Tomasz Tunguz - The Velocity of Money in Startupland

Tomasz TunguzVenture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Velocity of Money in Startupland

A venture dollar’s velocity has never been faster. The time it takes for a dollar to appear in an LP’s pocket, for the LP to wire it to a VC fund, and for the VC fund to invest can be measured in minutes. Then, hold your breath for the pre-emptive round, and you’ll have 3 term sheets before you pass out. I’m kidding of course, but the hyperbole illustrates the velocity of money in Startupland. I’ve never seen a dollar move faster. What’s driving this? Just look at these numbers in the exit markets.

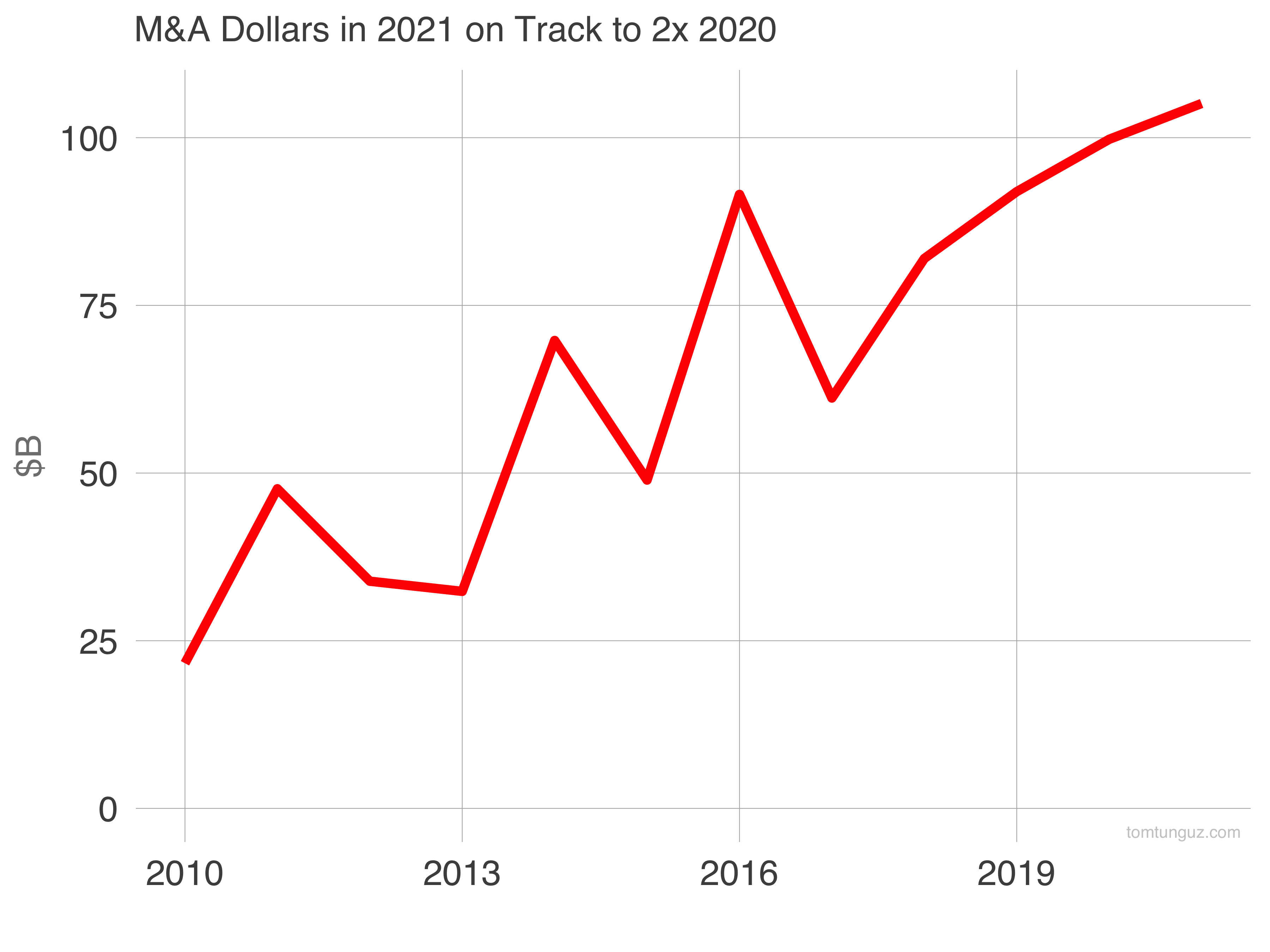

The M&A market is not far behind; it’s on track to double 2020’s decade high of M&A value transacted. With liquidity figures rocketing into space alongside Branson and Bezos, it’s no surprise to see the market behave this way. VC fundraising will achieve a record. Valuations are at decade highs. There are 3-5 financings and M&A every working day. There’s an IPO every fourth or fifth day. I wrote a post in 2015 called The Runaway Train of Late Stage Fundraising that examined the disparity between the number of growth rounds and unicorns versus the number of IPOs. If this year has shown us anything, it’s that the IPO and M&A markets have risen to the challenge; they’ve swelled to accommodate the team of unicorns born in the last decade. And there’s nothing more enticing to an investor to double down and move money faster than gains. |

Older messages

The Decline of Venture Debt at the Early Stage

Monday, July 26, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Decline of Venture Debt at the Early Stage A

Data Meshes, Apache Iceberg & Project Nessie - Novel Ideas in the Data World

Tuesday, July 20, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Data Meshes, Apache Iceberg & Project Nessie -

The Journey From Fortune 100 Executive to Startup Entrepreneur

Friday, July 16, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Journey From Fortune 100 Executive to Startup

The Next Step Forward for Conversational Intelligence - Chorus & ZoomInfo

Tuesday, July 13, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. The Next Step Forward for Conversational

My Mental Model for the World of Crypto

Saturday, July 10, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. My Mental Model for the World of Crypto How does

You Might Also Like

Europe’s 100 most active investors

Monday, March 10, 2025

+ Ultraleap sold for parts; Judith Dada joins Visionaries View in browser Powered by Deel Author-Martin by Martin Coulter Good morning there, When JP Morgan acquired an almost 50% stake in Viva Wallet,

#222 | Reimagining Learning, Consumer AI Opportunities, & more

Sunday, March 9, 2025

March 9th | The latest from Maveron, NextView, Altimeter, Emergence, Bessemer, and others ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

This dead simple web app generates $100K/year

Sunday, March 9, 2025

Starter Story Sunday Breakfast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Building Lovable: $10M ARR in 60 days with 15 people | Anton Osika (CEO and co-founder)

Sunday, March 9, 2025

Listen now (70 mins) | The AI startup that's Europe's fastest-growing company ever ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👻 The AI sourcing secret that's haunting your competitors.

Sunday, March 9, 2025

Uncover the mysterious ways AI is transforming product sourcing and why it's giving some brands an otherworldly edge. Hey Friend , Sourcing products used to be a slow, manual process—searching

🗞 What's New: Why AI can't replace my $1k/mo human assistant

Saturday, March 8, 2025

Also: 25+ AI agent opportunities ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #436

Saturday, March 8, 2025

Debating the future of SaaS + what many VCs are thinking... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎯 Fix your fulfillment, fix your profits

Saturday, March 8, 2025

The answer to higher profits is not always selling more. This is how smart businesses do it… Hey Friend , Most ecommerce founders focus on selling more to increase profits. But what if I told you that

Create a social media strategy in 7 (straightforward) steps

Friday, March 7, 2025

Plus, the latest from the blog and social media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10words: Top picks from this week

Friday, March 7, 2025

Today's projects: Wallpaperee • Chatbox • DesignLit • PH Deck • ChatPro AI • Opencord.AI • NexaAI • GReminders • Springs • crimalin • SuperCarousels • TitleSprint 10words Discover new apps and

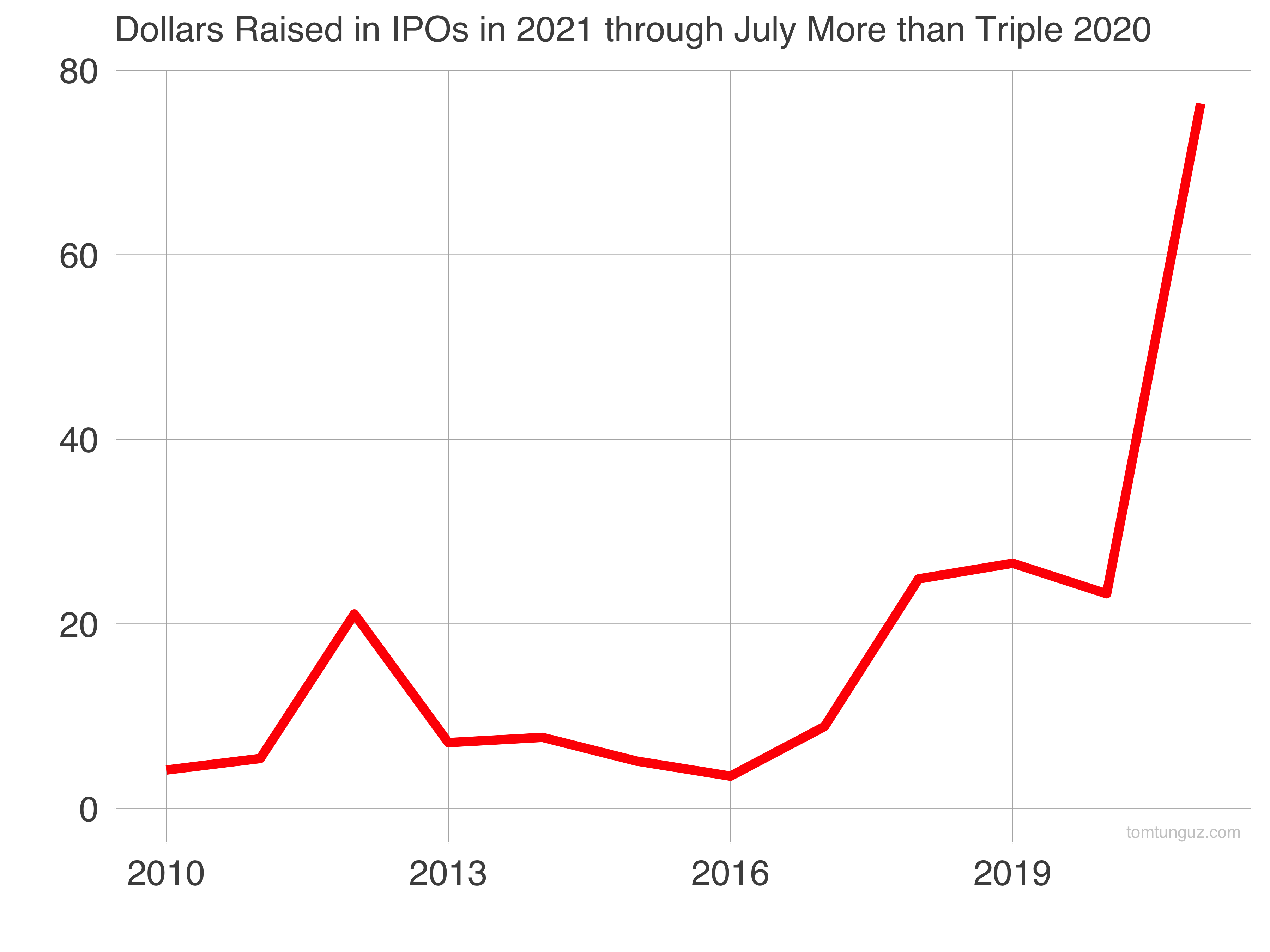

Startups are basking in the IPO market. They’ve raised 3x as much year-to-date in IPOs as all of 2020, which was a healthy market. Where will the tally end the year? $100B+? 120B+? See that blip in 2012? That was the Facebook IPO.

Startups are basking in the IPO market. They’ve raised 3x as much year-to-date in IPOs as all of 2020, which was a healthy market. Where will the tally end the year? $100B+? 120B+? See that blip in 2012? That was the Facebook IPO.