Net Interest - After Afterpay

Welcome to another issue of Net Interest, where I distill 25 years of experience investing in the financial sector into a weekly email. If you’re reading this but haven’t yet signed up, join over 22,000 others and get Net Interest delivered to your inbox each Friday by subscribing here 👉 After AfterpayWell, I said last week that I would be taking some time off over August. But this is a newsletter on financial sector themes, so when the biggest financial sector deal of the year is announced, it’s worth getting off the beach for! Earlier this week, Square announced that it’s buying Afterpay of Australia in a deal (now) worth US$33 billion. We’ve touched on both companies here before – Afterpay in Online Lending: the Good, the Bad and the Ugly precisely a year ago (Afterpay was the Good) and Square in a write-up of the company (Hip to be Square) just before Christmas. They are both at the vanguard of fintech and share a distinctive feature. Unlike many fintech startups which create a lot of value for venture investors, these two have created most of their value in public. Square came to the market in November 2015 at a US$2.9 billion valuation and has created 98% of its value since; Afterpay came to the market six months later at a US$125 million valuation and has created 99.5% of its value since. To understand the rationale of the merger, it is useful to delve into the background of Afterpay and the sources of its success. I am helped by the very timely publication of a new book, Buy Now, Pay Later: The Extraordinary Story of Afterpay, by Jonathan Shapiro and James Eyers, which came out not two days after the deal was announced. The authors write in their epilogue: “Writing a book about such a rapidly evolving subject was always going to leave us exposed to the risk that we’d be caught out by a dramatic plot twist.” They were right but it does mean they’ve written a complete account of Afterpay as an independent company, an account that Square shareholders may find very useful. From eBay to AfterpayAfterpay is a global pioneer in the growing Buy Now Pay Later market. It was founded in 2014 by Australian neighbours, Anthony Eisen and Nick Molnar. Molnar had grown up in his family’s jewellery business in Sydney. It was a classic offline business with a store in Wynyard Station in the city’s central business district. Seeing the potential of the online market, Nick and his younger brother convinced their parents they could sell stock over the internet to supplement the store’s sales.

That was when Nick was in college. He carried on selling throughout but was also attracted by a career in finance. He’d struck up a friendship with his parents’ neighbour, Anthony Eisen, who worked in investment banking. At the time, Eisen was winding down the investment portfolio of Guinness Peat Group, having previously worked as a corporate advisor at a number of firms including Credit Suisse. Through Eisen’s contacts, Nick secured an interview at a local venture capital firm. The firm’s founder, Mark Carnegie, was fascinated by Nick’s online jewellery business – so much so that he refused to give him a job, telling him to go away and scale up the business instead, and that they’d talk again next year. Nick was quick off the mark. He skipped his graduation ceremony to fly to an industry convention in Las Vegas and came back with the franchise to launch Ice Online, America's largest online-only jewellery retailer, into the Australian market. However, there were some fundamental differences between buying jewellery online and buying it in a store:

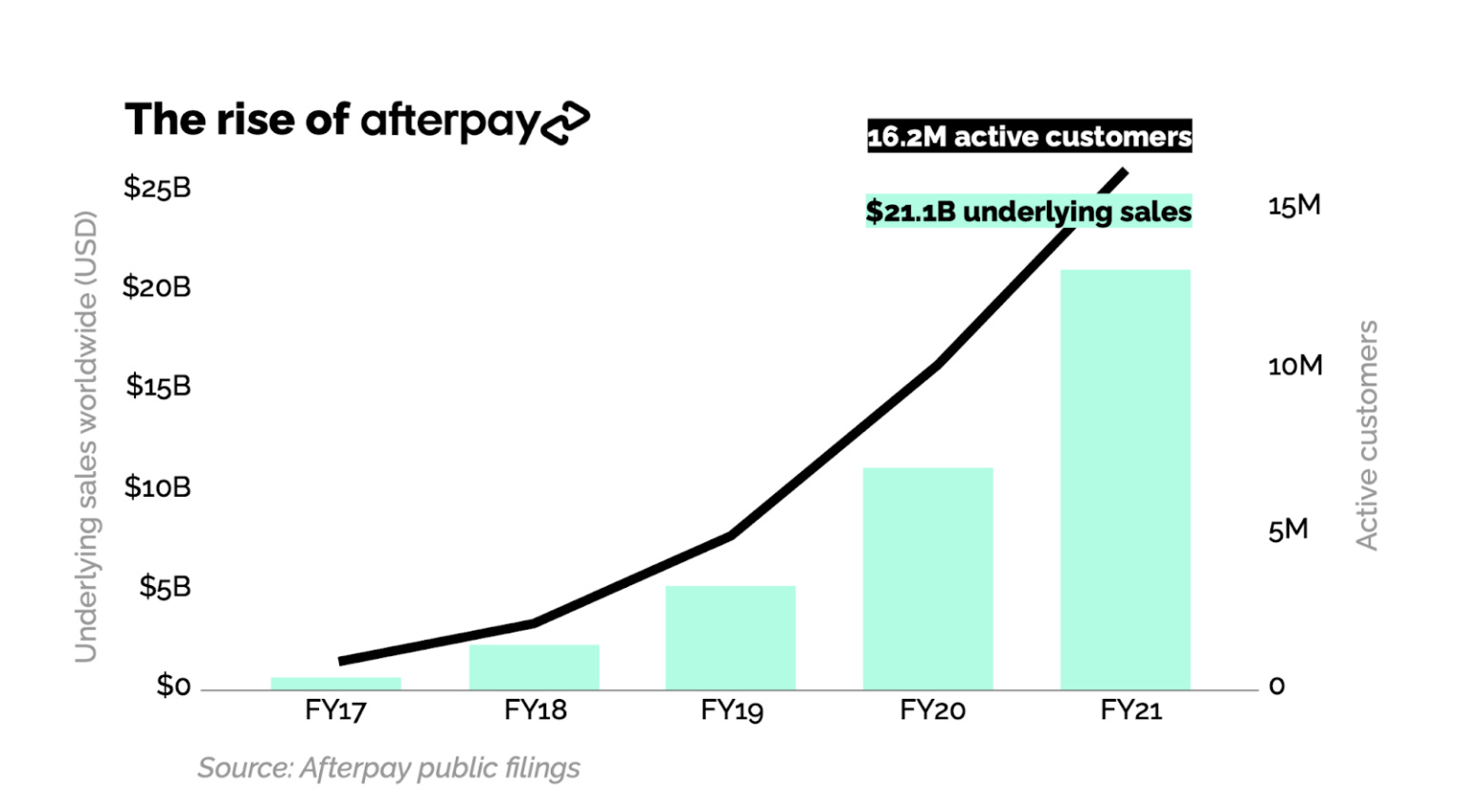

Nick observed that only 1 out of 100 visitors to the website would convert at checkout. He toyed with the idea of introducing credit as a mechanism to smooth the process and discussed his ideas with Eisen. Buying on CreditIt’s not unusual for retailers to offer credit to facilitate sales. In 1807, a furniture store in New York named Cowperthwait & Sons was the first to allow its customers to pay in instalments: “Liberal credit is granted without extra charge, while cash purchasers receive a ten per cent discount.” Shortly afterwards, Isaac Singer introduced a credit scheme to bolster sales of his sewing machines. According to Harvard Business School, “Singer’s machines were neither the best nor the cheapest products on the market. But the firm’s innovative credit plan, inspired by piano showrooms near company headquarters, tripled sales in just one year.” Others followed. Department stores introduced cards for their wealthier customers to defer payment and then smaller retailers banded together to form cooperative payment card systems. Visa and Mastercard grew from these roots, as we discussed in our piece on Dee Hock, the founder of Visa. But even twenty years after the launch of the first bank-issued card, Sears had more cards in circulation than Visa and Mastercard combined. Extending credit to customers hasn’t always gone well. That very first bank-issued credit card – dropped on the residents of Fresno, California in 1958 – suffered delinquencies of 22%, much higher than the 4% projected. Those losses cost its innovator his job. Managing the trade-off between retail sales and credit losses can still be a challenge. In 2014, Texas based furniture retailer, Conn’s, warned of major losses in its credit book. The company finances nearly 80% of its sales through an in-house credit business and deteriorating credit quality placed a drag on earnings. In the five years up to July 2019, Conn’s lost a cumulative $566 million in credit against profits in its retail business of $807 million before tax (a big price to pay compared with the 3% discount rate that merchants typically pay to accept credit underwritten by others). The divergent skills required to navigate retail and credit led many stores to outsource their credit books. For smaller stores, there was also the issue of scale, which is how Visa and Mastercard got their impetus. Larger stores took longer to convince since their own cards incurred no discount fees and stores that allowed customers to finance purchases generated additional interest income, like in the case of Conn’s over the past twelve months where credit losses have stemmed and credit now contributes over 40% of the bottom line. Dee Hock won over one of the largest stores, JCPenney, as a customer in 1979, but it took some doing. In the year prior, JCPenney’s credit volume amounted to 20% of Visa USA’s entire volume, so it’s not surprising the store came away with an attractive deal, one which precipitated Dee Hock’s exit. Most stores now outsource credit. Signet, the world’s largest jewellery retailer, was one of the last to fall into line. In its year ended January 2017, it financed 62% of sales in its Sterling Jewelers subsidiary (which includes Kay Jewelers, Jared and smaller regional brands) which it underwrote itself. Since then, it has been selling off its financing business in pieces (amidst sexual harassment allegations and questions from the SEC over how it booked credit losses). In March this year, Signet finalised receivable purchase agreements with third-parties, representing the final step in fully outsourcing its credit offerings and removing consumer credit risk from its balance sheet. Growing AfterpayNick Molnar registered a new business, Innovative Payments, in May 2014. Six months later he and Eisen changed the company’s name to Afterpay. The idea was to allow customers a choice of two financing options: to pay in full, within 30 days, after receiving delivery of their item, or to pay in four equal installments over six weeks. The experience at Ice Online was that nobody used the pay after delivery option, so that was soon killed. The pair did a deal with payments company Touchcorp to build the technology at a cost of A$13 million (paid in two cash installments – obviously – plus an equity stake of A$10 million). They hired a credit guy (Richard Harris) and a sales guy (Fabio De Carvalho) and set to work. In July 2015, they raised A$8 million of funding from 41 early investors, valuing the business at A$28 million. Early merchant customers liked the proposition. One of the first to sign up was Princess Polly, an online fashion brand. Afterpay soon grew to support one in five of its purchases, increasing its revenues by as much as 15%. General Pants came onboard next followed by Cue Clothing. In its first week on General Pants’ site, Afterpay accounted for 20% of sales. The company has retained a focus on fashion since, where there is greater demand for instant gratification and where ticket sizes are lower than in electronics, say, reducing risk. Merchants that add Afterpay at the checkout typically witness more conversion, larger basket sizes and higher repeat rates. Investors liked the proposition too. On a $100 sale, the merchant would pay Afterpay $4. After deducting $0.80 for Touchcorp to process the transaction and around $0.70 lost to bad debts and failed payments, around $2.50 would be left as a transaction margin. Because of the high turnover of loans (they were extended for six week periods) that margin could be earned multiple times over a year. And because Afterpay borrowed its funds – National Australia Bank would go on to provide a warehouse lending facility – the return on equity capital was even greater. By the end of 2015, Afterpay had run out of funds. Rather than raise a venture round, it went straight to the stock market, listing in May 2016 at a A$165 million valuation. The public offering meant that venture funds didn’t get a chance to invest, with one exception – Matrix Partners, which came in later, in 2018, to finance expansion into the US. Not even Nick Molnar’s former job interviewer, Mark Carnegie, was given a chance to invest, although nor did he put any of his personal funds in. Years later, he was asked by a journalist whether he regretted not putting money into Afterpay. His response: “What do you fucking think?”. At the time of its IPO, Afterpay had 100 merchants and 38,000 underlying customers signed up. After that, the company grew and grew. Its original pitch deck had projected A$677 million of underlying merchant sales in its third year of operations (2018 financial year); in fact it did A$2.2 billion. In the last financial year to June 2021, it did ten times that – A$21.1 billion – with 98,200 merchants signed up and 16.2 million underlying customers. Along the way, Afterpay merged with its early technology provider Touchcorp (hence its stock ticker APT, as in Afterpay Touch) and expanded into North America and Europe (in Europe under the brand Clearpay because a Dutch company, AfterPay, got there first). Expansion into the US was especially important given the size of the market – 25 times larger than the Australian market. In order to replicate a startup culture, Afterpay set up a separate company, Afterpay USA Inc, with US$15 million of funding from Matrix Partners in a deal that gave it conversion rights on 10% of the US business. Nick Molnar relocated to take charge. The first retailer to sign up was Urban Outfitters; it was soon followed by Revolve. Within nine months, Afterpay USA had signed up 900 merchants and attracted 300,000 users. And then, on Thanksgiving 2018, the Kardashian team reached out, wanting to onboard that very day to take advantage of Black Friday.

By the end of March, the number of users in the US had hit 1 million. In February 2020, the US overtook Australia by customer count; the number of users there is now 10.5 million. Regulatory ThreatsIt wasn’t all smooth sailing for Afterpay. Between 2017 and 2020, the company faced the glare of regulatory scrutiny; it has also been subject to intense competition. Regulatory scrutiny came in three waves. First, the Australian Securities and Investments Commission launched an inquiry focused on the industry’s lending practices. Afterpay offers consumer credit yet doesn’t conduct full credit checks of customers as per national lending laws. Doing so would slow down the application process, removing the product’s attractions. The company says that regardless, it rejects 50% of attempted transactions by first-time customers. It has been able to circumvent credit checks because its loans are short duration and don’t incur interest and so fall outside the definition of credit products in the credit laws. When it filed its report in November 2018, the Commission agreed. Then there was a Senate committee inquiry into credit and financial services. A focus here was late fees. Afterpay charges consumers a fee if they are late with payments – the only revenue it extracts directly from consumers. However, the fee is capped and so doesn’t compound like interest. The company told the inquiry that only 5% of transactions incurred a late fee in 2018. Since then, the contribution from late fees has been coming down, to ~13% of revenue from ~20% in 2017 and 2018. Finally, the Reserve Bank of Australia probed whether Buy Now Pay Later providers like Afterpay should be allowed to stop merchants passing their costs on to customers, as they insist in their contracts. Such restrictions were banned in the credit card industry in Australia in the early 2000s. Afterpay argues that its model is increasingly analogous to an internet referral platform like Google rather than to a payments processor like Visa. Indeed, in the year to June 2021, Afterpay drove ~1 million lead referrals per day to its merchant partners, with 55% coming from consumers browsing the home page on the Afterpay mobile app. Since its early days, the company has shifted its focus from merchant-as-customer to consumer-as-customer. The merchant partner finances Afterpay’s customer acquisition, but then gets value back through referrals and repeat business. One analysis shows that leads from Afterpay convert 8x more than leads from Google; lead referral is a growing part of the proposition for merchants. The Governor of the Reserve Bank of Australia plainly agreed and in December 2020, indicated that he would not remove the no-surcharge rules that would have put Buy Now Pay Later on equal footing with card processors. Together with SquareThere’s a widely held narrative that “Buy Now Pay Later companies are particularly popular amongst younger millennial and Generation Z consumers who came of age amidst the Great Recession and have a generally dubious view of credit.” It’s certainly true that Buy Now Pay Later, funded via debit cards (90% in case of Afterpay) is popular in that demographic – the average age of an Afterpay customer is 33. But it’s not clear whether a dubious view of credit is the reason. Robinhood, which we discussed a few weeks ago, has a similar demographic among its customer base (median age 31) yet sells a lot of margin loans (albeit its customers skew male while Afterpay’s skew female). Whatever the reason, Buy Now Pay Later is a useful way for merchants to convert debit-sized baskets into credit-sized baskets with no incremental risk and only slightly higher cost. Its popularity has bred a lot of competition. As well as Affirm and Klarna, Apple is launching a Buy Now Pay Later product in partnership with Goldman Sachs, and PayPal is investing heavily. The deal between Afterpay and Square recognises the changing competitive landscape, but it does something more. As we discussed in our Square write-up, Square has built two independent ecosystems that are approaching critical mass – an ecosystem of merchants (Seller) and an ecosystem of consumers (Cash App). The holy grail is to connect them (the “third horizon” as management puts it) to capture all the value available when the two sides transact. Management tried in the past with Square Wallet, but they went too early, before the sides had critical mass. Looking back, the CFO said: “I think what we learned there and why we shut it down is if you tried to contain what a consumer wants to do, you effectively are removing utility from them.” Afterpay provides the glue to mesh the two sides together. As well as bringing in both more merchants and more consumers, Afterpay has proven how to combine them. Like Square, it started out with a focus on merchants but has shifted its focus to the consumer side. It’s also the case that across financial services, lending reflects the largest profit pool, yet growing a lending business while managing risk is hard. Combined, Square and Afterpay are worth more than Citigroup, which once harboured a strategy to become a financial supermarket. The modern equivalent is a super app and although that’s not a term Square management likes to use¹, that’s what it’s becoming. More Net InterestBig Tech Doing FinanceThe Bank for International Settlements (BIS) has been wrestling with how to respond to the incursion of big technology companies into financial services for some time. We highlighted some of the challenges in The Policy Triangle earlier this year. For years, financial regulators have contained themselves to managing the trade-off between competition and financial stability, with stability usually winning out. Big technology companies add a new dimension to the trade-off: privacy. This week, senior BIS personnel published a paper, Regulating Big Techs in Finance. They reckon financial regulators have a role to play, given “the potential systemic relevance of big techs and the need to introduce specific safeguards to guarantee sufficient operational resilience. That may be especially relevant for big techs offering systemically important payment services to a significant section of the population.” Historically, regulators have taken an “activity-based” approach to non-banks entering financial services, i.e. that the specific activities they undertake need to be licensed, be they in credit or in payments or wherever. The scale of its non-banks has forced China to adopt a more “entity-based” approach, holding companies like Ant to higher standards. The BIS wonders if regulators elsewhere need to pivot, too: “[G]iven the unique set of challenges that are thrown up by big techs’ entry into financial services, a purely activity-based framework for regulation is likely to fall short of an adequate response to these policy challenges.” Financial regulators have big technology companies in their sights. European BanksEuropean banks have had a good earnings season. Most of them have now reported their second quarter earnings and they have beaten Goldman Sachs estimates by 18% at the pre-tax profit level. A lot of the beat comes from lower loan loss provisions, but pre-provision profits beat by 6% with revenues performing 2% better than expected to grow 4% versus the same quarter last year. Capital also accumulated over the period, providing the fuel for higher dividends once regulators lift restrictions on 1 October. Last Friday, just after Net Interest went to press, the European Bank Authority released results of its bank stress tests which contained no major negative surprises, providing support for higher payouts. After eighteen months of lockdown, European banks are close to being released. BlackstoneI discussed Blackstone with Zack Fuss on the Business Breakdowns podcast this week – part of the Colossus group of podcasts that also includes Invest Like the Best. David Haber summarised the firm’s essence on Twitter as “Firm > Fund”. That’s exactly right; few firms have historically been able to optimise both. If you enjoyed the primer on the company last week, the podcast is worth a listen. 1 “I don’t know what you call that combination of all those things, but we call it Cash App, and we think it’s a new definition. We think it’s rather unique, and we’re going to continue to add surface area to it to make it something that people want to use every day.” — Jack Dorsey. If you liked this post from Net Interest, why not share it? |

Older messages

Blackstone's Moment

Friday, July 30, 2021

Plus: Archegos, US Payments, Monzo, Finally

Ever Grande

Friday, July 23, 2021

Plus: Simply not Fintechery, Circle, Equity Research, Finally

Litigation Finance

Friday, July 23, 2021

Plus: Stress Tests, Revolut, Tink/Visa

The Long Slow Short

Friday, July 23, 2021

Plus: Robinhood/Distressed Investing, Banker Hours, Compound Treasury

What is Robinhood?

Friday, July 23, 2021

Plus: Buy Now Pay Later, M&A, Weather

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏