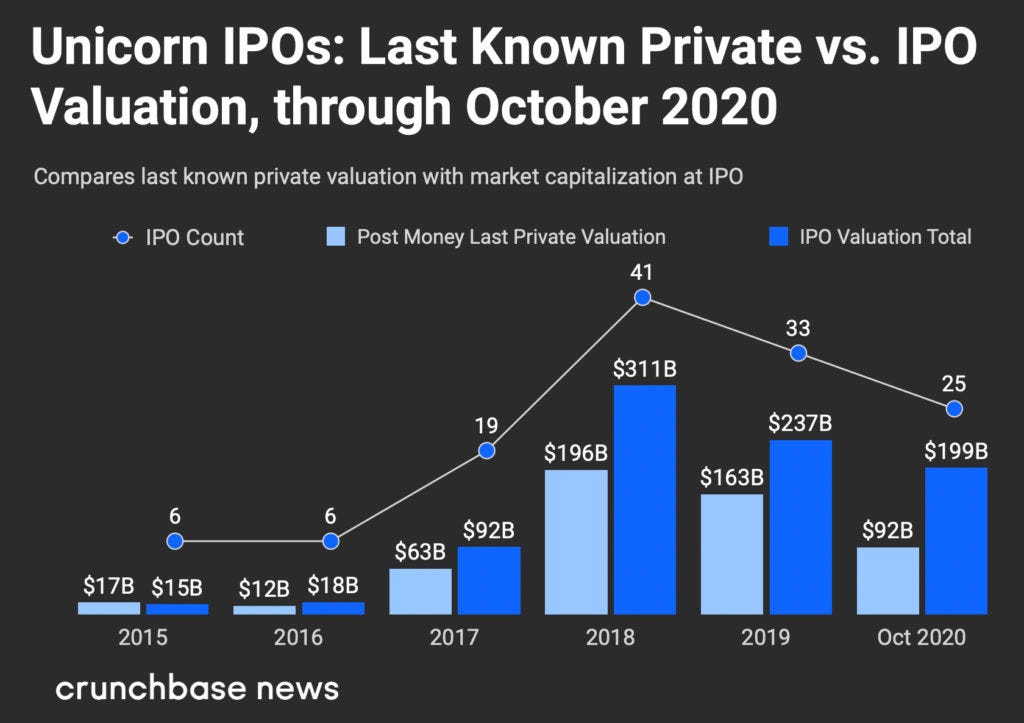

Crunchbase published an analysis on IPOs of “unicorns” (private companies with $1B+ valuation) in 2020. While 2020 is on track to see fewer unicorns enter the public markets than in 2018 and 2019, the companies that have IPO’ed are outperforming.

On average, unicorns going public in 2020 are seeing a 117% jump between their last private valuation (on average 2 years pre-IPO) and the IPO valuation, not taking into account post-IPO appreciation. This compares to 43% in 2019, and 59% in 2018.

What’s happening here? Public investors have recently offered high growth software companies larger multiples on annual recurring revenue (ARR) than private investors, according to an analysis from Tomasz Tunguz.

It’s also possible that only the strongest IPO candidates decided to make their debuts this year, given the turbulent market - and these companies would naturally see the largest increase in valuation at IPO. We’ll keep a close eye on this metric for 2021!

news 📣

🗳️ Social networks regulate election news. After years of preparation, social platforms were put to the test on their new policies to fight election disinformation! Reviews were generally positive, though some companies did better than others.

Twitter placed a warning in front of several of President Trump’s tweets (as well as other tweets from both sides that prematurely announced election results), and permanently banned Steve Bannon after threats of violence.

Facebook added labels to election-related posts clarifying when results were not final, blocked hashtags used to spread conspiracy theories, and put some groups on probation for consistently spreading misinformation.

YouTube came under the most criticism, after refusing to remove videos that falsely claimed Trump won the election, or spread conspiracy theories about voter fraud. However, it did demonetize some of these videos.

⁉️ Ant Group delays giant IPO. Chinese fintech company Ant Group had planned to go public this week at a ~$300B market cap in the world’s largest IPO. Shanghai regulators squashed these plans, indefinitely suspending the IPO due to a failure to “meet information disclosure requirements.” CEO Jack Ma has a tense relationship with the government, which may have boiled over last week when Ma criticized regulators for stifling innovation. Chinese President Xi Jinping is focused on supporting state-owned enterprises, which many feel motivated the Ant block.

⚖️ DoJ files suit to block Visa/Plaid deal. The Department of Justice officially filed an antitrust lawsuit against Visa’s $5.3B acquisition of Plaid. Government lawyers referred to Plaid as a “nascent competitive threat” to Visa, citing plans by Plaid to expand into transaction processing. After reviewing internal documents, they allege that Visa executives knowingly acquired Plaid to squash this potential competition. Visa responded that it will “defend the transaction vigorously.”

🚘 Prop 22 passes. California voters delivered a victory to app-based driving companies, as Proposition 22 passed with 58.5% of the vote. The measure exempts Uber, Lyft, DoorDash, Instacart, and others from a law that would have required them to classify drivers as employees. The proposition also set a minimum wage and mandated health insurance for drivers working 15+ hours per week. Prop 22 was the most-funded measure in CA history, sparking claims that companies “bought a law.”

📈 Big tech earnings trickle in. It was another important week for tech earnings - here’s a summary of what went down:

Uber’s revenue fell 18% YoY. While Uber Eats revenue more than doubled, Rides revenue is down 53% due to COVID. The company’s CFO still projects profitability by EoY 2021, and Uber’s stock shot up 15% after Prop 22 passed.

Match Group (parent company of Tinder and Hinge, among other dating apps) beat expectations for subscribers, driving the stock up 13% to end the week. Tinder’s 6.6M paid users comprise more than 60% of total Match subscribers.

Square also had a great quarter, with a 140% increase in revenue driven primarily by Venmo competitor Cash App. Cash App hit 40M MAUs over the summer, and profits grew 3x YoY - almost 80% of which came from in-app bitcoin purchases!

Delivery startup goPuff is spending $350M to acquire BevMo, a chain of alcohol stores with 160+ locations on the West Coast. Founded in 1994 and owned by a private equity firm, it’s definitely not a typical acquisition target for a VC-backed company.

goPuff, which recently announced a $380M round at a $3.9B valuation, will use this acquisition to expand into a previously untapped market - California! The company also plans to leverage BevMo’s locations as micro-fulfillment centers for its own deliveries, while leaving the in-store experience largely unchanged.

what we’re following 👀

Tesla is now selling a $250 bottle of tequila (feels very on brand for 2020).

Career coaches on TikTok are thriving during the pandemic.

Why the federal government seized $1B in Bitcoin this week.

A look at the rise of ransomware attacks targeting U.S. hospitals.

Cool new product 🚨 - Hebbia is reinventing Ctrl+F with smarter search! Add it to Chrome with invite code ACCELERATED (it’s in beta!), and submit feedback here.

It may have taken three days to declare the presidency, but we had one clear winner on election night - memes! As the nation waited for votes to be counted, we stayed somewhat sane thanks to the creators of some hilarious election content.

In case you somehow avoided both Twitter and TikTok this week (congratulations, you have more self-control than we do!), here’s a summary of the main themes:

Why it was taking so long for Nevada to finish counting votes

Traditionally Republican or swing states like Georgia that flipped Blue

Everyone’s inability to stop constantly checking the news or refreshing Twitter

Various news anchors and analysts who suddenly became national celebrities

Gritty, the mascot of the Philadelphia Flyers who was already a beloved meme

Four Seasons Total Landscaping (there’s not much more to say here)

Regardless of your political leanings, we hope you found some good memes that provided moments of levity in a stressful and confusing week. Feel free to tweet us your favorite election meme - if you’re looking to make your own, check out CRV portfolio company Kapwing’s meme generator (with templates!).

jobs 🎓

Everlane - Product Manager (SF)

Rothy’s - Digital Content Specialist (SF)

Shogun - Data Analyst (SF)

Juni Learning - Growth PM (SF)*

Poshmark - Growth Associate (Redwood City)

World Innovation Lab - Marketing & Ops Associate (Palo Alto)

Tesla - Corp Dev Analyst (Fremont)

Oliver Space - Ops Manager (LA)

B Capital Group - Chief of Staff (LA), Strategy & Ops Associate (NYC)

AngelList - Venture Associate (NYC)

Ollie Pets - Chief of Staff (NYC)*

Grow - Founding Designer (NYC, Remote)

Cigna Ventures - Associate (CT)

*Requires 3-5+ years of work experience.

internships 📝

Yotpo - Marketing Intern (Remote)

Wealthfront - Communications, Data Science Interns (Remote)

Done - Operations, Growth Interns (Remote)

645 Ventures - MBA Investment Team Fellow (Remote)

GGV - Next Gen Venture Fellows (Remote)

Nylas - MBA Product Marketing Manager Intern (Remote)

Reddit - Summer Product Intern (SF)

Pinterest - Data Science Intern (SF)

Snap - Design Engineer Intern (LA)

AlleyCorp - Venture Fellow (NYC)

Hydrant - TikTok Intern (Remote, NYC)

puppy of the week 🐶

Meet Ryker, a 12-week-old English golden retriever who lives in Baltimore.

His hobbies include biting leaves, following his mom, and chasing his own shadow. He’s often a man on the move (see last photo) - and his tail is usually wagging! Ryker is eagerly anticipating his first holiday season, and already has his Santa hat ready.

Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com.