It’s hard to admit when you’re wrong. But I was very wrong about Olympus.

When a crypto project has a cult-like following and super high APRs, I usually take that as a sign it’s some kind of scam.

So when I kept hearing about $OHM from the “Ohmies,” with “(3,3)” in their twitter handles and saw the ridiculously high APY on the Olympus site, I just assumed it was another ponzi coin with unusually good community and memeing skills.

But I was wrong. After months of writing it off, I finally dug into what was going on, and god damn it is a brilliant product. It might be one of the most important DeFi protocols ever built.

Is the price inflated by the Cult of $OHM? Almost definitely. Olympus is at a 2b market cap without being listed on any centralized exchange. They’re a top-5 DeFi protocol by market cap. They’ve grown 25x in the last six months. It’s one of the best investments you could have made this year.

But Olympus is also building something insanely cool that the crypto community desperately needs. A tool that could significantly improve the funding, ownership, and stability of every crypto project in the future.

It could even replace Bitcoin.

I’m not changing my Twitter bio yet, but I’m definitely on team $OHM now. Here’s why.

The Liquidity Problem

Olympus helps solve a huge problem faced by every new crypto project that launches a token: liquidity.

As I explained in my Decentralized Exchanges article, part of the magic unlocked by DEXs is that any new crypto project can launch their token, provide some startup liquidity with their token and whatever token they want you to trade it with, and then have the rest of the liquidity provided by the community. That’s how we were able to launch the Crypto Raiders tokens with only $200,000, but now have over $4m of liquidity supplied by our community.

But there’s a big downside to crowdsourced liquidity. As easily as your community can add funds, they can take it away. They might deposit millions of dollars of liquidity in the first few weeks to collect those sweet rewards you’re offering, but as soon as the rewards get less valuable, they’ll take the liquidity elsewhere.

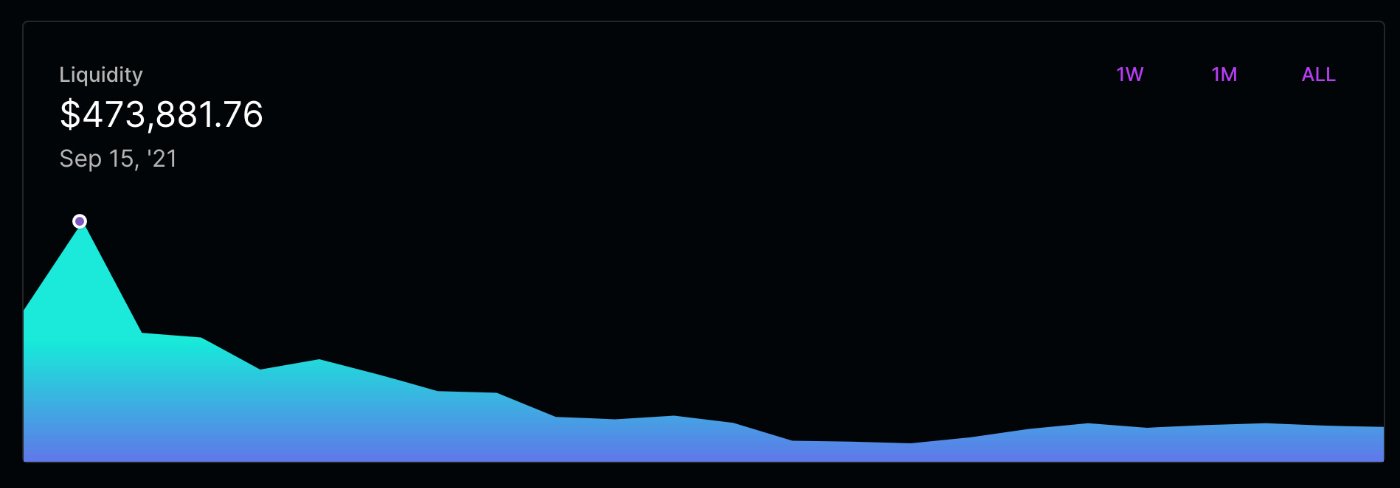

Here’s a good example. This coin launched on September 14th, and had almost half a million of liquidity on day 2:

But after a few days people started moving on to the next farm. Now, less than a month later, there’s only $110,000 of liquidity. They lost almost 80% of the funds supporting trades on their token in one month!

That’s a huge problem if you want people to be able to buy your token. Low liquidity means that trades above a certain amount will lose a lot of their value because they’ll actually move the price of the coin you’re trying to buy.

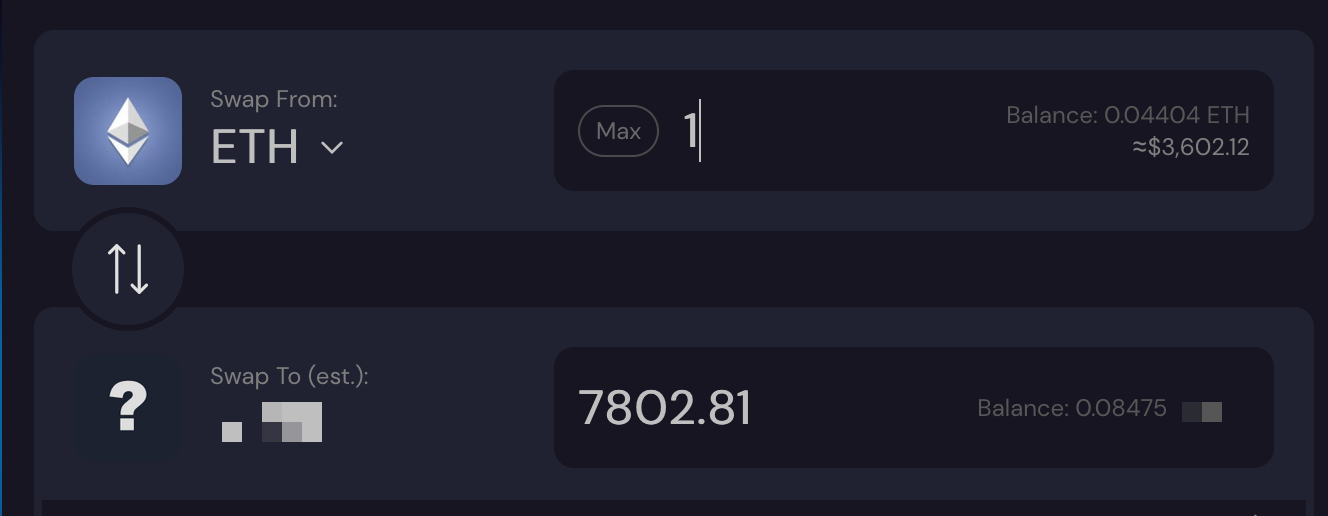

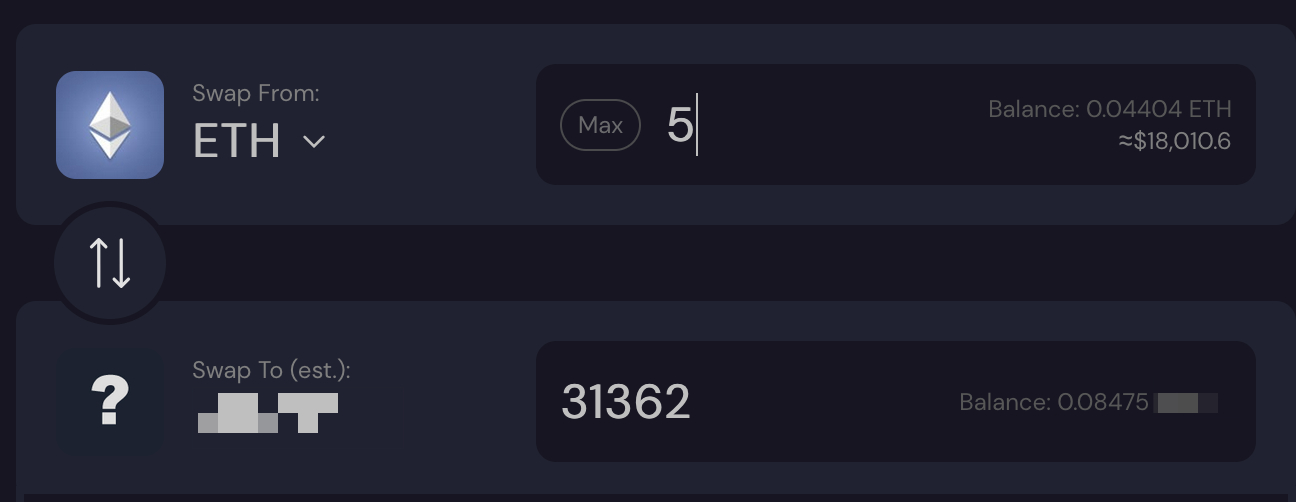

If I try to buy 1 ETH of this token right now, I’ll get 7,800 tokens:

But because the liquidity is so low, if I try to buy 5 ETH worth, I only get 31,362, instead of the 39,010 I should get!

Low liquidity can be a huge barrier to a new project’s success. And Olympus might have found a way to solve it.

Enter Olympus

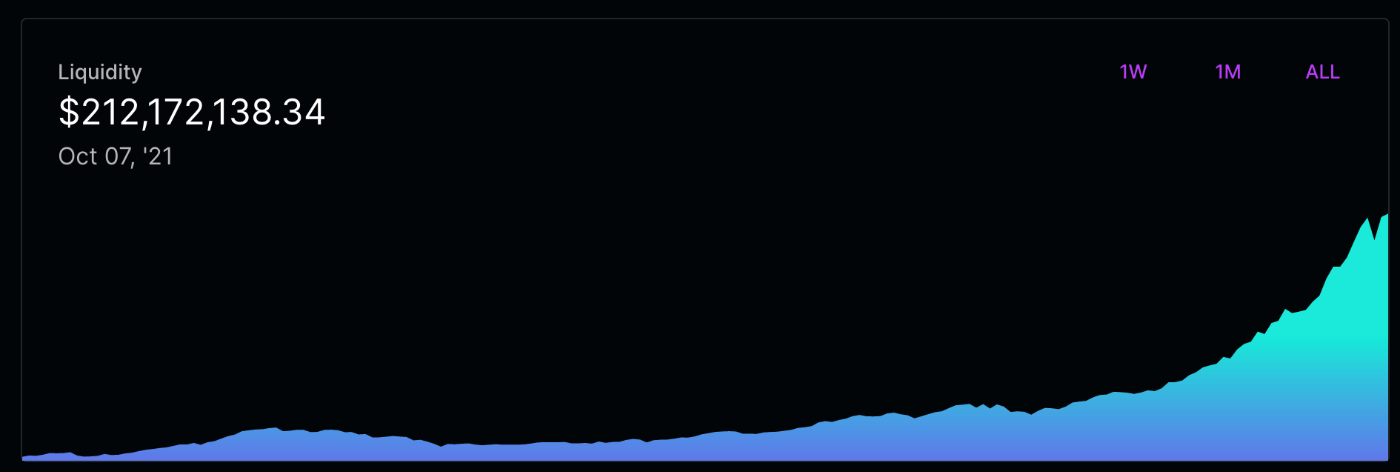

The chart above showed you what the total liquidity for a new project often looks like. Now here’s what Olympus’s liquidity chart looks like:

Steady progressive growth, now topping out at 212m just in the OHM-DAI pool on Sushi. In fact, it’s the biggest trading pool on SushiSwap that doesn’t use Ethereum.

$200m in liquidity is an insane achievement, but normally it’s not guaranteed to last. At any time, some big whales with a few million of your liquidity could sell it and not only reduce the value of your token but also make it less liquid.

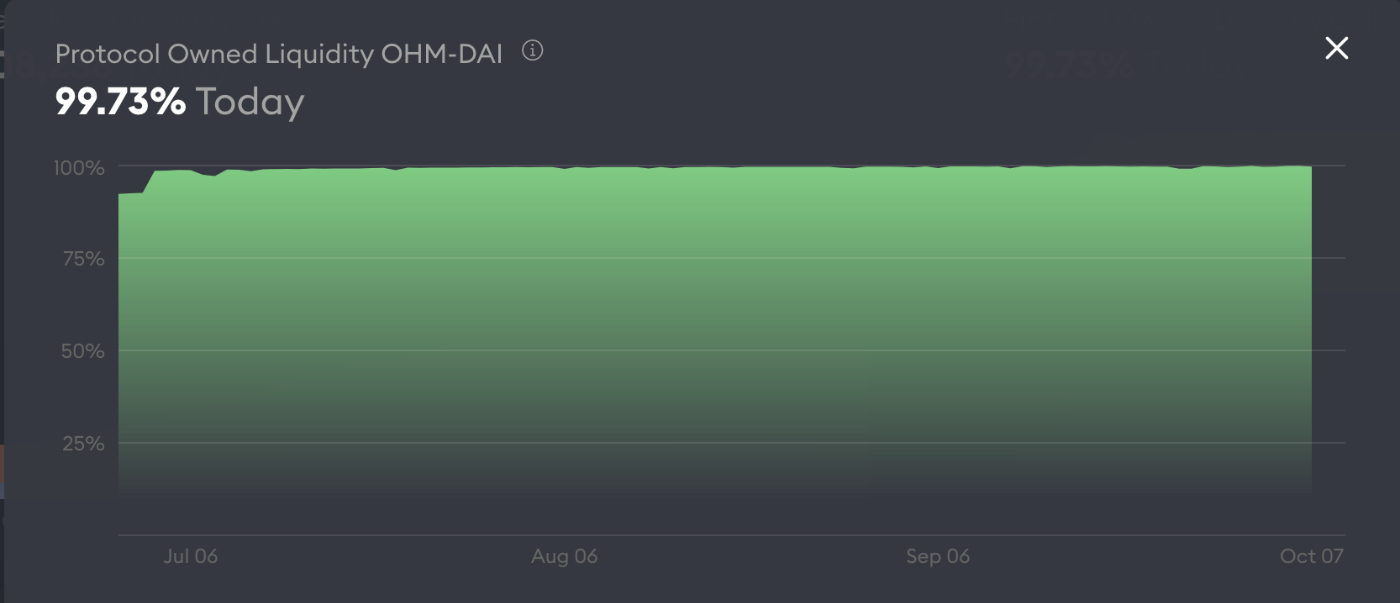

But Olympus doesn’t have to worry about that. They own 99.73% of all the liquidity for their token, which means no one but them could dump it on the market:

Normally, the only way you would own this much of your liquidity is if you funded all of it yourself. And even then, other people would probably fund some of it and hold it to earn trading fees. So how does Olympus own so much of their liquidity?

Well, this is what makes Olympus so smart. There are two ways you can get Olympus tokens. You can buy them on the market, like on SushiSwap, or you can participate in the Olympus bonds program.

Olympus Bonds

The Olympus bonds program buys Olympus LP (liquidity pool tokens) and other assets from investors in return for discounted OHM tokens. Here’s how it works.

Let’s say you wanted to invest $5,000 into OHM. For most tokens, you would just go to SushiSwap and buy $5,000 worth and that would be the end of it.

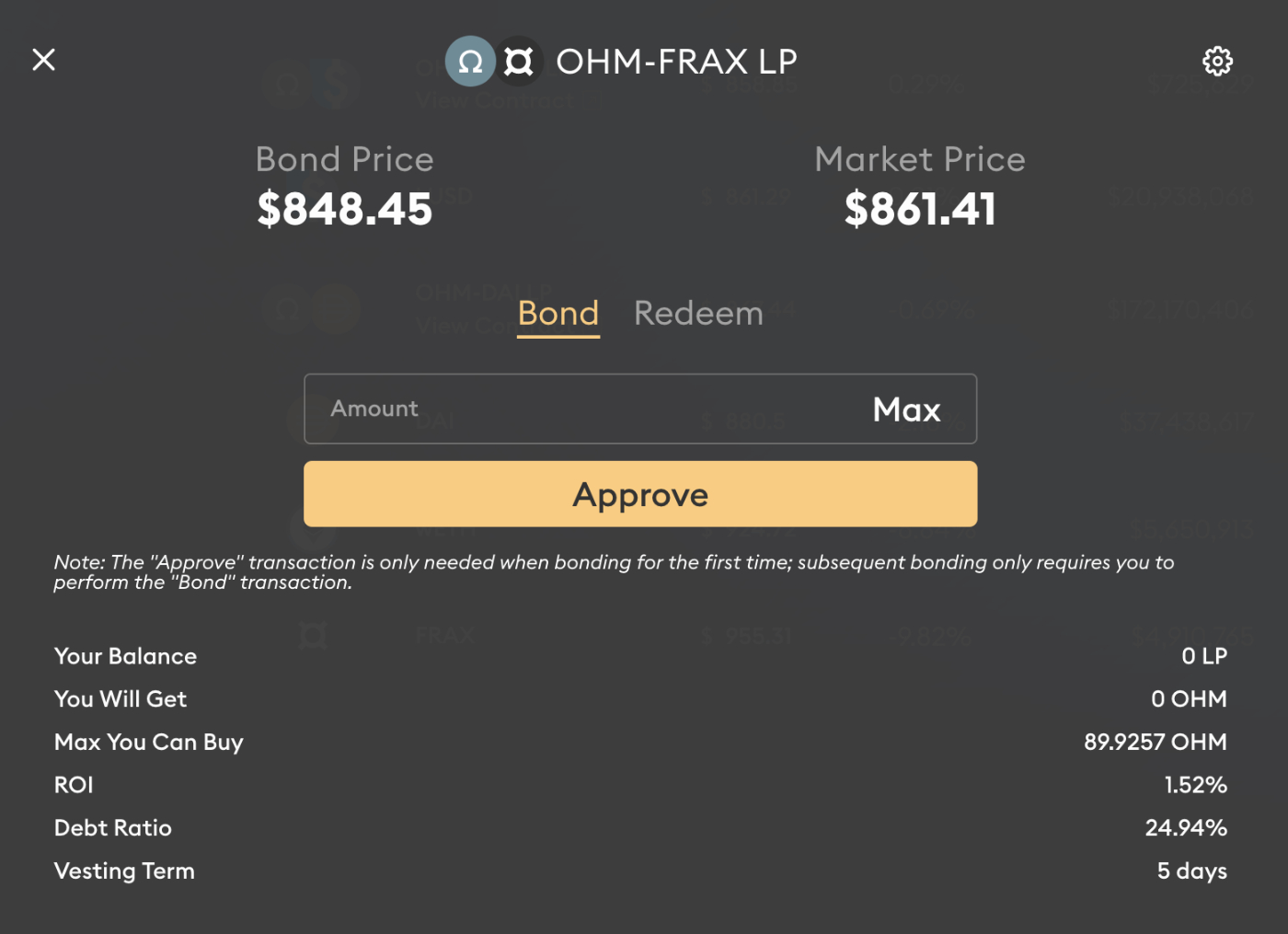

But for OHM, you have another option. Instead of buying $5,000 of OHM, you can buy $2,500 of OHM and $2,500 of FRAX, fund the OHM-FRAX liquidity pool, and then sell that liquidity position to Olympus for a bond.

At any time, Olympus is willing to pay you OHM tokens in return for selling them liquidity. In this case, you get a 1.52% return over 5 days for selling them your OHM-FRAX LP. So instead of getting $5,000 of OHM if you had bought it directly, you’ll now get $5,076 worth of OHM! Sure you’d earn some fees holding the LP tokens, but you won’t make 1.52% in 5 days.

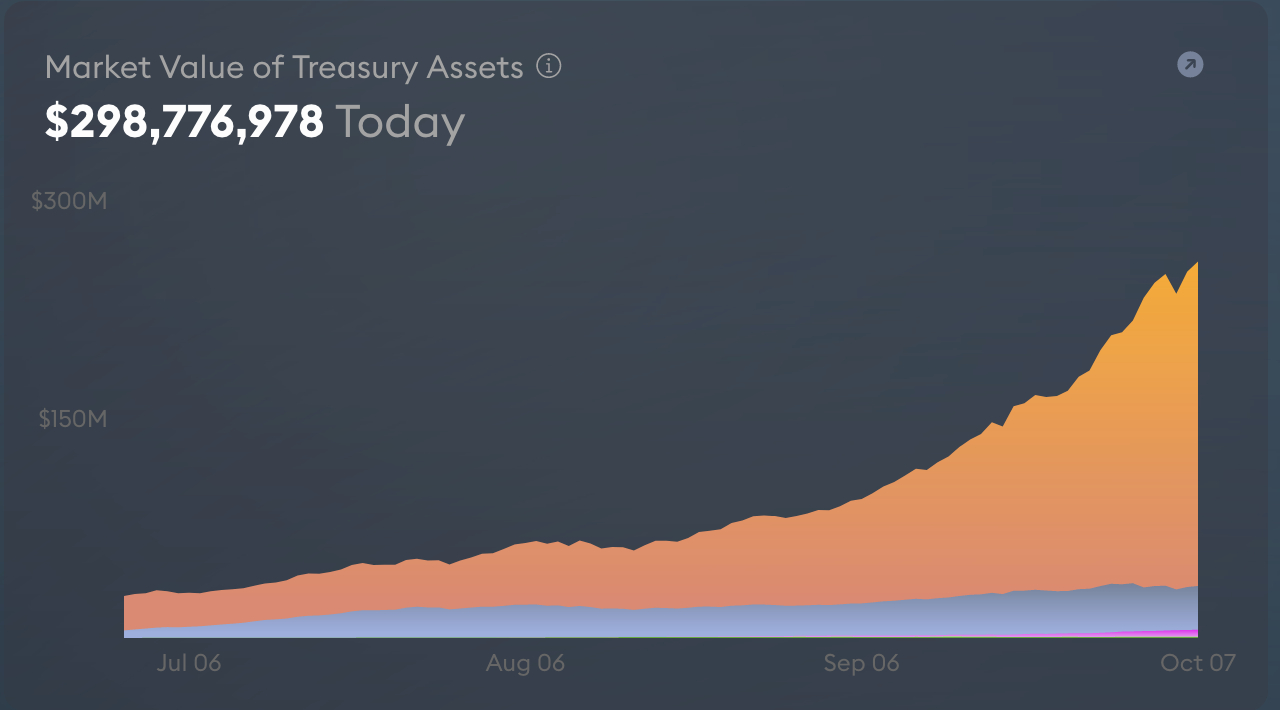

This is one of the main ways new Olympus tokens are issued, and it ensures that every Olympus token is backed by tokens and liquidity stored in the treasury. And it’s how Olympus owns almost all of its liquidity, with almost $300,000,000 worth of tokens in its treasury:

This should prompt a pretty big question though. If you can deposit LP, and get paid in extra $OHM tokens over 5 days, why wouldn’t you immediately sell them and run the process again? Shouldn’t there be some pretty strong sell pressure on OHM?

And there would be! If there weren’t some good incentives to stake your OHM tokens as well.

Staking OHM

New OHM tokens are constantly being minted to pay people for buying liquidity bonds. If you just hold your OHM tokens, they should be getting less valuable over time as more and more are minted.

So to counteract that dilution, you can stake your OHM tokens to earn more OHM.

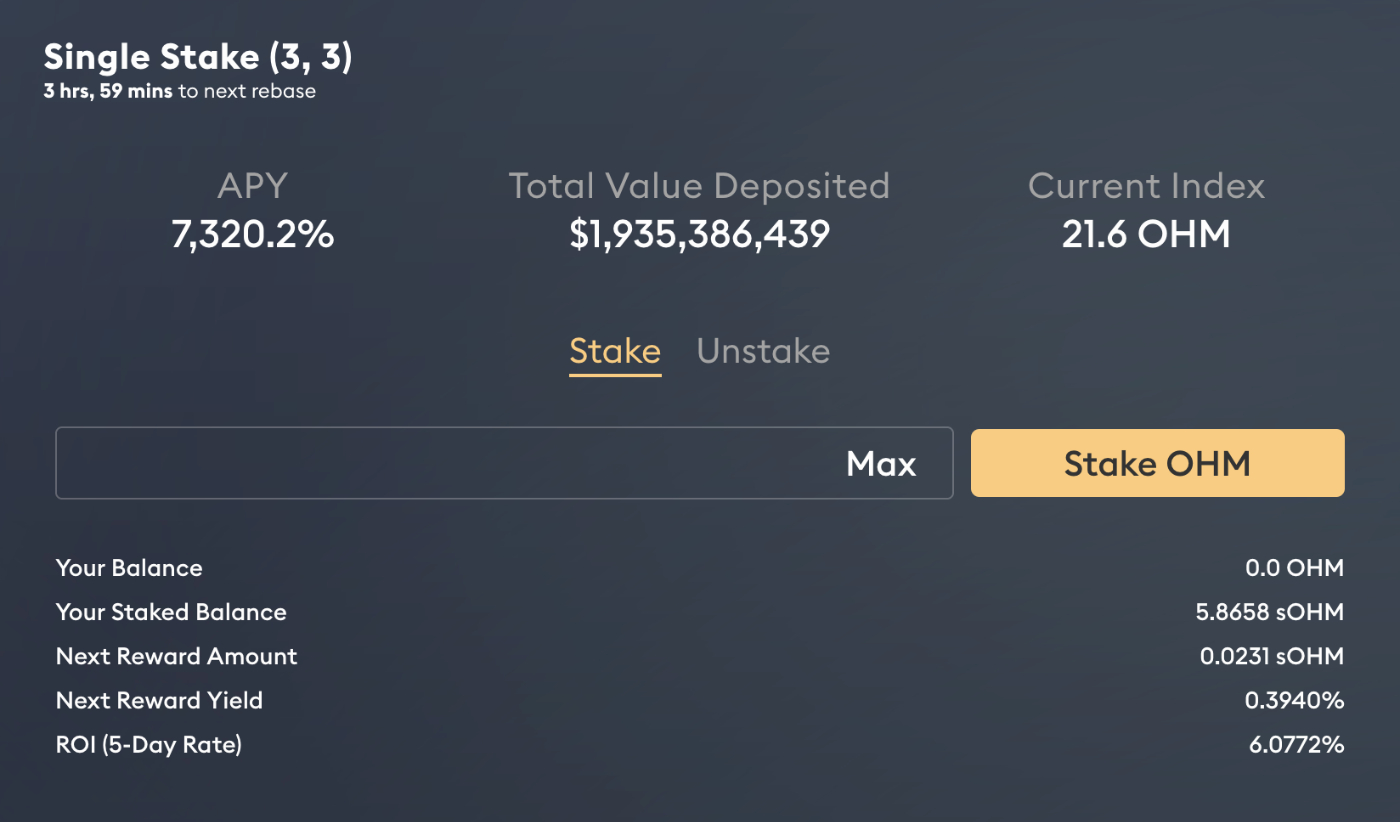

Now, here is where things start to look really ponzi-like: the APY for staking Olympus tokens is a whopping 7,320%. As I discussed in my “where does the yield come from” article, an APY like that is insanely high. That would normally mean that if you put in $1,000 today, you would have $73,000 in one year. It’s whyI initially wrote Olympus off.

But that’s not exactly what it means here.

In the context of Olympus, the APY is telling you how much your OHM balance will increase based on the minting schedule. So if you put in 1 OHM token today you might have 73 OHM tokens in a year, but there would also be many more OHM tokens in circulation.

Despite the high interest rate, the value of your position would not necessarily be any higher. Rather, your share of the protocol would stay consistent. If the price of an OHM token continues to rise, you would see pretty significant returns. And even if it stays flat or drops some you’d see pretty significant gains, since the additional number of OHM tokens you’re receiving may outpace the decreasing price.

You typically earn a higher 5-day ROI from keeping your OHM staked than from buying bonds, so you’re more incentivized to keep your OHM staked than sell it. And if the bond value shot up where you could get a higher return from bonding, people would sell their OHM, buy liquidity, then sell that liquidity to the treasury for more OHM, increasing the treasury funds even further.

The incentives encourage you to either not sell, or, if you do sell, immediately buy more OHM bonds with what you sold your OHM for. It’s win-win for you and for the protocol. You’re probably not going to actually 73x your investment over a year. But you’ll likely at least retain your share of OHM’s market cap.

This is a brilliant model, and if OHM just used it to build up their massive treasury it would be a seriously impressive project on its own. But they’re going bigger, and the next step in their evolution is even more important.

Olympus Pro

Owning 99% of your project’s liquidity is impressive and a huge advantage for project stability. If any project could sell their tokens for liquidity the way Olympus has done, it would give them a much more stable token launch and much more control over their token’s future.

And while they could try to copy Olympus’s contracts and do it themselves, they don’t have to. Olympus launched their Pro platform a few weeks ago, and now any project can apply to have their bonds listed on Olympus’s site. But instead of earning Olympus tokens for your liquidity, you earn the native token of whatever platform you’re buying bonds from.

Bonds are offered based on a fixed price for the payout asset, so depending on how the market moves, you can turn your existing tokens into more tokens by buying the bonds for the platform you’re already supporting.

For example, say that after the last DeFriday on Magical Internet Money, you bought 100,000 SPELL tokens. You can currently buy SPELL-ETH bonds based on a SPELL asset price of $0.0102, quite a bit below the current price of $0.012, which earns you a 24.46% ROI.

You would:

- Trade 50,000 SPELL tokens for ETH

- Create SPELL-ETH liquidity with your tokens

- Sell those SPELL-ETH LP tokens to buy the SPELL Bond on Olympus Pro

- After 5 days, you’d have 124,460 SPELL tokens, and Abracadabra would own more of their liquidity

- And Olympus receives 3.3% of the SPELL amount as well. 4107 tokens in this case.

For other protocols, this is a significant improvement over normal staking rewards, since they get to own their liquidity in exchange for tokens they were likely going to give to liquidity providers anyway.

And for Olympus, it provides a powerful way to diversify their treasury holdings into any token imaginable. At some point in the future, any new crypto project may launch with an Olympus bond program, natively built into their own site, which improves their initial liquidity bootstrapping and directs further funds to the Olympus treasury.

What’s the Catch?

Obviously, there is some risk here, right? Yes, but it’s a little different than most token risks.

If you look at almost any crypto asset, whether it’s Bitcoin or SHIB, most of the value is just based on whatever everyone thinks it’s worth. The value is subjective.

Most of OHM’s value is subjective, but the price also has somewhat of a floor based on the value of the treasury. There are about 2,400,000 OHM tokens in circulation, and the treasury has $300m of total assets, which would put the value of each OHM token at minimum $125. Though that $300m contains a significant amount of OHM tokens, so we can also look at the “risk free value” (purely stablecoins) of treasury assets, which is around $61m.

So if the community lost 100% of their faith in OHM and it had no speculative value, there would still be ~$30 per OHM token in existence. That’s quite a bit lower than the current price of $866, but considering most coins don’t have any backing like this, that’s pretty nice.

And that’s not including fees generated from Pro, fees earned from all the liquidity the treasury holds, and other revenue. But the big risk from a price perspective is that this excitement dies down and the price crashes to somewhere in that $30 to $125 range.

Could it go lower than that? Theoretically, yes, but then the treasury could just start buying OHM tokens to keep them at a certain floor. Most protocols can’t do that in the way Olympus can.

OHM: Crypto’s New Store of Value

After spending quite a while in their docs, and understanding their tokenomics, I think Olympus might have a secret, incredibly ambitious goal.

OHM could replace Bitcoin.

Bitcoin is often referred to as a “store of value.” A digital gold you can hold to fight the evils of inflation so that once we’re past the insane growth phase we’re in, one bitcoin should always have the same purchasing power.

As Parker Lewis explains in his excellent piece: Bitcoin is the Great Definancialization, inflation has caused our work to become less and less valuable over time, leading to greater financial risk-taking and an increasingly complicated financial landscape where you have to keep a huge amount of your net worth in risky assets just to retain the purchasing power of your labor.

Bitcoin fixes this by having a fixed supply, kind of like gold, so it should retain its value or increase in value over time. While a US Dollar becomes less valuable every year, one bitcoin should be equally or more valuable in terms of purchasing power (again, once the adoption phase is over.)

But Bitcoin has a problem. It’s not supported by anything besides intersubjective myths. And yes, before everyone who read Sapiens rushes in and says “EVERYTHING IS JUST AN INTERSUBJECTIVE MYTH INCLUDING MONEY AND THE GOVERNMENT” yeah sure but also there’s a difference between something backed by memes and something backed by a GDP and military. Treasury Bills have terrible returns. But they at least have something behind them beyond hashtags, lambos, and laser eyes.

A digital store of value is a fantastic idea, but if I have to choose between one that is purely meme-driven and one that has some assets supporting its value, I’m gonna take the one with a treasury every time. And that’s where OHM starts to look like it could be a better Bitcoin.

It’s a token where you can passively retain your share of the total supply (just like Bitcoin), but where the value of the token is supported by hundreds of millions of dollars of other crypto assets.

OHM says in their docs:

Users are comfortable with transacting using stablecoins knowing that they hold the same amount of purchasing power today vs. tomorrow. But this is a fallacy. The dollar is controlled by the US government and the Federal Reserve. This means a depreciation of the dollar also means a depreciation of these stablecoins.

OlympusDAO aims to solve this by creating a free-floating reserve currency, OHM, that is backed by a basket of assets. By focusing on supply growth rather than price appreciation, OlympusDAO hopes that OHM can function as a currency that is able to hold its purchasing power regardless of market volatility.

Put another way: Olympus wants to make OHM a store of value. Perhaps THE store of value.

Can they do it? With their rabid community, hundreds of millions in their treasury, and new platforms onboarding to Pro every week, they’re certainly off to a strong start.

OHM just might become the reserve currency of the Internet.

If you enjoyed this, you can subscribe below! I also occasionally say smart things on Twitter if you want to follow me there.