Very wealthy people can afford very good lobbyists

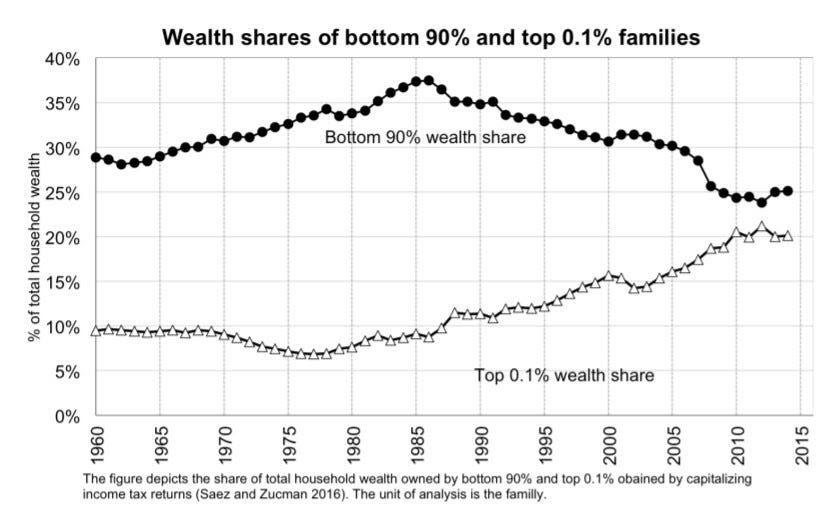

Too often, the media treats the news as a game. It's about who is up and who is down — who is winning and who is losing. Popular Information takes a different approach. We believe journalism should focus on people. We believe that at its best, journalism can have a positive impact on people's lives by holding the powerful accountable. That is the focus of today's edition. And it will continue to be the focus of Popular Information in the months and years to come. Our reporting has helped secure guaranteed sick leave for 170,000 restaurant workers and pressured large corporations to cut off donations to members of Congress who voted to overturn the election. You can support this work — and help us do more of it — by becoming a paid subscriber. If the cost of this newsletter ($6/month or $50/year) would create any kind of financial strain, please stay on this free list. That's why we've taken down the paywall. But if you can afford it, consider becoming a paid subscriber. Over the last three decades, there has been a dramatic concentration of wealth in the United States. Today, the top 0.1% of American families control nearly as much wealth as the bottom 90%. The Biden administration, as part of its domestic policy agenda, has proposed some changes to make things a bit fairer. These changes won't reverse wealth inequality in the United States. But they would improve the lives of average Americans while asking a little more from the very wealthy. Congress is considering the plan through a process called reconciliation, which means the legislation doesn't need Republican votes to pass. In other words, the changes contemplated have a real chance of becoming reality. The Biden plan, for example, would help pay for a paid family leave benefit and extend the enhanced child tax credit by closing a loophole used to protect dynastic wealth from taxation. Here is how the loophole works. Let's say Bob bought 1000 shares of Amazon stock in 1998 when the price was $5 per share. Bob paid $5000. Today, Amazon stock is $3,465 per share, and Bob's holdings are worth $3.465 million. If Bob sold the stock today, he would owe taxes on his capital gains. This is calculated by subtracting how much Bob paid for the stock ($5,000), from its current value ($3.465 million). So Bob would owe capital gains taxes on the difference, paying over $600,000 to the federal government. Bob still walks away with over $2.8 million but his tax bill is not insignificant. But there is an alternative. Instead of selling the stock, Bob could keep it and leave the stock in his will for his son, Bobby Jr. If Bob died today and Bobby Jr. received the stock, Bobby Jr. would not owe any taxes on the capital gains between 1998 and 2021. Under the law, the "basis" for the stock becomes the value of the stock on the day Bob died, or $3.465 million. No matter when Bobby Jr. sells the stock, the $600,000 in capital gains tax for the appreciation over 23 years will never have to be paid. Bobby Jr. would only owe tax on capital gains above the value of the stock on the day of his father's death. This loophole is called "stepped-up basis." The "basis" is the cost of the stock for purposes of calculating capital gains which, under this provision, is "stepped-up" when the owner dies. Closing this loophole would simply make extremely wealthy people pay the same capital gains taxes as everyone else. But when the House Ways and Means Committee released its version of the tax provisions for the reconciliation package, there was no provision to close the "stepped-up basis" loophole. There has been an intense lobbying campaign to convince Democrats to maintain the tax loophole for dynastic wealth. Former Democratic Senator Heidi Heitkamp (D-ND) is leading a "well-financed" effort to defeat any reforms. Heitkamp claims that she is "finding a receptive audience among potential swing voters in rural areas, especially owners of family farms." If that's true, it's based on misinformation. The Biden proposal would "exempt up to $2.5 million in capital gains from a family farm or small business from ever being taxed, and taxes on gains in excess of that amount could be deferred indefinitely until the farm or business is sold outside the family." Who is financing Heitkamp's work? She leads a new non-profit called "Save America’s Family Enterprises," which doesn't have to disclose its donors. Whoever is financing the operation was able to convince Heitkamp to reverse her own position. Appearing on national TV just six months ago, Heitkamp called the "stepped-up basis" loophole "one of the biggest scams in the history of forever." There is still time for the fix to be included in the final legislation. But, for now, Heitkamp and her allies are winning. And it's not an isolated incident. Across a host of issues, powerful lobbyists are prevailing over the interests of average Americans. Private equity managers can afford good lobbyistsEarlier this month, Popular Information covered the effort to preserve the "carried interest" tax loophole. It allows private equity managers, many of whom are billionaires, to pay a much lower tax rate on a portion of their income than everyone else. The Biden plan would have eliminated the loophole. But it faced an aggressive lobbying effort from the U.S. Chamber of Commerce and other business interests. They were armed with a "bogus" study claiming that closing the loophole would kill 4.9 million jobs. The House Ways and Means Committee proposal amended the loophole slightly, requiring private equity managers to hold assets for at least five years to qualify for the lower rate. But the loophole is largely left in place, allowing private equity managers to avoid paying nearly $50 billion in taxes over the next decade. The pharmaceutical industry can afford good lobbyistsYesterday, the Pharmaceutical Research and Manufacturers of America (PhRMA), the industry’s largest trade group, announced that it was launching “a seven-figure ad campaign” against Democrats’ proposal to allow Medicare to negotiate with drug companies on behalf of its beneficiaries. The goal behind this proposal is to lower drug prices and, ultimately, make healthcare more affordable. Currently, Americans pay “nearly three times more for prescription drugs” than people in other developed countries. The savings from the lower drug prices would also be used to finance other priorities in the Democrats’ $3.5 trillion reconciliation package. The proposal is widely popular––87% of Americans ages 50 and older “agreed that Medicare should be able to negotiate with drug companies,” according to a 2021 AARP survey. But pharmaceutical companies have spent millions lobbying to derail the Democrats’ drug-price plan. According to OpenSecrets.org, the pharmaceutical industry spent over $171 million on lobbying this year. This summer, for example, PhRMA “spent millions of dollars on ads opposing Democrats’ drug pricing plan this summer.” Yesterday, three Democrats on the House Energy and Commerce Committee voted against Biden’s drug pricing plan. Representative Scott Peters (D-Calif.), who voted against the provision, claimed that the legislation would “stifle future investment in drug development.” Since 2019, Peters has received over $265,000 in contributions from the pharmaceutical industry. Despite the vote, there are still ways for this drug-price provision to make it to the final bill. “[The provision] will remain a cornerstone of the Build Back Better Act as work continues between the House, Senate and White House on the final bill,” Nancy Pelosi’s spokesperson said. The oil and gas industry can afford good lobbyistsBiden’s original proposal eliminated a multitude of tax preferences that benefited the oil and gas industry, including credits for "marginal, low-producing wells and write-offs of some drilling expenses." But the new House measure maintains most of those. It does double the tax on the sale of chemicals and reinstates "a 16.4 cents-per-gallon tax on crude and imported petroleum products." On Tuesday, six House Democrats from Texas (Henry Cuellar, Vincente Gonzalez, Lizzie Fletcher, Sylvia Garcia, Marc Veasey, Filemon Vela, and Colin Allred) announced their opposition to eliminating fossil fuel industry tax breaks. The move followed a major lobbying campaign by the American Petroleum Institute. Of the seven House Democrats that indicated that they would not support the proposal, six of them received significant financial support from the oil and gas industry in the last election cycle. According to Open Secrets, since 2019, Cuellar received $252,500 in PAC donations from the oil and gas industry, Gonzalez received $190,000, Fletcher received $209,599, Garcia received $70,500, Veasey received $140,500, and Vela received $66,000. To stay completely independent, Popular Information accepts no advertising. This newsletter only exists because of the support of readers like you. |

Older messages

The January 6 attack never ended

Wednesday, September 15, 2021

On January 6, a violent mob incited by President Trump attacked the US Capitol, attempting to overturn the results of the presidential election. Ultimately, the Capitol building was secured and Joe

In key states, corporate donations go overwhelmingly to legislators that oppose abortion rights

Monday, September 13, 2021

The draconian abortion ban that became law in Texas this month may soon be spreading across the country. Substantively, the Texas law bans all abortions after six weeks — before many women know they

Treating billionaire hedge fund managers like everyone else

Thursday, September 9, 2021

People who make between $40000 and $85000 per year pay a top federal income rate of 22%. Anyone who makes more, pays more — except billionaire private equity managers. Here is how it works. Private

The shameful treatment of American families

Wednesday, September 8, 2021

When it comes to supporting families, the United States of America is stuck in the dark ages. There are many kinds of family leave, but the most common is paid maternity leave for new mothers. Among

These corporations bankrolled the sponsors of Texas' abortion ban

Tuesday, September 7, 2021

Texas just enacted the nation's most draconian abortion ban, prohibiting all abortions after six weeks — before many women even know they are pregnant. There are no exceptions for rape or incest.

You Might Also Like

GeekWire Startups Weekly

Friday, January 10, 2025

News, analysis, insights from the Pacific NW startup ecosystem View this email in your browser Gaming industry outlook: What's ahead for Microsoft, Amazon, Valve, and startups in 2025 Read more »

Frostbite Flute

Friday, January 10, 2025

Frostbite // Neanderthal Bone Flute Music Frostbite Flute By Caroline Crampton • 10 Jan 2025 View in browser View in browser The full Browser recommends five articles, a video and a podcast. Today,

🍿 ‘Den of Thieves 2’ Is A Shockingly Good Time

Friday, January 10, 2025

Plus: We sit down with the CEO who unintentionally leaked Nintendo Switch 2's secret weapon. Inverse Daily 'Den of Thieves 2: Pantera' is bigger and better, but retains the original's

☕ Regulatory futures

Friday, January 10, 2025

Plus AI's policy head on federal AV regulations. January 10, 2025 View Online | Sign Up Tech Brew It's Friday. Tech Brew's Jordyn Grzelewski has been pinging all over Las Vegas, searching

Down bad at the movies

Friday, January 10, 2025

Plus: California's wildfires continue, Tibetan boarding schools, and more. January 10, 2025 View in browser Alex Abad-Santos is a senior correspondent who covers all of our cultural obsessions.

Five Presidents Honor Carter, Notre Dame Wins, and a Deer at the Door

Friday, January 10, 2025

All five living US presidents gathered at the Washington National Cathedral for the funeral of former President Jimmy Carter on Thursday, honoring the 39th president who passed away in late December at

Numlock News: January 10, 2025 • Mercury, Cocoa, Hoagies

Friday, January 10, 2025

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

☕️ Toilet time

Friday, January 10, 2025

TikTok heads to the Supreme Court... January 10, 2025 View Online | Sign Up | Shop Morning Brew Presented By Incogni Good morning. At the beginning of each year, Lake Superior State University releases

The ultimate Pi 5 arrives carrying 16GB ... and a price to match [Fri Jan 10 2025]

Friday, January 10, 2025

Hi The Register Subscriber | Log in The Register Daily Headlines 10 January 2025 A 16 GB Raspberry Pi 5 board The ultimate Pi 5 arrives carrying 16GB ... and a price to match How much RAM does an

I Can’t Stop Buying Polartec Alpha Fleece

Friday, January 10, 2025

Plus: Half-off Collina Strada Baggu! The Strategist Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate commission. January 09,