Hello, I’m Lenny and welcome to a free monthly edition of my weekly newsletter. Each week I humbly tackle reader questions about product, growth, working with humans, and anything else that’s stressing you out at the office.

If you’re not a paid subscriber, here’s what you missed this month:

Q: I raised a small seed round, and I’m now thinking about raising our next round. Do you have any advice for navigating the process?

Whenever I need fundraising advice, there’s one person I immediately go to: Marc McCabe. Marc is a friend, a former colleague, and a prolific angel investor. He has personally helped dozens of startups raise money (even doing this full-time for a number of years). When I got this question, I went straight to Marc and asked him to do a guest post. Not only did he agree, he ended up putting together the most comprehensive fundraising guide I’ve ever seen, which you’ll find below. Thank you Marc 🙏

If you have any further questions, don’t hesitate to ping Marc on Twitter.

A Playbook for Fundraising

By Marc McCabe

|

Image: Gilbert Garcin

For an early stage founder, fundraising is one of the most nerve-racking parts of the job. It’s incredibly opaque, asymmetrical, and is often the difference between having a company and not. Even the most experienced founder may have only fundraised 5-10 times in their life, while VCs engage in this process daily.

Nonetheless, it’s also a very exciting time for a founder. Very few people ever get the chance to raise millions of dollars from top tier VCs. As a result, I often see founders rush into the process, setting up investor meetings before they’re truly prepared and end up with a bad outcome. This is a missed opportunity because the fundraising process is a great forcing-function for getting you to think deeply about your business and where it’s going.

Over the last decade I have personally helped dozens of companies raise capital, from pre-seed to Series C rounds, and through these experiences I’ve seen a lot of effective, and also counterproductive, fundraising patterns. I shared many of these learnings in a lengthy podcast interview a year ago in, but with a prod from Lenny I felt like now was a good time to revisit this topic.

This guide is for founders of technology businesses who have raised their seed round, and are thinking forward to their next fundraise. It’s most relevant for Series A, but a lot of the same concepts apply for seed rounds, Series B and to a certain extent Series C. While most tech businesses can benefit from this guide, there are plenty of exceptions, especially companies with products which take a long time to get to market, and companies raising capital outside the US. Consider yourself caveated.

Ultimately, fundraising is an exercise in building trust. Every week we read about new Series A, B and C rounds. We hear about pre-emptive offers and blank check term sheets from prominent investors. All of this can lull us into thinking raising capital is easy. Yet, each partner at a fund generally only makes 1-3 early-stage investments per year, and their career is ultimately staked to how successful these investments are. Each investment is incredibly significant to each fund and in order to convince a fund that you are worthy of that big check, you need them to feel incredibly confident that you will take the money and use it to take your business to a new level, whereby you could raise future funding and ultimately build a huge business. With that in mind, let’s get started with how I like to manage the various steps from thinking about fundraising to closing.

I typically break up a fundraising process into 4 steps:

Preparation

Outreach

Navigating the process

Partner meetings + closing

Let’s walk through each of these stages one by one.

Step 1: Preparation

First, you need to figure out why and when you should raise a round. Maybe this seems obvious, but rather than looking at new investment as an opportunity, many founders only start fundraising when they are running out of money. VC’s don’t invest because you’re running out of money – they invest because they believe their equity stake will be worth a lot more in the future.

When you should raise a Series A round is a blog post unto itself, and I’m not going to go in depth here. The truth is that there isn’t just one factor that will say you’re ready to raise Series A. For example, in SaaS, it’s common that companies that have achieved $1M ARR are told they are ready, but growth rate is a factor as well, and ARR doesn’t always apply for consumer focused businesses.

Generally the way to think about whether you are ready for a Series A is whether you’ve proven a credible value hypothesis. This is a combination of factors including the market you’re attacking, the features you’ve built to exploit the opportunity, and how well your product is finding its fit in the market. I often describe Series A as the “Product-Market Fit Round”: You want to show that you’ve convinced a slice of your market that your product is valuable enough to pay for (or if it’s free, use very regularly), and that this user base is growing. While seed rounds are intended to explore an idea and find some fit in the market, raising a Series A helps you pour more fuel on the fire.

Investors ultimately want to invest in growth. If a company is growing fast relative to its peers, this can make up for lower ARR especially if the business seems defensible and sustainable. It’s often helpful to speak with your seed investors early on about it, especially if they have experience raising capital themselves, to understand what milestones would make most sense to support a new round in the future.

When you think that you’re ready, the first step is to start pulling together your key metrics and wins, such as your growth rates, revenue numbers, customer testimonials, user feedback, and achievements. As mentioned, what makes you ready for Series A varies greatly, so find data points that will get investors excited about your business.

In terms of materials, I advise founders to prepare the following at a minimum:

A short blurb about your business, including a couple of headline numbers that indicate the business is doing well

A short teaser deck (3-7 slides)

A longer presentation deck (12-15 slides)

A 2-3 year forecast with assumed fundraise secured

Optional: Metrics deck or a data room. Sometimes you will get asked for this at Series A, sometimes not. t helps if you ask your prospective VCs in the first meeting whether they’ll ask for it.

You can find some good references for building pitches here, here and here.

The key is that your materials tell a compelling story. They need to explain what you’re building, why you’re building it, and how your strategy will capture considerable revenue in the future. The better this story ties everything together, the more your business will seem insightful. Ultimately we’re all human, and strong narratives that help explain the world around us are more compelling than a selection of disparate, albeit impressive, data points.

“If you can’t tell a credible and compelling story about your vision and how your plans will capitalize on broader societal, market, cultural, economic or other trends, you’re dead in the water. I believe my own secret to fundraising success was that I always spoke to the broader changes I saw happening in the world and my conviction about the opportunities they presented.”

— Eoghan McCabe, co-founder Intercom

As an early investor in Intercom, it always impressed me how consistent the narrative stayed from when the company started up until today.

The shorter teaser deck is for sharing over email but be mindful that you don’t want to share everything with VCs ahead of meeting your lead partner. Hence the longer deck for your in-person (or Zoom meetings). Remember, it’s a trust building exercise. In a relationship, trust is built over many interactions over a long period of time. You want to show some positive elements to get investors interested, but leave good content in reserve.

One thing that Covid has changed is that building a relationship with a VC, with fewer in-person meetings, is now harder. Think about this with respect to your materials. To make up for the lack of in-person face time, you need to find more digital approaches to building this relationship than before. Caitlin Bolnick recently had an excellent thread about this so consider preparing some of the following extra materials:

A Loom of your product flow explaining how you made key design decisions and how these relate to the use case or market

An appendix of interesting information you yourself have read or viewed that inspired your approach

A compilation of customer testimonials

You will need more content than ever to help build a shared belief in what you’re doing and why. I typically recommend spending at least 4 weeks building the deck and supporting materials. I find founders realize there are stronger elements they should have included 1-2 weeks into the pitch process. Taking time to get the narrative right and letting your points crystallize will likely result in a stronger deck from the start.

An important component in building this content is a part of the process I like to call “Hardening the Pitch”. Typically I recommend founders prepare their materials to about 70% completeness and then test them before going into battle. Put together a coherent story with great supporting data (not necessarily heavily designed). Find 4-6 people in your network, who have either fundraised at Series A for their own startup (ideally in the same or similar space), are friendly investors who know the space (perhaps from your seed investors), or even growth stage investors. Practice your pitch with them. Testing your materials and thesis before you hit the full pitch gauntlet will build your confidence and reps on the pitch. It will also provide you with helpful feedback and, potentially, warm introductions to relevant funds. I’ve seen this be immensely helpful in securing strong investment leads.

“Fundraising can be a lonely experience, especially as you will want to protect those in the company from the highs and lows during your round. Finding some good external people to lean on for vetting your pitch or providing introductions can really help relieve some of the burden on founders.”

— Jonathan Golden, NEA

I generally think you should plan to spend somewhere between 8-16 weeks working on your fundraise from start to term-sheet. You’ll be ideally speaking to 50-60 funds for your Series A. Starting early in the year makes sense, but if you’re in July and contemplating raising, it might make sense to wait for late August or early September to begin your outreach to funds. There are a lot of great jokes I could share about VC vacations in August, but the truth is that plenty of VCs work through August. Just maybe not enough to run a tight process with every fund.

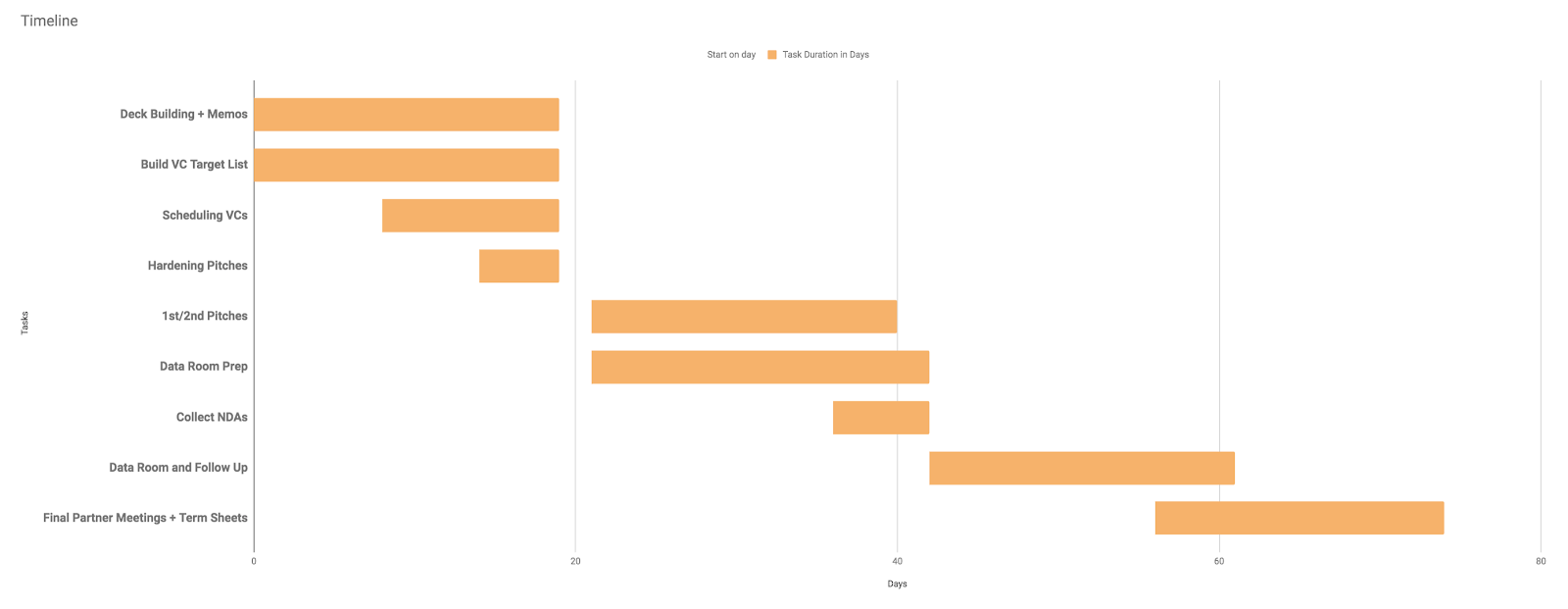

Another factor to consider when you go out to raise is runway. Generally I recommend having at least 8 months of runway when going out to raise. The most important thing is that your business is showing the signs that you should raise Series A. If you only have 4-6 months of runway, it might make sense to raise a bridge round from inside investors to gain leverage in the fundraising process. You will want to continue to show traction during the fundraising process as often investors ask for updated numbers as you get close to the end and a downturn can shake their confidence. It’s really helpful to think about fundraising at least 12 months before you need it so you can time things well. I pulled together a quick fundraising calendar below to help you think about the overall timing of the different elements of your round.

|

Step 2: Outreach

Planning your outreach is probably the most overlooked and tedious part of building a successful process. Your goal at this stage is to build a long list of funds who could lead your round. This means finding not just any funds, but those who have the capital to write a lead check. A lead check is one that can fill the majority of your round. You’ll also then need to identify the partners at these funds who will be interested in what you’re working on, and then find suitable introductions to speak with those partners.

I recommend putting together a list of 50-60 funds you want to talk to (here’s a template). With that list, figure out the partner you’d ideally want to work with at the fund, and then comb through your network to identify strong introductions to those partners. Warm introductions can make a huge difference. The best intro comes from a successful founder from within that fund’s existing portfolio. The stronger the referral source, the more interest and excitement that partner will have when meeting you and reviewing your pitch content. If your only point of contact is a principal or associate at a fund then you may want to check in with them ahead of time. Associates and Principles are the eyes and ears of a fund, and can be a good path in, but you should ask them if they have autonomy to make investments or if there’s a partner at the fund they recommend you start building a relationship with.

If you think you might fundraise in the next 6-12 months, and don’t have many good relationships with funds, this is a good time to start having some basic coffee meetings with top tier investors your network can introduce you to. If you’re seeing very strong traction and your value proposition is very clear, you probably won’t need to do these kinds of meetings. However, I have also seen that sometimes starting cold with investors when you begin fundraising isn’t always optimal. You should be cautious about doing too many of these coffee meetings because it’s time consuming and requires preparation, so I usually advise only doing this for top tier funds you want to cultivate a relationship with. You need to think of every investor interaction as something that could influence whether they do or don’t invest in your business, so make sure you prepare. Over the coming months you can continue these initial relationships with updates about your progress and the space you’re in.

What is important though is that you set yourself up well with these funds before you start eventually reaching out for fundraising.

Step 3: Navigating the process

You now have your pitch materials and your investor list ready. Your ultimate goal is to end up with multiple interested funds who have completed their diligence and want to invest all at the same time.

You should coordinate your outreach to have first meetings with all of these funds within a 2-3 week period. Making sure all these first pitches happen in a constrained period of time means you won’t have some VCs getting ahead of the others in terms of information and diligence. Generally I don’t recommend doing more than 4-5 pitches a day and leaving a suitable buffer each side of pitches to restore your energy, give you time to get to your next meeting without stress, and to allow a meeting to go late when they need to. With 50-60 funds, that’s going to take 3 weeks.

At the end of each meeting you should be asking your prospective partner:

What kind of diligence do they need to get through to build confidence?

What is their next step in moving this process forward?

When might that next step happen?

What parts of the business resonate with them?

Approach this with the eyes of a project manager. You should be building a calendar and keeping notes for each VC’s progress and feedback, per the tracker template, and be in regular contact with each fund you’re speaking to. Having lots of content you can share helps. No one likes sending (or receiving) the “just checking in” email. Compose some interesting emails with relevant content that will help build understanding about what you’re doing and why. Always finish these emails with actions and next steps that can move things forward. It’s important to maintain dialogue and stay top-of-mind with the partner you’re speaking to.

I’ll restate this because it’s important: try to keep all the funds on similar timelines. You may end up getting your first term sheet from the fund you are least excited about. If another fund you’re keen on is just starting their diligence you’ll be forced to either reject that better fund, or reject the deal you have on the table. You should think of your role here as creating a market for the equity you’re selling. Don’t create a market of one buyer that was able to get to a decision fastest.

Once you’re through the grueling first pitch phase, you’ll move on to a second pitch, along with customer references, VCs diligencing your data, projections, etc. Once again, focus on coordination. To keep everyone moving, it’s OK to follow-up and share some information a week after your last touch point. If you’re driving everything and there’s seemingly no corresponding interest for a week or two, then better to file that VC in a different bucket and focus on the funds who are reciprocating. If someone says they’re going to follow up then the laws of human decency dictate they should (though that doesn’t always happen when you want it to).

This will be painful, but know that some VCs just won’t be interested in your company or will be too focused on other deals. Some genuinely just won’t understand your business and the opportunity you see. Silence, or outright rejection, are tough pills to swallow for any founder, but this is normal. Having five VC partners still interested in investing after the diligence phase is a success. Another way of looking at that is that success normally means failing with 90%+ of the funds on your list. Y Combinator estimates you need to speak to 30 funds to get one term sheet. Still, you need to treat each fund with the respect that shows you believe they might lead your round, while avoiding wasting time with those that clearly show you they won’t. The later the passes come, the harder it’ll be to take, especially considering the time you’ve invested and the optimism you may have built up about their interest. This is unavoidable. Find ways to process and deal with this energy and try not to take it out on the investor in question. I’d genuinely recommend having a close friend/colleague/early investor who ideally understands the process on stand-by either to vent to or to get reassurance. Fundraising is, in the parlance of our times, a total head fuck. Rather than obsessing on the passes, focus on what next steps you can actually take to make progress with other funds.

Step 4: Partner meetings + closing

If you’ve made it this far, kudos, you’ll need that kind of perseverance to fundraise successfully.

You’ve now built some relationships and some fund partners have genuinely spent a lot of time on your business. Find ways to speak with those partners and show your true ambition and excitement for the deal. You’re possibly going to be working with this partner for years to come and they’re also thinking the same thing. At this point it’s likely that the partner wants to get this deal done but needs to convince their partnership. This is when you get called into partner meetings.

The partner you’ve been working with now generally turns into your co-conspirator. They’ve invested months into this process and want to get the deal over the line. Delian Asparouhov, from Founders Fund, and I recently chatted about this dynamic and I think he summed it up best:

“The world of venture capital actually closely mimics enterprise sales in this manner. Once your 'inside sponsor' has gotten over the line, then you are actually on the same team. The best founders recognize this and treat me like we're on the same side. We start to talk about how to tailor the deck to the firm, discuss and agree on an exact timeline for a term sheet, and what terms they would happily take.”

— Delian Asparouhov, Founders Fund

Typically you will get a response one way or another shortly after a partner meeting. If you get a term sheet, congrats! If there are other funds still interested, you can let them know you have a term sheet and that they’ll need to make a decision soon. Most of the time, I would not recommend sharing which fund offered you the term sheet or what the valuation is. However, transparency can be perceived as a sign of confidence and that you’re ready to accept that term sheet. If the term sheet is from a top tier fund, this can also have an impact on the VCs still in your process. If this term-sheet is not from your first choice fund, asking to speak to references for a fund can buy you some time and give you additional insight on the fund. If you leverage a term-sheet to push another fund to make a decision and they have not completed their diligence, it can force them to pass when they might not otherwise.

VCs don’t like offering term sheets that don’t get accepted – it’s a lot of work for nothing. Sometimes before getting the term sheet, you will get a call from the partner you’ve been speaking with. They’ll often ask you how many other funds are still involved, what you value the business at, and how much equity you’re willing to sell. It’s good to understand some comps and have a range of valuation in mind but don’t feel compelled to give them a low number they can anchor to. I would focus your comps around the top end of your range if you feel compelled to discuss a valuation with your VC partner.

Don’t forget, you’ve built this synchronized process keeping many funds in the loop for a reason. Rather than helping the fund set a valuation (which they probably have a clearer idea of than you), focus the conversation on what you want to raise, reiterate why you need this capital, and potentially identify other terms you may be more sensitive about (e.g. one board seat vs two, option pools, founder stock revesting in later rounds). YC put together a very nice post on the ideal Series A term-sheet, but it’s also good to speak with your legal support to get advice on what terms they typically see. Always have your legal team review a term-sheet and walk you through the terms. Your legal team will likely be quite conservative and sensitive to terms which might not really impact you so it’s helpful to ask them clarifying questions like “when will this actually impact me?” to get clearer on what you can stomach and what you want to negotiate.

Once you receive a term sheet, you are on the clock to accept, negotiate or reject it. Some VCs are aggressive with this and will only give you 24-48 hours to accept. Others understand you may need more time to gather references for the fund. There’s not a hard and fast rule here but it can be hard to keep a term sheet open for more than 1-2 weeks. When you get the term sheet, you should establish clearly how much time you will need and understand that if you go beyond this deadline, the term sheet could be withdrawn.

Once you’ve signed a term-sheet, some founders are surprised to find out the process isn’t fully over. I advise you to not publicly celebrate a term sheet or necessarily tell anyone in the company outside of the founders. It can take 3-6 weeks from this point to actually get the money in the bank. During this time funds will perform some additional legal diligence, and prepare the stock purchase agreement (which is the more detailed and contractually binding version of the term-sheet). This is a good time to identify who out of your existing investors will be taking their pro-rata (if they have it), or find other value add angels and small investors who might be good fits for supporting you.

Once you sign the stock purchase agreement you can breathe deeply. It’s important to celebrate this achievement. Use this moment to refocus and energize your team for the next stage of your business. But you’ll all too quickly get over this relief once you realize that you now need to grow the company considerably to raise your next round. The hard work of building a business continues.

It's important to state here that I have seen rounds closed in a lot of different ways. There is no one size fits all approach. This guide is intended to offer some structure around the fundraising process and alleviate the uncertainty and anxiety founders experience. If there's one point I hope you take from this guide, in the words of Benjamin Franklin, "By failing to prepare, you are preparing to fail."

If you have questions about it, hit me up on Twitter. And lastly, I want to thank Jonathan Golden, Delian Asparouhov, Eoghan McCabe, Riley Newman and of course Lenny Rachitsky for their help reviewing and adding their thoughts to this post.

🔥 Job opportunities

Product: KUDO

Design: Huddle, Pachama, Office Hours, Runway, Stytch, Watershed

Backend engineer: Sourcetable

Fullstack engineer: Centered, Icebreaker, neo.tax, Runway, Snackpass, Wren

Ops: Levels

Community: Outschool

Content: Levels

HR: Cerebral

If you’re finding this newsletter valuable, consider sharing it with friends, or subscribing if you aren’t already.

Sincerely,

Lenny 👋