UIPath S-1 Analysis: How 7 Key Metrics Stack Up

Tomasz TunguzVenture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. UIPath S-1 Analysis: How 7 Key Metrics Stack Up

UIPath, leaders in the Robotic Process Automation (RPA) category, filed their S-1 last week, revealing an impressive business. Founded in 2005 in Bucharest, Romania, by Daniel Dines and Marius Tirca, the company now operates more than 60 offices housing nearly 3000 employees. UIPath offers software to build robots, programs that automate repetitive work. Some examples include streamling customer onboarding. Robots read pdfs that customers provide and input that data into other computer systems. Customer support teams might use RPA robots to read the contents of an email, find an order number, look up the order, and present the support agent with some key data. The UIPath suite includes the software to write, execute, monitor, and maintain these robots.

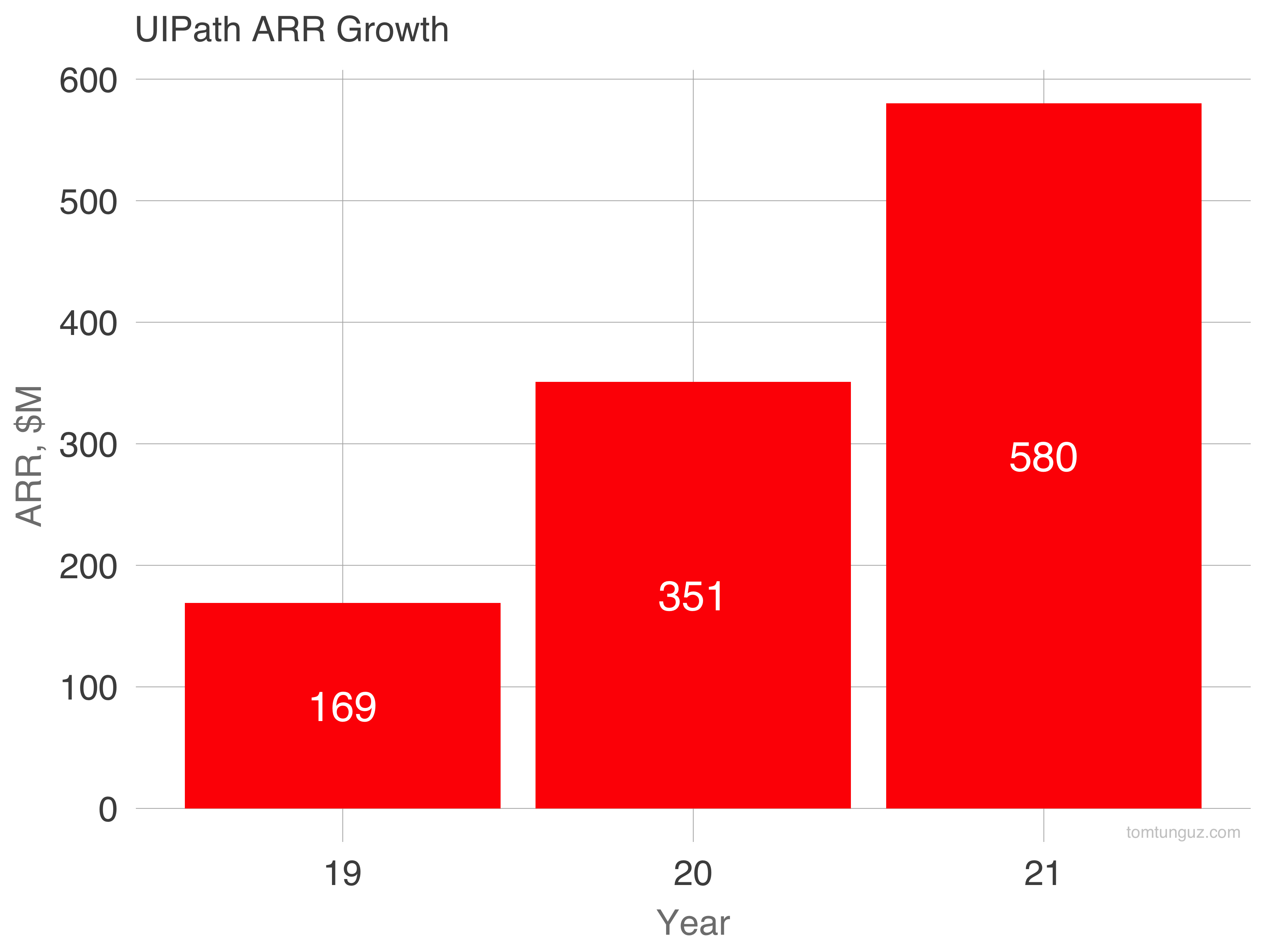

In the last three years, UIPath has grown ARR from $169m to $580m, a CAGR of 151%. Though it may seem that the growth was simply executing a constant gameplan, the underlying data suggests a significant shift in strategy.

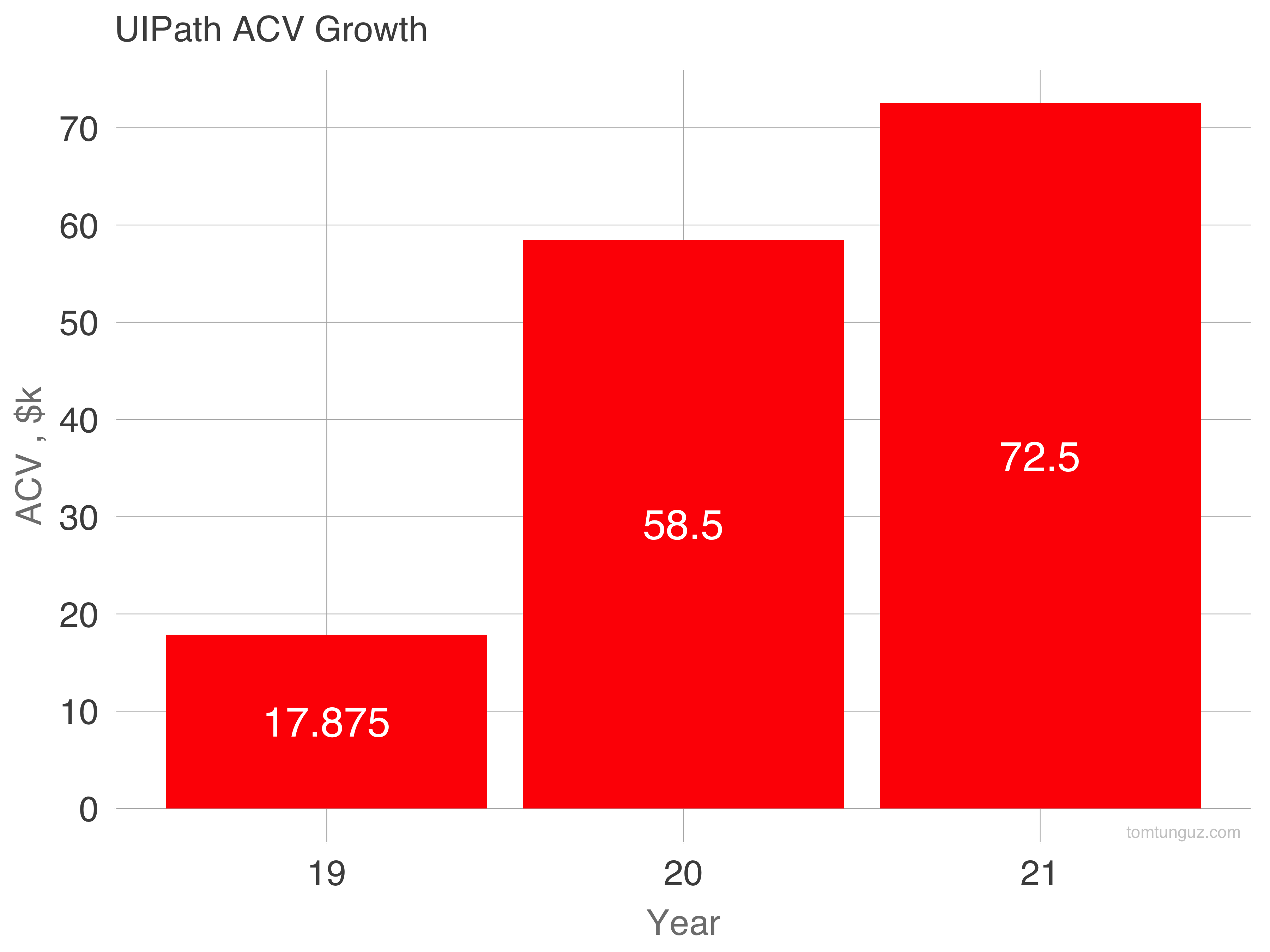

UIPath’s average annual contract value (ACV) grew from $17.9k to $72.5k in the same three year span, with a 3x jump between 2019 and 2020. In 2021, the business counted more than 8000 customers, with 1000 paying more than $100k and 89 paying more than $1m. In addition, 70% of new bookings in 2021 originated from expansions. The company also mentions the 2016 cohort of customers expanded 51x in the last 5 years. The increase in ACV, number of million dollar customers, and bookings composition implies the compnay pushed to serving bigger, enterprise customers. Why is this? My supposition is that robots improve efficiency by some percentage, let’s hazard 5-30%. Those efficiency gains don’t mean much for a company of generating $1m in ARR, but they are massive savings for companies operating call centers costing billions annually; a 5% improvement in a $2b support operation is $100m in savings accreting immediately as profits. Concurrent with the evolution in ACV, we can observe a few other trends.

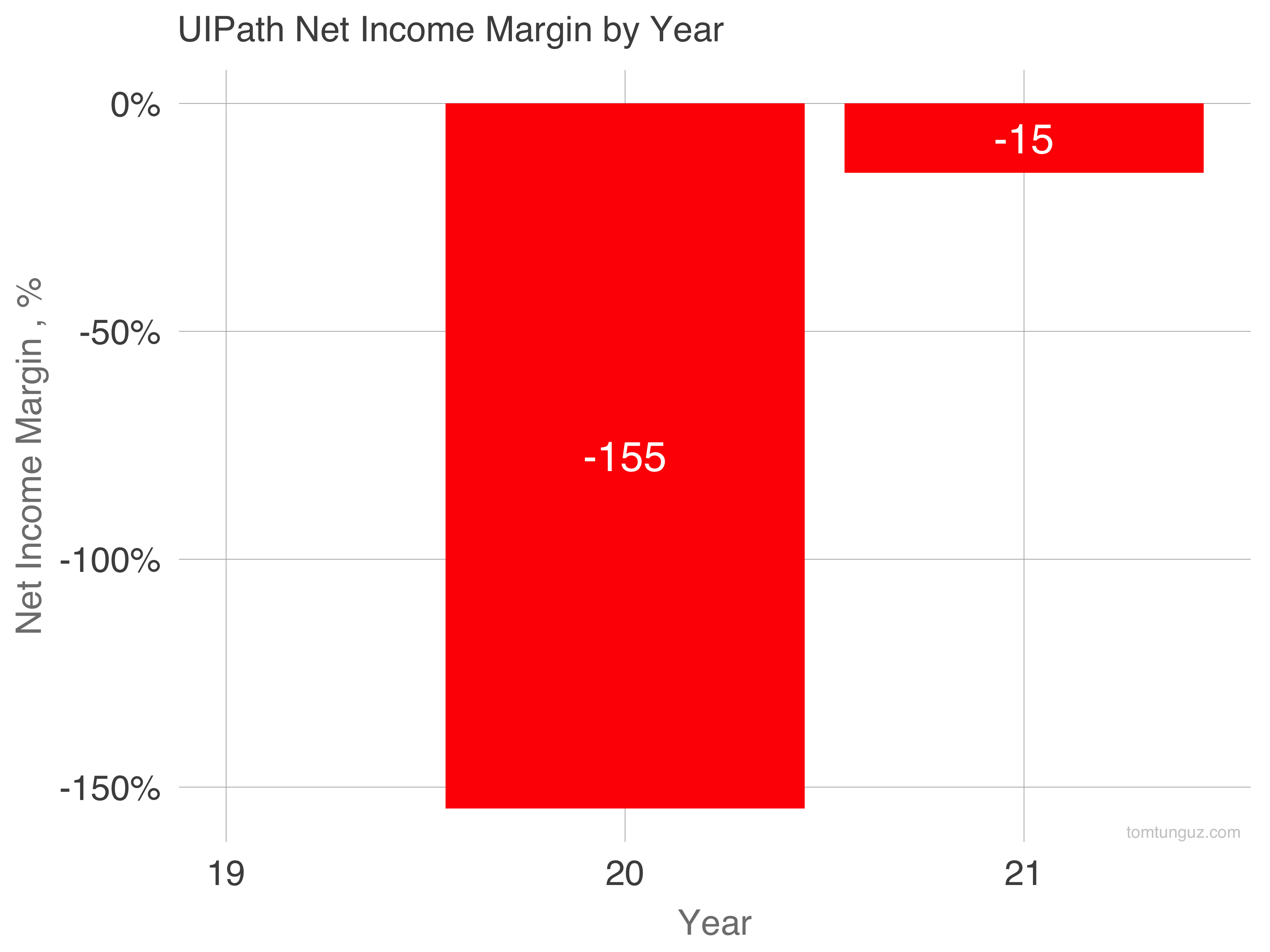

First, the company trimmed a -155% net income margin to -15%, a brobdingnagian (aka massive) improvement.

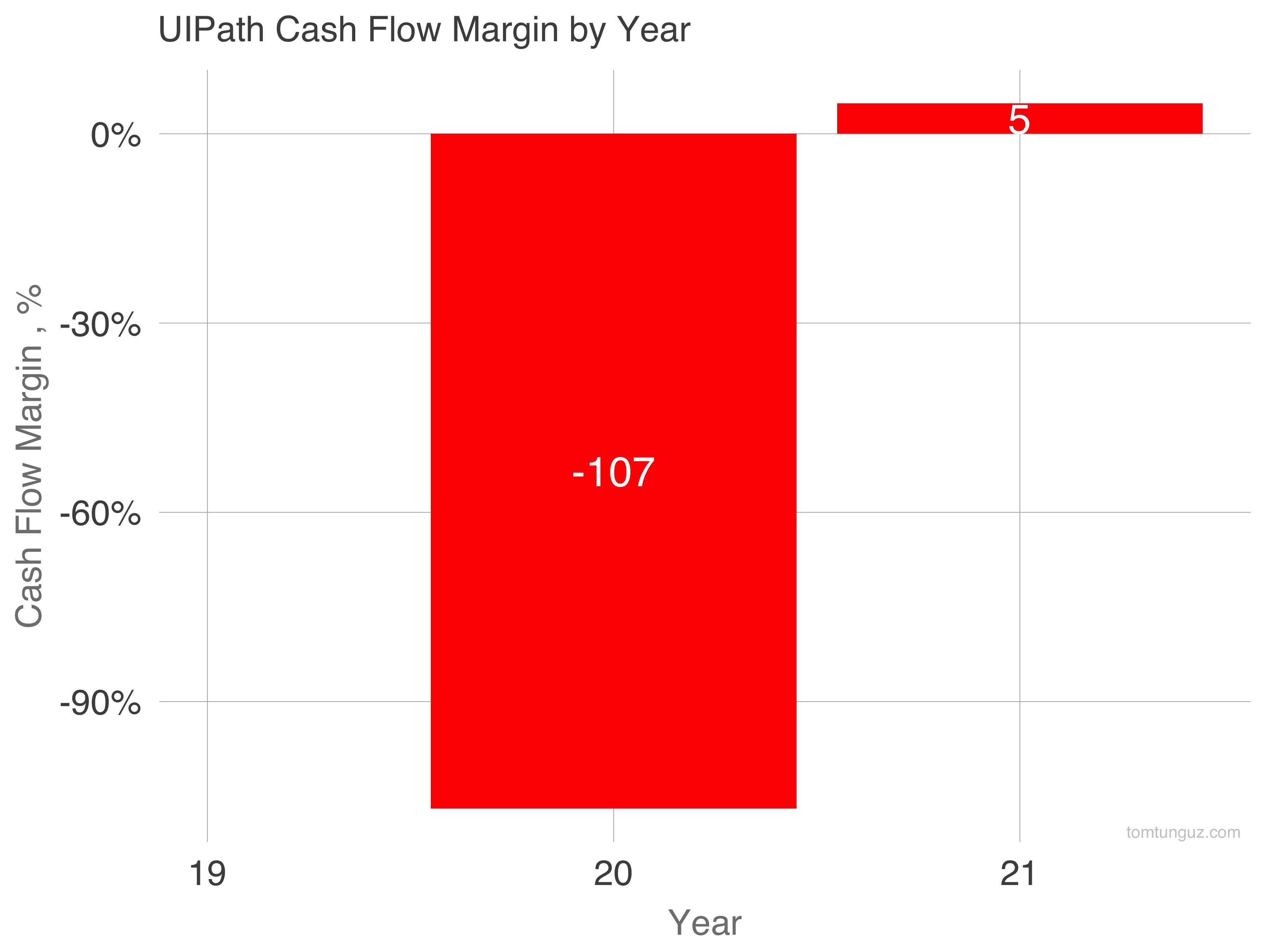

Second, UIPath’s cash flow margin, (defined as cash flow from operations divided by revenue), shows the company has attained a turnaround of similar magnitude on a cash basis. Larger enterprise contracts imply longer contract terms and larger pre-payments, boosting these figures. Improving the net income margin and the cash flow margin this quickly for a business of this scale is like ungrounding a large container ship from an Egyptian canal - no easy feat.

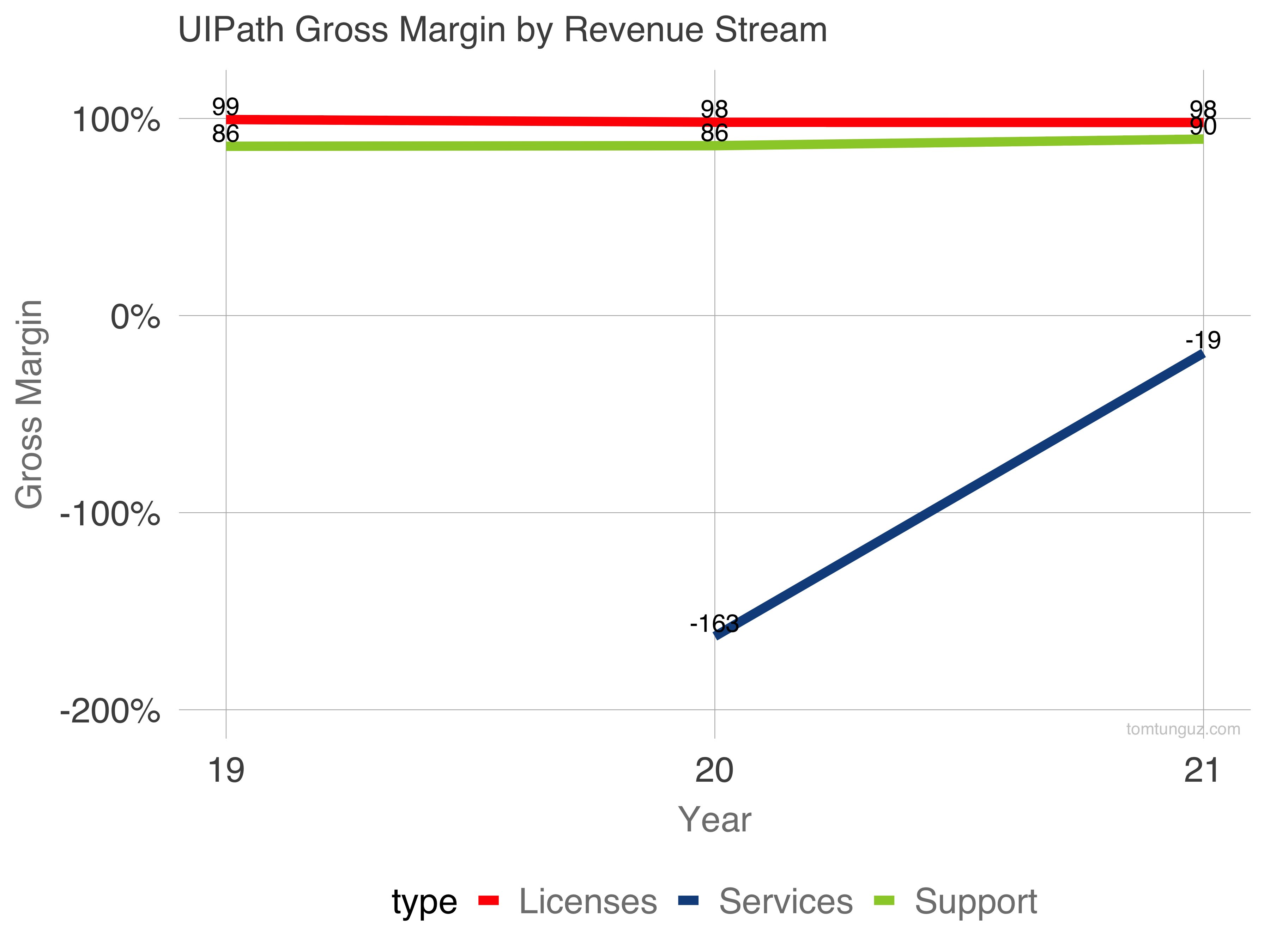

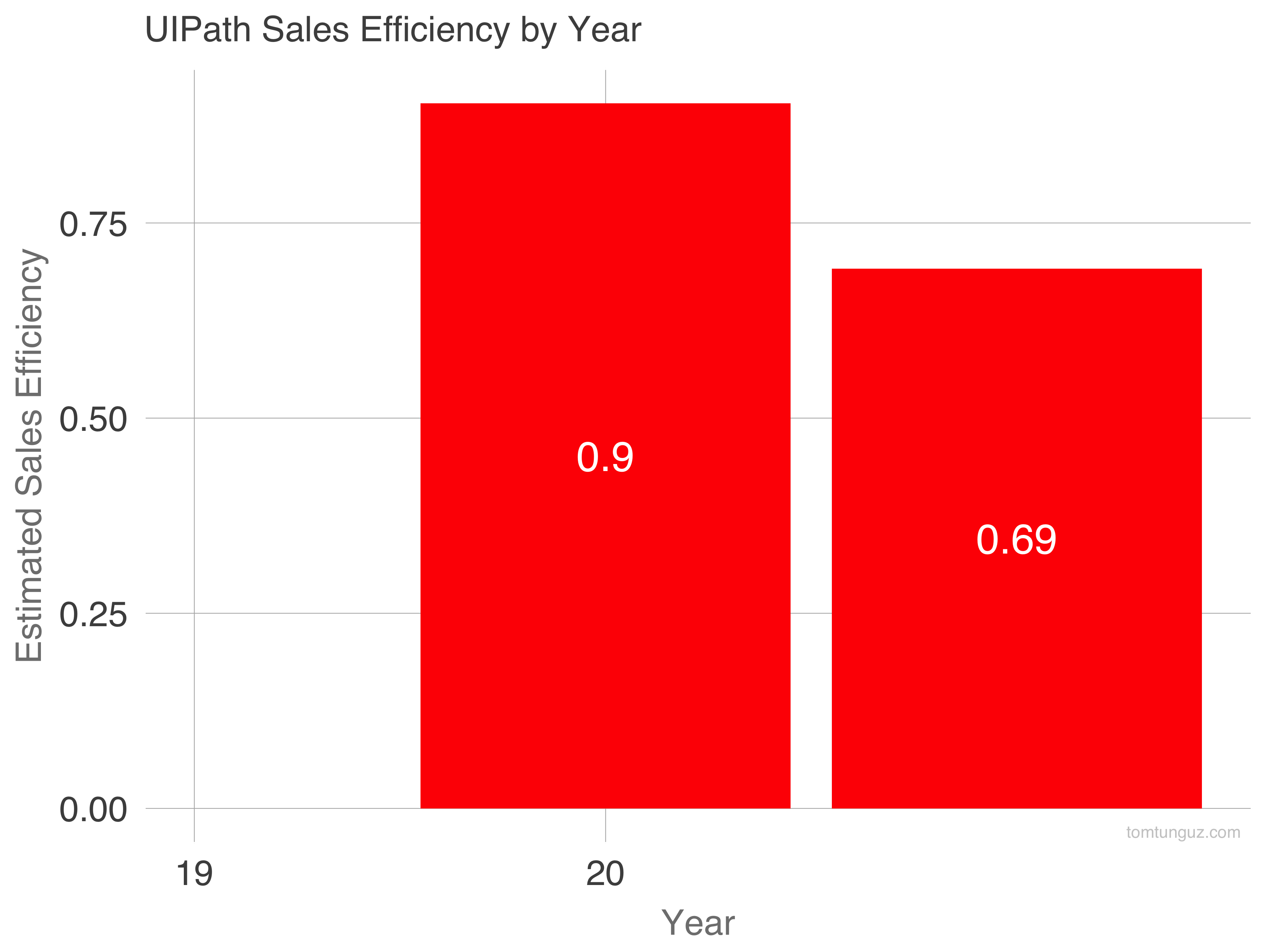

Throughout this transition upmarket, the company has sustained a strong sales efficiency number with an implied payback period of about 17-18 months. Lastly, let’s touch on UIPath’s revenue streams. Unlike many other SaaS companies, UIPath counts three distinct streams: licenses (customers paying for software), support & maintenance (assistance in running and maintaining robots), and services (training).

One hypothesis for this trend is that customers initially bought a large number of licenses and are now working with UIPath and the 3100 system integrators in their network to build a larger number of robots per license seat. It’s consistent with the previous data that the business is moving upmarket and cross-selling more frequently.

Impressively the gross margins for the two main revenue streams are stellar. Licenses revenue is 98% gross margin because the product runs on customers' computers. Without infrastructure costs, the cost to produce the product is zero. Support and maintenance operates at 90% gross margin, nearly 20 percentage points above the public median of 71%. So investors should be indifferent to the revenue mix when considering gross profit. The services gross margin is -19%. But at less than 5% of overall revenues, it’s barely worth mentioning. UIPath’s metrics rank it as one of the fastest growing and capital efficient businesses today. The transition apparent in the metrics must have been a tremendous effort internally, but the dividends are plain to see in the S-1 and even more so when the company begins trading. Congratulations to the team at UIPath on building a world-class company. |

Older messages

The Importance of Building & Maintaining Great Developer Documentation

Monday, March 22, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Importance of Building & Maintaining Great

How Selling Has Changed Post-COVID, and How it Will Change Again Afterwards

Monday, March 15, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. How Selling Has Changed Post-COVID, and How it Will

This is the Most Ridiculous Use of Money Management I've Ever Heard. What is Wrong with You?

Monday, March 8, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. This is the Most Ridiculous Use of Money Management

How Much is 20% More NDR Worth to Your SaaS Startup?

Friday, March 5, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. How Much is 20% More NDR Worth to Your SaaS Startup

The Feedback Loops in Data that Will Change SaaS Architecture

Wednesday, March 3, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Feedback Loops in Data that Will Change SaaS

You Might Also Like

This dead simple web app generates $100K/year

Sunday, March 9, 2025

Starter Story Sunday Breakfast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Building Lovable: $10M ARR in 60 days with 15 people | Anton Osika (CEO and co-founder)

Sunday, March 9, 2025

Listen now (70 mins) | The AI startup that's Europe's fastest-growing company ever ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👻 The AI sourcing secret that's haunting your competitors.

Sunday, March 9, 2025

Uncover the mysterious ways AI is transforming product sourcing and why it's giving some brands an otherworldly edge. Hey Friend , Sourcing products used to be a slow, manual process—searching

🗞 What's New: Why AI can't replace my $1k/mo human assistant

Saturday, March 8, 2025

Also: 25+ AI agent opportunities ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #436

Saturday, March 8, 2025

Debating the future of SaaS + what many VCs are thinking... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎯 Fix your fulfillment, fix your profits

Saturday, March 8, 2025

The answer to higher profits is not always selling more. This is how smart businesses do it… Hey Friend , Most ecommerce founders focus on selling more to increase profits. But what if I told you that

Create a social media strategy in 7 (straightforward) steps

Friday, March 7, 2025

Plus, the latest from the blog and social media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10words: Top picks from this week

Friday, March 7, 2025

Today's projects: Wallpaperee • Chatbox • DesignLit • PH Deck • ChatPro AI • Opencord.AI • NexaAI • GReminders • Springs • crimalin • SuperCarousels • TitleSprint 10words Discover new apps and

Experiment Report: Trying New Things — The Bootstrapped Founder 380

Friday, March 7, 2025

When I talked to Anne-Laure Le Cunff earlier this week, we get into experiments and how to run them effectively. Here's what I've been doing. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📍Why global trade tariffs might actually boost your ecommerce profits

Friday, March 7, 2025

The best ecommerce brands are now using these trade shifts to their advantage Hey Friend , If you think global tariffs and rising costs are bad for your ecommerce business, think again. Yes, some

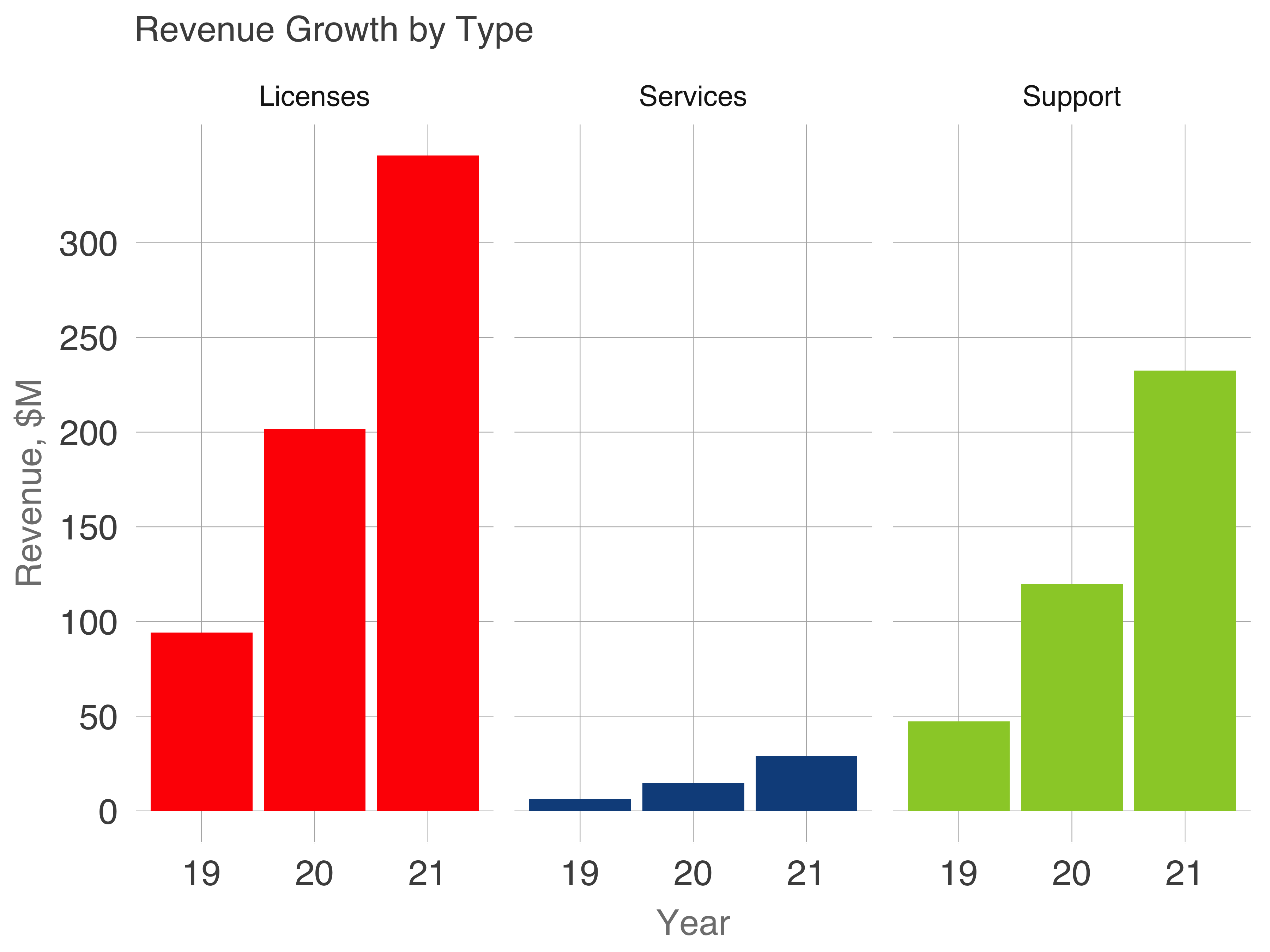

Licenses constitute the majority of the revenue, followed closely by Support, with services comprising less than 5% of revenues. The ratio of support & maintenance to license revenue has increased from 50% to 67% over this three year time period.

Licenses constitute the majority of the revenue, followed closely by Support, with services comprising less than 5% of revenues. The ratio of support & maintenance to license revenue has increased from 50% to 67% over this three year time period.