🚀 How to escape the Internet hype cycle

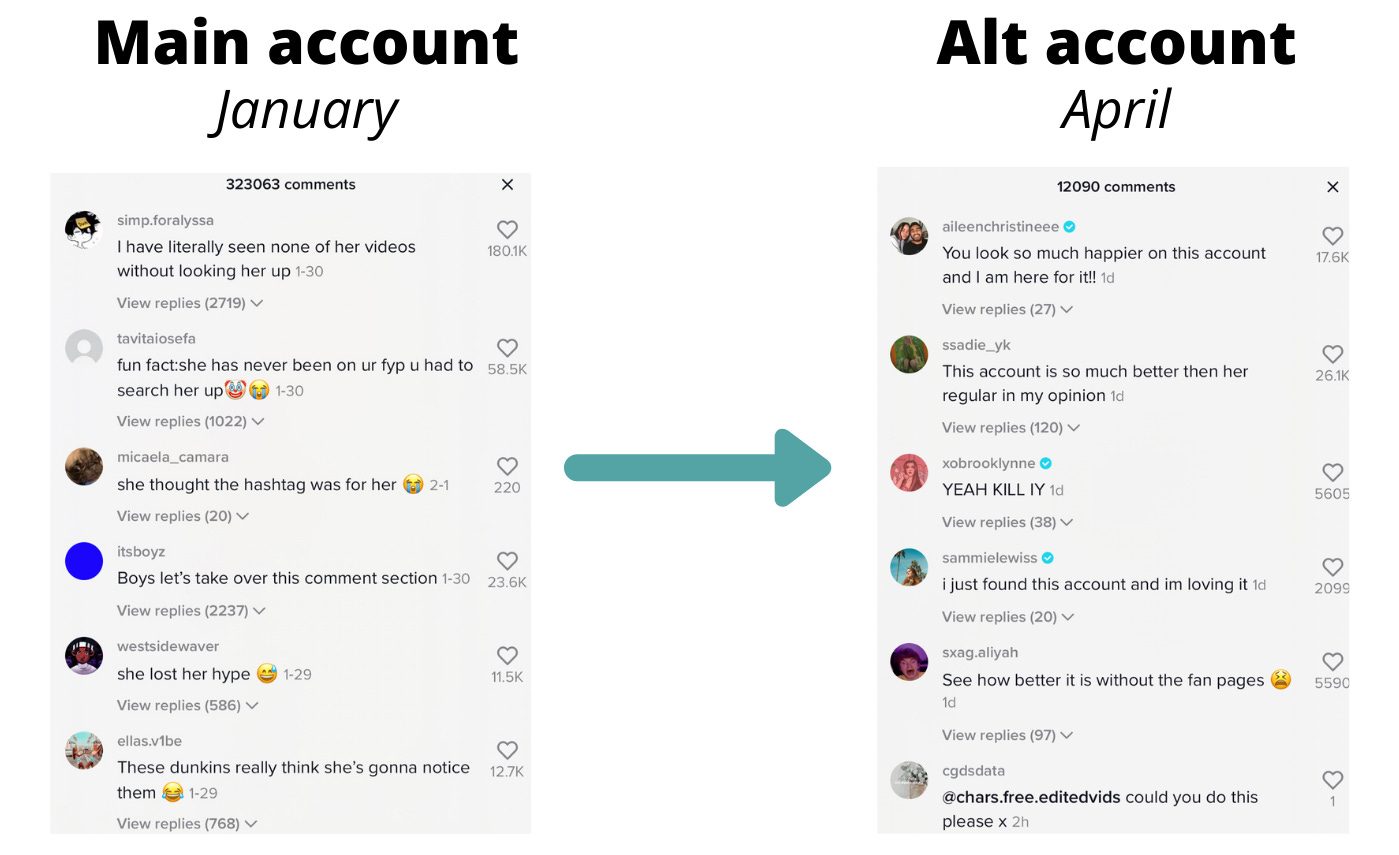

After a year of impressive outperformance, Netflix’s stock slid this week due to concerns about future growth. The company’s Q1 revenue and earnings per share beat expectations, but the number of global paid subscribers fell behind estimates. As the graph above illustrates, Netflix is adding net new subscribers at a much slower rate than previous years. This isn’t entirely unexpected - the company saw exceptional growth at the start of COVID, “pulling forward” some subscribers who would have otherwise joined later. Netflix’s slate of new content (which often brings in new members) was also relatively light in Q1, as COVID had a significant impact on production. However, Netflix is also facing more competition than ever before. New players like Disney+, HBO Max, and Paramount+ are spending heavily to acquire new customers and content. The good news is that existing Netflix subscribers seem to be sticking around - churn in Q1 2021 was lower than Q1 2020. We’ll be keeping an eye on this over the next few quarters! news 📣💻 Zoom launches a venture fund. Zoom is getting into the VC game, with a $100M fund targeting early-stage startups in the Zoom ecosystem. What does this mean? The fund will invest in companies building apps on top of Zoom, as well as a broader range of software/hardware products with Zoom integrations. Zoom is following the lead of Slack and Stripe, both of whom invest in startups that either: (1) use their APIs or SDKs; or (2) offer a similar product to the company in different markets. 🥛 Oatly files for IPO. Alternative milk company Oatly took another step towards IPO - the company’s F-1 (the international version of an S-1) dropped this week. Oatly’s revenue doubled in 2020 to $421M, but its net loss also grew nearly 2x to -$60M. The company was founded in the 1990s in Sweden, but didn’t enter the U.S. until 2016. Since then, Oatly has made a splash, raising $200M from Blackstone (and Oprah!) last year and releasing a viral SuperBowl ad. One of the most fascinating graphs in the F-1 showed how various alternative milks rank in different markets - check it out here! 📈 UiPath blows away IPO. Robotic process automation startup UiPath went public on Wednesday in the third-largest IPO ever for a U.S. software company. The stock closed its first day of trading up 23%, and UiPath ended the week at a $39B market cap. Investors were impressed by the company’s strong revenue growth (81% YoY) and exceptional net revenue retention. If you’d like to learn more about the business, we’d recommend this awesome thread from Mario Gabriele! 📷 Snap beats earnings. Snap’s stock continued its climb after the company reported another quarter of earnings outperformance. Snap had its first quarter of positive free cash flow as a public company, and broke even on an adjusted earnings per share basis. With 280M DAUs globally on the app (up 22% YoY), Snap’s Android user base also surpassed its iOS user base for the first time - CEO Evan Spiegel called this a “critical milestone,” as the company rebuilt its Android app from the ground up in 2018. In other interesting Snap news - the company invested $90M in Q1 on Spotlight, its TikTok competitor. Spotlight now has 125M MAUs (up from 100M in January). Chat platform Discord reportedly shut down conversations with potential acquirers, and may instead be moving towards an IPO. Rumors surfaced last month that Microsoft was in exclusive talks to buy Discord for up to $10B, a slight premium to the company’s last private valuation of $7B. Some sources now report that Discord had interest from other buyers in the $15-$18B range. what we’re following 👀Apple is finally releasing a Tile competitor that leverages the iPhone network. In a strange turn of events, Greylock’s office soap appeared for sale on Craigslist. The Generalist’s deep dive on the history & business model of Product Hunt. If you’re interested in more of these types of links, we’d recommend checking out Protocol Pipeline - they do a great job of curating articles & tweets! When someone becomes a mega-star, they run the risk of overexposure. People get tired of constantly hearing about them, and start to question whether they deserve their fame. The quirks that were once endearing become annoying. Their fans are accused of being “basic” and considered uncool. Negative stories come out in the press, and critics begin cheering for their downfall. This seems to happen most frequently with young women (Anne Hathaway, Jennifer Lawrence, and Taylor Swift are a few examples). And it started to happen to Charli D’Amelio, TikTok’s biggest star, late last year as she approached 100M followers. The top comments on her videos turned negative, with users claiming she “lost the hype” and questioning how she became famous. She’s constantly under fire for something - remember the personal chef debacle? Or the vacation controversy? For most celebrities, the way to fix this is taking time out of the spotlight. If you lay low for a while, people start to miss you, and the narrative changes. Taylor Swift is the perfect example of this - after “disappearing” in 2016 & 2017, she came back bigger than ever. But when you make a living online, can you afford to stop posting? Gen Z celebrities often rely on brand deals, ad revenue, and merch drops. They can’t count on streaming royalties or blockbuster movies - they have to constantly churn out content. Charli D’Amelio’s story took an interesting turn this week when she started an “alt” account (@user4350486101671). She posts on it more frequently and the videos are less polished than her main feed, featuring random clips or dances that aren’t advertiser friendly. This may not seem revolutionary, but it’s completely changed the sentiment around Charli, as the screenshots above illustrate. Creating an alt account reminded her fans that she’s still a 16-year-old who feels the pressure of her own public image - she’s relatable again. Platforms like TikTok accelerate the hype cycle of fame, which makes it easier to burn out or get “cancelled.” Charli’s alt account seems to have successfully refreshed her brand, but this struggle will inevitably play out with other creators. We have more questions than answers here - is it possible to prevent rising stars from overexposure? And how can we enable digital creators to take a break without losing their income or audience? If you have any creative solutions, we’d love to hear them! jobs 🎓Airvet - Biz Ops Analyst (Remote) Initialized Capital - Principal (SF)* Faire - Product Ops (SF) Pachama - Product Manager (SF) Lyra Health - Junior Biz Ops Analyst (Burlingame) Truepill - Customer Growth & Strategy Associate (San Mateo)* World Innovation Lab - Investor, Marketing & Ops Associate, Chief of Staff (Palo Alto) Share Ventures - Chief of Staff (LA) UTA - Strategy & Corp Dev Associate (LA) ERA - Program Associate (NYC) Headway - Provider Growth Associate (NYC) Virgin Management - Investment Associate (NYC) ProfitWell - Strategic Initiatives Associate (Boston) *Requires 3+ years of experience. internships 📝Headspace - Brand Design Intern (Remote) Fintech Today - Part-Time Chief of Staff (Remote) Spacecadet - Part-Time Venture Associate (Remote) Okta - Strategic Partnership Intern (SF) West Venture Studio - Strategist, Comms & Content, Design Interns (SF, Remote) SoFi - MBA PM Intern (SF) Poshmark - Marketing Ops Intern (Redwood City) January AI - PM Intern (Menlo Park) Silicon Valley Bank - Emerging VC Manager Intern (Santa Clara) Snap - Music Partnerships, Media Partnerships, Creative Dev Interns (LA, Remote) Chicago Ventures - MBA Intern (Chicago) Thrasio - Demand Gen Intern (Boston) Buzzer - Product Fellow (NYC, Remote) - HBCU & MSI students given special emphasis puppy of the week 🐶Meet Guggenheim, a two-year-old Newfoundland who lives in Pender Harbour, BC. Guggenheim enjoys captaining his boat (see right photo), playing in the water and in the snow, and gardening. Follow him on Instagram @guggenheim_thenewfie! Hi! 👋 We’re Justine and Olivia Moore, identical twins and venture investors at CRV. Thanks for reading Accelerated. We’d love your feedback - feel free to tweet us @venturetwins or email us at twins@crv.com. If you liked this post from Accelerated, why not share it? |

Older messages

🚀 Dogecoin heads to the moon!

Monday, April 19, 2021

Plus, the SEC puts SPACs on ice.

🚀 Coinbase preps for takeoff

Sunday, April 11, 2021

Plus, which country launched its own digital currency?

🚀 Everything's coming up Clubhouse

Sunday, April 4, 2021

Plus, a deep dive on Olivia Rodrigo & the future of the music industry

🚀 Is Discord worth $10B?

Sunday, March 28, 2021

Plus, Chipotle competes with VCs!

🚀 Would you buy land in the metaverse?

Sunday, March 21, 2021

Plus, an update on gender diversity at VC firms.

You Might Also Like

AI Assistants Will Be Great (Especially for the Biggest Companies)

Friday, February 14, 2025

Plus! Short Selling; Crypto Treasury Gresham's Law; The Joy of Higher Rates; Labor Substitution; Pricing Black Swans AI Assistants Will Be Great (Especially for the Biggest Companies) By Byrne

🏈 The Super Bowl flight that upped tariffs

Friday, February 14, 2025

The US stamped 25% tariffs on key metal imports, France is coming for America's AI reputation, and chocolate tinned fish | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Why Economists Got Free Trade With China So Wrong

Friday, February 14, 2025

“The China Shock” gets revisited View this email online Planet Money “The China Shock” Revisited by Greg Rosalsky By now, many economists are hoarse screaming that higher tariffs and a trade war will

FinTech is People - Issue #508

Friday, February 14, 2025

FTW Opinions: When fintech principles shape government finance, the stakes go beyond efficiency—trust, security, and oversight are on the line ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Special Announcement From Harry Dent

Friday, February 14, 2025

Harry Dent February 11, 2025 Many of you have heard me talk about John Del Vecchio, one of our trusted partners at HS Dent. He runs two highly successful programs, Microcap Millions and FAST Profits,

Using AI as a Retirement Vision Board

Friday, February 14, 2025

This tool paints a picture of your financial future ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Get a life insurance quote in seconds

Friday, February 14, 2025

And get approved just as fast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

❌ Altman dissed Musk's OpenAI bid

Friday, February 14, 2025

Musk bid nearly $100 billion for OpenAI, Europe prepared its own diss for the US, and the egg undercurrent | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 12th in 3:04

Fossicking in the dark or twenty-twenty foresight?

Friday, February 14, 2025

Rishi Khiroya and Lydia Henning If you asked people what skill they would most love to have, you might receive answers like 'to fly', 'to be invisible' or even 'predicting the

I love you(r high credit score)

Friday, February 14, 2025

plus Benson Boone + pizza perfume ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏