DeFi Rate - This Week in DeFi - October 8

This Week in DeFi - October 8This week Fei launches V2, DominantFi comes to Polygon, Visor Finance colab with Perp Protocol, and Stripes gets $8.5m for interest rate swaps

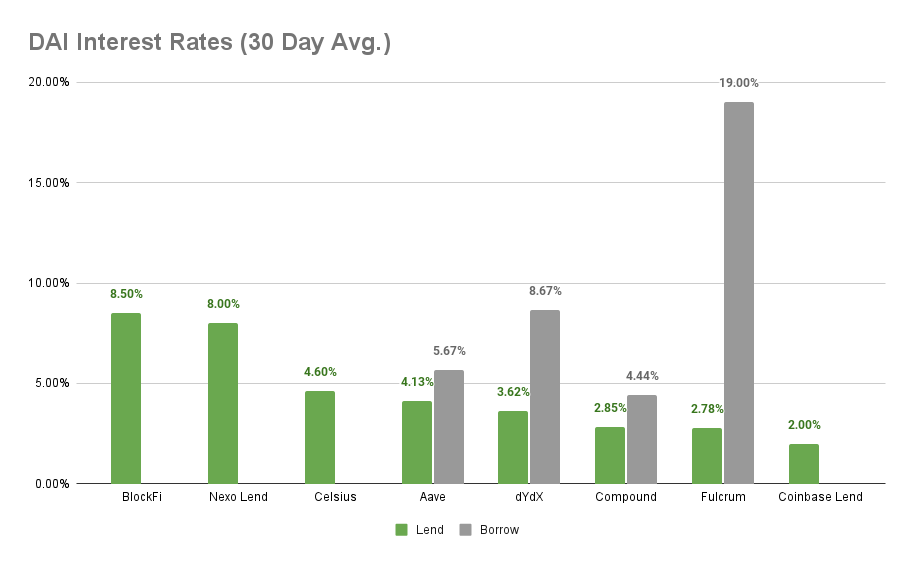

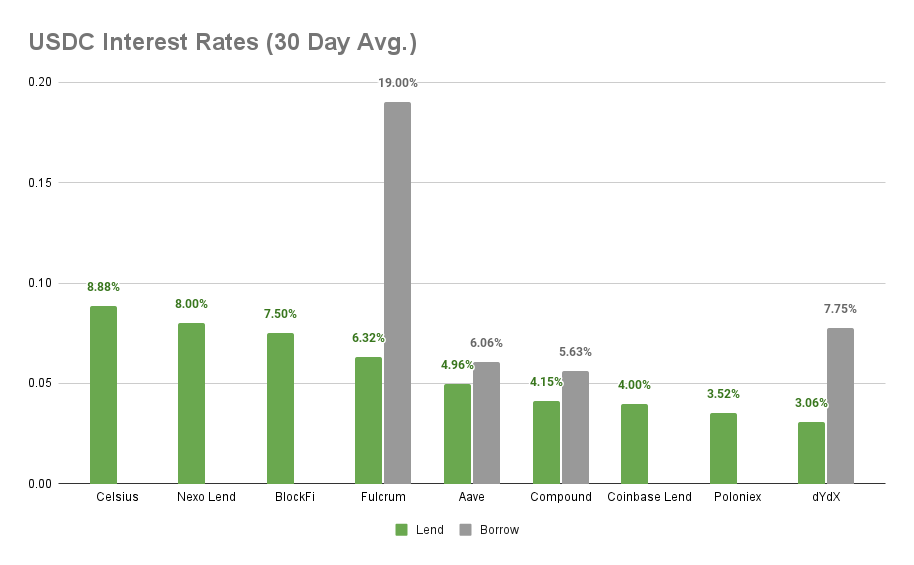

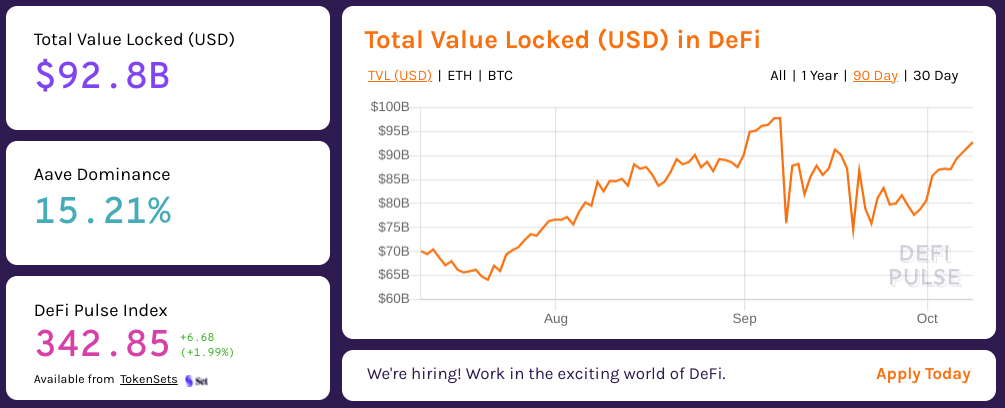

To the DeFi community, This week, Fei announced V2 of the hybrid stalecoin design, bringing improved incentive alignment and other improvements learned through the initial months of the platform operating in the wild. Fei will be redeemable 1:1 for PCV (protocol controlled value), and will employ Balancer pools to help mitigate volatility risk to the platform. Hybrid stablecoins are growing up quickly.  Fei Labs @feiprotocol Introducing Fei v2 🎉 https://t.co/bbq1CZdGXE This is a HUGE upgrade to the Fei mechanism! Highlights include 👇Dominant Finance has come to Polygon, allowing users to trade dominance pairs with faster transactions and far lower costs. Similar to perpetual contracts, dominance pairs allow users to trade based on the relative market cap of two different assets like ETH and BTC, increasing or decreasing their return based on the change in market caps after the trade has been initiated.  Polygon | $MATIC @0xPolygon 🚀 @dominationfi integrates with Polygon! Domination Finance is integrating #Polygon to increase the cross-chain functionality. It will allow users to track & trade BTC, ETH & USDT dominance. 🌐 Learn more: https://t.co/OWhul7i5jo https://t.co/9Nr0TlmTc5Visor Finance, a liquidity manager for Uniswap V3 pools, is pitching in on the Perpetual Protocol liquidity program, earning transaction fees and PERP rewards by depositing USDC in PERP pools on Visor. Managed liquidity can help reduce exposure to impermanent loss, and increase transaction fee earnings over time.   And Stripes Finance closed on $8.5 million in funding led by Multicoin Ventures, Defiance Capital, Fabric Ventures, and Morningstar Capital. The interest rate swap perpetuals protocol will spend the funds developing on-chain derivatives for interest rate swaps facilitated by AMM technology, with plans to add yield hedging and other advanced financial instruments in the future.   For such a new industry, it’s amazing how much can be going on at once in DeFi. While recent Compound bugs have shaken some community members and raised tough questions about the cadence of decentralized governance decision making, other Ethereum-based DeFi projects like Stripes continue to raise millions of dollars for markedly more complex financial concoctions. But for those who have been around for more than the current cycle, it’s not hard to remember a time when Ethereum, in the wake of the original DAO hack, seemed like little more than a pipe dream, with major doubts about the overall viability of the project and specific concerns around the true immutability of the Ethereum blockchain (ETC stans still haven’t forgotten). And while we’ve made incredible progress in just two years, moments like these stand out as reminders of how far we still have to go to create robust, reliable systems that can truly stand the test of time (and misaligned actors) and the rigors of real world uses. It’s easy to get in the mindset that the legal and financial infrastructure we enjoy in the modern world were built in a systematic way, tested and free from errors when they launch. The truth is, all of these systems have been through generation after generation of trial, error, and improvement, and in many cases still grapple with structural issues that may never truly be addressed. That’s the promise and power of DeFi and crypto more broadly - mistakes are bound to happen, but for the first time our infrastructure and incentives are designed to address even structural issues, along with the myriad of bugs and errors that crop up along the way. Just remember, this isn’t about living in the decentralized future. We’re building the decentralized future. Try to enjoy the ride :) Thanks to our partner: Nexo – Unlock the power of your crypto with up to 12% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8% APY Cheapest Loans: Compound at 4.44% APY, Aave at 5.67% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.88% APY, Nexo Lend at 8.00% APY Cheapest Loans: Compound at 5.63% APY, Aave at 6.06% APY Top StoriesStader Labs completes $4M funding raise to expand crypto stakingAlgorand-Based Tinyman Raises $2.5M Ahead of DEX LaunchPolygon Hikes its Minimum Gas Price by 30x in Bid to Foil SpammersTrustology Gets Fully Registered as Crypto Asset Firm With UK's FCAKava Labs Selects Cosmostation as First Recipient of $185M Ignition FundStat BoxTotal Value Locked: $92.8B (up 11.15% since last week) DeFi Market Cap: $131.57B (up 8.23%) DEX Weekly Volume: $16.27B (up 4.76%) Total DeFi Users: 3,488,530 (up 1.16%) Bonus Reads[rune – MakerDAO Forum] – The case for Clean Money [Brady Dale – The Defiant] – MakerDAO Chases ‘Real World’ Deals and Assets in Major Test for DeFi [Nilo Orlandi – Bankless] – Why ETH will hit $20K [Anthony Sassano – The Daily Gwei] – Early Adopters - The Daily Gwei #352 [Connor Spelliscy and Holmes Wilson – The Defiant] – A Call to Action: How to Mobilize and Save the Crypto Movement If you liked this post from This Week in DeFi , why not share it? |

You Might Also Like

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏