As you poke around the Ethereum and DeFi space on Twitter, you might notice that many people have the speaker and bat emojis in their name or bio:

It may look like some kind of weird calling card for echolocation enthusiasts but really it’s a battle cry. It’s a way to ask an important question:

Do we even need Bitcoin? Or does Ethereum deliver on Bitcoin’s promises and more?

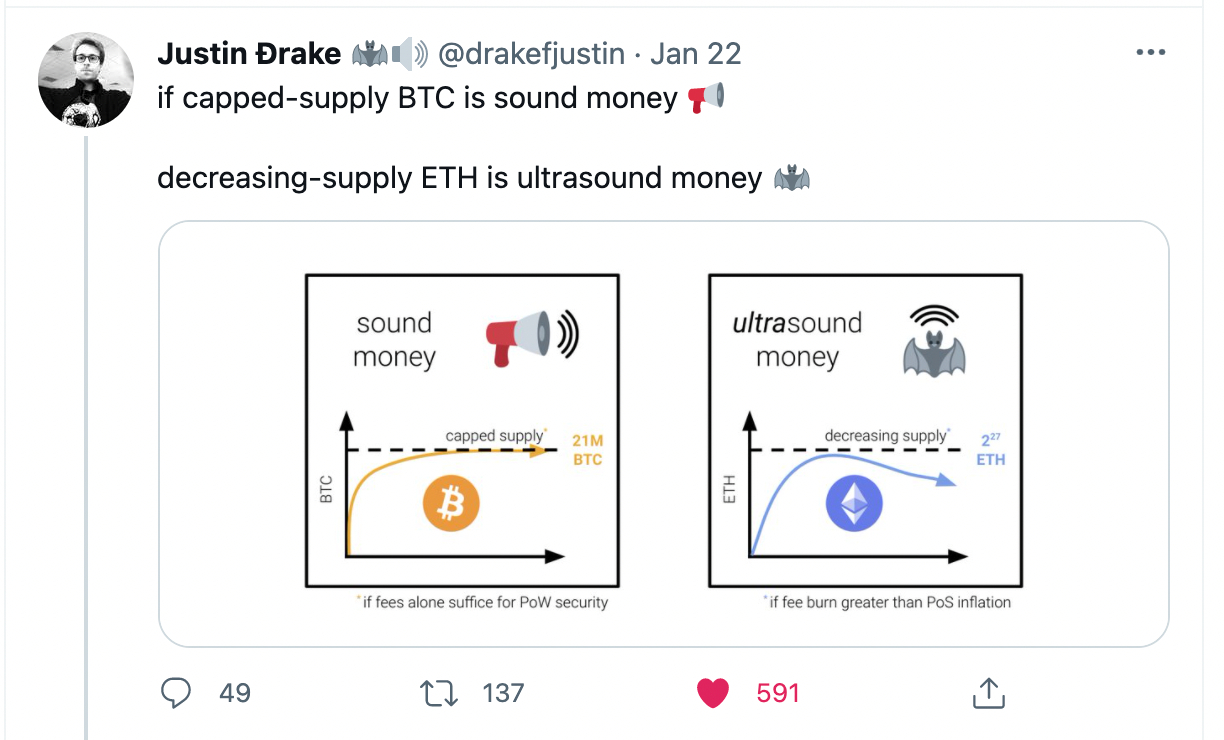

The combo of symbols represents a concept called “ultra-sound money.” It started off with a tweet from Justin Drake pointing out that if Bitcoin’s fixed supply makes it “sound” money, then Ethereum’s potentially decreasing supply should make it “ultra-sound” money:

It’s since evolved to capture the broader thesis that Ethereum can become the primary financial layer of the Internet, providing everything from a store of value to peer-to-peer transactions to settling multi-billion dollar transactions.

It’s a flavor of Ethereum maximalism: the idea that there isn’t a need for most other cryptocurrencies because we can just do everything on Ethereum. That’s a big claim, and the Bitcoin community often says the same thing, so what is the Ultra-Sound Money thesis based on? And does it have any merit?

What is Sound Money?

While “ultrasound” money might be a meme, “sound” money actually has a definition. It refers to

“money not liable to sudden appreciation or depreciation in value: stable money… specifically: a currency based on or redeemable in gold.” (Merriam-Webster)

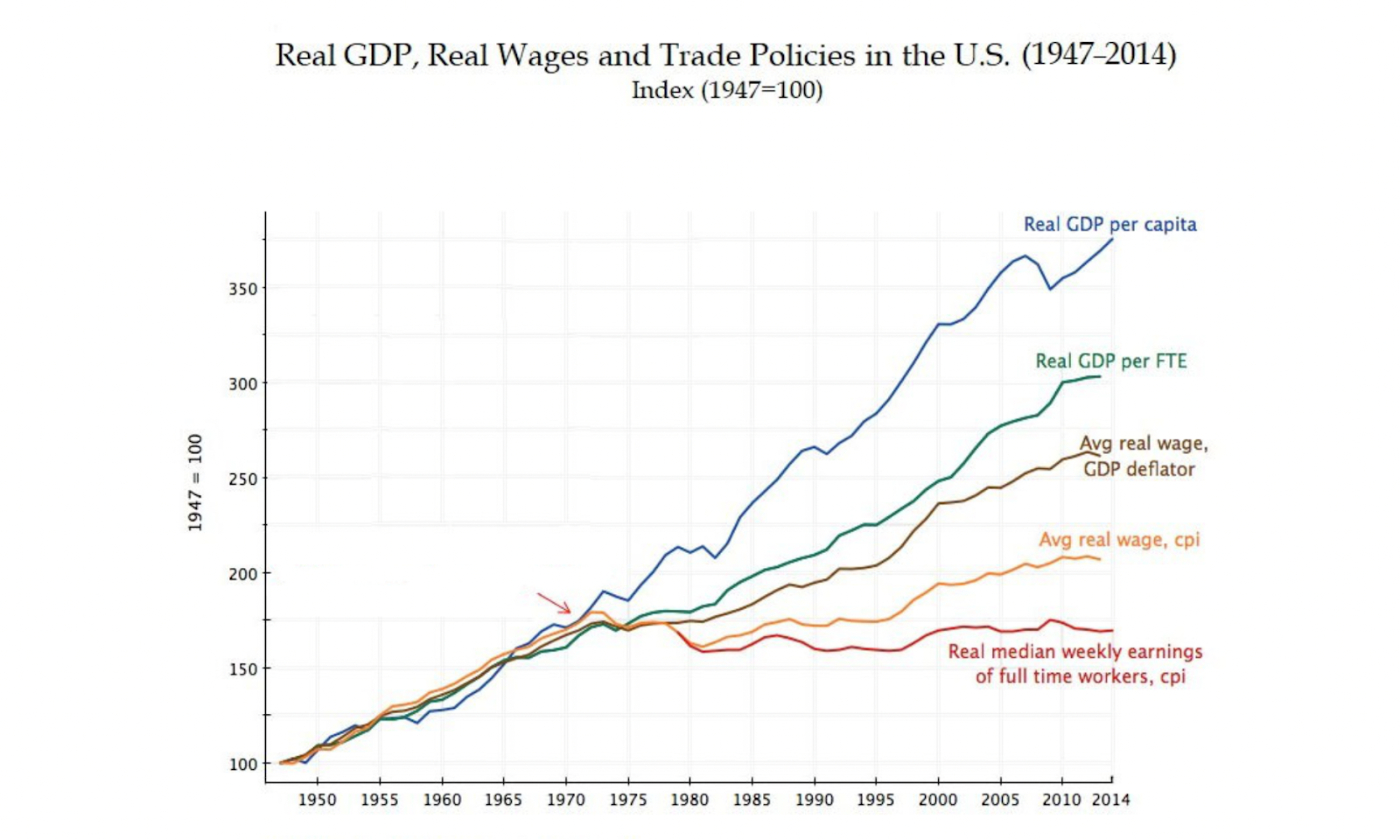

One of the core arguments for replacing fiat money with Bitcoin is that fiat money is not “sound.” The government can print more money whenever it wants which makes the value of “fiat” money unstable and unreliable. Some would argue that runaway price increases in areas like medicine and college, as well as growing economic inequality, can be traced back to getting off the gold standard and the increasing financialization of the economy since 1970:

Part of the Bitcoin thesis is that it can fix the financialization of our economy and its consequences by reintroducing a fixed supply asset to base our economy on. An asset whose value should increase over time, instead of our current fiat money system where your savings become less valuable over time. Bitcoin has been extremely volatile in value throughout it’s history, but the argument goes that as it approaches and surpasses the market cap of gold that volatility should level off.

It’s a hot debate and there are merits on both sides. My interest here is not necessarily who is right in the sound money vs. fiat money debate, but rather whether Ethereum can really call itself ultra-sound money. Can it be more sound than Bitcoin?

The Ultra-Sound Argument

For Ethereum to be Ultra-Sound it needs to be, well, more sound than Bitcoin. Here’s how that might happen:

First, the implementation of EIP-1559. This is an upgrade to Ethereum which changes how miners are incentivized and introduces the potential (but not the guarantee) that Ethereum will become deflationary.

It does this by changing the Ethereum transaction economics so that the base fee is no longer given to miners, but rather destroyed. This creates some downward pressure on the Ethereum supply—though not necessarily enough to counteract the amount of new Ethereum created as a reward for miners. I’ve written more about EIP-1559 here.

Second, the transition to Proof of Stake. This changes how the Ethereum network is secured, and can contribute to it becoming deflationary. I have a longer post about Ethereum 2.0 and the Proof of Stake shift too.

Once Proof of Stake ships, there won’t be any miners. There will be stakers. And one big difference between stakers and miners is that the stakers don’t need to constantly sell the ETH they’re earning in order to buy new mining gear. Instead, they’ll probably hold a decent chunk of it since the more ETH they have staked the more ETH they earn for staking.

This shift should reduce the amount of ETH being put into circulation since more of it will be locked up in staking contracts. In addition, the gas price threshold where ETH starts to become deflationary drops significantly, such that it might level off around 120,000,000 total ETH.

If all of that happens and ETH establishes a fixed supply around 120m, then it should fit the sound money definition as well as Bitcoin does. If the grander vision comes true and the Ethereum supply starts to shrink, then that could validate the “ultra” sound money idea as well.

But there are some problems that could get in the way.

The Ultra-Sound Problem

As I pointed out in the EIP-1559 article, there’s no guarantee that Ethereum will become deflationary.

It’s possible, for example, that as more transactions move to Layer 2 solutions there won’t be as much demand for transactions on the Ethereum base-layer, and there isn’t enough activity to flip Ethereum to deflationary.

It’s also possible that stakers end up dumping most of their earned Ethereum on the market as a source of income, and not as much gets locked up in staking contracts as we expect.

I don’t necessarily think these are the most likely futures, but they are possible futures we have to recognize. And while the Ethereum community might criticize Bitcoin for basically being the same product it was 10 years ago, that’s also its strength. Bitcoin is already sound. It’s built into its code. It doesn’t have to change anything or hope for a certain future. It’s already here.

Ethereum on the other hand has to get through these two big changes to its protocol and a certain vision of the future has to be realized. And even if that all happens we still have a big problem:

Ethereum was changed to make this happen. Who’s to say it won’t change again in some way in the future? If you were going to pick between two “sound money” options, wouldn’t you prefer the one that’s always been sound and is highly unlikely to change its monetary policy on you? The concept of Ethereum changing its monetary policy to become something that should be immune from monetary policy is kind of a contradiction. The whole ultra-sound money process challenges its own thesis.

Now to be clear I don’t think this means the price of Ethereum won’t go up, or that it won’t flip Bitcoin’s market cap, or that it won’t be the financial layer of the Internet. I think those are all true. But I think the Ethereum community is getting greedy: there’s no reason it needs to also be the sound money layer. And Ethereum’s strengths around programmability and improvability undermine its ability to be a reliable store of value.

A more interesting future to me is one where Bitcoin continues to be a reliable, durable, store of value. Something you can hold and not want to do much else with.

Ethereum can be the financialization layer: handling everything from peer-to-peer transactions to options and mortgages. The definancialization arguments are romantic, but I don’t think we’re going to put the cat back in the bag now that we know how to play all these various games with our wealth.

Gold and Derivatives both have important places in our current financial system, there’s no reason Bitcoin and Ethereum can’t both have important places in the new one.