I Turned 📧 into a 7 Figure Biz: 5 Step Process

5 Steps that Turned Influence Into A 7 Figure BizBienvenidos - If you’re new, let’s make it official. Join 10’s of thousands -> subscribe. I started Contrarian Thinking in January of 2020 officially. I had some spare time. It has now sprung out 6 different businesses, 2 are trending towards making $1 Million ARR, and 4 are clearing six figures profit. It is the SINGLE most fun thing I’ve done lately, making money on the interwebs through ideas. Fascinating. Here are my top 5 lessons learned and I’ll be putting together a full playbook on how you can do it too. BUT FIRST - I ain’t alone in this… Contrarian Take:Your investment manager will be an influencer.Before, you had to be a name to get into the hottest funds; now, you have to have a name to grow assets. That’s why:

… spend more time on Twitter than they do wearing PE-approved Patagonia vests. A new model is emerging… the investor influencer.And here I thought that finance influencers looked like this: You know, investment advice, from those without money or experience to those without money or experience. Seems smart. Truth is - The world of attention arbitrage is moving upstream to z billionaires.This progression has been whiplash-evoking. When I worked at State Street, I had a tiny little blog called Selling South. Covering investment trends in Latin America as I headed a group down south. When I say tiny, I mean tiny. I mean, not even my mom read it. Yet, I was told to shut it off because I might (I kid you not) “move the market” with my writings. Which is a fancy way of saying, “It would be better for us if you let the 65-year-old economists do the talking, eh kiddo?” Also - if I had a dime for every time I got called kiddo in finance, I’d be able to swim in them. Comment below your most ridiculous names called by bosses always gives me a chuckle. I recall vividly at Goldman, the tagline our MD coined was “Get Rich Quietly.” Yet, there is nothing quiet about Carl Icahn sharing insights with 400,000 strangers. Who’s Carl? He’s the revolutionary activist investor and corporate raider who took over and asset-stripped TWA and proceeded to become worth $16.7B and the 5th wealthiest HF manager in the world. And it’s not just Carl… we’ve got head of Andressen Horowitz himself (net worth $3.5B) sharing things he used to only share in his investor updates. Thankfully he’s masked as he doesn’t want you to catch something on Twitter. #science Then we’ve got Cathie Wood, who arguably grew her portfolio and proceeded to pump it to the moon, using the power of Twitter and sharing every single trade she makes. Back in my day, we guarded our trades, now investors are yelling out of megaphones. Oh, how the times have changed. What is your point, Codie?My point is that we in finance understand one thing really well. L-E-V-E-R-A-G-E Leverage is the multiplier. If you REALLY like a deal, you don't just go ALL in. You go 110%+ in. There are four types of leverage: Labor + Capital + Code + AudienceThey have each ushered in a new age of wealth and abundance for those in charge:

“Audience” is the newest tech-enabled lever. It’s no surprise that investors are capitalizing. Each age of leverage brings massive wealth to those who wield it. If you had access to employees early (or servants), you had bigger profits. If you were able to access banking during its advent, you bought railroads or oil fields and controlled all transport. If you had access to a computer early, you unlocked virtual armies. Today if you have access to attention, you have access to $0’s. As we move to the age of audience leverage (we wrote more about that here) my bet is, you need to do one of two things.

So we will talk about how to grow media businesses, your audience, your company’s audience, or your investor base. Then we’ll culminate with a segment from Jack Butcher himself on building your audience and a playbook from me. Lessons as an Investor turned (GASP) Influencer?These 5 things turned a newsletter I did on the side in 10 hours of work a week, into a 7 figure business with a bunch of businesses shooting off of it. More on that —> how I got my first 10,000 subscribers and —> my business model and revenue streams.

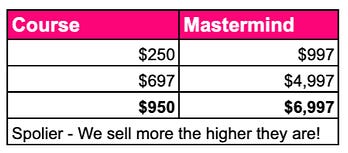

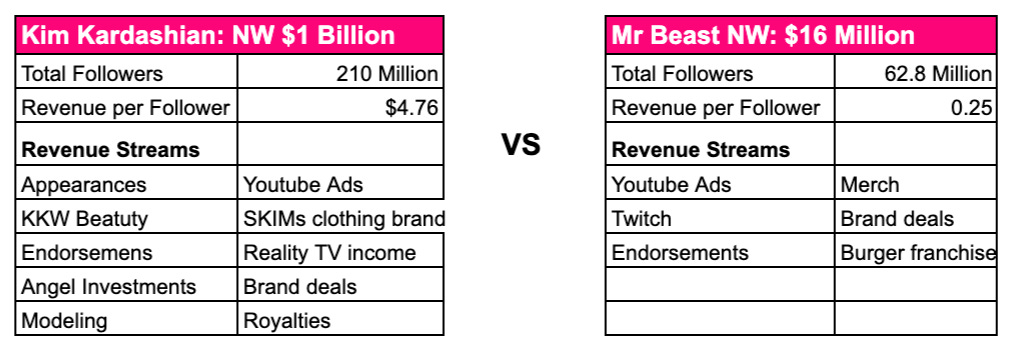

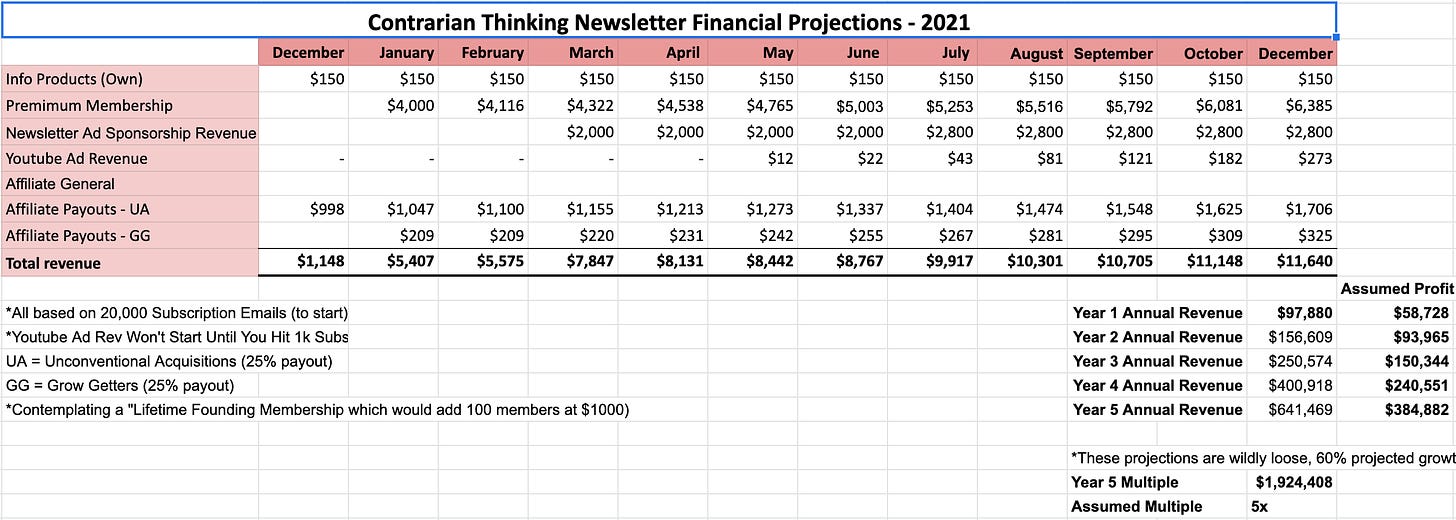

#1 Give Me Your Money First: Do a Founders OfferingBefore you spend time on creating any business, test the market. I ALWAYS test the market. And not like most people who say, “Oh, I have this idea I’m going to do, it’s going to be amazing, change world, next Uber of X, would you use it?” I don’t care for opinions. I care for your dollars. Give me them. So we start with a pre-sale before we even have the product. Here’s my example: Cashflow Prelaunch. #2 Choose Your Price: Then Add a Zero to ItI ALWAYS underprice. It’s a personal fault. Lesson of the day. Don’t be Codie. For one of my businesses, Unconventional Acquisitions, we stair-stepped the price and kept finding the more we raised, the more we sold, and THE LESS CHARGEBACKS and HEADACHE we had. So don’t be afraid to price higher. Right now, our premium version of this newsletter costs $299 for a year. I’m going to up it to $500 by the EOY. It’s worth it 10x. #3 Be A LeechThe single biggest way to grow? Piggyback off someone else’s content. I did this ad nauseum with Trends, The Hustle, Side Hustle Nation, and a slew of other Facebook groups. I gave until my eyes hurt from writing out responses and sharing. Then I gave more. Then I started sharing my articles, and the subscribers started FLOWING. If I was to do it again. I’d do that. BUT I’d also leech off of Twitter accounts. Twitter is by far the best way for RN to grow email. My new bud Alex - breaks down how to use Twitter like a G. #4 Get Obsessed with Business ModelsKim Kardashian has 210 million followers. Mr. Beast has 30% of that. Yet, he certainly doesn’t have 30% of her net worth. He has 1.6%. Why? Kim and her team understand business models. It’s why she has multiple revenue streams, moated businesses (not just easily duplicated, low margin, and poor quality merch), and investments. SO - if you’re going to grow wealth, you can’t just have followers; you need to know what to do with them. #5 Know Your NumbersThis was my original model. I thought off of 20k subscribers; you could do about $90k in profit in year one. Instead, we did $150k in revenue in the first quarter.And we’re growing faster than the national debt. Too soon? The benefits of looking at THOUSANDS of deals from investing in them. I knew which revenue lines to add and which to ignore. Aka - ignore YT ad revenue, double down on branded online products.

Then maybe move out of this country because, dear lord, are we printing money faster than we can hand it out. SIDENOTE: I read a fascinating article, thanks Alex, on what happens when countries default on debt. Essentially, anytime a country has gone to 130% debt / GDP, it has been a metaphorical point of no return. THE US HIT THAT. Do you want to hear more about it? Tell me in the comments. Question everything and find your leverage Codie *FUN STUFF!!* We’re doing a thing on TWITTER! (@codie_sanchez) . If you give me a follow on Twitter and retweet just ONE of our posts that resonate with you, we’re going to choose 3 people at random, to receive one of our Contrarian Cashflow playbooks (of your choice) for FREE! You only have 24 hours…. so let’s connect :) You can choose from: How to Raise a Fund - With Shaan Puri Cashflowing on Tiny Homes - With Robert Abasolo Buying Real Estate At Auction - With Aaron Amuchastegui, or; Staking and Earning Crypto - With Mike Dillard And if you want ALL the playbooks…JOIN THE CLUB!PSS: If you join Premium here’s a sample of some of the resources you’re going to get on how we created our newsletter. Models, templates and tools OH MY. DISCLAIMER: This is the be an adult section, not advice, just what I did. Said otherwise: This article is presented for informational purposes only, is an opinion, and is not intended to recommend any investment, and is not an offer to sell or the solicitation of an offer to purchase an interest in any current or future investment vehicle managed or sponsored by Contrarian Thinking, LLC or its affiliates. All material presented in this newsletter is not to be regarded as investment advice but for general informational purposes only. Day trading and investing does involve risk, so caution must always be utilized. We cannot guarantee profits or freedom from loss. You assume the entire cost and risk. You are solely responsible for making your own investment decisions. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer. If you liked this post from Contrarian Thinking, why not share it? |

Older messages

From Brain Eating Mold, to Cryptro Proving Assets > Income

Wednesday, June 2, 2021

Decentralization of wealth + health + Assets > Income From Brain Eating Mold, To Crypto Proving Assets > Income Decentralization of wealth + health + Assets > Income Ah Contrarians, we got a

What if Money Does Grow on Trees?

Saturday, May 29, 2021

Million Dollar Trees & 5 Figures a Month from Selling Plants...

Shaq: $400M from Carwashes & Franchises?

Saturday, May 29, 2021

Sexy Celebs, Boring Businesses = The How to game

Lessons Learned from My Navy SEAL Man

Saturday, May 29, 2021

Deal frameworks, leadership lessons and things learned the hard way.

Well, it's been 2 weeks...

Saturday, May 29, 2021

What do you think?? Hey friend, So, it's been 2 weeks of journeying through Contrarian Thinking. Hopefully you've learned a lot of new ways to make that paper, have begun asking questions, and

You Might Also Like

🧙♂️ The EXACT Job Titles To Target (Based On Brand Size)

Monday, March 10, 2025

Please stop DMing brands ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Why American Christianity has stopped declining

Monday, March 10, 2025

Hi all, Please have a wonderful week. Trevor The man who wants to know everything (article) Fantastic profile on Tyler Cowen. Part of me feels like he's missing out on some of the joys of life, but

The Biocomputer That Blurs Biology, Tech, and The Matrix - AI of the week

Monday, March 10, 2025

Cortical Labs introduced CL1, a biocomputer merging neurons and tech; AI advancements included autonomous agents, AI-powered phones, healthcare assistants, and humanoid robots; plus, Derek Sivers

• World Book Day Promo for Authors • Email Newsletter + Facebook Group Posts

Monday, March 10, 2025

Book promo on 4/23/25 for World Book Day Join ContentMo's World Book Day Promotion #WorldBookDay is April 23rd each year. ContentMo is running a special promo on 4/23/25 for World Book Day

If you're meeting with someone this week...

Sunday, March 9, 2025

Plus, how the LinkedIn algorithm works and how to get your first 100 newsletter subscribers. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$30,000 Youth4Climate grant, USAID support festival pro bono resources, Interns at Fund for Peace

Sunday, March 9, 2025

The Bloom Issue #205, March 9 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Food for Agile Thought #483: Leadership Blindspots, Tyranny of Incrementalism, Who Does Strategy?

Sunday, March 9, 2025

Also: Product Teams 4 Success; Rank vs. Prio; Haier Self-Management ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Authors • Spring Into Reading Book Promo • Email Newsletter + FB Group Posts & More

Sunday, March 9, 2025

Promo is Now Open for a Limited Time MARCH 2025 Reading Promotion for Books Join ContentMo's

Why you’re always busy but never productive

Saturday, March 8, 2025

Do you schedule time to think? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

• 30-Day Book Promo Package • Insta • FB Groups • Email Newsletter • Pins

Saturday, March 8, 2025

Newsletter & social media ads for books. Enable Images to See This "ContentMo is at the top of my promotions list because I always see a spike in sales when I run one of their promotions. The