UPDATES: The corporate campaign to tank reconciliation

Many of the nation's largest media outlets are owned by corporations that are participating in the lobbying campaign detailed in today's newsletter. Popular Information, on the other hand, has no corporate overlord. That gives us the freedom to provide you with the unvarnished truth. You can support our independent accountability journalism — and help us do more of it — with a paid subscription. To stay completely independent, Popular Information accepts no advertising. This newsletter only exists because of the support of readers like you. The reconciliation bill, also known as the "Build Back Better" plan, has two main components. There is a wide-ranging collection of new policies, including:

There is also a set of proposals to pay for these new policies, including:

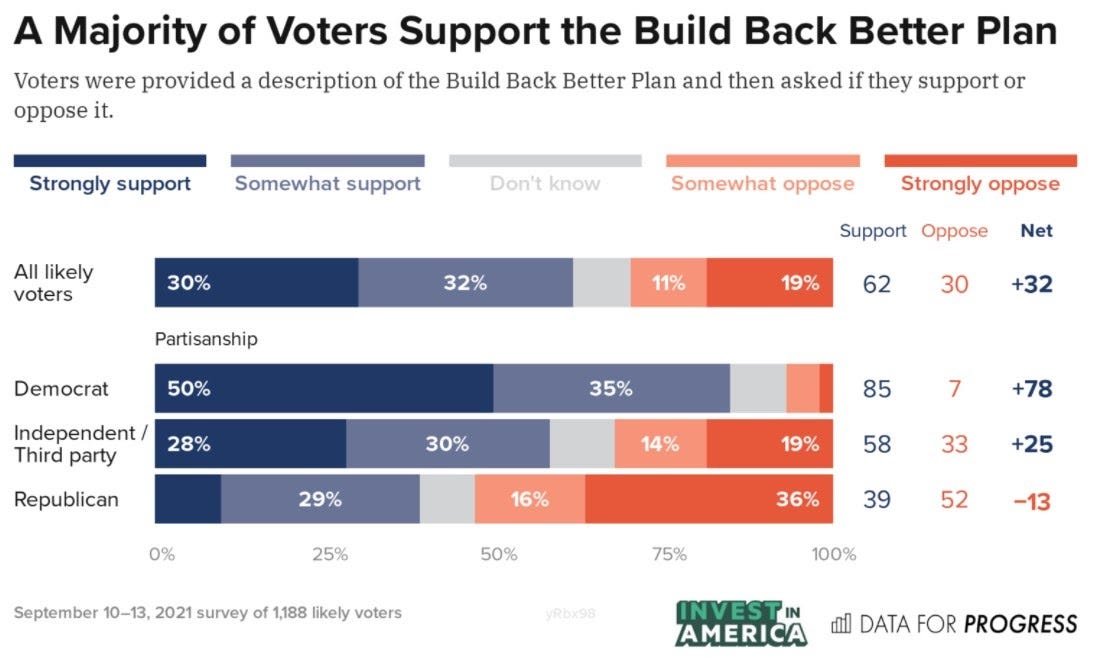

People can debate whether or not these policies are good. But there is no question these policies are extremely popular. A recent poll from Data for Progress found that 62% of Americans support the reconciliation package. This includes 85% of Democrats, 58% of Independents, and 39% of Republicans. Likely voters also overwhelmingly support proposals to raise taxes on wealthy business owners (68%), increase funding for IRS enforcement (64%), and raise the corporate tax rate (62%). The Data for Progress poll is not an outlier. Every recent poll of the reconciliation bill found supporters outnumbering opponents, including Pew (+24), Fox News (+22), Monmouth (+28), and Quinnipiac (+30). While opponents of the bill are relatively small in number, they make up for it with money and power. Corporations and the wealthy have launched an aggressive campaign to defeat the legislation. Despite the bill's significant support among independents and some Republicans, opponents can count on every Republican in Congress to vote against the legislation. But since it is a reconciliation bill and the Democrats control both chambers of Congress, it doesn't require any Republican votes to pass. So opponents need to peel off some Democrats. Since the Senate is evenly split and Democrats control the House by a razor-thin margin, they don't have to convince many Democrats to kill the bill. Corporations and the wealthy need to convince a handful of Democratic members of Congress to vote against the preferences and interests of their constituents. Much of this lobbying effort is taking place behind closed doors. But as Congress creeps closer to finalizing the package and holding votes, we are learning more. Corporate lobbying groups opposing reconciliation hold high-dollar fundraiser for SinemaIn the Senate, even one Democratic defection could sink the reconciliation bill. Many eyes are on Senator Kyrsten Sinema (D-AZ) who has publicly said she believes the bill is too large and privately "told Senate Democratic colleagues that she is averse to the corporate and individual tax rate increases that both the House and Senate tax-writing committees had planned to use to help pay for the measure." On Tuesday, five corporate lobbying groups are hosting a fundraiser for Sinema in DC. For a ticket price of $1,000 to $5,800, the event provides an opportunity to schmooze with Sinema for 45 minutes. Several of the hosts ardently oppose the reconciliation bill. “Passing the largest tax increase in U.S. history on the backs of America’s job creators as they recover from a global pandemic is the last thing Washington should be doing,” the CEO of the National Association of Wholesaler-Distributors said. (The reconciliation bill is not the largest tax increase in U.S. history.) Corporate opponents of the reconciliation bill shower select Democrats with PAC cashSinema isn't the only Democratic member of Congress who has seen an influx of corporate cash after raising doubts about the reconciliation package. Campaign finance filings reveal that "nine of the Democrats threatening the bill were rewarded during the month of August with over $150,000 in donations from PACs, including many affiliated with business groups that are lobbying against it." For example, in August, Senator Joe Manchin (D-WV) received $5,000 each from the PACs of International Paper Co. and Marathon Petroleum. Manchin has been a key Democratic voice objecting to the size and scope of the reconciliation bill." The paper company’s chair and CEO, Mark Sutton, is a member of the Business Roundtable. Suzanne Gagle, Marathon’s general counsel and senior vice president for government affairs, is a board member of the National Association of Manufacturers (NAM)," Sludge reports. Both the Business Roundtable and NAM are lobbying against the legislation. Group of influential CEOs intensify effort to defeat the reconciliation billThe Business Roundtable, which represents many of the nation's top CEOs, also intensified its public campaign against the legislation. On Tuesday, the Business Roundtable released a slickly produced video in which CEOs warn that there will be "consequences" to raising corporate taxes as ominous music plays in the background.   In the video, the CEOs claim that raising the corporate tax rate from 21% will diminish their ability to make "investments." But the corporate tax rate, however, only applies to profits. Investments in the business are not taxed. One year after the 2017 tax cuts — which reduced the corporate tax rate from 35% to 21% — business investment "returned to pre-overhaul levels." By January 2020, growth in business investment "all but stalled and even declined." A July 2020 report from the Federal Reserve Bank of Cleveland concluded that "the permanent cut in the corporate tax rate may have held investment down rather than stimulated it." This is because corporations finance most of their investments with debt, and they can deduct interest expenses from their tax bill. With lower tax rates, these deductions become less valuable. The Business Roundtable also held a press call with reporters on Tuesday. During the call, Business Roundtable President Joshua Bolten, who served as George W. Bush's Chief of Staff, insisted that increasing the tax rate on corporate profits would undermine the "competitiveness" of U.S. companies. American companies were able to compete in 2017, however, when the corporate tax rate was 35%. The Business Roundtable also announced a "multi-million-dollar campaign" to defeat the reconciliation bill which will include "direct CEO engagement to Capitol Hill and the Administration, as well as high-frequency radio print and digital ads in over 50 media markets across the country, generating calls and letters from constituents in target states." As Popular Information reported, Apple CEO Tim Cook is on the board of the Business Roundtable. Apple has publicly endorsed the climate provisions of the reconciliation bill, calling the legislation's Clean Energy Standard "urgent." But, as a leader of the Business Roundtable, Cook is part of this aggressive effort to defeat the bill. |

Older messages

Bad Apple

Tuesday, September 28, 2021

Apple does not want the public to think of the company only as a profit-obsessed manufacturer of iPhones, AirPods, and MacBooks. Rather, Apple would like to be viewed as a responsible corporate citizen

Fox News embraces white nationalism and these advertisers embrace Fox News

Monday, September 27, 2021

For months, Tucker Carlson has been promoting the racist "great replacement" conspiracy theory. The concept, which is embraced by white nationalists and neo-Nazis, is that there is a secret

Florida legislator imports Texas abortion ban

Thursday, September 23, 2021

Texas' draconian abortion ban is headed to Florida. On Wednesday, Florida Representative Webster Barnaby (R), introduced legislation that tracks Texas' new law banning nearly all abortions.

AT&T abandons pledge, makes contributions supporting Republican objectors

Wednesday, September 22, 2021

After the January 6 riot at the US Capitol, AT&T announced that it was suspending contributions to all 147 Republicans who tried to overturn the election results: Employees on our Federal PAC Board

The Manchin industry

Tuesday, September 21, 2021

The latest Intergovernmental Panel on Climate Change (IPCC) report, which was released in August and represents the consensus of thousands of scientists, makes one thing abundantly clear: There is no

You Might Also Like

☕ Regulatory futures

Friday, January 10, 2025

Plus AI's policy head on federal AV regulations. January 10, 2025 View Online | Sign Up Tech Brew It's Friday. Tech Brew's Jordyn Grzelewski has been pinging all over Las Vegas, searching

Down bad at the movies

Friday, January 10, 2025

Plus: California's wildfires continue, Tibetan boarding schools, and more. January 10, 2025 View in browser Alex Abad-Santos is a senior correspondent who covers all of our cultural obsessions.

Five Presidents Honor Carter, Notre Dame Wins, and a Deer at the Door

Friday, January 10, 2025

All five living US presidents gathered at the Washington National Cathedral for the funeral of former President Jimmy Carter on Thursday, honoring the 39th president who passed away in late December at

Numlock News: January 10, 2025 • Mercury, Cocoa, Hoagies

Friday, January 10, 2025

By Walt Hickey ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

☕️ Toilet time

Friday, January 10, 2025

TikTok heads to the Supreme Court... January 10, 2025 View Online | Sign Up | Shop Morning Brew Presented By Incogni Good morning. At the beginning of each year, Lake Superior State University releases

The ultimate Pi 5 arrives carrying 16GB ... and a price to match [Fri Jan 10 2025]

Friday, January 10, 2025

Hi The Register Subscriber | Log in The Register Daily Headlines 10 January 2025 A 16 GB Raspberry Pi 5 board The ultimate Pi 5 arrives carrying 16GB ... and a price to match How much RAM does an

I Can’t Stop Buying Polartec Alpha Fleece

Friday, January 10, 2025

Plus: Half-off Collina Strada Baggu! The Strategist Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate commission. January 09,

What A Day: Misinferno

Friday, January 10, 2025

Trump's spreading misinformation about the LA wildfires. That's not a good sign. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Carter’s Funeral Reminded Us How Presidents Ought to Behave

Thursday, January 9, 2025

January 9, 2025 EARLY AND OFTEN Carter's Funeral Reminded Us How Presidents Ought to Behave Donald Trump could learn a lot from the 39th president's commitment to honesty, human rights, and

A handsome alarm clock we love

Thursday, January 9, 2025

Plus: A printer that doesn't suck View in browser Ad The Recommendation January 9, 2025 Ad The case for … a clock Photo of an Oct17 Wooden Alarm Clock on a bedside table, with an illustration of a