The Pomp Letter - Gold Bugs Are Capitulating

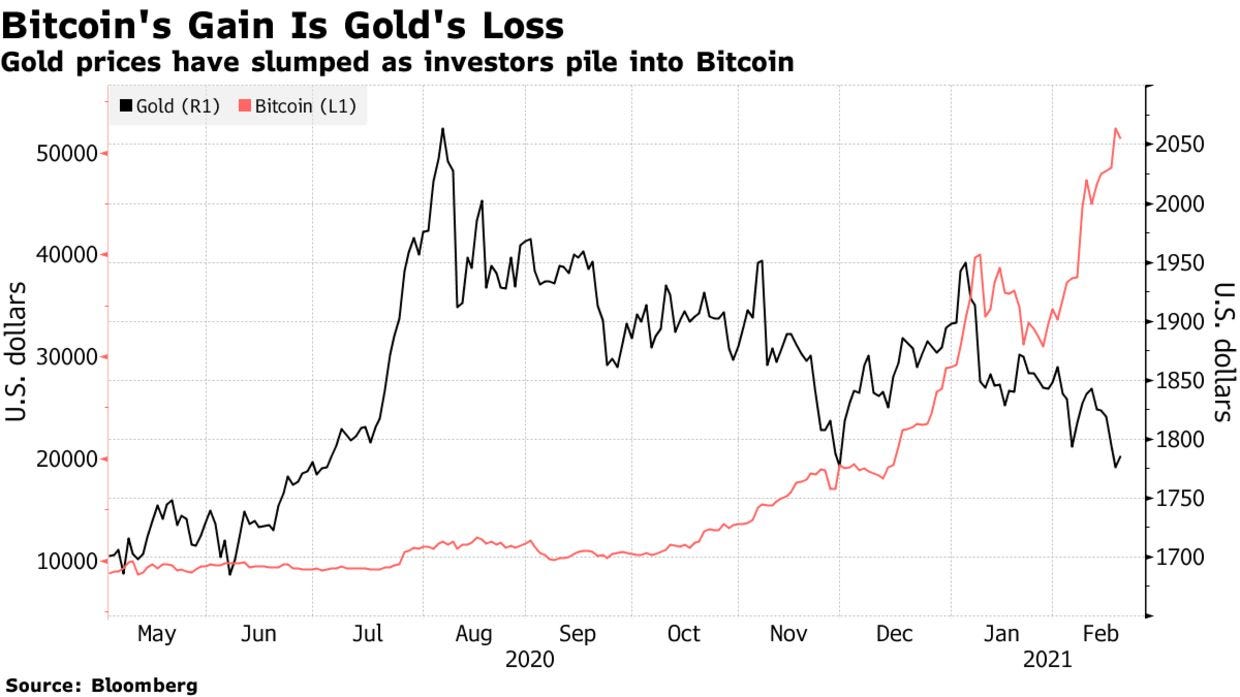

To investors, Bitcoin has unique properties that continue to prove valuable in the market. This value leads to increases in demand, which drive the US dollar price higher. As the price goes higher, previous bitcoin bears are forced to re-evaluate their prior analysis. Some of the bears continue to conclude that bitcoin is over-hyped at best and worthless at worst. It is unclear if they reach the same conclusion because they truly believe their analysis or if it is the product of a lack of intellectual rigor. Either way, plenty of prior bears are still bearish today. There are a few people, and I mean a select few, who have been previously skeptical of bitcoin publicly and are now changing their mind. The latest person to do this is Jeffrey Gundlach, the founder of DoubleLine Capital. For those of you who don’t know Gundlach, he is known as the bond king and has been a gold bug for years. The revelation came from one of his tweets yesterday: The idea of Bitcoin: The Stimulus Asset has a nice ring to it. But what is more interesting to me is that Gundlach’s analysis is not a statement on bitcoin exclusively, but rather a three pronged analysis of the US dollar, gold, and bitcoin. This is exactly how someone should think of these assets — each can serve as a store of value in different environments or time periods. Over the last 12 months though, holding bitcoin was a better decision over dollars or gold. In fact, it is becoming increasingly clear that gold is seeing outflows at the same time that bitcoin is seeing inflows. Bloomberg’s Lynn Thomasson explained it well by saying “Gundlach’s comments are another sign the investment case for Bitcoin is winning over institutional money managers and possibly siphoning cash from the gold market. Historically, traders have turned to the precious metal as a way to play rising inflation expectations. But over the past year, it has been range-bound and gold exchange-traded funds have seen outflows.” While the chart is clear that gold is losing and Bitcoin is winning, that doesn’t necessarily guarantee causality. It is hard to argue against the data and results though. Investors have a short memory unfortunately. If they did not, you would remember people were yelling and screaming about Bitcoin’s correlation to traditional assets during the start of the economic crisis in March of 2020. As I wrote at the time, we were not seeing sustainable correlation, but rather a liquidity crisis where all assets would sell off together. As predicted, assets eventually were bailed out by government and central bank intervention. We saw an aggressive recovery and eventual decoupling of correlations that trended back to the historical non-correlation for bitcoin. The question that I keep asking myself is “how long will gold bugs hang on to their gold while they watch the digital store of value gain market adoption?” The short answer is that no one actually knows. Some people are likely to bail in the short term because of the US dollar price of bitcoin. Some people will take time to critically think about their world view and then change their mind. And a few people are more focused on being “proven right” than actually “being right.” Ultimately, everyone capitulates though. Bitcoin is the hardest, soundest money the world has ever seen. That may sound like a bombastic claim, but it is proving to be more accurate with each passing day. Remember, changing your mind when you receive new information is a sign of intelligence. We should encourage people to do it. The real sign of stupidity is watching the market, and related data, tell a story that is impossible to ignore, yet you sit idly by submerged in your ignorance. Gold has done a fantastic job for thousands of years. We live in a digital world now and the old solution just doesn’t cut it anymore. You don’t send all of your communications via physical letters anymore. You’re intelligent enough to use email, text message, and phone calls. Holding on to your gold is the equivalent of physical letters. Does it get the job done? Yes, in the most basic sense, but it is drastically inferior to the digital application of communication. This is what the world is waking up to and realizing at almost the same time. The world’s richest entrepreneurs and investors. The largest financial institutions. They all see the writing on the wall and they’re trying to figure out how they want to participate. It is a beautiful thing to watch. Bitcoin doesn’t care though. It continues to produce block after block after block of transactions. Enough to process nearly $15 billion of on-chain transaction volume in the last 24 hours. That puts it on a path to $5+ trillion annualized transaction volume, which is approximately 50% of Visa and MasterCard. Just as everyone eventually capitulates, bitcoin will eventually eclipse these monolithic payment networks. It is just a matter of time. Have a great day. I’ll talk to everyone tomorrow. BONUS: If you want a job in the bitcoin and crypto industry, there are thousands of open roles at http://www.pompcryptojobs.com -Pomp SPONSORED: Even with 50% of my net worth in bitcoin...I know that portfolio diversification is important. And if you’re looking to invest outside of crypto then you should check out blue-chip art. Like bitcoin, there is a fixed supply of paintings that decreases every year as works get donated to museums and foundations (+ the Fed can’t print Picassos...). According to Citi, contemporary art returned 13.6% per year over the last 25 years - that’s 52% better than the S&P 500! The 1% have dominated the art market for years. Because blue-chip paintings cost millions of dollars, there hasn’t been a way for regular investors to get into this exclusive asset class. Thanks to Masterworks, everyone can invest in blue-chip art from artists like Basquiat and KAWS at a fraction of the price. So if you’re sitting on some parabolic gains, it doesn't hurt to shave off a few Satoshis and diversify into one of the oldest and safest asset classes in the world. The best part? Pomp Letter subscribers can skip their 14,750 person waitlist today.* *See important info THE RUNDOWN: First Bitcoin ETF in North America Is Launching in Canada: The first exchange-traded fund tracking Bitcoin in North America begins trading in Toronto on Thursday, in a potential milestone moment for both the cryptocurrency and ETF industries. The Purpose Bitcoin ETF provides exposure to the world’s largest cryptocurrency by investing directly in “physical/digital Bitcoin,” issuer Purpose Investments Inc. said in a statement. The fund will be available both in Canadian dollar and U.S. dollar units. Read more. Jeffrey Gundlach Says Bitcoin May Be a Better Bet Than Gold: DoubleLine Capital LP chief and long-time gold bull Jeffrey Gundlach has changed his mind on the metal and considers Bitcoin a better trade. Gundlach tweeted he’d been a long-term gold bull and U.S. dollar bear, but has turned neutral on both. Bitcoin may well be “the stimulus asset,” he said, a reference to the cryptocurrency’s rally amid a wave of cash pumped into the financial system during the pandemic. Read more. Tesla Tapped Coinbase for $1.5B Bitcoin Buy: Coinbase’s institutional trading wing handled electric car-maker Tesla’s $1.5 billion bitcoin investment earlier this month, according to The Block. The report illustrates Coinbase’s growing role as corporate America marches deeper into crypto. Coinbase handled MicroStrategy’s early allocations; The Block reported it has five Fortune 500 firms as clients. Read more. Coinbase, Readying for Public Listing, Gets $77B Valuation From Nasdaq Private Market: Cryptocurrency exchange Coinbase, which is preparing to trade publicly in the next few months, is being valued at $77 billion, based on trading of the company’s privately held shares on a secondary market. Those shares in the largest crypto exchange in the U.S. are changing hands on the Nasdaq Private Market at $303 a piece, according to two people with knowledge of the auction. That implies a total company value of about $77 billion – greater than Intercontinental Exchange Inc., the owner of the New York Stock Exchange. Read more. US Lawmakers Looking Into China’s Role in GameStop Pump: U.S. lawmakers are set to question a trader named Keith Gill and the chief executives of Reddit and Robinhood about their roles in the GameStop frenzy at a congressional hearing later this week. But some have another concern: whether China is involved. Several Republican lawmakers on the House Financial Services Committee plan to examine Reddit’s ties to Chinese tech conglomerate Tencent and Robinhood rival Moomoo, according to a Politico report. Moomoo is a wholly owned subsidiary of Futu Holdings, which is also backed by Tencent. Read more. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE James Peyer, PhD is the Founder and CEO of Cambrian Biopharma, a Distributed Drug Discovery Company developing therapeutics targeting the biology of aging. Cambrian builds, finances, and manages a pipeline of therapeutics. In this conversation, James and I discuss:

I really enjoyed this conversation with James. Hopefully you enjoy it too. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

Special Message From Pomp 🙏🏽

Tuesday, January 26, 2021

Hey! What a wild ride 2020 was. Thanks for being a free subscriber to The Pomp Letter. Hopefully this has helped you understand what is currently transpiring across assets and markets. I really enjoy

Time Billionaire

Friday, January 15, 2021

Listen now (5 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 93000 other

KYC and AML Help Bad Actors, Instead of Good Actors

Friday, January 15, 2021

Listen now (8 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 95000 other

Special Message From Pomp 🙏🏽

Friday, January 15, 2021

Hey! What a wild ride 2020 has been. Thanks for being a free subscriber to The Pomp Letter. Hopefully this has helped you understand what is currently transpiring across assets and markets. I really

Inflation Is Killing The American Dream

Friday, January 15, 2021

Listen now (6 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 100000 other

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏