GitLab S-1 Analysis: How 7 Key Metrics Stack Up

Tomasz TunguzVenture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. GitLab S-1 Analysis: How 7 Key Metrics Stack Up

GitLab is the first fully remote software company to go public. More than 2000 employees work all over the world and have collaborated to build a massive software business. GitLab provides a suite of DevOps tools that enable engineering teams to build and deploy software, and then secure it. The breadth of the solution is hard to convey, unless you visit the features page; when printed it’s more than 100 pages long. If that’s not a suite… Founded ten years ago, the company has scaled rapidly selling their software management suite to small and large companies alike.

GitLab is the third fastest growing software company at IPO, registering 87% revenue growth in 2020, while charting 88% gross margins. This fabulously high gross margin results from many customers hosting their own GitLab suites. In other words, customers pay for their own hardware, rather than using GitLab’s cloud, which reduces the costs of goods sold and boosts gross margin relative to other cloud products. The sales efficiency of 0.67 implies a 17 month payback period with a contract size of $55k, but the S-1 suggests the enterprise part of the business has been an important focal point. Customers paying GitLab more than $100k have grown 75% year-over-year to 383. More compelling than simply the growth in count is the disparity in Net Dollar Retention of these large customers. They expanded last year at 283% compared to 148% of the customer base broadly. This implies large customers must land with a large initial deployment, and at some point, roll out the GitLab product company-wide. To achieve these incredible numbers, GitLab does burn quite a bit of money viewed both through the lens of accrual and cash accounting. Net Income Margin is -120% and Cash Flow from Operations Margin is -48%. The significant delta in the figures suggest customers pre-pay their contracts often.

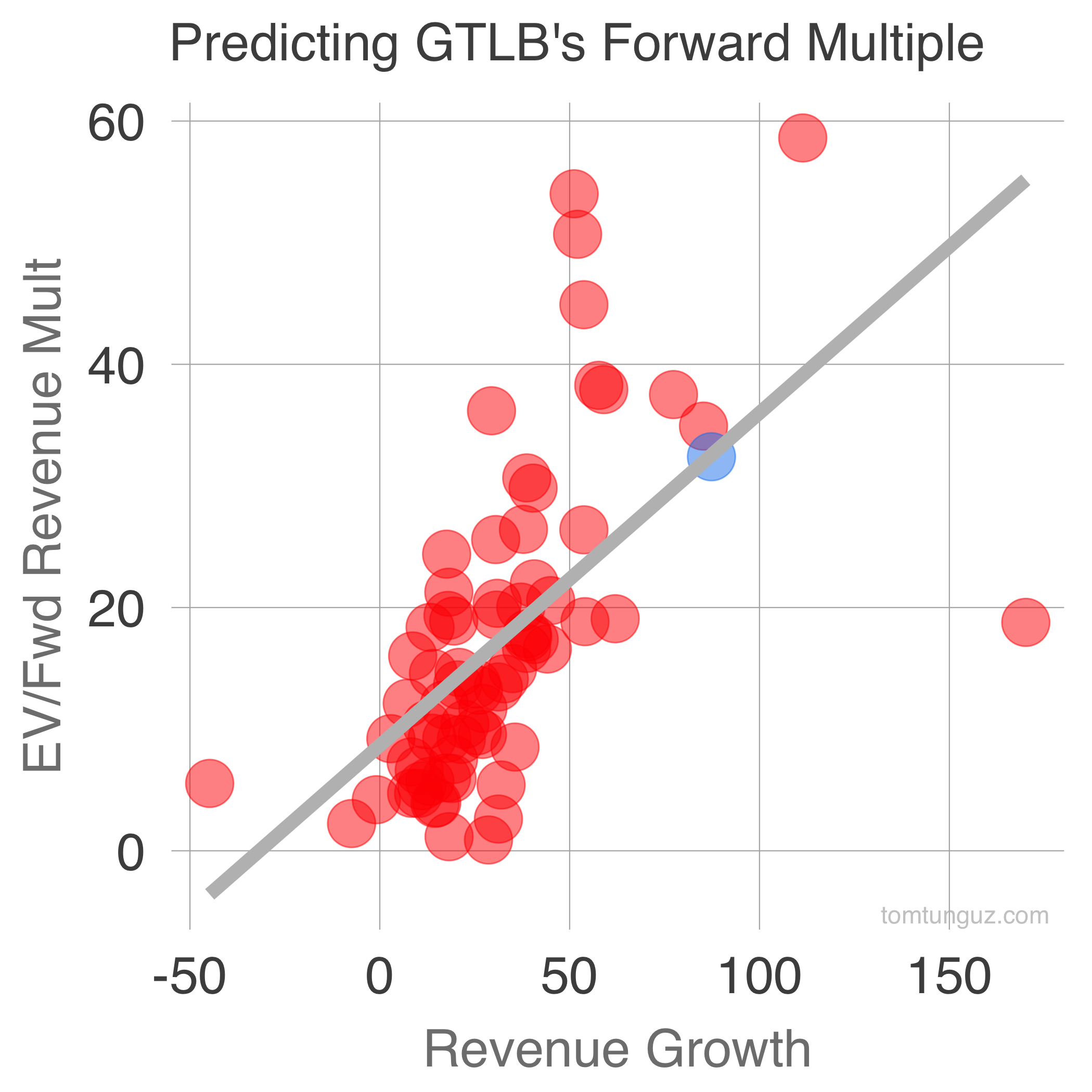

Using a basic linear regression model considering revenue growth and gross profit, the two factors most highly correlated with forward multiple, we should expect GitLab to trade around a 32x forward multiple. Assuming the company grows at similar levels to the first half of 2021, the model suggests the company should expect a market cap in the $15-17B range. Congratulations to the entire (distributed) team at GitLab on having developed a massively successful business. |

Older messages

Scaling and Measuring an Effective Developer Relations Organization

Thursday, September 16, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Scaling and Measuring an Effective Developer

What is the Product the Customer Buys Before They Buy Yours?

Tuesday, September 14, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. What is the Product the Customer Buys Before They

How Will We Value a Crypto Token?

Tuesday, September 7, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. How Will We Value a Crypto Token? Imagine you have

Benchmarking Amplitude's S-1: How 7 Key Metrics Stack Up

Thursday, September 2, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Benchmarking Amplitude's S-1: How 7 Key Metrics

Per Seat or Per Use Pricing: A Framework for Evaluating the Right Strategy for Your Startup

Wednesday, September 1, 2021

Tomasz Tunguz Venture Capitalist at Redpoint If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Per Seat or Per Use Pricing: A Framework for

You Might Also Like

#222 | Reimagining Learning, Consumer AI Opportunities, & more

Sunday, March 9, 2025

March 9th | The latest from Maveron, NextView, Altimeter, Emergence, Bessemer, and others ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

This dead simple web app generates $100K/year

Sunday, March 9, 2025

Starter Story Sunday Breakfast ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Building Lovable: $10M ARR in 60 days with 15 people | Anton Osika (CEO and co-founder)

Sunday, March 9, 2025

Listen now (70 mins) | The AI startup that's Europe's fastest-growing company ever ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👻 The AI sourcing secret that's haunting your competitors.

Sunday, March 9, 2025

Uncover the mysterious ways AI is transforming product sourcing and why it's giving some brands an otherworldly edge. Hey Friend , Sourcing products used to be a slow, manual process—searching

🗞 What's New: Why AI can't replace my $1k/mo human assistant

Saturday, March 8, 2025

Also: 25+ AI agent opportunities ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #436

Saturday, March 8, 2025

Debating the future of SaaS + what many VCs are thinking... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🎯 Fix your fulfillment, fix your profits

Saturday, March 8, 2025

The answer to higher profits is not always selling more. This is how smart businesses do it… Hey Friend , Most ecommerce founders focus on selling more to increase profits. But what if I told you that

Create a social media strategy in 7 (straightforward) steps

Friday, March 7, 2025

Plus, the latest from the blog and social media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10words: Top picks from this week

Friday, March 7, 2025

Today's projects: Wallpaperee • Chatbox • DesignLit • PH Deck • ChatPro AI • Opencord.AI • NexaAI • GReminders • Springs • crimalin • SuperCarousels • TitleSprint 10words Discover new apps and

Experiment Report: Trying New Things — The Bootstrapped Founder 380

Friday, March 7, 2025

When I talked to Anne-Laure Le Cunff earlier this week, we get into experiments and how to run them effectively. Here's what I've been doing. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏