Accelerated - 🚀 A note on Internet culture

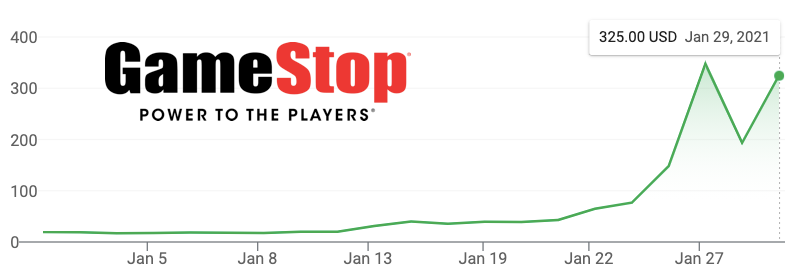

For a long time, we struggled to comprehend how the stock market functions. We know that a company’s enterprise value should theoretically be determined by expectations for its future free cash flows. But anyone who has spent time at an investment bank knows that it’s easy to manipulate a DCF to get the value you want. In real life, stock prices sometimes feel like made-up numbers we’ve collectively decided to believe in. We used to ask our dad (a legit money manager) - if we all want to make money, why don’t we drive up the price of a given stock? We eventually learned it was more complicated than that, but held out hope that one day, retail investors would make it happen. This week, in true “13th month of 2020” energy, it finally did! It’s probably going to take a long time to unpack how r/wsb was able to rally enough people to meaningfully move the price of $GME (and then $AMC, $BB, and others). We suspect that quarantine-induced boredom played a part - when you’re stuck inside all day, you may as well entertain yourself. And as Gen Zers increasingly buy into the “hustle mentality,” speculative stock trading seems like an easy way to make money. However, it’s also a testament to the power of online platforms. “Niche” communities on Reddit, Discord, and Twitter have achieved things that once seemed impossible, from storming the U.S. Capitol to disproving the Efficient Market Hypothesis. And as we all spend more time online, it seems likely that significant events and movements that define our lifetimes will originate online. Ignore Internet culture at your own risk - for better or worse, the rules of society are being rewritten on the Internet! news 📣💸 Robinhood has a rocky week. Robinhood faced massive backlash this week after halting trading of GameStop and AMC. The move raised concern from politicians on both sides of the aisle (AOC and Ted Cruz were in agreement!), who questioned whether the company was protecting hedge funds that had shorted the stocks. However, it later emerged that Robinhood made the call in order to meet the SEC’s regulatory requirements for net capital and clearinghouse deposits. The company raised an additional $1B in emergency funding to cover the deficit going into next week. 🎧 a16z doubles down on Clubhouse. Audio social app Clubhouse, which has been climbing the App Store rankings, announced a Series B this week. The company didn’t disclose round size or valuation, but Axios reports that it was $100M at a $1B post-money. The round was led by a16z, which also won a bidding war for the Series A (at a $100M valuation!) last May. Clubhouse’s user base has grown from 5,000 to 2M since then, despite the fact that it’s still invite-only. Co-founder Paul Davidson said the team will focus on helping creators monetize via grants and in-app subscriptions & tickets. 💻 Calendly raises at $3B. Scheduling startup Calendly announced its first major fundraise - a $350M round at a $3B+ valuation. Calendly scaled to $70M in annual revenue and 10M monthly users (up more than 1,000% in 2020) after raising only $550k in funding in 2014. The round reportedly includes some secondary to give liquidity to early employees & investors. While Calendly is already profitable, the company will use the remaining funds to double headcount and release more tools/integrations. 📈 IPO updates. It was a busy week for tech startups looking to go public!

In other bizarre news, digital currency Dogecoin hit an all-time high thanks to the coordinated efforts of Redditors, Elon Musk, and Tiger King’s Carole Baskin. We’re going to be honest - this one was not on our 2021 bingo card! Dogecoin peaked at a market cap of ~$10B, up from $1B at the beginning of the week. It also set a record for the most tweets about a cryptocurrency in a 24-hour period (beating Bitcoin!). But the good times didn’t last - the coin plunged 70% on Saturday. There’s really no rational explanation for this! The coin was created as a joke, and is now being described as “the crypto GME,” as the rally was driven by activity on Reddit’s “SatoshiStreetBets” (which describes itself as the crypto version of r/WSB). what we’re following 👀The New York Times explores the truth behind the “growth hacks” that claim to make your content go viral on Instagram. A look at the brands using the “adorkable” aesthetic to target Gen Z consumers. Greylock’s Corinne Riley explains how startups can leverage community-led growth. Harry Stebbings breaks down Sequoia’s investment in DoorDash on a special episode of the Twenty Minute VC with Alfred Lin. 🚨 We need your help! We’re joining Mario Gabriele’s S-1 Club to do a deep dive on Bumble 🐝, which filed to go public two weeks ago. We’re trying to gather some data on how millennials & Gen Zers use dating apps, as well as how Bumble fits into the (crowded!) landscape of options. If you can spare two minutes, we’d really appreciate if you could fill out this quick survey - the results are completely anonymous and we’d love to get your thoughts! Envision Accelerator has opened applications for its 3rd cohort! Join the next batch of diverse founders for Envision’s 12 week program - you can apply here. jobs 🎓hims & hers - Product Manager (Remote) Nurx - Strategy Associate (SF, Remote) Truework - Software Engineer (SF) Forté Ventures - Associate (Bay Area) LinkedIn - Associate Product Manager (Bay Area) The Production Board - Chief of Staff (Bay Area) DocuSign - Associate Product Manager (Seattle) Whatnot - Ops/Customer Support (LA) Albert - Finance Associate (LA) Insight Venture Partners - Investment Analyst (NYC) Metaprop - Principal (NYC)* NextView Ventures - Platform & Ops Associate (NYC, Boston) Founders Factory - Investment Analyst (London), Venture Designer (NYC) *Requires 3+ years of experience. internships 📝Utmost - Marketing Intern (SF, Remote) Curology - Product Development Intern (SF) Unity - Business Ops Analyst Intern (SF) DocuSign - Product Manager Intern (SF) Emerson Collective - Summer Interns (SF, DC) Wealthfront - Data Science Intern (Palo Alto) Founder Collective - MBA Associates (Boston) The Motley Fool - Summer Venture Fund Intern (Alexandria, VA) Divergent Capital - Fellowship (Washington DC) Two Sigma Ventures - Summer Intern (NYC) Samsung Catalyst Fund - MBA VC Intern (NYC) Insight Partners - Summer Analyst (NYC), also hosting a virtual sophomore diversity summit Vice Ventures - Summer Data Analyst (NYC) puppy of the week 🐶Meet Roo, a five-month-old mini labradoodle that lives in New York City! Roo enjoys exploring Central Park, chewing on anything her parents haven’t taken off the ground, and playing with every puppy she meets on the street! Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Netflix crosses major milestone

Sunday, January 24, 2021

Plus, what % of companies are now starting fully remote?

🚀 Airbnb presses pause on D.C.

Sunday, January 17, 2021

Plus, apps to level up your life in 2021!

🚀 Trump gets deplatformed

Sunday, January 10, 2021

Plus, Roblox shakes up its plans for going public!

Special Edition: Our Top Ten Books of 2020! 📚

Sunday, January 3, 2021

We'll be back to our regularly scheduled programming next week, but wanted to use this week's newsletter to highlight our best reads of 2020! Olivia read 155 books this year and Justine read

🚀 Our top 10 trends for 2021

Sunday, December 27, 2020

Plus, the last job & internship postings of 2020!

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏