This is the once-a-week free edition of The Diff, the newsletter about inflections in finance and technology. The free edition goes out to 15,957 subscribers, up 249 week-over-week.

In this issue:

Engineering a Conglomerate

Pretty Bad Privacy

Exercising the Whistleblower Option

Who Owns Streamed Games?

Rebooting Transit

Palantir

Tech Sees Like a State

Rationalists and Thymos

Engineering a Conglomerate

Conglomerates are a strange category. At one level, a conglomerate is the industry classification equivalent of “Misc.”—a company whose subsidiaries seem to have nothing in common. But every institution is the product of constraints it faces. A conglomerate is some combination of a) good at raising money, b) bad at returning money to shareholders, and c) good at the disciplines of acquiring and managing companies, independent of what those companies do.

“Management” doesn’t seem like it could be a real skill. Or, at least, it seems like it could be a skill that someone might be terrible at, but not one they could be sufficiently good at to offset a lack of domain expertise. Can someone who knows a lot about fracking also operate a company that sells dental hygiene equipment, insurance, semiconductors, and steel?

This, as it turns out, is not a rhetorical question. The answer is: yes, when Henry Singleton ran Teledyne it was involved in all of the above. Singleton was unusually smart (he was on the MIT Putnam team with Richard Feynman). So, Singleton was an exceptional case. But there are other conglomerates that have put together enviable track records: Danaher, for example, owns an assortment of specialty manufacturers, diagnostics, and life sciences companies. And Berkshire Hathaway has holdings in insurance, railroads, energy, manufacturing, and a long tail of smaller holdings and minority stakes.

But most conglomerates are not so successful. In fact, Google’s search suggestions—the absolute arbiter of the G- and PG-rated word association zeitgeist—says “conglomerate discount” is one of the most common searches. Historically, diversified companies have gone through boom and bust cycles, and for financial-theory reasons they often deserve a discount: investors don’t need to invest in diversified companies, because they can get diversification themselves. If management skill is constant, a diversified portfolio is a better deal, because one bum investment can only go down 100%, while an underperforming subsidiary can cost multiples of its original value.

Conglomerates came about in the 1960s, as a creation of three factors:

Strict antitrust enforcement made it hard for companies to merge with competitors, suppliers, and customers.

Flexible accounting rules around mergers made it possible for conglomerates to report deceptively high growth rates, which gave them access to capital, which they could use to fund more growth, and

Business as an academic study got more respectable; it looked like there really was such a thing as general management skill.

These businesses were in vogue in the 60s, mostly fell apart in the 70s, and have periodically come back since then, usually at more modest scale.

There are conglomerate horror stories. GE under Jack Welch was covered by several books, with titles like Straight from the Gut or Jack Welch and the GE Way, but the company’s subsequent performance led to Lights Out, which details how GE went from being the most valuable public company to being booted from the Dow.

For a long time, GE looked like a validation of the model where conglomerates apply superior management skills to a variety of industries, and always come out on top. From power equipment to jet engines to appliances, GE’s superstar managers always hit their numbers. But an increasing share of GE’s growth in the 80s and 90s came from its financial services arm, and financial services are a good place to hide bad numbers. GE’s financial services group encouraged a sort of Dorian Gray accounting; in any given quarter, it could delay recognizing some bad debt (or use its financial firepower to lend to customers, improving performance in another part of the business). But those problems accumulated until they were unavoidable; in 2008, GE had to recognize a couple decades worth of slightly bad quarters all at once.

GE isn’t the only case study in this. Earlier conglomerates played fast and loose with their numbers, too. The first wave of conglomerates in the 60s included National Student Marketing (which hit its earnings target by forging backdated contracts) and Leasco (which competed with IBM in the computer leasing business by buying computers from IBM and depreciating them more slowly).

These conglomerates seem to be pure accounting fiction. They’re diversified because it’s easier to run a shell game with more shells.

But other conglomerates have done better.

Can the best elements of the conglomerate model be copied? Berkshire Hathaway may be the most-studied company in history. And many companies try to copy it; there are two publicly-traded Berkshire cover bands (Biglari Holdings and Boston-Omaha). Duplicating Berkshire is straightforward:

Be born right after a market crash so catastrophic that nobody gets into the equities business for two decades afterwards.

Take advantage of extreme mispricings—stocks trading below net cash, companies trading at 1x earnings, companies priced at a fifth of the value of their real estate—to quickly build a fortune and a reputation.

Get a captive pool of capital by buying insurance companies when they’re cheap. Use this cheap capital to a) make money from capital appreciation, and b) bail out distressed companies who will pay up to be associated with your brand name.

Easy!

Part of the point of the Berkshire model has been that nobody truly competes with Berkshire. When a company is a week away from bankruptcy and needs to sell preferred stock to stay alive, that company is either selling to Berkshire or selling to its second choice, and Berkshire sets the terms of the deal accordingly. The elegance of the company’s model is that working with them is such a powerful signal: Berkshire is the buyer of first resort for one set of high-quality, non-distressed companies, and the buyer of last resort for distressed companies experiencing a run on the bank. This model only works if Berkshire’s underlying returns are good, and if it keeps lots of cashon hand. But the factors that make those returns exceptional over longer periods are impossible to copy, and most companies can’t justify keeping so much cash on hand without their shareholders revolting.

If conglomerates have a competitive advantage at buying cheap assets, that’s less of a benefit than it looks like. Suppose a conglomerate can reliably identify companies that are priced at 80% of their fair value. That’s great, but if those companies are public, buying them means paying a merger premium that wipes out the price advantage. And even if they can be bought at a discount, it’s expensive to buy and sell companies. If it takes a decade for the company’s value to be recognized, that 80% discount translates into about 2.3% excess return each year. Nothing to sneeze at, but not the results out of which fortunes are made.

And the buy-cheap model has another limit. There are many, many misvalued private companies with a private market value of $10m or so. There are fewer at $100m, fewer still at $1bn. And it’s extraordinarily hard to find a public company worth $10bn or more that’s trading at a wide discount to private market value, unless that discount is explained by management problems, or the “discount” represents a difference of opinion about the firm’s prospects. A conglomerate can’t grow on underpriced acquisitions alone, before it becomes a victim of its own success.

There is a conglomerate model that has some explanatory power: conglomerates can win if they have a regulatory advantage. There are large, diversified companies with solid long-term growth records outside of the US. I’ve written about Samsung and Reliance before. Both companies function well in many industries because they have the ear of the government, and in some sectors the only way to do business in the country is to do business with them. That factor explains part of the success of one of the largest of the first-generation conglomerates, ITT. ITT was involved in basically every business—Avis, Wonderbread, Hartford Insurance, Sheraton Hotels. They were also involved in a fairly aggressive form of politics, offering large under-the-table donations to Richard Nixon and allegedly helping Pinochet’s coup in Chile.[1]

Conglomerates are relevant today because some big tech companies look suspiciously similar to conglomerates, and for antitrust purposes would like to look like them. But they’re organic conglomerates: Google didn’t buy its way into self-driving cars, fiber, and immortality research. It built that. Most of its acquisitions have been more related to the core business. These side businesses might be related to another part of the big tech model. After a certain point, every major tech company needs to have a comparative advantage at overhiring talent, just in case it needs to deploy a thousand engineers to some pressing new problem. So they’re generally overstaffed, and need to give their people something to do. They also keep large capital buffers, also for emergencies, but sometimes that excess cash burns a hole in their pockets. Large tech companies conglomeratize mostly by accident, as a result of being entirely too successful at their core business. To the extent that this pattern shares anything with the original conglomerate pattern, it’s that their diversification is driven by antitrust: even if aggressive growth in the core market is the right business decision, it’s not worth the legal risk.

At various times, in various parts of the economy, it starts to look like the entire world will be owned by half a dozen faceless, soulless companies. So far, that hasn’t happened yet. There are a handful of successful conglomerates, but they all tend to be the work of one person; ironically, a model that was originally justified by the idea that management was a science floundered because the best examples all required management by a particular auteur. Corporate growth is mildly terrifying because corporations are, in principle, immortal, and any immortal entity that compounds its size faster than GDP will eventually swallow the entire economy. But the ones whose growth isn’t bounded by industry happen to be very mortal indeed. When their creator leaves, the growth stops, or it turns out not to have been real in the first place.

[1] It’s unclear exactly how culpable ITT as a whole was, as opposed to aggressive lobbyists and local managers working on their behalf. As one piece of circumstantial evidence, I own a fairly positive biography of Harold Geneen, who created ITT. The author of that book wrote one other biography, also fairly positive, about Al Capone.

A Word From Our Sponsors

As economic activity comes online, new data trails are left behind. Over 200 innovative investment firms leverage this data for alpha-generating insights. Thinknum’s alternative datasets power investment decisions across more than 500,000 public and private companies around the world.

For example, track job listings to identify which companies are expanding in real time. Or track the individual tenants by commercial mall to analyze churn on a daily basis.

Interested? Come learn about all of our 35 datasets here.

Elsewhere

Pretty Bad Privacy

Motherboard has a lengthy piece about Phantom Secure, a company that sold encrypted phones used by criminals. Encryption is a fraught topic; at one level, it’s just math, and at another level, it’s a way for some of the worst people in the world to do their worst. The line between helping political dissidents and privacy nerds versus helping drug lords and terrorists is a blurry one when the tools are available to anyone. But the cryptography world teaches the same lessons the cryptocurrency world does: the onramp from public to private can be monitored, and if you control the onramp you’re liable for what your signage says. Phantom marketed itself to “executives” who valued discretion, but the founder ultimately admitted to undercover law enforcement that it was a pretty good product for narcotics smugglers.

There are two parallel privacy debates right now: the one about how the average person is losing their privacy over time, as more and more companies mine their data to sell them things. And then there’s the problem that some people have too much privacy, whether for pseudonymous speech or for drug smuggling. Ironically, one of these problems is solving the other. Phantom started losing popularity because it was a Blackberry-based service, and Blackberries fell out of fashion. Google’s relentless efforts to sell new Android phones (in order to sell more Google ads) made the drug lord’s phone of choice look tacky and unfashionable. There are, of course, Android apps that provide secure privacy (at least as far as we know; presumably, some law enforcement agencies have at least considered whether or not offering a subtly broken encrypted messaging app is a good idea). But switching from one platform to another leads to data leakage, and these users need their systems to be airtight.

Exercising the Whistleblower Option

Usually, option exercises are reported on SEC.gov with a Form 4, but sometimes there’s a press release. In this case: a whistleblower collected $114m for reporting a financial crime, beating the $50m record set earlier this year. As I’ve written before, whistleblower rewards have perverse incentives:

The money from fraud is a carry trade: a share of some positive returns, with an unknown risk of catastrophic blowups.

The whistleblower program is a somewhat exotic option, that simultaneously a) closes the carry trade, and b) delivers a one-time payout as a share of the SEC’s fine, which is a function of how big the cumulative fraud has been.

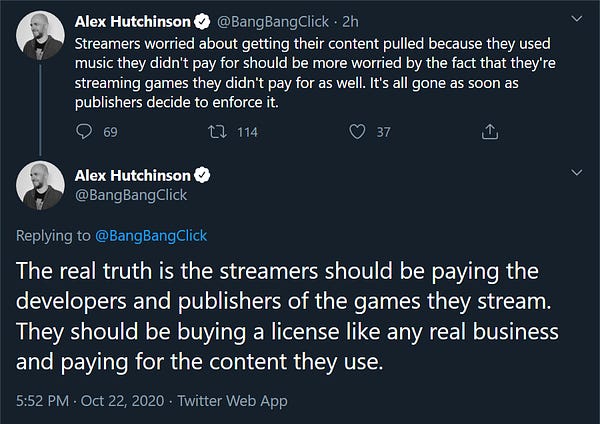

Who Owns Streamed Games?

A twitter thread points out that the rapidly-growing game streaming business relies on some uncertain legal foundations. Posting a stream of a TV show or a song without a license isn’t legal by default, and games might fall in the same category:

Arguably, game streamers are closer to cover artists than to music pirates. They’re not streaming the game, they’re streaming their interaction with the game. Nobody thinks they can split a streamer’s audience just by playing the same game. But as eSports and streaming get better-monetized, game companies may choose to start controlling their IP more strictly. Monetization doesn’t just mean more money for them to go after. It means more ads interfering with the stream. Since the stream is essentially a free ad for the game, they don’t want it cluttered with ads for something else.

Rebooting Transit

Aaron Renn points out that many cities' public transit systems are struggling now, or will face problems in the future, due to Covid. Functioning public transportation is an important part of a dense city’s network effect, because it’s a subsidy for the most economically marginal inhabitants. If cities are going to survive, it’s because risk-seeking people will move in now that the stodgier tax base has moved out, and they’ll make cities interesting enough to be lucratively re-gentrified in a few years. But that’s not going to happen to New York if it ends being a city where everyone who lives there needs to own a car.

Palantir

The New York Times ran a lengthy profile of Palantir yesterday, perhaps most notable because it finally has a definitive explanation for why the company’s name is not a sloppy literary allusion, not a winking one, but actually an important point about the nature of good and evil according to Tolkein:

The Tolkien point I always make is that at the end of the day, it was actually a good device that was critical to the plot of the whole story. The way it worked was that Aragorn looked into the Palantir, and he showed Sauron the sword with which the One Ring had been cut off Sauron’s fingers at the end of the Second Age. This convinced Sauron that Aragorn had the One Ring and caused Sauron to launch a premature attack that emptied out Mordor and enabled the hobbits to sneak in to destroy the One Ring… The plot action was driven by the Palantir being used for good, not for evil. This reflected Tolkien’s cosmology that something that was made by the good elves would ultimately be used for good.

This is not exactly the sort of thing that will change Palantir’s critics' minds about deportation and the privacy/civil liberties balance, nor is it going to find its way into Palantir’s other critics' discounted cash flow models. But it’s a revealing point: for at least one critique of the firm, there’s a sophisticated counterargument that’s far less obvious than the surface-level complaint.

Tech Sees Like a State

Two examples of an ongoing Diff theme:

Welfare in the form of food assistance is a fairly popular government program, but it tends to assume that everyone has the means and willingness to collect the food themselves. Instacart is helping to make that happen, by letting people pay for their food with EBT cards. This doesn’t just make an existing government program work as intended; it can actually improve it, since Instacart is collecting data on which foods people use their benefits to buy, and can also help them comparison shop.

Palantir is helping track the Covid-19 vaccine supply chain. The firm’s network analysis is particularly useful for vaccines, since the efficacy of a vaccine is partly tied to protecting the most at-risk people, and risk is partly a function of who spends time with whom.

Rationalists and Thymos

Applied Divinity Studies asks why adherents to the rationalist online subculture aren’t more successful. It’s a good question: rationalists try to identify and improve on their biases (the group first gelled on Overcoming Bias before moving to LessWrong—avoiding mistaken beliefs is their whole theme). Rationalists tend to be well-educated, and they’re overrepresented in the high-earning field of software. And yet, they don’t seem overwhelmingly successful. ADS has a theory:

Rather than general dishonesty, my theory is that founders neglect one kind of reasoning very specifically. The same kind most rationalists are obsessed with: taking the outside view.

…

Here’s a more concrete example: A rationalist has a good startup idea, so they set out to calculate expected value. YC’s acceptance rate is something like 1%, and even within YC companies, only 1% of them will ever be worth $1 billion. So your odds of actually having an exit of that magnitude are 10,000 to 1, and then you’re diluted down to 10% ownership and taxed at around 50%. Of course, there are exits under and above a billion, but back-of-the-napkin, you’re looking at an expected $5,000 for 10+ years of work so grueling that even successful founders describe it as “eating glass and staring at the abyss.”

This may be true. Rationalists are unusually likely to respond to Fermi Estimates by agreeing that, for example, the impact of runaway AI or nuclear war suggests that we should spend more time solving existential risks, or that the high payoff from living forever offsets the low probability that cryogenics will work. But they may have run the numbers on founding companies and decided that it’s a poor risk-reward tradeoff, and that they’re better off working for big tech. In that case, rationalists may be very successful on a Sharpe ratio basis, but under-levered.

There’s a collective action problem here. Many of the most successful companies are somewhat ideological, which gives them a monopoly on recruiting particular kinds of employees, and keeps the organization motivated even when things are difficult. Odd shared beliefs are a source of thymos. For any one person, starting such a company might be suboptimal, but for the group, the existence of a rationalist-dominated startup would be a net gain. So the outside view strikes again: rationalists are always in the habit of asking “why would I be special?” but if nobody asks that question, nothing special gets started.

(Another possibility is that there are a number of highly successful, rationalist-sympathetic people, but they’re discreet about their adherence to rationalism. This could be a prudent choice not to draw undue attention, or it could be because rationalists are much more introverted than average, and simply haven’t gotten around to telling people about their views.)