This is a free preview of a subscribers-only post.

TL;DR

- This is a preview of a paid post, you can subscribe to unlock all of the strategies I discuss

- Pricing is much more complex than simply picking a numerical price. It involves a complex overlap of finance, go-to-market strategy, and product decisions.

- Getting access to rich user data gives technology companies the ability to price more accurately than any other industry.

- Pricing strategy is really product strategy in technology. Non-tech companies are playing with financial levers, technology companies are playing with product ones.

- Accurate pricing is determined by quantifying the value of the problem your product is solving, capturing as much of that value as you can, and then charging in a manner that aligns you with customer growth.

Perhaps the most difficult question to answer as a business owner is how much to charge for your product. Too high and you’ll have too few customers, limiting your growth. Too low and you’ll leave too much money on the table, keeping your company in a cashless, anemic state. Historically, people had to just kinda...pick something. Even if the product was selling well, they would have no idea how people actually felt about the product/price. Was the utility they received from the product matched by what they paid for it?

However, there is an elect group of businesses that get much more granular data then that - technology companies. By being able to monitor the “who, what, when, where, and how” of customers using their product, they have the ability to price much more accurately than businesses without this privilege. To get a sense of how big an impact technology makes on pricing, just imagine if Nike not only knew what shoes you had bought, but understood the conditions under which you used them. Are you throwing on some runners to head to Starbucks? Or are you using them in hardcore marathon prep? In this hypothetical world, what if they could upcharge you on a rainy day for “Mud Mode” to make your shoes stick? This kind of pricing superpower is a major reason why technology businesses tend to be worth so much more than analog businesses.

The thing is, you don’t get this benefit automatically by being a technology business. All the technology does is increase your degrees of freedom. It gives you more options, but it’s still on you to choose a good one. And it’s far from a given that you’re anywhere near optimal pricing territory. If you run a technology business, there’s a good chance you picked something simple in the early days and stuck with it because it seemed like a pain in the ass to change. It might be worth re-thinking.

Today I want to talk about the 3 types of pricing strategies that exist. Afterward, I’ll go into more depth about how these strategies are implemented by leading technology companies. The majority of case studies will draw from business-to-business (B2B) software. This might seem weird if you’re building a consumer company, but enterprise software is perhaps the most developed market vertical that utilizes the advanced pricing models, and frankly, it’s what I know best :).

Understanding what to charge

There is maybe no more terrifying thing than going to your customer and saying, “ You need to pay us more this year.” Perhaps because of this, most people default to the quickest method of deciding pricing.

The easiest of the three pricing models is cost-plus pricing. It’s super simple: figure out the cost of delivering a service and then charge a targeted profit margin above it. So if your product costs $1000 dollars to deliver and you had a gross margin target of 20% then you simply charge $1200. The algorithm is PRODUCT x (1+ %GROSS MARGIN TARGET).

This method is often decried by internet thoughtbois, who are quick to remind you that one must always “pRiCe BaSEd On ValUE, NoT On COsT”. I’m not so sure this is the case. When you think about pricing, the natural tendency is towards revenue maximization for the product you are selling. However, pricing is a strategic choice, not solely a revenue one. By pricing some products at the absolute lowest you can sustain (or even pricing it below what you can do in the long-term) cost plus pricing can allow you to gain market share. Many Software as a Service (SaaS) companies will price their services arms (where they help customers use their product for a fee) at the absolute minimum if it unlocks additional software revenue. If you are looking for a more in-depth case study of that choice, check out my case study on Workday (Paying subscribers only).

But the problem with cost-plus pricing, especially when seeking to maximize profit margins, is it’s often hard to tell how much “plus” you can get away with. More is better, but at a certain point, nobody will buy. So how do you decide? This leads us to the next model...

The second easiest model is competitive pricing. Again, fairly simple, just go to your competitors’ websites, see what they are charging, and set your pricing accordingly. This is really only a good pricing strategy for those in established markets. If you are the 945th startup who is making a note-taking app, then you can just copy what your competitors are doing. If you are doing some completely novel, with no real competition this strategy isn’t for you. There is no specific formula for this method.

Note: Transparently, this is the exact method I used when thinking about Napkin Math’s pricing. The newsletter is $20 a month which puts it about in the middle for other publications discussing finance and technology. However, I actually think I’m undercutting all the other newsletters out there! (My apologies to my brothers and sisters of the pen). When you subscribe to NM, you also get access to all the incredible writers in the Every bundle who cover topics like business strategy, productivity, and internet culture. Plus you get the moral high that comes from helping me pay rent, which IMO should be an even sweeter reward.

The final method is the one I usually recommend. This is value-based pricing. There are a variety of definitions online about it, but I define it as, “The pricing methodology that is driven by how much a specific customer segment believes the product to be worth.” Value-based pricing is totally separated from the COGS of a product or the actual monetary value of what the product does. Instead, it is how valuable a specific customer perceives it to be. For example, I think anyone who buys a Gucci $495 t-shirt is being silly. It is just a shirt! However, many, many consumers disagree with me and perceive the value of that flimsy piece of cotton to be at least $495. The reason Gucci can get away with this highway robbery is that they are very good at identifying the customer segment for this product. When you are conducting a pricing analysis, segmenting your potential customers based on what they value is just as important as the actual price itself.

As an example of this methodology (I warn you, this is truly stupid) let’s assume you are selling the world’s most fantastic toilet in the frigid north of Canada. It heats your butt, it never clogs, it makes your poop smell like chocolate chip cookies, it does your taxes, and it can even save your marriage. Note: I told you this example was stupid. You chose to read this. Unfortunately for you, a Japanese conglomerate also has incredibly advanced toilet technology and has released a competing product with almost all the same features at $999. This magical toilet can do the cookie thing, it's better than TurboTax, etc, etc. The only thing it can’t do is have a heated seat. The temptation here would be to do a value analysis for each individual feature. You would hire Qualtrics (and get ripped off in the process) to do a conjoint analysis asking customers such questions as, “How important is your marriage? Why would you want it to be saved in an outhouse?”

This would be the incorrect choice. The only question you actually need to ask is, “How important to you is a heated seat?” You would discover that to Canadian consumers, having a heated seat is super important! It is very cold up there. A warmed nether region is worth $500 bucks in addition to $1000 bucks in value of all the other features. This would enable you to charge $1500 versus your competitor but only in Canada. You would need to do this math again if you tried to sell your product in other, less frozen, regions.

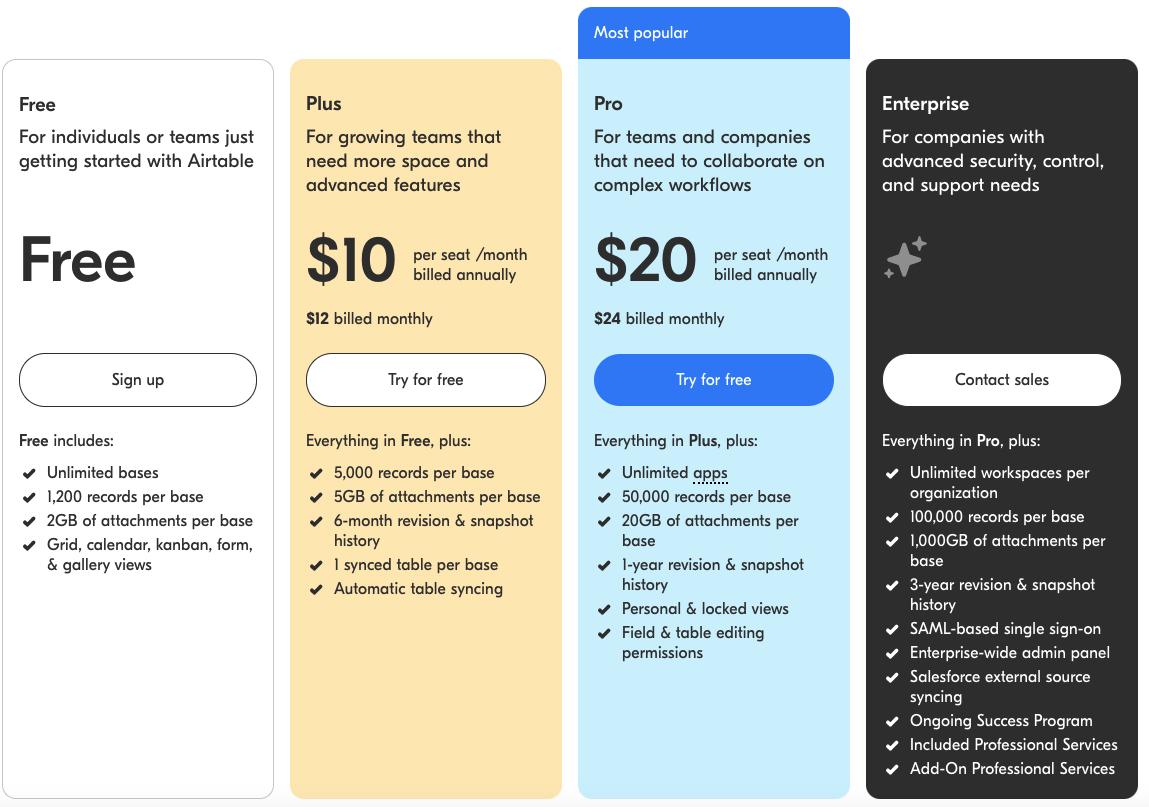

When you undergo the work of figuring out which customer segments value which feature, you can tier them based on who values what. An alternative and maybe easier way of saying this is how your price is set by how valuable is the problem you are solving for the customer. Let’s look at an example with Airtable’s pricing (a Microsoft Excel competitor).

They clearly have done a lot of pricing work segmenting out how the product would be used. This is even better than a simple survey - by tracking what product behavior patterns are among their user base, they are able to tier things off of what matters. As an example, their enterprise plans (which from what I hear from my data engineer friends is 3x+ the price of their Pro Tier) have a single sign-on. This is where you click “Sign in With Google” or Okta or whatever and it logs you in sans password. This is actually a super important feature! Single sign-on really tightens up enterprise security and is an absolute necessity for any company with a half-decent security standard. Enterprise clients will almost certainly be forced to have this upgrade. Security is one of those things that have very nebulous value so there is an additional opportunity for pricing arbitrage. Airtable understood what value was important to what customers and used that as an opportunity for increased pricing.

Understanding how to charge

So let’s say you have done the work to understand what is important to users. There are beautiful charts presented that clearly link features to value. The only question is - what do you do now? There are three basic options:

If you are interested in reading how to implement these methods please join Napkin Math as a subscriber :)