Flipside Crypto - The Bounty Brief #6 💸

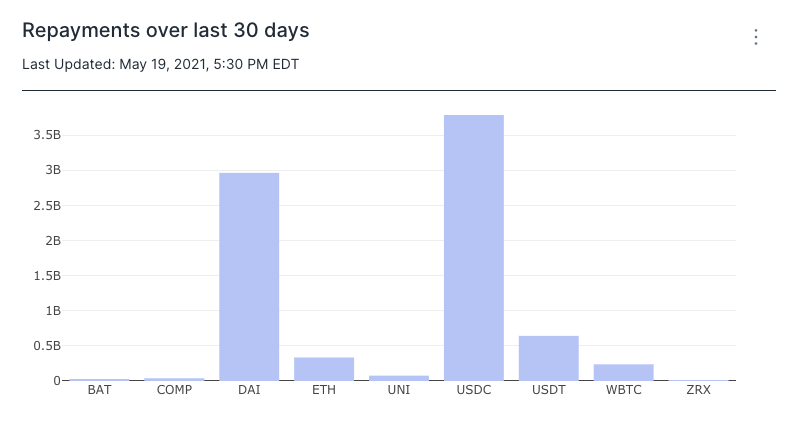

Happy Thursday, Bounty Hunters 💸 Uniswap bounties have officially arrived! We’ve been spending the past week beginning to build out the biggest, baddest, and all-around best Uniswap V3 dashboard. And, in case you missed the big news, Flipside Crypto received a Uniswap V3 grant, so make sure you submit your bounties to the Uniswap Grants program so you can be considered there as well. We’ve also got the latest round of bounties from Compound, as well as the best of the available analytics bounties from around the web. So, if you haven’t already, sign up for an account on Velocity, claim a bounty, and get started earning money 💸💸💸 . Now, onto the bounties for this week. Uniswap 🦄V3 Capital Returns Insights 🔍 Bounty: Up to 9.47 UNI Description: Create a dashboard with insights into the results of the fees earned per LP relative to the liquidity provided on V3 and compare to V2. How much in fees have LPs collected in different tiers of liquidity provided ($1,000, $10,000, $100,000, and $1M+)? Early V3 Users 👥 Bounty: Up to 9.47 UNI Description: Create a summary of liquidity providers that have moved liquidity from V2 to V3. UNI distribution via 'Swapmining' (Volume Mining) ⛏️ Bounty: Up to 9.47 UNI Description: Look at the last 3 months and calculate how much would have been spent in UNI, by pool, and by swapper, if Uniswap was paying out a small amount of UNI swap. Estimate spending by using various UNI per swap values and recommend a value. Which pairs should be incentivized/included? Could this strategy favor the average user and limit the favor to large stakeholders? See all Uniswap Bounties🦄 Bounty: Up to 9.47 UNI Description: Answer one of these top analytics questions from the community and receive up to 9.47 UNI as a reward. 📈 CompoundThird-party + Flipside data combined for insightful Compound analytics 📊 Bounty: Up to 0.5 COMP Description: What third-party data can be combined with Flipside Velocity data to provide insightful analytics for the Compound community? The most informative and creative insight will win the bounty. Consider including traditional markets data, or data sources that can provide additional context and information that will provide a more complete picture of the question and answer you are solving for. Analysis of Capital Utilization Ratio 🪙 Bounty: Up to 0.5 COMP Description: What percent of the available supply is borrowed against? This is a health metric- over time we would see if the LTV rate is going up (people are leveraging up / taking on more leverage / getting more aggressive) or down (people are de-leveraging, “risk-off” mentality). This would be interesting to see over the course of time. The Top DeFi Lending Platforms Dashboard 🏆 Bounty: Up to 0.5 COMP Description: What are the top competitors to Compound in the DeFi ecosystem? Create a dashboard comparing Compound to Aave, Maker, and any other notable DeFi lending protocols (InstaDApp, Liquity). Use the major leading insights (TVL, volume, users) and anything else that would be insightful in analysis. See all Compound Bounties💰 Bounty: Up to 0.5 COMP Description: Answer one of these top analytics questions from the community and receive up to 0.5 COMP as a reward. 🕸️ IoTeXTrack Public API Nodes For IoTeX Mainnet🌀 Bounty: 3500USDT Description: Build a portal and with relevant tools to track all public API gateway nodes of the IoTeX testnet and mainnet (i.e. Full nodes running that have their API enabled). NFT Marketplace 🖼️ Bounty: 8000USDT Description: Build a general-purpose NFT marketplace with an eye on a modern UI providing a seamless user experience. 🗳️ Metagov DAOGovernance Challenge 🏅 Bounty: 5000 NEAR Description: Challenge entries must consist of a submission post, a slide presentation, and a GitHub repo with code (where relevant). Entries do not have to be technical. We encourage a mix of technical and social innovation. 🔏 HOPRCreate Subgraph That Indexes HoprChannel 📇 Bounty: 300 HOPR Description: The HOPR protocol provides network-level and metadata privacy for every kind of data exchange. A mixnet protects the identity of both sender and recipe ent by routing data via multiple intermediate relay hops that mix traffic. Payments are handled via probabilistic micropayments, our custom layer-2 scaling solution on top of the Ethereum blockchain. We need to index HoprChannels using subgraphs from TheGraph. The GraphQL schema has been defined in the folder. Please complete the mapping logic and deploy the subgraph. 📈 Bounty Submission of the WeekSubmitted by Cryptolion and MonetCapital Welcome to a new segment on the Bounty Brief — our Bounty Submission of the Week! Each week, we’ll feature one of the best submissions as voted by our community on Discord. In this edition, we’re excited to feature Cryptolion and MonetCapital, who examined Compound repayment trends over time. What did they find? Well, when looking over the past 30 days, it seems that stablecoin markets are most heavily trafficked. They also found that the number of addresses in the three major stablecoin markets (USDT, USDC, and DAI), seem to all follow the same trends. Cryptolion and MonetCapital had tons of great findings we couldn’t fit into this newsletter, so make sure you check out their submission to see all of the dynamic data they presented, and get your submissions in to be considered for future editions of the Bounty Brief. Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Don’t forget — sharing is caring! So make sure you subscribe and share the Bounty Brief with a friend that wants to get involved with crypto analytics bounties. If you liked this post from The Bounty Brief , why not share it? |

Older messages

Uniswap V3 Dashboard Debrief #3: Swap Stats 🦄 🔄

Wednesday, May 19, 2021

Flipside Crypto takes a closer look at Uniswap V3 swap volume with the help of our labeled, on-chain data.

Uniswap Dashboard Debrief #2: Help us build a bigger, better dashboard — and get paid 💸 💰

Tuesday, May 18, 2021

Join us as we work to build the biggest, baddest, and all-around best Uniswap V3 dashboard available!

Uniswap Dashboard Debrief #1: Total Liquidity Passes $1 Billion — Then Falls Back Down

Monday, May 17, 2021

Join us as we work to build the best Uniswap V3 dashboard available!

⚓ All You Need To Know About Anchor ⚓

Friday, May 14, 2021

Navigating the seas of the Terra Ecosystem's newest protocol

The Bounty Brief #5

Friday, May 14, 2021

Help us build the biggest and best 🦄 dashboard!

You Might Also Like

Solana Foundation sparks backlash with controversial ad comparing pronouns to DeFi

Tuesday, March 18, 2025

Matt Sorg of Solana defends against backlash, highlighting limited internal involvement in controversial video production. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Cross-Currents Shaping Crypto Markets

Tuesday, March 18, 2025

Exploring the macro and crypto forces driving current market dynamics ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Talks with BitMart Founder Sheldon: From Bicoin in College to 7 Years of Entrepreneurship and US Regu…

Tuesday, March 18, 2025

Sheldon, founder of BitMart, first encountered Bitcoin as a college sophomore in 2013 after reading about an ASIC mining breakthrough. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

In-depth Analysis of the $1.5 Billion Theft Incident at Bybit: Identifying Security Blind Spots in Multi-signature…

Tuesday, March 18, 2025

This discussion started with the $1.5 billion theft incident of Bybit, mainly exploring the security vulnerabilities of multi-signature wallets (like Safe) and their solutions. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Michael Saylor says US needs Bitcoin to continue as military superpower aligning with SoftWar theory

Tuesday, March 18, 2025

Viewing Bitcoin through a military lens, Saylor champions its role in national cybersecurity and global strategic dominance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: Donald Trump Creates U.S. Bitcoin Reserve

Tuesday, March 18, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

The Rise of TIMEFUN: An In-Depth Analysis of Celebrity Time Tokens

Tuesday, March 18, 2025

Recently, Binance founder CZ shared his idea of time-based tokens, where KOLs tokenize their time. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Ethereum's Pectra upgrade successfully deployed on the Sepolia testnet; Pump.fun saw a sig…

Tuesday, March 18, 2025

Ethereum's Pectra upgrade deployed on the Sepolia testnet; Pump.fun saw a significant drop in token launches; World Network's messaging app introduced intra-network fund transfers. ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Ethereum's Pectra upgrade successfully deployed on the Sepolia testnet; Pump.fun saw a sig…

Tuesday, March 18, 2025

Ethereum's Pectra upgrade deployed on the Sepolia testnet; Pump.fun saw a significant drop in token launches; World Network's messaging app introduced intra-network fund transfers. ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump cabinet’s Bitcoin investments raise ethics alarms in pro-crypto era

Tuesday, March 18, 2025

Cabinet members' Bitcoin holdings spark debate over ethics and influence in Trump's pro-crypto governance approach. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏