The eCoinomics Team - September 2021, #5

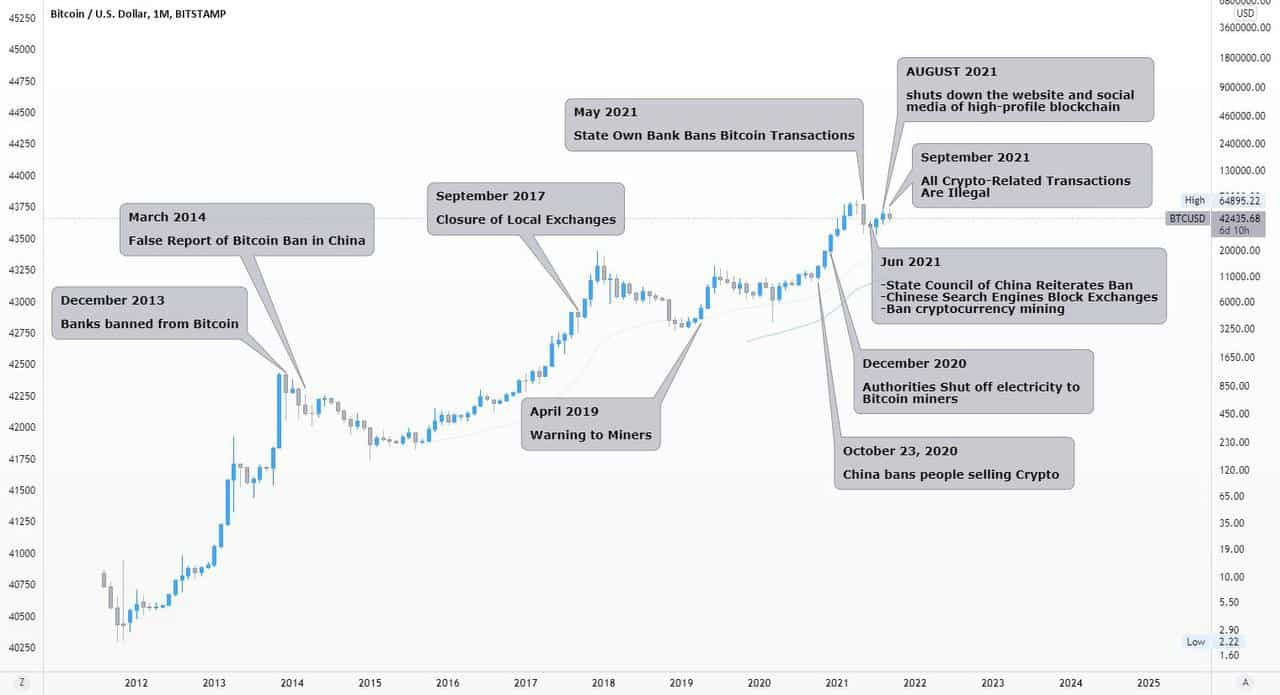

September 2021, #5We discuss price action and expectations for Bitcoin and Ethereum, part 1 of trading systems, how the China FUD is different this time, and Zoom-In on Axie Infinity (AXS) and Fantom (FTM)This Week. 1. Bitcoin and Ethereum trading in a tight range. 2. Getting your trading system right (Part 1) 3. China Fud. What’s different this time? 4. Zoom-In: Axie Infinity (AXS) and Fantom (FTM) Dear readers, Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues. When we thought about writing a weekly newsletter, we weren’t thinking about an audience. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line. It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics. We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section. These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them. You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__ If you missed any of the Twitter live sessions, check out the podcast at https://linktr.ee/cryptoroundupafrica The eCoinomics team. 1. Majors trade in a tight range.The thesis for Bitcoin this week is similar to that of last week. If you look at the chart from last week’s issue, you’ll see that Bitcoin price action looks the same on the weekly. The daily has traded in a tight range with a low of $40750 and a high of $44377. Price action has stayed in this range after a previous week close of $43300. $40000 local support held despite another China FUD. This is bullish in the macro sense. It’s the first time China FUD has not resulted in a new low. The macro market structure remains bullish and that remains the case until a close under “max pain support of $35000. We have outlined the $38000 daily support (DS) for perspective. If we get one more dip for any reason, that’s the level we expect the price to bounce. Above the current price, a close above the next trouble area (NTA) at $45000 is a good price to stack more satoshis as we expect a retest of the $53000 level from there. In summary, in so far price does not break below $35000, we good. 1.1 Ethereum.Ethereum’s weekly/daily multi-timeframe support at $2700 held. Above the current price, the bull run continues when the price breaks above $3500 which is the top of the next trouble area. A break below $2300 changes the market structure. It’s the Ethereum equivalent of a break below $35000 for Bitcoin. Punting orders between $2700 and $2300 makes R:R sense if the price were to pull back to those areas from any FUD this week has in store. Invalidation of a long position at those prices is a close below $2300. 2. Getting your trading system right (Part 1)(We started this series with an introduction last week, so if you are a new subscriber, we suggest you check out last week’s issue to get a sense of what you should expect to learn in this series.) A lot of people have opinions and if you’re on Crypto Twitter a lot, you’ll see a lot of conflicting ones. So if you depend on CT for your information, you’ll be confused a lot and make a lot of bad trading decisions as a result. How to counter this? By taking a systematic approach to trading. This brings us to our first lesson. 1. Price action is the main alpha.Last week, Robert Kiyosaki the author of the classic- “Rich Dad, Poor Dad” predicted a stock market crash on his Twitter account. As a trader who understands the impact of the stock market on the crypto market, you may have been tempted to close all your positions because “this guy must know what he’s talking about right?” Wrong! Turns out he’s called a stock market crash several times in the past and he’s been wrong all those times. He may be right this time but it still doesn't justify making trading decisions off it. The opposite of this happened during the April bull market characterised by high premia. Everyone and their grandmas were calling Bitcoin to $180k which made a lot of people hold their positions longer than they should have. The price of an asset at any time is the price buyers and sellers meet to reach an equilibrium price. At this price, every piece of information that is available to inform price has already informed it, as such there’s no such thing as price trading at a discount or premium. The price of an asset at any given time is the correct price in a free market. When “experts” make price predictions, what they are doing is taking a leap of faith and as we know, they are either right or wrong which is the default setting of any price prediction. Everything you need to know about an asset has already been factored into the price. Except you’re part of the top 1% of the 1% that have access to insider information. All this to say, the study of price action is all you need to give yourself an edge if there’s one to be had. Too many variables establish a price. The only accurate measure of value is the current price itself. “Trust the price.” tbc…. 3. China FUD. What’s different this time?Last week, China's central bank tightened its policy on crypto, declaring all crypto-related activities illegal. Following the news, the crypto market took a hit that most tokens are yet to recover from. Bitcoin the largest coin by market capitalization has been in slow sideways choppy price action as traders continue to monitor the news and situation coming out of China. A notable difference is that the new policy was co-signed by the Supreme People’s Court, the Supreme People's Procuratorate and the Public Security Ministry, suggesting law enforcement agencies are now directly involved unlike before when it didn’t go as far as calling it “illegal.” However, a different sector of the cryptocurrency market has benefited from cryptocurrencies being outlawed in China. During the week decentralized leverage trading exchanges like DYDX, Perpetual Protocol, Wootrade and Mango Market are getting increased attention and seeing gains in price as it is being speculated that traders are moving to decentralized and censorship-resistant exchanges in reaction to the China ban of cryptocurrencies and overseas exchanges being prohibited from providing services to Chinese traders. Although ten agencies of the Chinese government have agreed to work together to enforce the latest ban, it is important to remind our readers that in June, China informed its local banks to stop processing crypto-related transactions and also banned mining of cryptocurrencies in the country which led to the drop in Bitcoin hash rate and miners’ migration to other jurisdictions. Maybe this is the final straw that breaks the camel’s back and we can finally move on from China FUD every news cycle. This is also the first time that a China FUD has not resulted in a new low in Bitcoin price. 4. Zoom-In: Axie Infinity (AXS) and Fantom (FTM)The entire crypto market doesn’t look attractive at the moment. Most of the major alts have been in a downtrend and barely hanging on to support. Regardless, this week we Zoom-In on two tokens (AXS & FTM) that have caught our attention and we think you should pay attention to them. AXS is showing a strong bullish divergence on the high time frame chart. AXS has been consolidating for weeks while layer 1 tokens took the forefront and led the market. The narrative, chatters and reallocation into NFTs are starting to gear up once again and if that is the case then AXS is adequately positioned and ready to move out of its current range. $71 is still resistance and the price will have to break this level for more upside and to have a chance at challenging all-time high price. If rejected then $63 is a solid buy zone and area of confluence where the weekly open also currently sits. After the massive run-up recently, FTM has slowed down during the market-wide selloff to retest an old all-time high. Price is currently sitting at support ($1.2) which also coincides with weekly open. If Bitcoin does not shit the bed, we expect FTM to move up to challenge overhead resistance at $1.48 and continue to trend upward. If the price is rejected at this level then the old all-time high area of $0.97 is an optimum area to look buy. The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions. If you liked this post from eCoinomics Newsletter, why not share it? |

Older messages

October 2021, #1

Thursday, October 7, 2021

This week we discuss the Bitcoin rally, Ethereum price action, part 2 of trading systems, E-naira postponement and Zoom-In on FTX Token (FTT) and Curve DAO Token (CRV)

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏