Flipside Crypto - The Bounty Brief #11

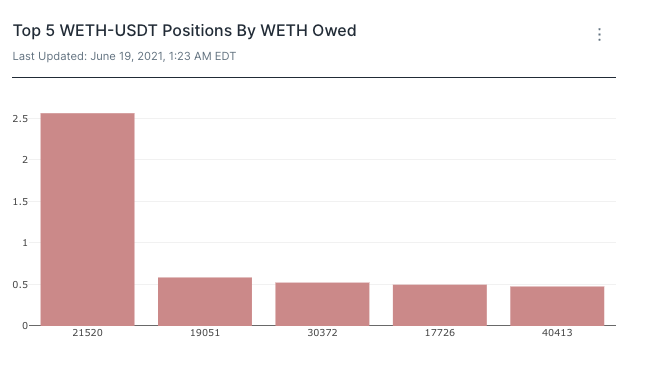

Terra bounties have arrived. You heard us. We’re bringing community-enabled analytics to the Terra ecosystem, in the form of new bounties, available right now. To get started or get your biggest Terra questions answered, join our community on Discord. Now, onto the bounties. Terra 🌎[EASY] Transaction Fees 💸 Bounty: Up to 71.51 LUNA Description: On Terra, transaction fees generated by token swaps work to maintain the peg of stablecoins to their associated fiat currency. How many fees are being paid out each day for the past 30 days? Do we see any big differences between the different stablecoins? [EASY] Decentralization of Validator System ✅ Bounty: Up to 71.51 LUNA Description: How decentralized is the validator system? Show the distribution of the staked amounts on the top nodes. [EASY] Who Should You Delegate To? 👥 Bounty: Up to 71.51 LUNA Description: How might someone decide which validator to delegate their Luna tokens to? Show the metrics that you think would be most relevant to that decision. Suggested data points: Commission rate; Total value staked [EASY] Peg Variance 📈 Bounty: Up to 71.51 LUNA Description: How stable are the stablecoins on Terra? Calculate how far from peg the stablecoins have performed in the past 6 months. [HARD] New User Inflow 👤 Bounty: Up to 143.03 LUNA Description: Show new user inflow to Terra. Relate this to new user inflow to Mirror and Anchor - for example, are the majority of Mirror and Anchor users new to the Terra ecosystem? Are the Whales on the Terra ecosystem engaging with Mirror and Anchor? [HARD] Best Yield-Farming Opportunities for Terra assets on Ethereum 🚜 Bounty: Up to 143.03 LUNA Description: Create a dashboard of the best yield-farming opportunities for Terra assets on Ethereum. Please note you will have to use the Flipside ETH tables (documentation provided here: https://app.gitbook.com/@flipside-crypto/s/flipside-docs/our-data/tables/table-schemas) See all Terra Bounties 🌎 Bounty: Up to 143.03 LUNA Description: Answer one of these top analytics questions from the community and receive up to 143.03 LUNA as a reward. Uniswap 🦄[EASY] Voting Power Distribution 🗳️ Bounty: Up to 14.18 UNI Description: To vote on governance in Uniswap, you can choose to self delegate or delegate to a trusted party to vote on proposals for the protocol. In the past 30 days, what is the distribution of addresses to votes? How many smaller volume addresses are voting vs. larger volume addresses? Please include your definition of larger vs. small. [HARD] ETH Price Drop and Liquidity Pools 📉 Bounty: Up to 27.83 UNI Description: With ETH dropping below $2000 how is it affecting the liquidity pools for ETH? Are people decreasing liquidity of their v3 pools and re-entering it in a new range or are they staying put? With the people who are decreasing liquidity and not coming back in are they holding the amount they took out of their positions or are they moving it to another DEX pool (Sushi, Uni v2)? See all Uniswap Bounties 🦄 Bounty: Up to 27.83 UNI Description: Answer one of these top analytics questions from the community and receive up to 27.83 UNI as a reward. 🟥 AgoricPort Chainlink Price Feed Contracts To Agoric ⛓️ Bounty: Up to $6,400 Description: This issue is to port the core Chainlink aggregation contract functions into Agoric: FluxAggregator.sol; AccessControlAggregator.sol. Implementation must be written in JavaScript following Agoric's smart contract model. The contract must result in a PriceAuthority API that the Agoric Treasury can consume. The Agoric team will review the initial design and will be available for consultation on implementation questions. Implement AMM Curve For Like-Asset Pairs In Agoric ⤵️ Bounty: Up to $9,600 Description: Implement a curve for Agoric's Automated Market Maker (AMM) which minimizes slippage, similar to curve.fi's StableSwap in Ethereum. A completed bounty will include: A new version of bondingCurves.js using new curve structure; An update to Agoric's MultiPool Autoswap contract to include a term that chooses which bonding curve to use Build A Pool-Based Loan Protocol On Agoric 🏊♂️ Bounty: Up to $6,400 Description: Launch a basic pool-based loan protocol on Agoric. Functionality should align with pooled loan protocols on other chains (e.g., Compound, Aave, Cream, etc). 🕸️ BluzelleBlockchain Inbox 📥 Bounty: Up to 5,500 USDC Description: An inbox that is keyed on blockchain addresses. Imagine that you need to contact Bob on blockchain X with address Y. How would you do that? You cannot. This is a client application that is the decentralized inbox for all blockchain addresses. It would be a responsive (ie: mobile friendly) app that listens for messages sent to any of your registered addresses. So you can receive messages to your BTC, ETH, DOT, ATOM, BLZ, etc addresses. Implement AMM Curve For Like-Asset Pairs In Agoric 🟣 Bounty: Up to 8,00 USDC Description: We need to build a “pallet”, using Polkadot Substrate technology. This pallet is like a module, and would get included into a “Parachain”. A parachain is a blockchain that is part of the Polkadot ecosystem. Parachains use a blockchain-building framework called Substrate. Substrate is written in Rust. Pallets are also written in Rust. As such, for testing, you’d likely build your own mini “test” blockchain with Substrate, and test it with your pallet. The pallet would be built and tested to work with any parachain. This test blockchain would be the place to test that the pallet works properly when dropped into any arbitrary parachain. EVM OCW (Off Chain Worker) Bridge To Bluzelle 🌉 Bounty: Up to $7,500 Description: A challenge right now for smart contract developers on an EVM (Ethereum, BSC, etc), is their inability to get simplified access to Bluzelle's plethora of services (specifically DB and Oracles). Bluzelle offers an oracle and a key value store. It would be valuable for a smart contract to query Bluzelle's oracle for the value of something like the price of the BTC/USD pair, or to ask for the value of a key in the Bluzelle key-value store DB, such as the "name" field in the "ABC" database, where name is, say, "Alice". For the sake of simplicity, we assume only reads happen -- the EVM cannot write to Bluzelle in any way. 🎶 HarmonyHarmony <> ICON BTP Bridge 🎼 Bounty: Up to $7,500 Description: This bounty will add Harmony blockchain to the set of blockchains supported by ICON's BTP interoperability solution. BTP is a decentralized cross-chain data transfer protocol that allows cross-network smart contract interactions, cross-network token transfer, cross-network NFT transfer, and more. 🏆Bounty Submission of the Week 🏆Welcome back to our Bounty Submission of the Week! Last week, we encouraged you to learn SQL while earning crypto with some easy bounties. We received a ton of great submissions, so thanks to all that participated! For this week’s Bounty Submission of the Week, we’re highlighting some great work from @danmdoherty. Dan took a look at the max WETH owed to a given position in the WETH-USDT pool. Dan’s submission found that, as of June 18, 2021, there is one position in the main WETH-USDT pool that’s owed more WETH than any other. According to the findings, NFT ID21520, at more than 2.5 WETH, is owed more than the next four positions combined, as can be seen below. @danmdoherty also provided a great step-by-step tutorial for completing SQL queries in submission. Check it out here! Good luck with your bounties this week🤞🍀 Make sure you join our community on Discord to keep up with all things bounties and get answers to any questions you have about solving our queries: Sharing is caring! Make sure you subscribe and share the Bounty Brief with a friend that wants to get involved in the space: If you liked this post from The Bounty Brief , why not share it? |

Older messages

Terra Bounties Have Arrived — See Them Now

Thursday, June 24, 2021

Discover Flipside Crypto's community-enabled analytics program

Terra Ecosystem Map

Tuesday, June 22, 2021

See How Flipside Crypto's Data Is Organized

These 6 Compound Data Dashboards Won The Grand Prize

Friday, June 18, 2021

Join us as we look at the best Compound data dashboards from our community of bounty hunters.

These 6 Uniswap Data Dashboards Won The Grand Prize

Friday, June 18, 2021

Time to get lost in some beautiful bounties. Join us as we look at the best Uniswap data dashboards from our community of bounty hunters.

The Bounty Brief #10

Thursday, June 17, 2021

Learn and earn 📚 💸

You Might Also Like

Donald Trump cabinet’s Bitcoin investments raise ethics alarms in pro-crypto era

Tuesday, March 18, 2025

Cabinet members' Bitcoin holdings spark debate over ethics and influence in Trump's pro-crypto governance approach. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: Rumors Circulate About Trump Family Investing in Binance US, UAE Royal Family Invests in Bina…

Tuesday, March 18, 2025

According to the Wall Street Journal, representatives of President Trump's family have held negotiations regarding an investment in the US subsidiary of cryptocurrency exchange Binance. ͏ ͏ ͏ ͏ ͏ ͏

Gold breaks $3,000 for first time amid global uncertainty as Bitcoin trades sideways

Tuesday, March 18, 2025

Bitcoin struggles as gold emerges as refuge amid economic unease triggered by President Trump's policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Hyperliquid Faces Losses as Whale Liquidation Rocks the Platform, and Tokenized Treasury P…

Tuesday, March 18, 2025

On March 12th, the HLP Vault of Hyperliquid suffered a loss of over $4 million. The reason was that a whale took a long position in ETH with 50 — times leverage. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Democrat lawmaker calls on Treasury to abandon Trump’s Bitcoin reserve plans

Tuesday, March 18, 2025

Democratic scrutiny is intensifying over Trump's pivot to digital assets, with critics warning of potential conflicts of interest. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 10 to Mar 16)

Tuesday, March 18, 2025

Insiders have disclosed that Russia is employing cryptocurrencies in its oil trade with India so as to evade Western sanctions. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Deep liquidity cushioned Bitcoin’s price during March volatility

Tuesday, March 18, 2025

Increased bid-side liquidity absorbed sell-offs, preventing prolonged dips below $80000 during volatile March trading. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Tariffs Exacerbate Trade Deficit

Tuesday, March 18, 2025

March 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Trump's Tariffs Exacerbate Trade Deficit Arrest Warrant For LIBRA Mastermind Issued Ripple Vs The US SEC May Finally End Soon

Interview with Gate.io Founder Han Lin: A PhD in Optoelectronics from Canada, Solo Developer, and a Sudden Strateg…

Tuesday, March 18, 2025

In this interview, Gate.io founder Han Lin sat down with Colin, founder of WuTalk, to share his journey, platform strategy, and industry insights. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📉 BTC and ETH futures open interest on exchanges saw a 30% and 48% drop since their peaks, respectively; Crypto.c…

Tuesday, March 18, 2025

BTC and ETH futures open interest saw a significant drop; Crypto.com received a limited license to offer derivatives in the UAE and became the exclusive crypto partner of a leading UAE AI company ͏ ͏ ͏