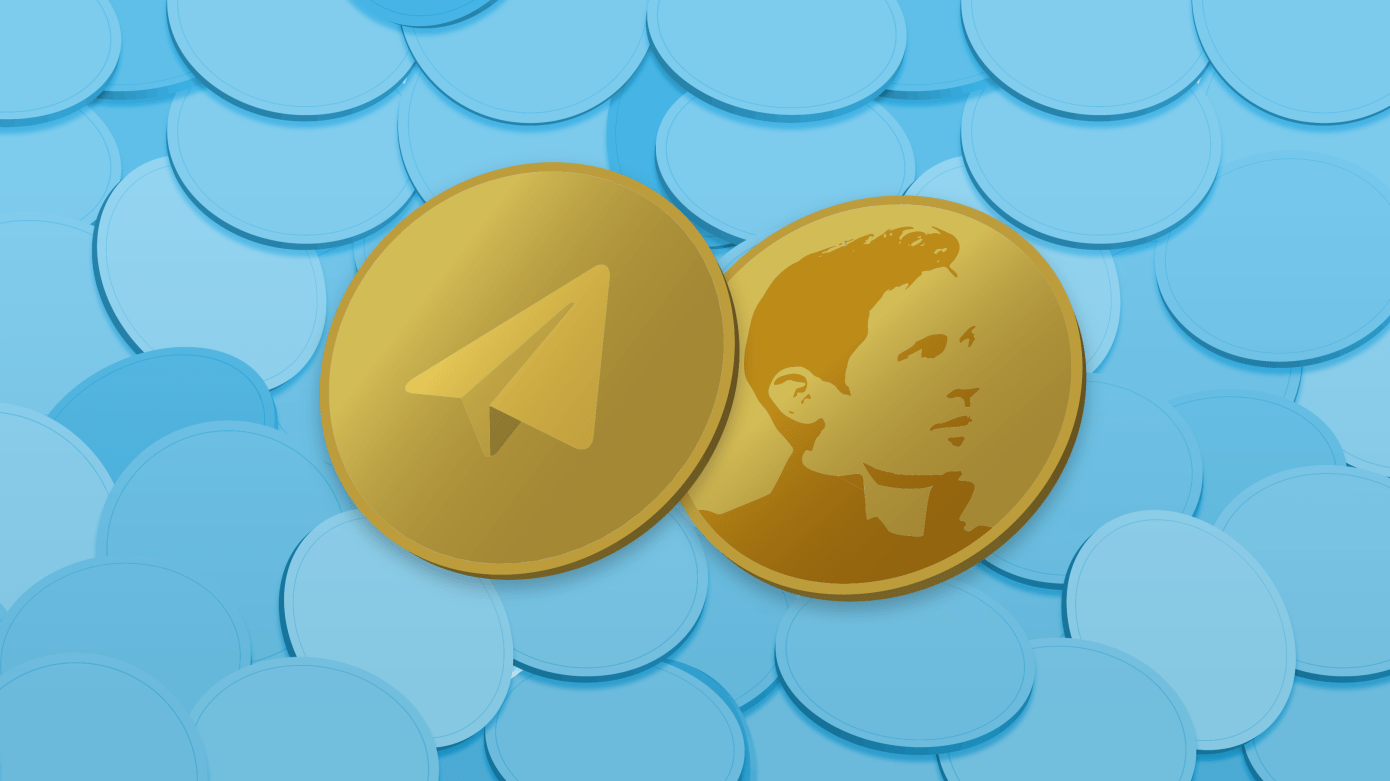

Telegram to pay SEC fine of $18.5 million and return $1.2 billion to investors as it dissolves TON – TechCrunch | | | - In October 2019 the SEC filed a complaint against Telegram alleging the company had raised capital through the sale of 2.9 billion Grams to finance its business.

- The SEC sought to enjoin Telegram from delivering the Grams it sold, which the regulator alleged were securities.

- In May, Telegram announced that it was shutting down the TON initiative.

- "This settlement requires Telegram to return funds to investors, imposes a significant penalty, and requires Telegram to give notice of future digital offerings."

- The argument from the regulator is that Telegram didn't follow the rules.

- Had it worked with the regulator instead of launching the token offering without any oversight, the outcome might have been different, according to the SEC. "Our emergency action protected retail investors from Telegram's attempt to flood the markets with securities sold in an unregistered offering without providing full disclosures concerning their project," said Lara Shalov Mehraban, Associate Regional Director of the New York Regional Office.

- "The remedies we obtained provide significant relief to investors and protect retail investors from future illegal offerings by Telegram."

|

YC to cut the size of its investment in future YC startups – TechCrunch | | | - The first would see the size of the standard deal for YC startups decline from $150,000 for 7% to $125,000 for the same equity.

- The deal will continued to be offered using a SAFE, which YC and a group of others pioneered as a simpler investment option compared to convertible notes.

- Full terms of Y Combinator's deal are available on its website.

- The new deal will apply to startups who join Y Combinator in the Winter 2021 batch, and doesn't include startups in the current summer batch.

- "In our case, we want to be set up to fund as many great founders as possible - especially during a time that is creating an unprecedented change to consumer and business behavior; with these changes comes endless opportunities for startups. And with the changes made to our standard deal, we can fund as many as 3000 more companies."

- One is the increased use of Work From Anywhere, which presumably can help lower some of the running costs of a startup, particularly in its earliest days.

- Y Combinator has also invested more of its funds into emerging markets startups, which can have dramatically lower costs of development given prevailing wages for talent in local markets.

|

|